Leading outdoor and lifestyle apparel and footwear retailer KMD Brands [ASX:KMD] released guidance today for the full-year ending 31 July. With only several weeks remaining, the company has announced that it will reach a record high of $1.1 billion in sales.

This is the first time that KMD will top $1 billion in sales, an impressive feat in an environment of softening consumer sentiment and slowing sales. The share price was down by 8.76% by midday, trading at 88.5 cents per share, as investors were increasingly concerned about winter sales indicators showing a considerable slowdown.

The company reached sales of $980 million last year, bouncing back from a significant pandemic dip. 2022 saw KMD struggle to seek profits from rising shipping costs and the three-month closure of Vietnam factories due to a large COVID outbreak compounding problems.

Shares have been down by 11.94% in the past 12 months, along with much of the sector, as investors worry about consumer spending and economic headwinds within retail and the global market.

Source: TradingView

KMD on track for $1.1 billion full-year sales

KMD, the parent company of global outdoor, lifestyle and sports brands Kathmandu, Rip Curl, and Oboz, has announced guidance for the full year ending 31 July. Today’s trading update claims the company is on track to surpass $1 billion in global sales, a first for the company.

Underlying EBITDA is expected to be in the range of $105–110 million.

An impressive achievement for KMD despite the headwinds the retail industry faces, such as falling confidence from consumers and rising living expenses.

Throughout the first three quarters of the financial year, KMD Brands experienced robust sales growth across all its brands, setting the stage for record performance.

Source: KMD 1HFY23 Report

However, the fourth quarter presented some challenges.

Kathmandu, KMD’s flagship brand, faced a slower start to its winter trading period. The impact of a milder winter and general consumer caution led to reduced sales and foot traffic.

This weakness has been reflected across the retail sector, causing investors to remain sceptical, despite posting strong sales throughout this past financial year.

Nevertheless, the company remained optimistic, with Group CEO & Managing Director Michael Daly remarking today:

‘“With three weeks of trade still to come, we remain focused on delivering our key Kathmandu winter and Rip Curl Northern Hemisphere summer results while continuing to moderate our cost base for the year ahead,” Daly said. “We’re looking forward to delivering over $1 billion in sales at year-end — a first for KMD Brands.”’

The company has recently seen some shifts in leadership across its brands, with KMD CFO Chris Kinraid announcing last week that he plans to leave the company.

In May, Kathmandu named former Crocs executive Megan Welch as CEO of the outdoor brand. This is a position that was held temporarily by Michael Daly when long-time chief executive Reuben Casey resigned after 12 years at the post.

With the company’s full-year results to be released on 25 August 2023, what is the outlook for KMD?

KMD expands

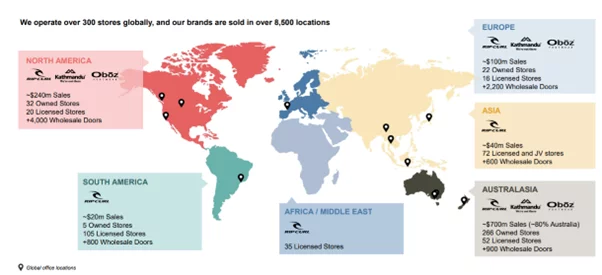

The positive sales numbers reflect strength in the KMD brands as it looks to expand its global reach despite market headwinds.

In March this year, all three major brands under the KMD umbrella received the B Corp certification, highlighting a wilful move by the company to more sustainable social and environmental practices.

KMD’s decision to obtain B Corp certification can also be viewed as a reaction to similar brands like Patagonia, Allbirds, TOMS, and Veja Shoes. These companies have already received the B Corp certification and hold a considerable market share in KMD’s target market expansion.

‘We want to continue our market dominance in Australia and NZ, but long-term growth is international‘, explained Michael Daly to AFR earlier this year.

Source: KMD

KMD followed this up with expansion into French, German, and Canadian websites and wholesale partners, where fashion-forward items are less sought after than environmentally conscious items.

It remains to be seen if the expansion pays off for the company. However, today’s sales indication shows that regardless of their European or Canadian success, they still command a loyal consumer base in the US and Australasia despite recent slowing sales.

While navigating the challenging market conditions, KMD aims to balance driving sales growth and managing costs.

The company said it remains optimistic about its future prospects and is dedicated to delivering sustainable long-term value to its shareholders. The reality may hit in the coming year as investors expect a considerable slowdown, reflected in today’s share price.

Investors should keep a close eye on the sales of the next quarter to gauge the future trajectory of KMD.

As more earning guidances are expected to be announced in the coming months, it’s a great time for savvy investors to pick up bargains or temperature-check the performance of many companies as markets slow.

For many, that means the hunt for income without growth — but why not make it both?

Six stocks that can grow while paying you dividends

If you’re worried about your stocks, then it’s time to shift gears and think of a proactive but defensive position.

That’s companies that can give you capital growth while paying you income along the way.

In turbulent times, finding a sweet spot between growth and income has long been the dream of defensive investors.

Our editorial director, Greg Canavan, has focused on this task for his latest research.

Greg thinks that after two years of the Aussie market treading water, there’s an ‘income/growth sweet spot developing‘.

He has just published a report on six growth stocks that pay a healthy dividend.

For Greg, you don’t have to chase growth or income.

You can chase both.

And now is the time.

Regards,

Charles Ormond

For Money Morning