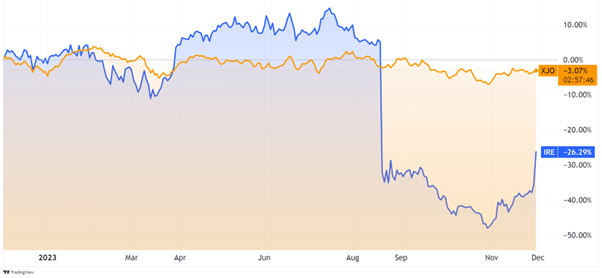

Financial software company Iress [ASX:IRE] has seen its shares climb by 15% today, trading at $7.07 per share.

The jump only recovers around one-quarter of the company’s losses, after its disappointing 1H23 results saw its shares drop over 35% in August.

It’s been a tough year for the new CEO and CFO, who joined earlier in the year and took on the task of transforming the business.

CEO Marcus Price joined the company from PEXA, a digital property exchange that had the largest float of 2021 with a $1.18 billion share issue.

The pair started a strategic transition that ‘will focus on its core offering’. This meant divestment of its international businesses and a 10% workforce cut.

In October, the company announced it had completed the sale of its MFA business for $52 million to refocus back into the Australian market.

With the previous poor results and pains of restructuring, the company’s share price has fallen -25.6% in the past 12 months.

So is the new strategy paying off for the company?

Source: TradingView

Strategy and the Rule of 40

The abandonment of global expansion hopes was at the heart of the company’s strategic shift.

The sale of its Managed Funds Administration (MFA) business to global software provider SS&C was the, largest but UK assets were also sold.

The company used these proceeds to pay down its debts as the first pillar of its strategic ‘reset’.

Net debt levels were $308 million on 31 October, down from $375 million at the end of June.

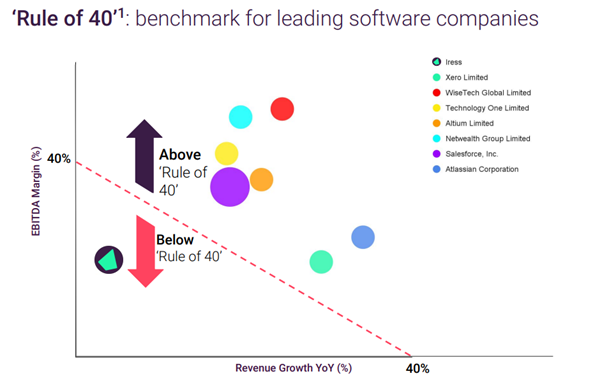

The next phase of the company was its ‘refocus’, where Mr Price has firmly set the target of achieving the Rule of 40.

The Rule of 40 is a principle that states a software company’s combined revenue growth and profit margin should equal or exceed 40%.

The problem is that Iress is still a long way from that target.

Source: Iress

In its update today, Iress said it had accelerated this transformation and was already seeing benefits.

For 2H23, the company saw revenue increase 2.6% versus 1H23. The company is targeting 5–7% annual revenue growth within the medium term.

Another factor Iress said it was addressing was its rising costs. Staff costs were down 3.9% from the last half, while non-wage opex was up 2.4%.

The company blamed inflation for rising input costs and some seasonal trends impacting its bottom line.

The company said initiatives around cost savings will see full effect in FY24 as its transformation program ends.

‘Iress’ transformation plan has been accelerated and is delivering outcomes. Revenue in the second half of FY23 is now expected to be slightly ahead of expectations. With accelerated cost benefits, we are also modestly upgrading Underlying EBITDA guidance.’

‘We brought forward a number of transformation initiatives which are delivering improvements at the cost and revenue lines. We are executing our significant transformation plan well and remain confident we’re on the right path towards the Iress Group operating at Rule of 40.’

For FY23, the company upgraded its underlying EBITDA guidance from $118–122 million to $123–128 million.

Outlook for Iress

For Software as a Service (SaaS) that lives or dies on its growth, the Rule of 40 was an ambitious target for Iress — but razor-focused.

The company has trimmed its fat to remain agile by shedding all its international assets.

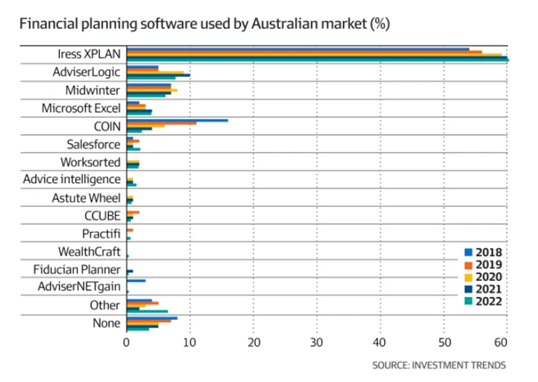

This could be important in the coming years as the company begins to see competition in its traditional stronghold.

Iress holds a market dominance over the Australian Fintec landscape with its Xplan software. Xplan allows financial advisors to interact with clients. No competitor has even 10% of the market share in this space.

Source: AFR — Investment Trends

However, heavy investment from two giants is set to shake up the space. British software giant Intelliflo and Morningstar’s AdvisorLogic have pledged large sums as they smell weakness.

Iress responded with investments into software, including uplifts to its Xplan and other services. Some of this was reworked visuals and ‘enhanced user experience’, but some improved tools were added to the suite.

If Iress wants to hold onto its moat, it will need to continue offering the best tool for financial advisors as the switching cost continues to fall.

Looking beyond its software, the company’s transformation appears to be tracking well. If it can continue cutting costs and improving revenue, the company could be an attractive takeover target in the future.

Beyond the premium investors could see with any potential takeover, Iress should probably remain a watchlist pick for now.

Another tech miracle?

If you’re looking for other tech stories to invest behind, look no further than the incredible moves of Bitcoin [BTC].

The asset class many had claimed dead has now pulled a return of 120 % for the past 12 months. That makes it the best-performing asset class this year.

Compare that to the ASX 200’s -3.42%, and you can see why more people are taking notice.

Our exponential investor and tech specialist, Ryan Dinse, has been a long-time cryptocurrency investor and isn’t surprised at all.

In fact, he mapped out these movements. What is next on his timeline?

Could bitcoin go to US$1 million? Sound ridiculous? Too good to be true?

Watch his video here to see how the market looks coming out of this crypto winter and where it could be headed next.

Regards,

Charlie Ormond

For Fat Tail Daily