Over the last two months, our focus at Diggers and Drillers has made a dramatic shift toward adding lithium stocks. But that wasn’t always the case…

In an article I published in November 2022, I had this to say about the commodity (emphasis added):

‘Most market commentators have stated future demand for EV batteries will continue to drive a boom in lithium prices.

‘But that’s the typical mainstream sentiment; I believe much of the excitement has already been priced in. In my opinion, I see much stronger opportunities presenting in other areas of the commodity sector.’

You can read the full article here.

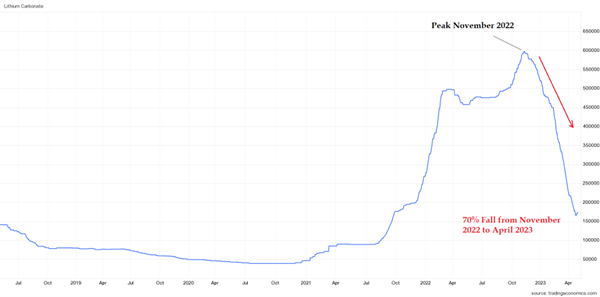

Indeed, by November 2022, the lithium hype had been ‘fully priced in’.

Lithium carbonate reached its highest-ever-recorded price of around 600,000 Chinese yuan on 15 November.

From there it fell a staggering 70% into April 2023.

See for yourself below:

|

|

| Source: Trading Economics |

Coincidentally, our Diggers and Drillers publication was launched that same month…

This was when the lithium story was reaching its euphoric peak. Investors were clambering into stocks as they continued to defy all other sectors of the market.

However, using the lithium story would have been an easy but (in my mind) reckless way to promote our release.

Given what we were seeing play out in the market, we steered clear and focused on other areas of the resource sector.

That’s why avoiding certain markets is JUST as important as picking the right areas for investment.

As an investor that places you in a MUCH stronger position to capitalise on lower prices…both financially and mentally!

So, with the correction well and truly underway, is there any justification for adding lithium stocks now?

Rumblings of a recovery are emerging…

Opportunistic bids from majors in the industry offer investors clues that the lithium market is preparing to stage a comeback.

It started in March when US chemical giant Albemarle made a $3.7 billion bid for West Australian lithium developer Liontown Resources [ASX:LTR].

That sent LTR’s share price soaring more than 60% in a single trading session.

The company is now trading above its all-time highs, despite the underlying commodity still languishing well below its November peak.

But in many ways, Liontown stood out…

In terms of scale, Liontown’s enormous Kathleen deposit in Western Australia will be competing with Pilbara Minerals’ [ASX:PLS] Pilgangoora Project.

As you might remember, PLS was the darling of 2022’s lithium surge…rocketing around 150% through the second half of last year.

With very few active producers in the lithium sector, PLS stood out. That’s why new upcoming producers could be about to repeat Pilbara Minerals’ success.

It’s one of the reasons we’ve been adding lithium stocks over the last two months…focusing on both the hard-rock lithium miners in Australia and lithium brines in Argentina.

A strategy for adding lithium stocks

As I’ve highlighted to my subscribers, early production is the ideal investment phase in the mining lifecycle.

At this stage of development, the company holds a JORC-compliant and economically viable deposit. Resource drilling and the geological and metallurgical due diligence have been completed.

That eliminates the biggest risk of all…the geology.

Construction and finances are all controllable factors. Engineers can tweak processing facilities to optimise output while CFOs can pursue different avenues for investment — capital raisings and offtake agreements.

The deposit on the other cannot be changed, fixed, or altered…

Economic deposits are a freak of nature that sits under management’s feet as an unknown beast that can only be tamed through extensive drilling and geological interpretation.

That’s why we would expect a premium for a stock holding a known deposit with measured reserves.

But there’s another reason to favour the early producers…

Cash is king in the resource game. Production means revenue…an opportunity to pay down debt and test new exploration targets.

But why do I emphasise the need to focus on EARLY producers?

Mines are a depleting asset. Declining output is the thorn that sits in the backside of every major mining firm.

The young mid-cap producers have the advantage of YOUTH. There’s no immediate need to explore for replacement reserves or overpay for acquisitions to maintain output.

Years of production lay ahead.

It’s for this reason I tend to focus on companies operating in the early production life cycle.

But there’s another critical factor to consider…

The price of the underlying commodity.

While we can’t always get the timing right, the Goldilocks scenario is to own a company entering maiden production on the back of rising prices.

This is the sweetest spot of all for an early producer. But when the stars align, value can be hard to find as an investor.

Enter lithium…

In terms of the lithium sector, several late-stage developers are looking to begin production in the next 12–24 months.

This could occur on the back of a strong recovery in the sector…making now an opportune time to potentially add lithium stocks.

But as an investor, it’s likely you’ll be competing with the majors in the months and years ahead.

The world’s largest mining firms have been unanimous in their push to grow their exposure to critical metals.

But when it comes to the race for critical metals deposits, each mining conglomerate has their own specific shopping list of commodities…

The world’s biggest miner, BHP, has been squarely focused on nickel and copper acquisitions as it looks to boost its output of future-facing metals.

While Australia’s richest person, Gina Rinehart, made a surprise move on a REE developer based in the Northern Territory — Arafura Rare Earths [ASX:ARU] — absorbing around 10% of its stock after pumping $60 million into the company.

While Twiggy’s Wyloo Metals looks to be zeroing in on PGEs, REEs, and nickel…his latest bid was for a stock in the Diggers and Drillers portfolio…Mincor Resources [ASX:MCR].

But so far, none of these big players have expressed any interest in lithium.

However, mining giant Glencore [LON:GLEN] is one such miner that could be about to enter this space.

This Swiss-based miner holds various coal, copper, and nickel assets in Australia and has expressed a strong interest in adding lithium assets to its commodity pipeline.

But despite voicing its intentions to break into this niche market, Glencore has not made any moves into this sector…yet…perhaps waiting for a drop in the market.

But as I’ve outlined, lithium has just had its ‘come-back-to-Earth’ moment…meaning several majors could be about to embark on their long-awaited move into the sector.

As I highlighted earlier in the piece, we just witnessed a bid from US-based Albemarle for Australia’s Liontown Resources last month.

Liontown holds a large shovel-ready deposit that’s slated for maidan production as early as 2024.

But there’s another mining conglomerate pushing its way into the lithium sector…Rio Tinto.

Early last year, the company snapped up the Rincon lithium project in Argentina for $825 million.

Rincon is a large lithium brine project holding a PROVEN resource that is also knocking on the door to maiden production.

The majors have shown that they move on these opportunities when the market turns down. We saw that last year with Gina Rinehart’s move on Arafura Rare Earths. We also saw it amongst BHP execs winning a bid on copper producer Oz Minerals.

Andrew Forrest also lit a match under the M&A mining space with his bid for the nickel play, Mincor Resources in March 2023.

That’s why, IF Rio Tinto is prepared to make a serious commitment to lithium, then NOW is the time to make its move on a late-stage developer.

But acquisitions aside, adding lithium stocks to your portfolio could offer strong upside as sentiment returns to the sector.

With more EV gigafactories coming online each month, a short-term glut in the lithium market could soon be replaced with supply pressure and renewed excitement amongst investors.

Get ready for the lithium recovery!

Until next time,

|

James Cooper,

Editor, Fat Tail Commodities

Comments