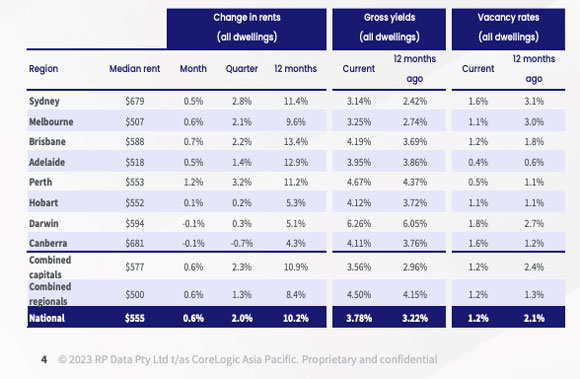

This week, news from CoreLogic shows that rents nationally increased by 10.2% in 2022.

Having said that, over the last couple of months, rental listings have started to increase, and the pace of growth has moderated.

It’s likely that we’ll see a peak in rents this year and stabilisation in rental prices, particularly in some regional locations where migration has slowed and a moderate return to the city is underway.

Here’s a breakdown per city:

|

|

| Source: CoreLogic |

Despite this, however, the two cities that are rumoured to buck the trend, with increases set to continue, are Melbourne and Sydney.

This is largely due to the impact of international migration.

It’s rocketing to pre-pandemic levels — fuelled further by the return of international students.

Sydney traditionally picks up the lion’s share of international migration. However, if we slip back to previous pre-pandemic trends, Melbourne wins on interstate migration.

In other words, more people move to Melbourne from other Australian cities than leave. That’s despite Melbourne’s grey skies and cold winters. It’s one reason why Melbourne’s population is spruiked to exceed Sydney’s in years to come.

These three factors:

- A return of workers to the office

- An uptick in international migration and forecast improvement in internal migration

- And rapidly rising rents

Are said to be the reason why median prices in Melbourne’s CBD apartment sector have rocketed upwards in comparison to other inner-city regions spooked by buyer concern regarding the sudden sharp increase in lending rates.

The CoreLogic breakdown of the top 10 SA3 capital cities with the highest 12-month value growth, in median values, has Melbourne city at more than 6.2% higher throughout 2022.

That’s a pretty impressive statistic, considering the economic climate:

|

|

| Source: CoreLogic |

Set against low construction activity, it’s leading to some investors questioning if it’s a good time to step into the apartment market.

The notion being that they may capture the ‘golden egg’ of property investment — a rapid increase in capital gains along with positive rental yields.

A few points to take note of, however…

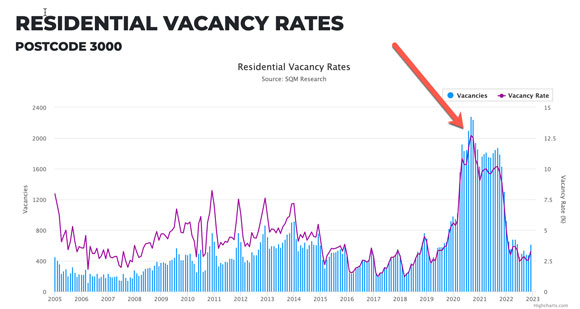

Firstly, the rise must be taken in context of the sharp downturn in rents and prices through the extended COVID lockdowns in Melbourne.

At the time, the situation was termed an ‘apartment apocalypse’ as short- and long-term rental listings flooded the market leading to residential vacancy rates in the CBD exploding by more than 10%!

Take a look:

|

|

| Source: SQM Research |

In other words, a sharp rebound once conditions changed, and residents returned, was inevitable.

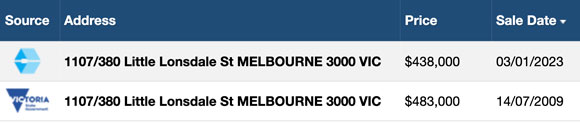

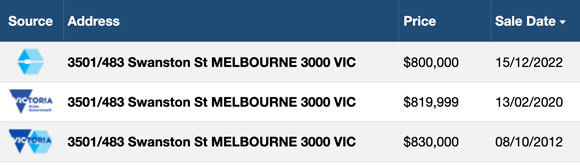

Secondly, don’t be fooled by changes to median values without breaking down what’s actually happening to individual prices!

I’ve always said that median price — which is, after all, just the middle figure of a bunch of sales — hides a lot of what’s occurring on the ground, either underestimating or overestimating the increase or decrease.

So it’s easy for median data to be skewed upwards by top-end sales.

Such as the Southbank skyscraper, STH BNK, planned to be the tallest in Australia, that began marketing its apartments early this year, setting a $35 million record for Victoria’s highest-ever apartment price in its first weekend of sales!

The sad truth is that when analysing individual sales results of the kind of apartment stock most investors would target, the median gains are not all that visible.

If I scroll through some recent sales in Melbourne, on one of the property databases I use, for example, it’s clear that properties purchased this year are still significantly discounted on what they were initially sold for a few years previously.

A few snapshots to demonstrate:

|

|

|

|

|

|

| Source: Property Data Online – REIV. |

I’m not saying there’s no exception to the rule, just that when growth has occurred, it’s minimal — certainly not close to what can be achieved in other property types.

I’ve said it before, but it’s worth reiterating for new subscribers: overall, apartments are poor investments.

The logic is simple.

They have a skinny buyer market — made up mostly of investors.

Of the buyer market, 7/10 investors purchase apartments so demand tends to wax and wane with sentiment.

The demographic that lives in apartments is tiny also.

There are around two million apartments across Australia (which make up around 16% of the dwelling stock). Yet, only around 10% of the population live in apartments — mostly a younger generation of renters.

And contrary to the concept that we have a growing number of one-person households, which prospects a good omen for future investment, it’s worth noting that only around 14% of those households live in a one-bedroom apartment.

Likely a larger proportion of those households are elderly residents that have lost a spouse, for example, and are now rattling around in post-war suburban housing. After all, there’s little policy incitive to downsize.

Demand from first home buyers is also lacking.

The average age an Australian first home buyer steps foot onto the mythological ‘property ladder’ is in their early 30s — once they have found a partner.

Therefore, the trend is to look for somewhere to start a family, and a small one- or two-bedroom apartment — for the sake of staying pinned to the city — often doesn’t cut it.

For this reason, over the longer term, family housing and land has seen the biggest gains. In my opinion, that will continue.

Families with children are our biggest buying demographic. If possible, you want to cater to this sector.

All the available data indicates they want land. Not townhouses or apartments. Obviously, housing and land require a bigger budget; therefore, if you’re a unit buyer, focus on the ideal downsizer accommodation.

I suggest the small two- and three-bedroom single-level villa units that share a common driveway that are in the middle-ring suburban regions of the larger capitals.

I’m talking about properties like this, for example:

|

|

| Source: Trovit |

Prices can be fairly comparable to apartments, yet they have a much broader buyer demographic that gives a better chance to get some upward movement in price over the longer term.

- Investors

- Downsizers

- Young families

- First home buyers, for example

There are numerous other reasons to steer clear of apartments, including high owner’s corporation fees, unexpected levies, poor construction quality on the newer builds, and high insurance premiums on the older stock.

All in all, apartments are great for renters, not so great for investors. At least, not if you’re expecting the price to go up, not down!

Steer clear.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments