Today’s my first day back at the coalface after a short break over Christmas.

It was good to switch off a little and spend some time with my wife and two boys.

Though at the ages of nine months and three, a return to the rough and tumble world of finance somehow sounds a bit more relaxing!

So, what’s been happening while I’ve been away?

I ask you this with tongue firmly in cheek of course. Even on holidays the news tends to find you, no matter how hard you try to avoid it.

And as you know there have been some pretty big events to kick off the new decade.

We’ve had catastrophic bushfires around Australia, a stand-off in the Middle East that’s seen us on the brink of the Third World War and now, to top it all off, the Prince Harry and Meghan Markle saga.

Or Megxit as it’s being called on Twitter.

It’s a world of chaos right now.

And you shouldn’t expect things to get much better on the news front.

As well as these new events, the dramas of 2019 continue to roll on too…

The Trump agenda dominates

The China–US trade war trundles on. Last time I checked we were at phase 1 still. Or maybe that was phase 1-b?

I can’t keep up…

At the same time, the impeachment of President Trump weaves its way through the hyper-partisan political apparatus of Washington.

It’s an election year in the US this year, so expect to see issues with China and Iran magically develop around the needs of Donald Trump’s election chances.

My best guess?

China — good news. Iran — bad news.

Elsewhere…

In the UK, despite the recent UK election, Brexit is pretty much where we left off. It’s like watching the TV show, Deal or No Deal.

Some think there’s more chance Megxit will happen first!

Back to China, and the protests in Hong Kong seemed to have died down for now. But with no apparent resolution, I’d expect to see trouble here brewing again at some point in the year.

And here in Australia, the bushfires have reopened a fierce debate on climate change and severely wounded Prime Minister Scott Morrison’s political authority.

The Newspoll results from today show his approval ratings have plummeted over the summer.

So, as you can see, it was with some trepidation that I took a look at the financial markets for the first time in a while this morning.

What would I find?

It couldn’t be good…

Surprise!

As I looked at the charts of the major financial markets, chart after chart told the same story.

Australian market (All Ordinaries) — record highs.

US market (Dow Jones) — record highs.

Technology market (Nasdaq) — record highs.

German market (DAX) — record highs.

Gold — Six-year highs.

And Australian property seems to be continuing its post-election rally too. Both selling prices and clearance rates — two major metrics of property market health — finished the year strongly.

[conversion type=”in_post”]

It’s weird isn’t it?

That in all the turmoil, financial markets have never been performing better.

There’s an old stock market saying that says: markets climb a wall of worry. Which makes sense when you think about it.

The worriers keep the markets from getting too irrationally exuberant.

It’s when no one is worrying that you actually need to worry!

And when you take a step back and look at the big picture, you’ll see it has always been this way.

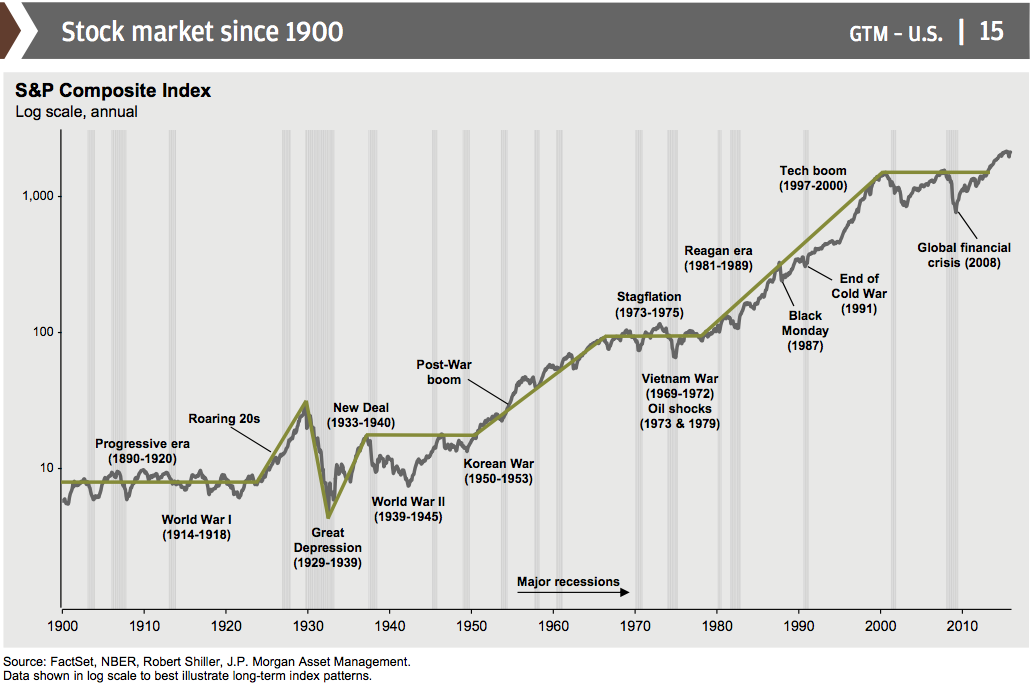

Here’s the S & P index since 1900 (on a log scale to account for percentage moves) plotted against major events:

|

|

| Source: FactSet |

As you can see, through thick and thin, the relentless trend is up. Of course, there are drawdowns, recessions, dips…but the economy always recovers eventually and the stock market moves higher.

In all the noise, it’s good to remember that.

This helps you to keep your cool

The dramas of today might seem worse than ever. But in reality, every generation thinks that. That their moment in history is worse than in the past.

Even Jesus’ disciples thought they were living in the ‘end times’.

But, so far at least, the doomsayers have been wrong 100% of the time.

That’s why you’ve to keep your cool when you invest.

An important step you can take is to get your asset allocation right.

That is, to make sure you’ve got investments spread around in different assets in proportions that make sense to your situation, goals, and appetite for risk.

In my opinion, that means having some money — even if it’s just a little — in the most promising small-cap stocks.

Why wouldn’t you want a stake in the exponential trends that could define our lives over the next decade?

Sure they can be volatile and risky. But if you take a step back and look at the big picture, the small-cap arena is where the large-caps of tomorrow come from.

And if history has taught us anything about life — and investing — it’s that the future is always brighter than the past.

No matter the dramas of the day.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments