Commodities look like they’ve got a new lease on life after last week’s inflation data from the US pointed to headline CPI figures slowing down faster than expected.

Only last Monday I wrote an article about how commodities have traded weakly these last couple of months, but that these CPI figures were a key piece to the puzzle.

And it looks like I was right on the money in picking the end of the lull for commodities stocks!

The ASX 300 Metals and Mining Index [ASX:XMM] rose by almost 7% while the ASX All Ordinaries Gold Index [ASX:XGD] rose 10% in a week.

The biggest winners were gold stocks. The bigger players like Evolution Mining [ASX:EVN], De Grey Mining [ASX:DEG], Regis Resources [ASX:RRL], and Westgold Resources [ASX:WGX] rose at least 15% over the week, further pointing to the possibility that the correction since April has ended.

It looks like — finally — the beginning of a good run for gold and other resources stocks!

A protracted gloom gives way to renewed optimism

Over the past three years, the global economy has been on a wild rollercoaster ride.

In short, we witnessed a major supply, monetary policy and economic shock that caused inflation to spiral out of control.

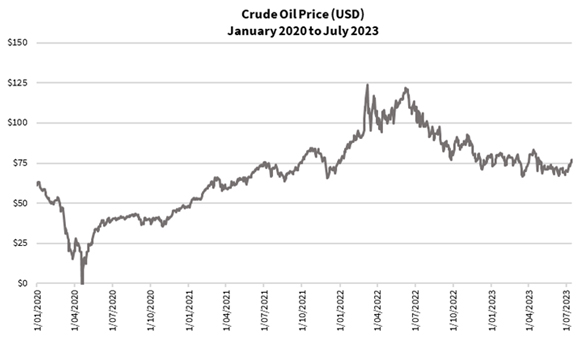

This tough environment has started to moderate somewhat in the past year. We’ve seen the price of crude oil fall below US$100 (AU$150) a barrel from August 2022 onwards, trading at around US$60–80 (AU$90–120) a barrel in the past seven months. You can see it in the figure below:

|

|

| Source: Thomson Reuters Refinitv Datastream |

That’s provided some relief for industries and mining companies after being ravaged by labour shortages and health-related restrictions that caused delays in operations, driving up input costs. Nonetheless, many companies continue to hint at elevated costs even in the recent quarter.

It’s for this reason that many who bought mining stocks in the past year may be frustrated. Many companies’ shares didn’t move in line with the price of the underlying commodity, which often traded at the higher end of the historical range.

This was because many companies reported underperformance in successive quarters. Management gave a laundry list of reasons as to why their operations were disappointing, causing investors to lose interest and sell their holdings.

However, we’re now starting to see a positive trend return for some mining companies for the 2023 June quarter. Indeed, some companies have provided the market with a brief update earlier this month pointing to improving conditions. This led to a better cash build and higher production, which has caught the attention of investors.

So it seems I was right that last week’s CPI release showing inflation is slowing down faster than expected may’ve completed the picture in bringing forth a commodities market revival!

However…

This doesn’t mean going all in on commodities and resources.

Timing your entry to avoid any short-term corrections is crucial to maximising profits.

This is why I want you to keep an eye out for crude oil…

Keep watch on the price of crude oil…

As you saw in the figure above, crude oil has crept up since the start of the month from below US$70 (AU$105) a barrel to US$75 (AU$112) at the close of market last Friday.

There’s no need to be alarmed yet, however. This rise has been partly driven by the weakening US dollar due to the lower inflation reading.

The US Dollar Index [DXY] actually fell below 100 last week for the first time since mid-April 2022, as you can see below:

|

|

| Source: Thomson Reuters Refinitv Datastream |

Now that’s a significant result.

Why’s that?

The weakening US dollar may, on one hand, spur risk-taking in the markets as asset prices rise. This bullish behaviour could help boost investment returns.

On the other hand…

If the price of crude oil rises, this could bring back inflation. Should that be the case, the US Federal Reserve could make good its earlier warnings that one or two more rate rises are forthcoming, causing the US dollar to strengthen once more.

So, while inflation has slowed down, it’s possible that it’ll pick up pace in the next two months.

All this is because, as I mentioned in last Monday’s article, there’s a six-to-nine-month delay in the effects of monetary policy set by the Federal Reserve and other central banks passing through to the broader economy.

On top of that, the effects of tightening supply of crude oil by the Organisation of Petroleum Exporting Countries (OPEC) since mid-June could similarly kick in, accelerating the price increase.

Now, be clear, I’m not saying that the markets are definitely going to face this fate.

But you’d do well to keep this in the back of your mind as you ride the current bullish phase.

Or, you can have someone keeping it in the back of your mind for you…

Check out my service, The Australian Gold Report. It’s a one-stop newsletter providing you with insights on investment strategies across all precious metals assets — from bullion to ETFs to individual gold producers.

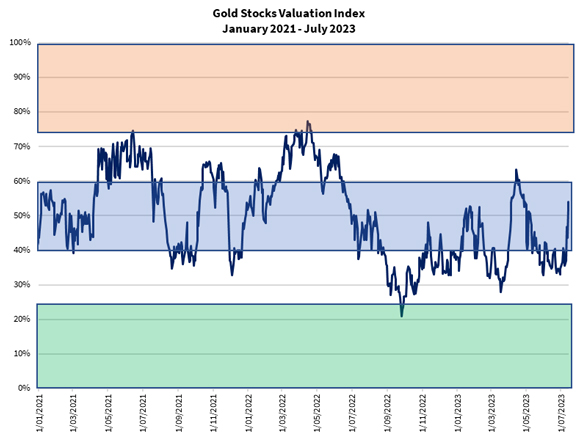

You can see how my proprietary valuation model shows that the trend for gold stocks has just turned bullish thanks to last week’s rally.

|

|

| Source: Internal Research |

The momentum has started to build, with market sentiment tipping upwards in the sector.

For long term gold investors, it’s time to sit tight and ride the bull!

Become one today by signing up here!

Regards,

|

Brian Chu,

Editor, Fat Tail Commodities