The Ioneer Ltd’s [ASX:INR] share price rose today on news Ioneer contracted FLSmidth for major product engineering at Rhyolite Ridge.

INR shares were up 3% at the time of writing.

The engineering contract represents a ‘major step’ towards the construction and development of the firm’s Rhyolite Ridge lithium project.

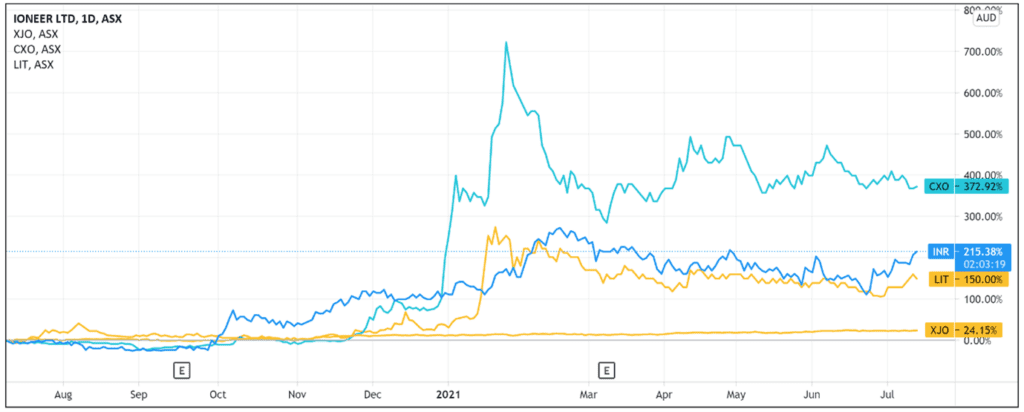

The lithium and boron explorer’s shares are up 45% year to date and 225% over the last 12 months.

Ioneer awards engineering contract to develop US lithium project

INR today announced it awarded a major engineering and equipment supply contract to Danish firm FLSmidth.

FLSmidth will now develop Ioneer’s wholly-owned Rhyolite Ridge Lithium-Boron project in Nevada, US.

INR awarded the contract on a limited notice to proceed (LNTP) basis, with the supply of equipment conditional on a final investment decision (FID).

An LNTP contract is usually a notice by an employer instructing a contractor to commence with part of the works.

This often happens when not all conditions to fully proceed with the project have been fulfilled.

In these circumstances, the employer and contractor both share the risk for expenses incurred during the LNTP period.

FLSmidth has already started on product engineering for equipment packages, including crushing and material handling equipment, and lithium carbonate and boric acid dryers.

FLSmidth initiates financing options

On top of the engineering work, INR revealed that FLSmidth has ‘initiated discussions’ between Ioneer and Denmark’s Export Credit Agency regarding potential financing options.

Export credit agencies provide government-backed finance to help businesses grow their exports.

For instance, Export Finance Australia is the Australian government’s own ECA, which provides financial solutions to ‘drive sustainable growth that benefits Australia and our partners.’

If credit agencies sound familiar, that’s because INR is not the only emerging lithium player to court government-backed project finance.

Lake Resources NL [ASX:LKE] also floated the idea of securing finance for its Kachi lithium project via export credit agencies.

Last month, LKE flagged the possibility of acquiring lower-cost capital if it secures longer-date ECA-backed debt.

What did Ioneer management have to say?

INR Managing Director Bernard Rowe offered this comment:

‘The contract with FLSmidth is one of the more significant supply packages we will award at Rhyolite Ridge and represents another step in the development of the Project.

‘FLSmidth is focused on providing environmentally sound engineering and technology solutions.

‘This aligns with ioneer’s ambition to not only produce materials necessary for electric vehicles and renewable energy infrastructure, but to do so in an efficient and environmentally responsible.’

Investors may have noticed the emphasis on environmental responsibility echoes the sustainability stance taken by fellow lithium player Vulcan Energy Resources Ltd [ASX:VUL].

VUL has made sustainability its competitive differentiator.

Vulcan’s lithium project in the Upper Rhine Valley — dubbed the Zero Carbon Lithium Project — uses renewable heat derived from geothermal brine to drive the lithium extraction process.

VUL states this will involve no fossil fuel consumption.

INR Share Price ASX outlook

Investors will likely be pleased Ioneer has taken a major step towards developing its US lithium project.

But the modest share price gains may also indicate investors are aware of the long path ahead for the lithium and boron producer.

The engineering contract awarded to FLSmidth is a limited notice to proceed, dependant on plenty of conditions.

One of the biggest of those conditions, of course, is INR making a final investment decision.

Today’s announcement shows Ioneer is on track, but starting a journey is not the same as finishing it, so investors will likely continue to closely monitor INR’s progress.

The interest in lithium stocks is likely to intensify as governments and legacy automakers shift their focus to electric vehicles.

Therefore, if you want more information on a sector enjoying a resurgence, then I recommend reading our free lithium 2021 report.

If you’re keen for more reading, this report on energy disruption is also a great resource.

It analyses promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.