In today’s Money Morning…be careful who you listen to…this idea of tech-led progress isn’t a new idea…the difference between good investors and bad investors…and more…

It’s surprising how often this happens…

I send my colleague Lachlann Tierney an innocuous email on something that interests me.

He emails me back.

Then, after a bit of back-and-forth banter, we usually seem to hit upon a good idea.

A sort of ‘aha’ moment.

Anyway, I reckon we had one such moment on Friday.

Here was the exchange:

Ryan: This looks interesting for our synbio (synthetic biology) thesis

|

|

Lachlann: Are we becoming ARK fanboys? The more stuff I encounter of theirs the more I’m into it.

Good information in there.

Ryan: Haha maybe. I think kindred spirits maybe? And partly I just like them cause every other analyst hates them!

Lachlann: The contrarian fund manager bitterness index!

It’s just so cool that an investment company employs a full-time genomics analyst — seriously it’s the way to go.

Lab coat the new pinstripe suit!

Lab coat is the new pinstripe suit!

This is such an important point few realise…

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Be careful who you listen to

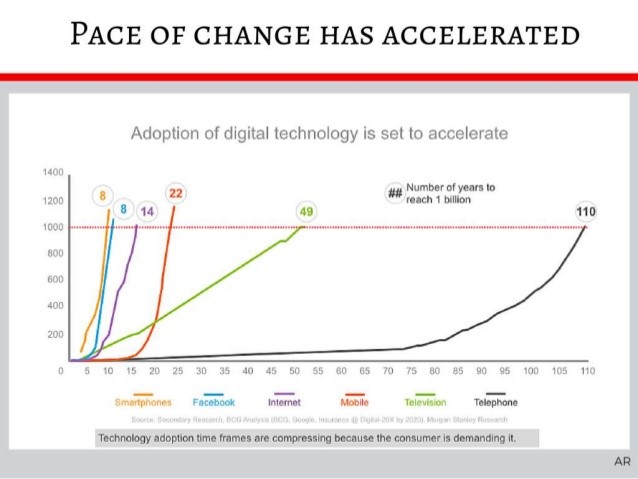

Mine and Lachy’s overarching thesis on markets is that the process of change is happening faster than ever before.

Technological advancements are disrupting every single industry out there. From finance, to shopping, to energy, to mining.

This idea of tech-led progress isn’t a new idea.

Venture capitalist Marc Andreessen famously coined the phrase that ‘software is eating the world’ as far back as the early 2000s.

But what is perhaps more obvious now, is that this process is speeding up rapidly.

Check out this chart of how quickly new technology spreads through society these days:

|

|

| Source: Rick Fox |

But it’s not just computing technologies that are advancing fast.

Think about our recent experience with the new coronavirus vaccines. Ideas like gene editing and CRSPR technology have been around for decades.

But this year we finally saw some of these concepts being used to help create mRNA-based vaccines in record times.

This process took less than a year to complete which is crazy fast compared to traditional vaccines.

Naturally, that makes some people nervous — and some investors cynical — that shortcuts have been taken.

But in my opinion, that’s because they don’t understand the technology behind it.

And no doubt it’s hard to keep up with all these startling advances.

That includes fund managers that can analyse balance sheets but not necessarily accurately value innovation.

But think about it…

In a fast-changing world chock full of new technologies, who do you want helping you look for investing opportunities?

Backward-facing number crunchers or forward-facing technology specialists dealing in the frontier of these new ideas.

Ideally a bit of both is probably best.

But if faced with the choice of one or the other, in today’s world I’d go for the ‘lab coat’ any day.

The difference between good investors and bad investors

Now, it’s probably too late for you or me to go back to university and do a PhD in biotechnology or computer science!

But at the same time, we do have one tool at our disposal that any investor can use. And that’s healthy curiosity.

That doesn’t mean you can’t have a dose of healthy scepticism too.

There is no doubt new ideas are often hyped up above their fundamental values in the short term.

But I reckon people that are too sceptical — especially a lot of mainstream finance types — are quick to scoff at these innovations. Innovations they often don’t understand and usually haven’t even made any effort to understand.

The best investors make the effort.

I remember a famous story about legendary investors George Soros and Jim Rogers, who ran a fund called the Quantum Fund. It’s one of the best-performing hedge funds of all time.

As the story goes, it was 1978 and they had the idea that the world was going to go from analogue to digital.

A big tech-led disruption of the time that is the precursor to many of the changes we see today.

Soros recalled:

‘Jim and I went out to the AEA (American Electronics Association) conference in Monterey — it was called WEMA then — and we met with eight or ten managements a day for the entire week. We got our arms around this whole difficult field of technology.

‘We selected the five most promising areas of growth and picked one or more stocks in each area. This was our finest moment as a team. We lived off the fruits of our labor for the next year or two.

‘The fund performed better than ever before.’

In short, if you can be curious, if you can accept the inevitability of change, and make sure your investments account for it, then we think your portfolio will be better for it.

Or as my old soccer coach would say:

‘Bad players know where the ball is. Good players know where it’s going to be.’

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also the editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

Comments