I attended a startling presentation last week from our resident geologist James Cooper.

As you might be aware, James is very positive on the potential of key miners in the battery metals space.

It is, as he explained to us, ‘a simple imbalance between future supply and future demand’.

But what I didn’t realise until last week was how insanely out of whack the supply demand dynamics actually were.

A slew of recently released independent data says we’ve a snowball’s chance in hell of ever meeting our net zero — that is, zero carbon dioxide emissions — targets by 2050.

But that’s not stopped a lot of governments happily signing up anyway.

Net zero targets are already legally binding in countries such as the UK, France, New Zealand, Denmark, and Hungary.

And many other countries around the world — like Australia, most EU countries, and the US — have made strong commitments to this goal too.

But here’s the thing…

Today, the plan is to go all in on renewable technologies such as wind and solar.

At face value, it’s an admirable and easy to agree with proposition.

Cheap, unlimited energy direct from nature?

Why not?

Unfortunately, there’s a huge catch to this plan and it could end up being one big pipe dream.

Let me show you why…

The math doesn’t add up

Here’s the part from James Cooper’s presentation that made me take notice.

Quoting a peer-reviewed and highly credible study from Professor Simon Michaux he stated that:

‘It’d take 400 years for the world to produce enough nickel to run the world on renewable energy.’

You’d need just under one billion tonnes of nickel to make the wind turbines, solar panels, batteries, and electric vehicles needed to replace fossil fuels.

And that’s just for phase one — the first 20 years (all these things need to be replaced over time fairly regularly).

For context, in 2019, the world mined just 2.4 million tonnes of nickel.

And it’s not just nickel that is in short supply.

Take copper…

Michaux found that to replace fossil fuels with renewables would require more than 4.5 billion tonnes of copper.

In 2019, the world mined around 24 million tonnes.

In other words, it’d take 189 years at current production rates to dig up enough copper to make the transition some countries have legally committed themselves too!

The situation is the same for many other minerals.

As James laid out in his presentation:

‘So what does the data show? In a peer review study based on current annual mining production…we’ll need:

‘9,920 years’ worth of Lithium

‘1,733 years’ worth of Cobalt

‘3,287 years’ worth of Graphite

‘189 years’ worth of Copper

‘400 years’ worth of Nickel…’

You can’t just will into existence such materials.

For example, a typical copper mine takes between 10–20 years to get into production from exploration.

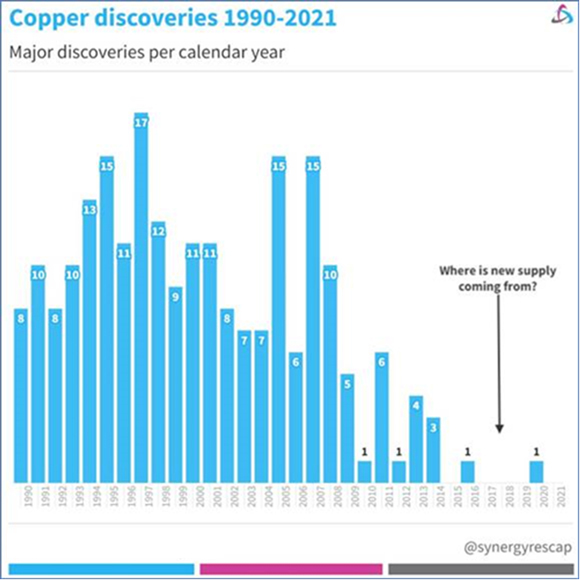

Which brings me to this chart:

|

|

| Source: S&P Market Intelligence |

As the graph states, ‘where is new supply coming from?’.

New major discoveries are few and far between. Never mind the fact spending on exploration has been trending down for the past eight years too.

It begs the question…

How in the heck do we meet targets only 27 years away if we’re nowhere near finding the copper needed?

Beyond this seemingly insurmountable problem, there’s also another huge problem.

The cost of upgrading the energy grid to work with renewables is enormous.

David Wojick, a former consultant with the Office of Scientific and Technical Information at the US Department of Energy stated in a recent paper:

‘Grid scale storage at the scale needed to replace fossil fuels with wind and solar is impossibly expensive.

‘Even assuming fantastic price reductions, analysis shows the cost of the required battery storage still nearly equals the $23 trillion annual American GDP. The likely cost would be many times GDP. Clearly this is economically impossible.

‘Despite this impossibility, present government policies and utility practices are driving toward massive grid penetration by renewables. This reckless drive must be properly constrained and managed, in order to protect reliability. American grid reliability must be maintained.’

You can read the full paper here for more detail.

But the biggest irony of this situation is probably this…

The catch-22 of going green

Despite the reality of the situation, it seems our leaders are hell-bent on forging ahead regardless.

It reminds me of a quote from Joseph Heller’s classic novel, Catch-22:

‘Yossarian was going to live forever. Or die in the attempt.’

The catch-22 of our current situation is that we’re going to need an almighty mining boom to get anywhere near these targets.

And guess what that’ll need?

A lot more energy and a lot more CO2 emissions!

Another inconvenient truth is that energy required to dig up the ‘green’ metals we need in the timescale required will likely involve vast amounts of fossil fuels too.

Renewables simply aren’t up to it yet.

No wonder the likes of Rio Tinto and BHP are these days happily ‘going green’!

They’ve realised it’s a massive money spinner for them.

And it could be for you too…

If you can’t beat them, join them…reality bites…or go nuclear?

Knowing there’s not going to be enough materials to go around, you could simply buy up well-chosen copper, nickel, and rare earths companies and let the failed plan play out.

The ‘if you can’t beat them, join them’ approach.

We still won’t meet our net zero targets, but you’ll potentially profit as a result!

But you need to choose well here.

The worst thing in the world as an investor is to get a trend right but end up backing the wrong horse.

This is where our resident geologist James Cooper can help.

He knows how to sift the duds from the miners with genuine mineral deposits.

You should definitely check out his process here for more information.

A second idea…

Reality bites!

At one stage, perhaps our leaders will realise the impossibility of the situation?

Then they’ll have a choice:

Ration energy or allow cheap fossil fuels back into the mix?

My bet is the latter will be chosen.

This means there could be opportunities in key beaten down oil, coal, and gas stocks.

Funnily enough, Germany just made that exact choice and is in the process of reopening coal mines in the wake of its own energy shortages.

As this tweet states, this is having a compounding effect on the renewables transition:

|

| Source: Twitter |

On that note, one of my European-based colleagues told me recently that there’s been a growing public pushback on the policies of net zero.

He noted:

‘Farmer rebellions in Holland, President Macron of France calling for an end to green EU laws, Germany returning to coal, new drilling for oil in the North Sea…there are major signs Europe is u-turning on net zero plans all over the place.’

I suppose people start seriously questioning things when the lights go out, your work closes down and sacks you due to high energy costs, and you can’t heat your home in winter.

Let’s hope it doesn’t get to that extreme back here in Australia.

Lastly, there’s the nuclear option…

For some remarkable reason, most people driving the energy transition seem to be strongly against nuclear power, despite it being a highly reliable, base-load generator of carbon-free power.

I think that viewpoint could change soon.

Indeed, France — which has been running a nuclear fleet since the 1960s — has committed to making nuclear power a central focus of its own 2050 targets.

As reported in Reuters:

‘President Emmanuel Macron has put nuclear power at the heart of his country’s drive for carbon neutrality by 2050, with plans to build at least six new reactors.

‘An energy ministry official said in September the aim was to start construction of the first next generation EPR2 reactor at Penly in Normandy before the end of the presidential term, before May 2027, with commercial operations at that reactor starting from 2035–37.’

I expect more countries will follow this lead…

The natural opportunity here is in uranium miners and certain new nuclear technologies.

Aside from these three themes, there are other niche ideas worth exploring around hydrogen and carbon capture.

But I think the key takeaway from all this is that the reality of the energy transition is a lot more complex and fraught with difficulties than we’re being told.

And that reality is already starting to hit home…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: If anyone has research that can refute any of the above points, especially around the raw material constraints, I’d be very happy to hear about it and examine the other side of the story. If so, send it to support@fattail.com.au with the heading ‘Renewables Transition’.