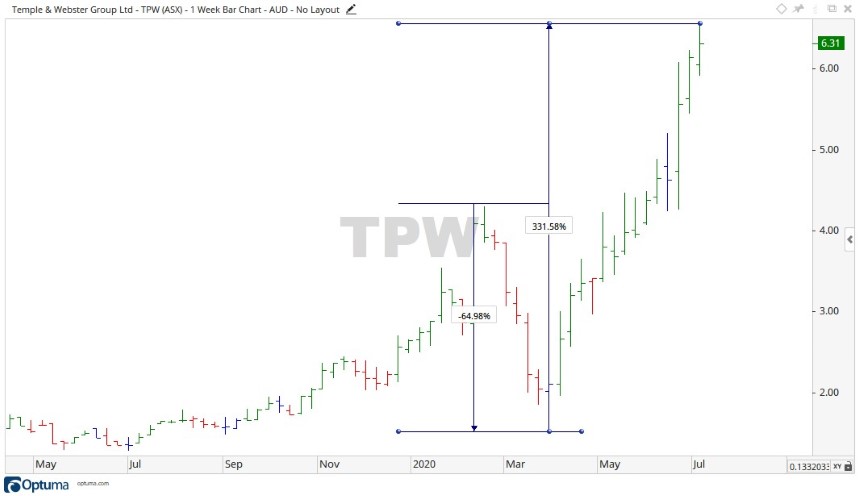

Today, we take a quick look at the fortunes of Temple & Webster Group Ltd [ASX:TPW].

The TPW share price is on a tear of late, rocketing up to the all-time-high price of $6.56.

The explosion in growth is fantastic, but will it last?

Source: Optuma

What’s happening With Temple & Webster?

Initially, TPW felt the effects of the COVID-19 virus as a global equities selloff unfolded.

Trading at an all-time high in February 2020, when the pandemic hit, the company’s share price tumbled over 64% into the March low.

From the March low of $1.52, the TPW share price then burst up over 331%. This huge acceleration in price is down to the huge growth in online sales and more people shopping for items for their homes in the wake of the pandemic.

When you can’t leave your house, you may as well spruce it up…

Source: Optuma

It’s not just TPW that is benefiting from the knock-on effects of the pandemic. It’s been reported that online sales of homewares and appliances have jumped 10–15% across the board.

While this all looks wonderful, the big question is: Can it continue?

Technical outlook for TPW share price

In a 1 July announcement, the company said it will be going into a trading halt as it seeks to undertake a fully underwritten institutional placement of AU$40 million.

The announcement said: ‘Given the recent acceleration in the adoption of online purchasing, particularly with respect to the Australian homewares and furniture market, Temple & Webster considers it prudent to strengthen its balance sheet, providing the Company with further financial flexibility.’

It’s common for companies on strong runs to opt for balance sheet-strengthening capital raises.

We saw this with Kogan.com Ltd [ASX:KGN], which recently went for its first ever capital raise.

Source: Optuma

Looking at the chart, the TPW share price is sitting at $6.31.

Should the run-up continue, the projected levels of $6.50 and $6.75 may provide future resistance.

It’s worth noting that this run-up is happening on ever-decreasing volume, indicating the move up may be running out of steam.

On the downside, should the share price start to contract, then the levels of $4.65 and $4.15 may come into focus.

Looking at all-time highs is a great way to spot which industries and sectors have the most potential.

But ideally, you want to be getting into a stock at the early stages of a breakout.

‘Buy low, sell high’ is the motto.

Many technical traders actually use the motto ‘Buy high, sell higher’, though.

Looking at the TPW all-time high and decreasing volume, it’s a legitimate question to ask: Is it may perhaps too late for some traders?

That’s why, if you are looking to stay ahead of the curve in finance, our publication Money Morning is a fantastic place to pick up investment stories before they hit the mainstream press. It will come to your inbox six days a week, and I strongly encourage anyone trying to become a better investor to subscribe. It’s free and you won’t regret it.

Regards,

Carl Wittkopp,

For Money Morning

Comments