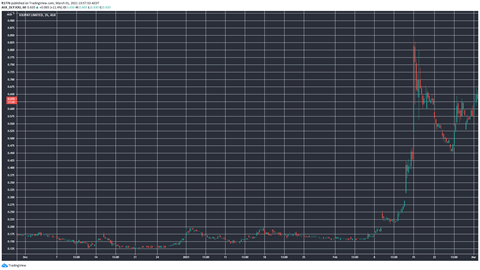

At time of writing, the share price of IOUpay Ltd [ASX:IOU] is up nearly 10%, trading at 62.5 cents.

After a brief retracement, the IOU share price is moving higher again today:

We look at the key points from IOU’s latest results and the outlook for the IOU share price.

Highlights from IOU results

Here they are:

- Net loss of $1.1 million

- Revenue of $2.8 million

- Cash and cash equivalents of $8.5 million

Importantly, after the half-year reporting period, IOU did a big capital raise — to the tune of $50 million.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

So, the company has a bit of a war chest available to it for its Southeast Asian expansion plans.

The Australian Financial Review’s Street Talk column initially said the company was hunting a $40 million cash injection, which we now know is actually $50 million.

As part of their platform launch, compliance and professional fees expanded rapidly from roughly $253,000 to over $1 million.

As with any new product launch, getting the product off the ground involves a fair bit of legwork and expenditure.

Here’s what I think could happen to the IOU share price.

Outlook for IOU share price

With an increasing number of ASX-listed BNPL companies out there, IOUpay’s success will be determined by how well they carve out their niche.

While there are BNPL behemoths out there like Afterpay Ltd [ASX:APT], IOU will be looking to cement its place in its target market and grow its market share, particularly in the e-commerce space.

I covered my thoughts on IOU in the video below, and it’s well worth a watch:

Steady news flow, a mammoth capital raise, and a niche market may have investors bullish about its prospect.

At the same time however, it’s conceivable that we are approaching market saturation when it comes to BNPLs.

If you are on the hunt for more fintechs with significant growth potential, be sure to download this particular report on the topic.

In the report, you’ll find profiles of three exciting small-cap fintechs that have yet to completely take off.

With so much hype in the fintech space at the moment, it’s well worth a read.

Regards,

Lachlann Tierney,

For Money Morning

Comments