|

It used to be parroted ad infinitum that low new supply, coupled with high immigration, was to blame for soaring property prices.

A 2016 report by Andrew Bolt sums it up nicely:

‘Malcolm Turnbull: “It’s very clear what the cause is [of unaffordable housing]: we simply have not been building enough dwellings. You have failure to meet demand year after year and you get the consequences”.

‘Bolt: “No. The real problem is not that there aren’t enough houses. It is that every year, there are even more people wanting one. The real problem is immigration.

‘“For more than a decade now, we have been bringing in massive numbers of immigrants…[it’s] historically high. Those are all people who need a home to rent or to buy.”’

Now we live on a prison island.

No one allowed in, no one allowed out. Zero immigration.

The government’s ‘HomeBuilder’ program has driven a mega construction boom. There’s an abundance of new stock.

Yet we still have rapidly increasing prices.

Go figure.

The take-up rate of the federal government’s HomeBuilder scheme was more than four times higher than expected.

The government received more than 99,000 applications to build a new home via the scheme, as well as some 22,000 applications to undertake renovations on an existing home.

Even so, the construction industry has now hit a bottleneck.

Firstly, there are stories of major construction companies approaching tradies on rival job sites offering bonuses and other incentives to try and lure them away and cover a shortage of workers.

I’m told, tradies such as concreters and bricklayers are in very high demand. Some booked out until 2022.

Combine this with the rapid inflation in construction materials.

The price paid per brick has gone up from less than $1 late last year to as high as $2.50 or more.

Supply chain disruptions for construction equipment, building materials, and skilled labour come from delays in production and shipments from China, the US, and Europe.

If you want to renovate, you face a 10–15% increase in costs at least.

That’s putting a halt on various construction projects Australia-wide.

Timber prices reached record highs earlier this year, soaring 380%.

They’ve fallen somewhat since, but shortages are still keeping prices at top dollar.

It’s made worse from domestic timber supplies destroyed by the 8.5 million hectares of forest burned in the 2019/20 bushfires.

On the ground — of the 99,000 families who applied for the grant to build their home — 9,800 (10%) currently have no idea when construction will complete.

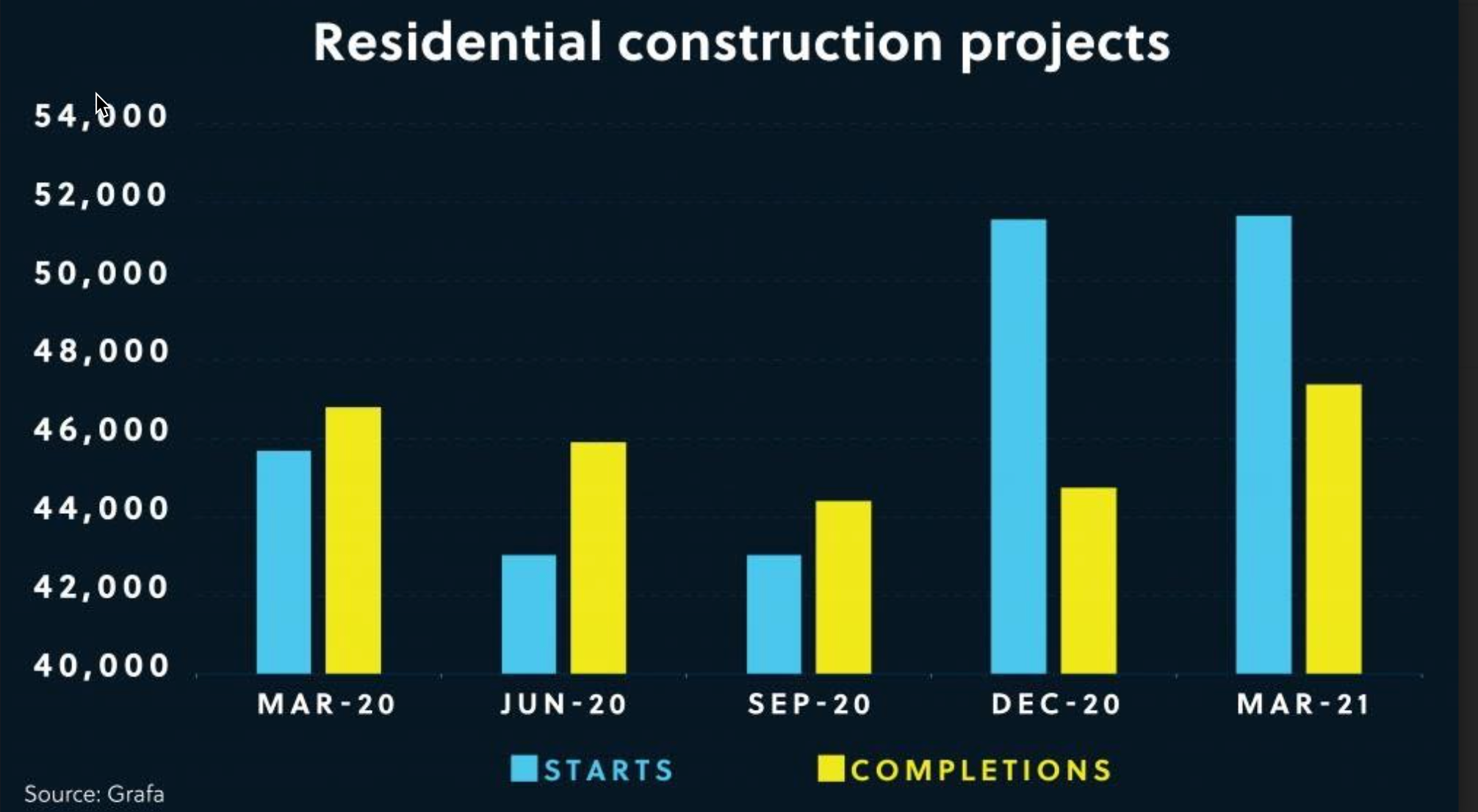

The graph below shows the difference between residential projects commenced and completed quarterly.

You can see the diminishing capacity of construction businesses during the latest boom:

|

|

| Source: Data analysis by Grafa |

The other issue here is that suburban land prices in the last year have been run up by home buyers — not developers.

That means that there is no profit for small developers wanting to subdivide land — the prices are too high to make a profit.

Projects are not commencing; others are going bust.

Further, the shortage of construction materials and price hikes is speeding a trend that has the potential to disrupt the next real estate cycle (post the downturn in 2027/8).

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

I’m talking 3D printing — a practice that often uses recyclable materials.

Back in 2018, the CNN website posed the question:

‘Will the world’s next megacity drip out of a 3D printer?’

There wasn’t much imperative to rush into the new technology prior to COVID. A little like the work from home culture.

But now, it’s increasingly seen as a viable solution to a supply crisis, and projects using the technology are popping up everywhere.

In Tempe, Arizona, for example, a company called Habitat for Humanity has started building the US’s first 3D-printed homes.

We’re talking a 1,700 square foot, three-bedroom, two-bath townhouse:

|

|

| Source: msm.com |

In southeast British Columbia, Canada, The Fibonacci House — a spiralling concrete tiny house — is not only Canada’s first-ever permitted 3D printed dwelling; it’s now enjoying an additional superlative as the first-ever 3D-printed property to be listed on Airbnb.

|

|

| Source: AirBnB |

Scoot over to Amsterdam, and a few weeks ago, we had the opening of the world’s first 3D-printed bridge:

|

|

| Source: dezeen.com |

The 12-metre 3D-printed pedestrian bridge spans the Oudezijds Achterburgwal canal in Amsterdam’s Red Light District.

It used 4,500 kilograms of stainless steel — 3D printed by robots.

Efficiency is the key here; the structures use less material.

There’s significant weight reduction in the materials used, parts are manufactured onshore, and it’s seen as more ‘environmentally friendly’.

How much does it cost to 3D print a house?

Aside from the printer, which can run anywhere from $180,000 to $1 million, the cost of building a 3D-printed home can be as little as $4,000 for the structure (i.e., the base, walls, roof, and sometimes the wiring).

Or for a larger, more complex structure, 3D-printed homes can run anywhere from $10,000 to $100,000.

When you consider that it currently costs around $350K upwards for a very basic similar style property in Australia, that’s pretty impressive!

There are a few companies gearing up to do this in Australia.

One example is Melbourne start-up SLIK Build.

‘Imagine building your home for under $100 per square metre,’says Tom Macrokanis (founder of SLIK Build).

‘You go to the machine hire factory, pick up your 3D printer, go to your block, set it up on the slab, concrete trucks start turning up, you flick on the printer, and you sit back and watch your home almost grow out of the ground.’

Of course, what no one tells you, is the effect it has on land prices.

Obviously, the cheaper it is to construct, the more money is available to bid up the price of land.

Land always takes the gains!

This could be very inflationary to future cycles…

That is, however, unless the outward migration we’re seeing now continues! Taking more and more people out of the inner city zones.

It’s this that could really disrupt the next real estate cycle.

Still, with the mega boom of new accommodation, Tim Toohey of Yarra Capital says it will result in an oversupply of new housing by 2023.

‘[Toohey said] historic building approval levels for stand-alone houses, matched with the “unprecedented” fall in population growth — largely due to closed borders — would create the biggest overbuilding of new houses since 2008.

‘“Going into Covid-19 we had a little bit of a shortage, but that will turn into significant oversupply,” Mr Toohey said.

‘“The penny hasn’t dropped, but when it does it will take the heat out of house prices.”’

The only thing to offset this would be a massive ramp up of immigration. And under current conditions, who knows when that would happen.

I can’t envisage many wanting to rush here with state borders closed, vaccine passports mandated, and lockdowns promised to continue indefinitely.

I wouldn’t mind leaving myself!

Even so, these trends are unlikely to affect the inner and middle-ring suburbs in capitals and large regional cities.

Most of the new accommodation is situated in new estates.

Another reason why — if you’re in the market to buy — you absolutely must avoid these regions (new estates) if you are looking for profit over the next few years.

Sincerely,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.