At time of writing, the share price of IOUpay Ltd [ASX:IOU] is down more than 12%, trading at 54 cents.

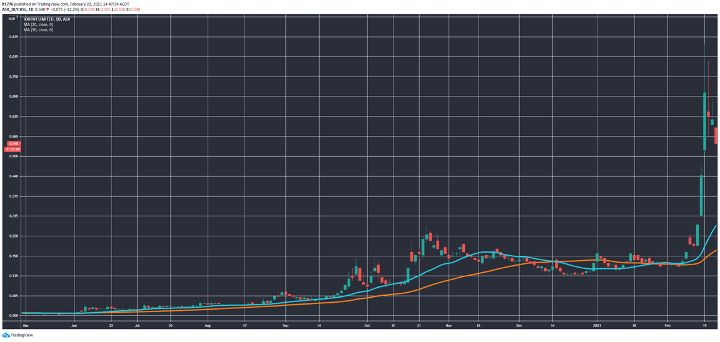

After a massive run up, the IOU share price is in the process of retracing as you can see below:

Source: tradingview.com

We look at the details of its latest move, a $50 million placement, and how this plays into the outlook for the IOU share price.

Highlights of IOU placement announcement

Here they are:

‘• IOU completes significant placement of $50 million within 48 hours — the largest single raising in the Company’s history

‘• Strong demand from both new and existing institutional investors significantly exceeded available capacity

‘• Proceeds to be used for growth initiatives including digital payments and to accelerate new business development opportunities in the BNPL sector in South East Asia, along with working capital purposes’

So, a fair chunk of change against their current market cap of around $250 million.

It’s a good sign that institutional investors were snapping their hand off, with the placement coming in at 50 cents.

That’s a ‘28.57% discount to the closing price of $0.70 on 15 February 2021.’

Things have been moving quickly for IOU, ever since the EasyStore partnership was announced.

Subsequent to that, the Australian Financial Review’s ‘Street Talk’ column covered a proposed $40 million cash injection. Which in the end, turned out to be $50 million.

Outlook for IOU share price

I’ve seen it many times before in the small-cap space.

A breakthrough product or announcement followed by a quick smart cap raise.

Then a retracement, following that the share price breaks one of two ways after it finds support around the price the new discounted shares were issued.

It’s a pattern that repeats over and over again.

The trick is positioning yourself before these breakouts, which involves some serious research.

Which is why you should check out Exponential Stock Investor, our flagship small-cap publication.

We do the research for you.

If you don’t want to do that just yet, you can catch extended commentary on IOU’s rise up the charts in the video below:

And our small-cap fintechs report right here.

Regards,

Lachlann Tierney

For Money Morning

Comments