1. Housing investors, it’s not Christmas in July this year, but May/June!

Let’s sing together…

‘Jingle bells, jingle bells, jingle all the way! Oh, what fun it is to ride along in a housing bubble song tonight.

‘Dashing through the market, propping up the industry in any way, Scotty Morrison will buy your vote by promising to inflate…in a one-horse housing policy.

‘Jingle bells, jingle bells, let’s put super into property. After all, what’s a few more thousand, hey! Anyone with a brain is laughing all the way.

‘Just forget the homeless because they don’t get a say. Hey!

‘Jingle bells, jingle bells, buy housing stocks and you might be making your spirit bright!

‘Oh, what fun it is to be in property with Scotty Morrison and the Liberal Party in a one-horse housing sleigh!’

Thank you! Thank you!

I hope you enjoyed that little ditty. Now let’s get to the serious stuff.

Shiver me timbers, watch housing stocks if Scott Morrison gets back into government. We’ve already seen this play before.

His last election win resurrected the mortgage broking industry from the dead.

He jacked off all that stuff from the royal commission about the stupidity of their juicy trailing commissions for shuffling a few papers around, plus biasing their advice to bigger loans. But it worked at the ballot box!

What’s going on today?

Senor Morrison is promising to allow first-home buyers to access $50,000 from their super to buy a home.

The Australian Financial Review reports:

‘The government argued the super policy, combined with the downsizing initiatives, would have “limited, if any, impact on housing prices”.’

Oh dear.

At this point, you don’t know whether to hold your stomach from laughing at the stupidity of that claim or wipe the tears from your eyes at the tragedy for all concerned.

Hmmm…a potential extra $100,000 for a couple buying a home isn’t going to move the needle…not even a little bit.

Some of the more vocal housing analysts that were worried about rising interest rates killing the market are walking it back already…and rightly so.

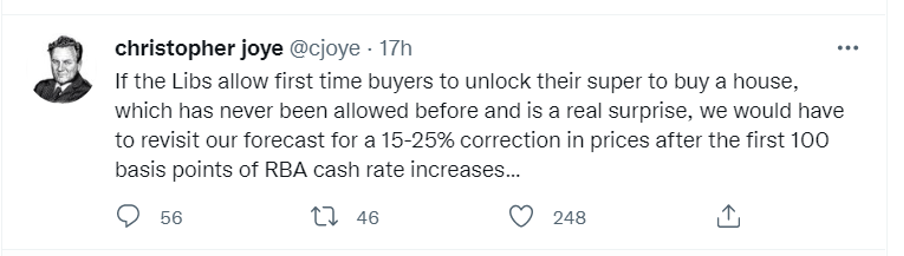

See Christopher Joye below, a man with a decent track record in this area:

|

|

| Source: Twitter |

Like I’ve been telling you the last few weeks, property-related stocks have been dumped in the bargain bin from the fear of rising rates.

Now we have a potential trump card to send the market into a boom time.

We can’t know if Scott Morrison wins, of course, but make sure you know the stocks to be watching if he does. My April issue was on the best ones to pick up…before he promised to send the market toward the Moon. You can still check it out here.

2. I will put one caveat on the above. You must be prepared to hold the above stocks for at least two years and put up with potentially extreme volatility in the share market.

Why is that? One reason is that we have a potential global famine brewing. India, for example, just announced it’s banning wheat exports to keep them at home.

This, at a time when Ukraine’s supply is now in serious distress. That may not be a problem for Australia. But it’s a massive problem for countries like Egypt and Jordan that get most of their imports from there.

That’s the first thing.

The second is that the West’s support of Ukraine is provoking Russia to become more aggressive instead of less. Instead of talking about peace, Western ‘leaders’ send arms and money.

That’s setting up to escalate the situation. That doesn’t make me super comfortable having the bulk of my money in risk assets right now.

I haven’t pulled the plug completely. But I’m not sticking around Dodge for any short-term stuff if this really hits the fan either.

This isn’t something to be blasé about. My colleague Jim Rickards is warning of the very serious consequences of what’s happening in the world today.

Make sure you check out his latest presentation too. This is a time to listen to multiple voices because there are so many pressing issues bearing down on the world and markets.

See Jim’s views on the food and Ukraine crisis here.

All the best,

|

Callum Newman,

Editor, The Daily Reckoning Australia