Lithium developer Lake Resources [ASX:LKE] announced that its Kachi demonstration plant produced ‘at spec’ lithium product.

LKE management elaborated that lithium recoveries at the Kachi-installed demo plant were similar to those achieved at key partner Lilac Solutions’ Oakland pilot plant in California.

Lake expects to ship the first samples for lithium carbonate conversion in the next two weeks, after which it will be qualified by a ‘tier one’ battery maker.

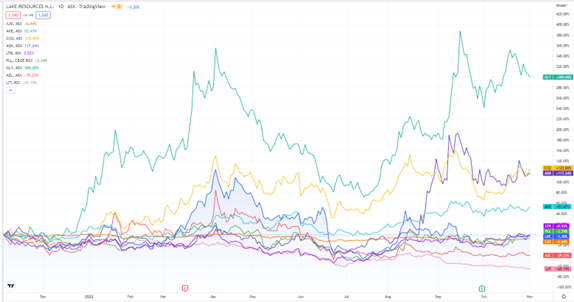

LKE shares rose as much as 10% in early trade on Wednesday before pulling back somewhat by the afternoon.

LKE shares have been down 35% in the past six months.

Source: tradingview.com

LKE and Lilac produce first lithium from Kachi demo plant

On Wednesday, Lake Resources announced that initial test work at its Kachi demo plant in Argentina has delivered ‘at spec’ product with the help of LKE’s technological partner Lilac Solutions.

Lilac CEO David Snydacker said the demo plant is ‘already achieving 80% lithium recoveries.’

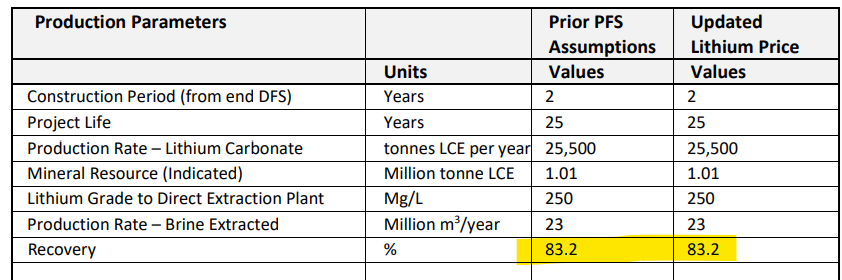

In its updated pre-feasibility study, released in March 2021, LKE pinned the overall plant recovery at 83.2%.

Source: Lake Resources

Lilac’s Vice President Bart Packer has been on the site to supervise plant adjustments. He commented:

‘Initial operations of the demo plant have already delivered product at spec, with the demonstration plant achieving similar lithium recoveries that were achieved in the Oakland pilot plant test work in California.

‘Optimisation work continues on site; Lilac anticipate the first samples of Lithium Chloride will be shipped for conversion to Lithium Carbonate within two weeks.’

Lake Resources’ CEO, David Dickson, pointed out recent construction struggles in all resources projects across the globe and acknowledged the hard work both Lake’s and Lilac’s teams in Argentina have endured — overcoming early construction challenges and continually striving for top results.

‘This validates the many years of test work that took place in Lilac’s Oakland facility during Covid whilst access to site was impossible,” Dickson said.

‘We look forward to seeing the test work move into to steady state and then for the process to be validated by Hatch so that work on the DFS can be completed.’

LKE said the latest ‘at spec’ results further de-risk the project in the eyes of prospective offtake and financing partners.

CEO Snydacker says the results validate Lilac’s abilities to scale up production. He also thanked the LKE team and flagged expanded collaboration with the lithium developer, in a sign a recent dispute over performance timelines hasn’t been debilitatingly acrimonious:

‘Cheers to our field operations team, which has been working 24/7 to achieve these results in partnership with Lake Resource’s fantastic team at Kachi.

‘We are excited to expand our collaboration with the Lake team as we work to fast-track commercial-scale production of lithium carbonate.’

Overlooked ASX lithium stocks

In 2021, lithium stocks dominated the ASX — eight of the 10 best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

But lithium stocks haven’t fared as well in 2022, with many of last year’s high-flyers trading well below their 52-week highs.

The easy money has already been made, it seems.

So does that make it too late to consider the lithium sector?

Two of our top analysts wouldn’t say that’s the case.

In fact, they have recently profiled three Australian lithium stocks they think are being overlooked by the wider market.

Regards,

Kiryll Prakapenka,

For Money Morning