Lithium exploration minnow Jindalee Resources [ASX:JRL] has announced its preferred lithium extraction method for its wholly-owned McDermitt Lithium Project, located in south-east Oregon, US.

Courtesy of engineers Fluor Corporation, acid leaching has come out as the top choice for obtaining lithium extracts from ore samples, with research and testing suggesting this method will provide the best economic outcome.

Jindalee says McDermitt metallurgy compares well with more advanced peers, and has already begun test work to refine recommendations ahead further studies.

Shares for JRL were rising more than 2% in the early afternoon on Friday, worth around $2.40 each.

So far in 2023, JRL has gained 27% in stock valuation, yet it is down 18% against its industry average and 16% against the wider market average:

www.TradingView.com

Jindalee opts for acid leaching extraction method at McDermitt

Jindalee Resources has advised that in enlisting the help of global engineering, construction, procurement, and maintenance company Fluor Corporation, it has made a decision about its preferred method for lithium extraction.

JRL has now reviewed several extraction options and is already looking to advance to the next stage of the process, by moving to advance metallurgical test work at its wholly-owned McDermitt lithium project.

The reviewing process included a number of examinations for different lithium extraction methods and pathways, yet the process of choice that appears most attractive to Jindalee is that of acid leaching.

Jindalee says it has determined that the acid leach process along with beneficiation is expected to produce the best economic outcome for McDermitt lithium.

Also in the reviewing process, the lithium researcher found that metallurgical test work is best to begin immediately, in order to refine the preferred flowsheet and also to support further studies at the project.

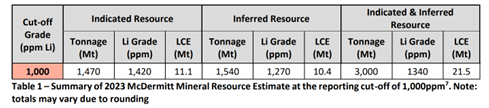

The refined flowsheet will also be compiled to incorporate the recently updated Mineral Resource Estimate (MRE).

Jindalee stated:

‘Currently, there are two potential pathways for the extraction of lithium from sedimentary deposits such as McDermitt: sulphuric acid leaching of either whole or beneficiated ore, and alkali salt (sulphation) roasting.’

At first, no significant differences were found in capital costs, however, further analysis determined that ‘acid leaching with beneficiation (to upgrade the leach head grade) delivered the lowest operating costs and best financial outcome’.

The company’s initial work on beneficiation and sulphuric acid leaching has been completed and was found similar to the flowsheet proposed by the Thacker Pass project.

Jindalee highlighted acid lead test work would include lithium recoveries of more than 95%, using sulphuric acid leach at moderate temperatures and atmospheric pressure on ore samples.

There’s also an expected increase of lithium in the 0.01mm fraction, by more than 50% (from 0.22% to 0.34%) via beneficiation of McDermitt ore, with further test work suggesting another increase towards 60.9%.

Leaching experiments on beneficiated samples demonstrated lithium extraction rates of 94–97% with 26% less acid consumed per lithium unit than previous experiments on non-beneficiated ore.

The company concluded by commenting on its next steps:

‘Jindalee intends to immediately commence the metallurgical testwork recommended by Fluor to refine the preferred flowsheet. The results of this testwork will be integrated with optimised mine studies on the latest McDermitt MRE and will inform the next phase of studies at McDermitt.’

Source: JRL

The state of the Australian economy

The economic trade system is breaking.

The change is all around us, in the wavering global supply chain and bare supermarket shelves.

Bank branches are closing, prices are soaring, food packets are shrinking, and workforces are struggling.

Top financial and geopolitical analyst Jim Rickards has been joining the dots and mapping it all out.

He’s realised it’s all a part of something bigger.

The changes we see now are nothing in comparison to what will be.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, and get an explanation from Jim Rickards himself, click here to learn more.

Regards,

Mahlia Stewart

For Money Morning