In today’s Money Morning…from things to experiences…‘jailbreak’ stocks to start researching today…some things won’t change…and more…

Before I start today, I want to alert you to a bumper seven-stock report my mates Ryan Clarkson-Ledward and Murray Dawes have just released.

In case you didn’t know, they run our flagship small-cap investing newsletter Australian Small-Cap Investigator.

Anyway, it’s a cracking read.

Go here to see how you can access your copy.

Now on with the show…

From things to experiences

I don’t know about you, but every other day through lockdown, a friendly courier arrives at our door with a delivery.

Though there was one awkward moment when I mistook my new neighbour handing in a mis-delivered parcel for one of them.

‘Cheers mate, do I need to sign anything?’

‘What?’

Anyway, we soon had a laugh about it.

At least, I think we did.

It’s hard to tell with masks on these days…

Whether it’s a new book, a treat for the kids, a juice machine, or my most extravagant purchase — a whizz bang drone — I’ll admit the allure of consumerism has helped dull the boredom of being locked inside all the time.

|

|

| A typical scene in the Dinse household through lockdown — the theory here was a juicer could replace a lack of gym access… Source: Ryan Dinse |

Yeah, I know…you can’t buy your way to happiness.

But at least it stops each day turning into our own personal version of Groundhog Day!

And it would seem my family is not alone in this.

The proof can be seen in the big market winners since COVID hit.

Internet shopping giant Amazon.com, Inc [NASDAQ:AMZN] has seen its stock price double over the past 18 months.

Breville Group Ltd [ASX:BRG] — maker of said juicer — just touched all-time highs this month.

Ancillary services around this home shopping boom are doing well too.

Courier giant FedEx Corporation [NYSE:FDX] is up almost three times over the same period.

But it hasn’t just been ‘things’ we’ve bought to alleviate the boredom of lockdowns.

Netflix Inc [NASDAQ:NFLX] shares rose from a low of US$298 per share in 2020 up to around US$550, and remains close to that level today.

Which brings up an interesting insight…

As humans we crave new experiences as much as new things.

Perhaps even more so.

In a book I’m reading right now (delivered in lockdown, naturally) called The Consolations of Philosophy, pop philosopher Alain De Botton writes about how the things we buy are often substitutes for deeper needs.

A point advertisers know only too well:

|

|

| Source: Ryan Dinse |

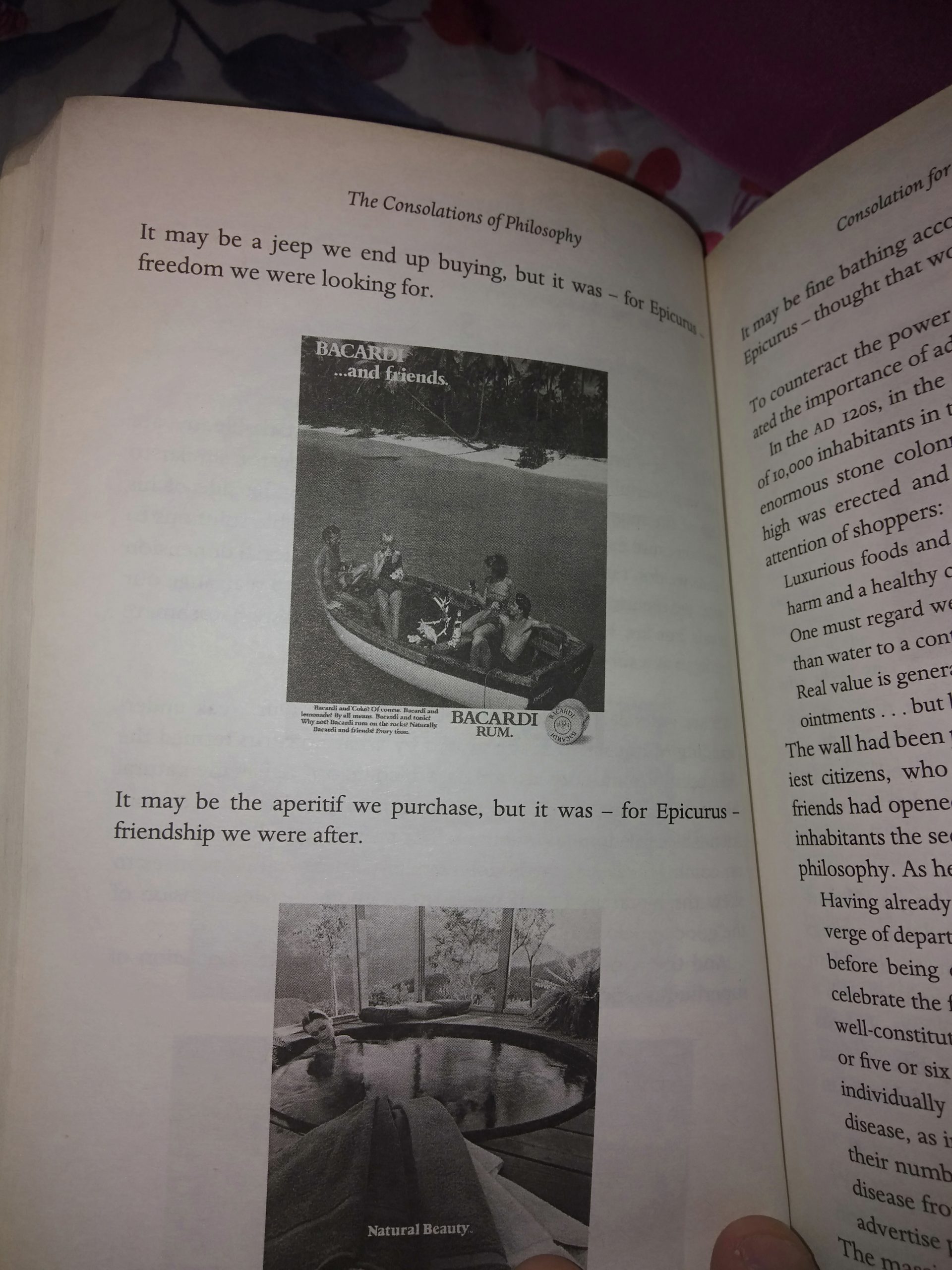

The passage above reads:

‘It may be a jeep we end up buying, but it was — for Epicurus — freedom we were looking for.

‘It may be the aperitif we purchase, but it was — for Epicurus — friendship we were after.’

Streaming services like Netflix offer us a form of temporary escapism, perhaps.

But I think in 2022, when we finally get out of continuous lockdowns (hopefully), people will seek to escape for real.

And that throws up investing opportunities for you now…

‘Jailbreak’ stocks to start researching today

I tell you what, I’m hanging for a decent holiday.

Whether locally in Victoria to somewhere like Phillip Island, interstate to sunny Queensland, or maybe even overseas.

And I think as soon as the gates open, a whole host of Australians — we’re a country renowned for our wanderlust after all — will be doing much the same.

I can guarantee you, if I was a 20-something with no care or responsibilities, I’d be on the first flight out of here to travel the world while I could.

The good news for our economy is that this will apply in the opposite direction too.

I can imagine an army of British backpackers hitting our shores as soon as they can, along with the return of students from all over the world.

But I think the urge to travel will be common through the generations.

If I’m right, a whole host of beaten-down stocks in that sector could make great gains.

You can even see a few of them start to move higher this week as the market starts to look six months ahead:

|

|

| Source: Twitter @ChrisWeston_PS |

Another area I think will go nuts is restaurants, theme parks, and basically anywhere people can go and do things.

You can use your own imagination here and think what you’ll want to do personally because it’s more than likely many others will be thinking the same way.

But although there may be a major relief rally in the experience economy as people look to their bucket lists, I also think some things from COVID are here to stay.

And there’s opportunity in that too…

Some things won’t change

The big one is working from home.

That’s not going away and it has huge ramifications across a number of areas.

For example, a piece in The Age last week talked about the rise in demand in city fringe suburbs of Melbourne as proximity to the CBD became less of an issue.

They wrote:

‘The population of Melbourne’s fringe suburbs will grow by more than 900,000 people in the next 30 years, leading Victoria’s independent infrastructure adviser to urge sweeping reforms to housing, transport, and energy use.’

Lifestyle suburbs — whether that’s tree change or sea change locations — will likely be in high demand too.

But the biggest beneficiary from the new work-from-home paradigm is the data industry.

Video presentations, online meetings, tele-appointments, and the like, are all very data intensive.

This is data demand that was already rising but has just moved up a notch.

This chart shows the rise in demand for broadband throughout the day from pre-COVID in February 2020 through to May.

|

|

| Source: Internet Australia |

While work from home is good for software companies like Zoom Video Communications Inc [NASDAQ:ZM], it’s even better news for the infrastructure which these companies build upon.

Perhaps that’s why a company on our own market, data centre company Data #3 Ltd [ASX:DTL], surged last week?

They revealed record-breaking revenue of $1.9 billion, with cloud revenue the key driver. It was up 36.2% from the previous year.

I don’t think this is a trend that changes anytime soon.

Anyway, I hope that’s given you some ideas to look into.

Of course, none of the above are recommendations to buy, just ideas to consider.

If you’re looking for firmer post-pandemic stock picks, I again recommend you read Ryan and Murray’s latest report here.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.