Retailer JB Hi-Fi [ASX:JBH] released its full-year results today, announcing NPAT for the year rose 7.7% to $545 million in FY22.

While JBH shares are up 10% in the last month, the retailer is still down 7% year to date.

www.tradingview.com

JB Hi-Fi’s FY22

According to the company’s FY22 announcement, JBH’s highlights this financial year are:

- ‘Total sales up 3.5% to $9.23 billion;

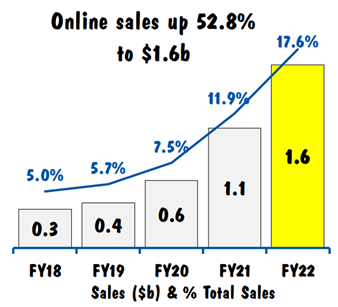

- Online sales up 52.8% to $1.63 billion;

- Earnings before interest and tax (EBIT) up 6.9% to $794.6 million;

- Net profit after tax (NPAT) up 7.7% to $544.9 million;

- Earnings per share up 8.8% to 479.5 cps;

- Final Dividend per share up 46.0 cps or 43.0% to 153.0 cps, bringing the total dividend for FY22 to 316.0 cps, up 29.0 cps or 10.1%;

- Through the total dividend for FY22 and the FY22 Off-Market Share Buy-Back, the Group will have returned $604 million to shareholders’

JB Hi-Fi saw online sales rise 52.8% in FY22 to $1.63 billion (representing 17.6% of total sales), up from FY21’s 11.9% share.

However, in the second half of FY22 — when all stores were open — JBH’s online sales were 11.9% of total sales.

JBH ended the year with cash and cash equivalents of $125.6 million (down from $263.2 million) as the retailer upped its dividend payout.

Source: JBH

JBH by segment

Australian sales increased 4%, totalling $6.20 billion for the year.

The Group reported strong sales brought from Australian customers, with an increase of 11.77% in the second half alone:

- Total sales up 4% ($6.20 billion)

- Online sales rose 52.3% ($1.19 billion), 19.2% of total sales

- Gross profit increased 4.7% ($1.39 billion), gross margin up 22.4% (15 bps)

- EBIT up 4.2% ($544.9 million), EBIT’s margin rose 8.8% (1 bp)

- Cost of doing business (CODB) was up 11.4% (21 bps)

JBH said that a lower CODB gave them a competitive edge — boosted by improved productivity and careful spending.

Customers in New Zealand brought some increased activity, albeit a little more subdued than Australian customers:

- Total sales increased by 0.3% (NZ$262.4 million)

- Online sales grew 56.7% (NZ$43.3 million), 16.5% of total sales

- Gross profit slumped 2.1% (NZ$45.7 million), gross margin down 17.4% (43 bps)

- EBIT was up 51.7% (NZ$8.8 million)

- Underlying EBIT (excluding the 2021–22 impairments) was down NZ$1.3 million (NZ$4.7 million)

- CODB was 12.8% (36 bps)

JBH’s other business, The Good Guys, saw an improvement of 2.7% in the year for total sales, coming in at $2.79 billion.

- Good Guys’ profit increased 6.8% ($649.9 million), gross margin up 23.3% (89 bps)

- EBIT rose 12.5% ($241.4 million), EBIT’s margin up 8.7% (75 bps)

- CODB was 11.8% (12 bps)

Group CEO Terry Smart said:

‘We are pleased to report record sales and earnings for FY22. These results reinforce the enormous trust our customers have in our brands and the strength of our multichannel offer, which continues to provide customers with choice on how to shop.’

JBH and retail trends

The retailer seemed confident for 2023 due to its rising sales and growth rates spanning the past three years.

Smart says:

‘As we enter an increasingly uncertain retail environment and household budgets come under further pressure, customers will gravitate to trusted value-driven retailers.

‘Our ongoing strategy of providing customers with the best value and outstanding service every day, will ensure our brands continue to deliver for our customers and remain a destination of choice into the future.’

In its full-year report, JBH also noted that its core electronic goods offering is considered ‘less discretionary than in the past’, arguing:

‘The Group maintains its relevance using its strong market position supported by its low price proposition. Many of the products sold by the Group are now considered less “discretionary” than in the past, with products such as mobile phones and computers now being seen as “essential” by many consumers. The Group’s stores, which are both in convenient and high traffic locations, seek to maximise both destination and impulse sales, reflected in the Group’s high sales per square metre of floor space.’

From electronics to electric vehicles

EV sales are rising, and we’ve all received the ‘save the date’ for zero carbon emissions by 2030.

But our energy expert, Selva Freigedo, believes the shift to greener energy will lead to a great materials supply crunch, potentially sending prices for battery materials soaring.

Get the scoop on battery tech metals by reading Selva’s latest battery metals report here.

Regards,

Kiryll Prakapenka,

For Money Morning