A supposedly recovering POTUS, an RBA policy decision, a budget due, and increasing momentum behind US fiscal stimulus…

There’s a lot to digest out there at the moment.

Today, I’ll focus mainly on what the federal budget could mean for your investments.

And the government certainly is throwing the rulebook out on this one!

Regardless of what your ideology is, since I started investing 12 years ago, I’ve learned one simple thing.

Always bet on more spending, more debt, and bailouts.

At the height of the GFC in 2009, my finger was hovering over buying a US$1,000 parcel of Barclays shares.

I thought: Well, they are keeping their sponsorship of the football league in England, so they must be confident that a care package is on the way.

Anyway, if I’d hit buy in 2009 and held for just eight months, I would have clocked a 700% rise.

I opted for a Singaporean semiconductor stock in the end, but hindsight taught me well.

With this in mind here’s a breakdown of the key aspects of the budget.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Three things to look for in the federal budget

The first thing on the agenda is a proposed investment allowance measure in the budget.

As the Australian Financial Review explains:

‘Investment allowances are, in effect, asset write-off schemes that allow companies to bring forward tax deductions for plant, equipment and vehicles instead of following traditional depreciation schedules.

‘When time limited, they encourage businesses to bring forward capital expenditure to take advantage of favourable tax incentives, and can have a strong stimulatory effect on the economy.’

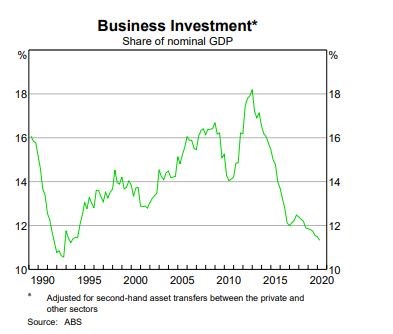

Here’s the chart motivating this move:

|

|

| Source: RBA |

Remember this is nominal GDP, not real GDP, so no GDP deflator applied.

The investment allowance is designed to reverse the sharp downtrend or at least halt its descent.

Second on the agenda is a range of ‘lollies’ for small businesses and start-ups.

Here are some key aspects of the budget drawn from The Guardian’s coverage (my emphasis):

- ‘Extra tax concessions for eligible small businesses will be offered from July, including the ability to deduct some start-up expenses. From next April, businesses that fall within the turnover definition will be exempt from FBT [fringe benefits tax] for perks provided to employees, such as free parking, or the provision of smartphones or laptops.’

- ‘The manufacturing package includes a $1.3bn co-investment fund for large projects in the priority sectors, which are resources technology and critical minerals processing, food and beverages, medical products, recycling and clean energy, defence and space.’

- ‘The government will also top up a pre-existing manufacturing modernisation fund by $52.8m. Under that program, eligible small-to-medium businesses can apply for grants of between $50,000 and $1m. Round two will see grants of between $100,000 and $1m with a co-funding requirement for businesses.’

The last two points fit in with my thesis that certain niche, tech-manufacturing projects could be a boon to Australian productivity.

Small-caps and start-ups in the highlighted sectors could thrive in this environment.

Which means the pivot to growth could continue as well.

Securing the supply chain is clearly a major part of this budget, so all of this seems to make sense.

Finally, tax breaks will be backdated to 1 July this year instead of July 2022.

Here’s the effect — for the people that are still working from home (and for a long time more, it appears) the temptation to invest in the market with these extra funds could be strong.

Much was made of the flood of new retail investors.

Whether it’s done with pulling out super or with a bit of help from the taxman, it doesn’t matter.

Infrastructure spending to balloon — meaning certain resources (again)

Here’s a snippet from Bloomberg (my emphasis):

‘Australia’s government is bringing forward an extra A$7.5 billion ($5.4 billion) of spending on roads, railways and bridges as it seeks to bolster the nation’s economic recovery.

‘Prime Minister Scott Morrison in a statement Monday said the plan lifts the government’s total spending on shovel-ready transport projects to A$11.3 billion and supports 30,000 direct and indirect jobs.

‘It’s part of the government’s plan to pressure its state counterparts to lift their own spending on roads and bridges as it seeks to revive the economy from its first recession in almost three decades.’

That’s a huge increase on initial plans.

Meaning some key commodities could be even more exciting.

I’m thinking copper especially plays a critical role in the construction industry.

The take-home point:

A lot of the trends we’ve highlighted over the last few months could continue along the same trajectory following the federal budget.

This includes small-caps, particularly ones in resources and tech, medicine, and clean energy.

Always bet on more spending.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments