In today’s Money Morning…supply crunch looms as world stops looking for oil…a strange consequence for interest rates…oil up, interest rate rises muted…and more…

If you’ve filled up your car at the servo recently, you don’t need me to tell you that oil prices are on the up.

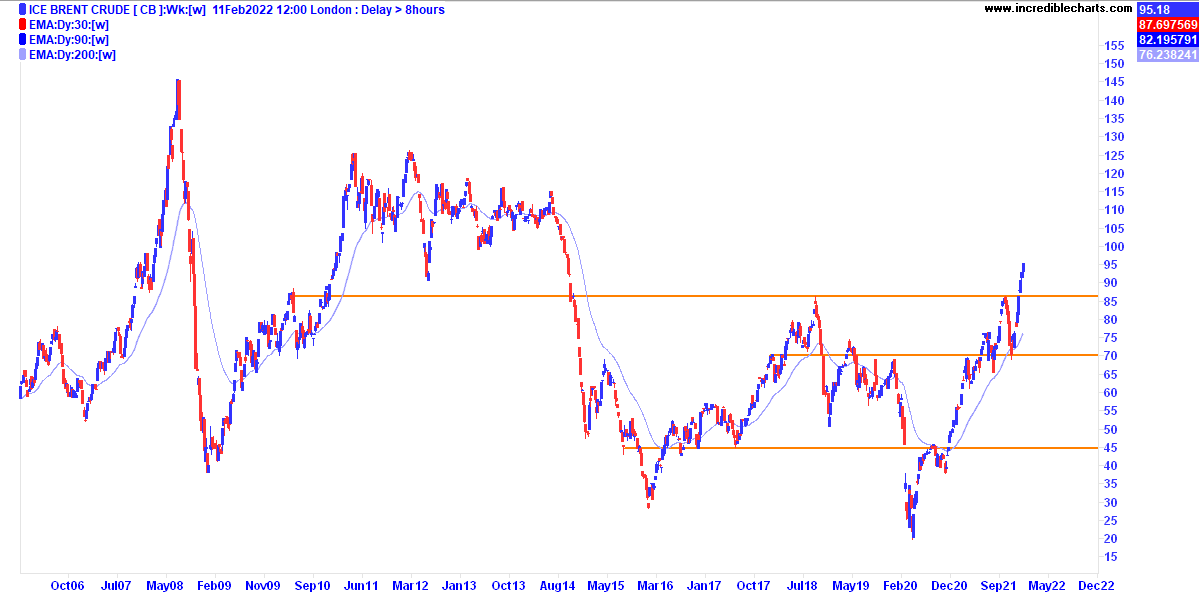

In fact, they just hit levels not seen since 2014.

Check out the 20-year chart:

|

|

| Source: Incredible Charts |

As you can see, oil last hit these levels in the midst of a rapid plunge. This time the opposite is occurring.

We’re seeing oil prices rising rapidly.

As the chart also shows, oil can make big moves both up and down a lot faster than you might think.

Which is always an opportunity for a nimble trader.

So what’s happening right now? And what should you do?

There’s more at play than you first might think.

First, the obvious…

Supply crunch looms as world stops looking for oil

The world is watching the Russia–Ukraine situation play out with increased trepidation.

The drums of war are getting louder, and markets are starting to price in its impact. Oil is front and centre of it.

As strategist David Roche told CNBC:

‘I think if there was an invasion of Ukraine and there were to be sanctions which impeded either Russia’s access to foreign exchange mechanisms, messaging systems and so on, or which prevented them from exporting their commodities, either oil or gas or coal, I think at that point in time you would most certainly see oil prices at $120 [a barrel].’

This makes logical sense…

Russia exports most of its crude oil to Europe (with China being the next biggest buyer) and would draw Europe into supporting US sanctions in any conflict.

That means the supply of oil available to buy is set to fall.

And while in the past, US oil drillers and others in the Middle East would be quick to take up the slack and increase production, there are perhaps signs they’ll be more reticent at doing so too quickly this time.

After all, they’ve been burned in the past by bringing on supply in response to price shocks, only to see prices whipsaw lower. Again, note that volatile price chart from the start.

But then there’s the fact that future oil supply is declining anyway.

Oil exploration hit 75-year lows last year. And it’s already having an effect on production.

As Palzor Shenga of Rystad Energy noted towards the end of 2021:

‘Although some of the highly ranked prospects are scheduled to be drilled before the end of the year, even a substantial discovery may not be able to contribute towards 2021 discovered volumes as these wells may not be completed in this calendar year. Therefore, the cumulative discovered volume for 2021 is on course to be its lowest in decades.’

No doubt the shift to electric cars and a plethora of ‘green’ regulations have made oil companies a lot less willing to spend on multiyear — or even multidecade — exploration programs.

Which suggests any long-lasting conflict — whether military or economic — could cause an oil supply crunch for a lot longer than you might think.

But there could be a strange and perhaps unnoticed consequence to all this in another part of the market…

A strange consequence for interest rates

As we saw in the latest data last week, inflation is running red-hot at 7.5%.

What happens to inflation if oil prices rise too?

Well, in theory, everything gets more expensive because fuel is used throughout the entire supply chain for every single good.

So the gut reaction is to think increased oil prices will stoke the inflationary fires even further as producers pass on costs.

It probably will in the very short term.

But rising energy costs in this circumstance aren’t necessarily the kind of problem that can be solved by putting up interest rates.

The idea of increasing interest rates to combat high inflation is to calm demand down a bit, and hence bring prices down.

But an oil price shock essentially does the same thing, in a different way.

Think about it…

Every single product is produced using energy and needs to be transported on trucks, trains, planes, and ships.

In other words, it’s almost a de facto interest rate rise — an increased cost — on the whole economy.

Which would bring an interesting possible outcome for markets.

Perhaps rising energy costs will do some of the Fed’s dirty work for them?

Right now, the market is pricing a 75% chance of a 0.5% interest rate rise next month from the Federal Reserve. Consensus is this will be the first of around seven rate rises over the next 12 months or so.

But personally, I don’t buy it…

Oil up, interest rate rises muted

You’re telling me that a global economy with record levels of debt — the US alone recently topped US$30 trillion in debt — can survive a world of increasing oil prices and increasing interest rates at the same time?

I’d suggest if this is the way it goes, we’ll see markets crashing sharply as consumers tighten their belts and confidence evaporates.

And then we know from the past 20 years that the Fed will change course very rapidly and turn the money printers back on.

So my best guess?

Short term, there’s a decent trade in oil and gas stocks being higher for longer. But I reckon interest rate rises will come slower than many are thinking right now.

Of course, I hope the Russia–Ukraine situation resolves itself peacefully too. And if it does, this scenario might not occur.

But as investors, we’ve got to be prepared for all possibilities.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: My mate Murray Dawes is probably the best trader I know. And he’s got exactly the right type of system to trade the volatile world we’re living in right now. He honed his trading system over three decades trading ‘the pits’ and is sharing his secrets right now. You can watch his presentation here. But be quick as this is only up for a limited time.