The Ioneer Ltd’s [ASX:INR] share price is up 5.5% today after its March 2021 quarterly report reveals acceleration of its Nevada lithium project.

Upon the release of its activities and cash flow reports, shares in the lithium and boron miner spiked as much as 6.8%.

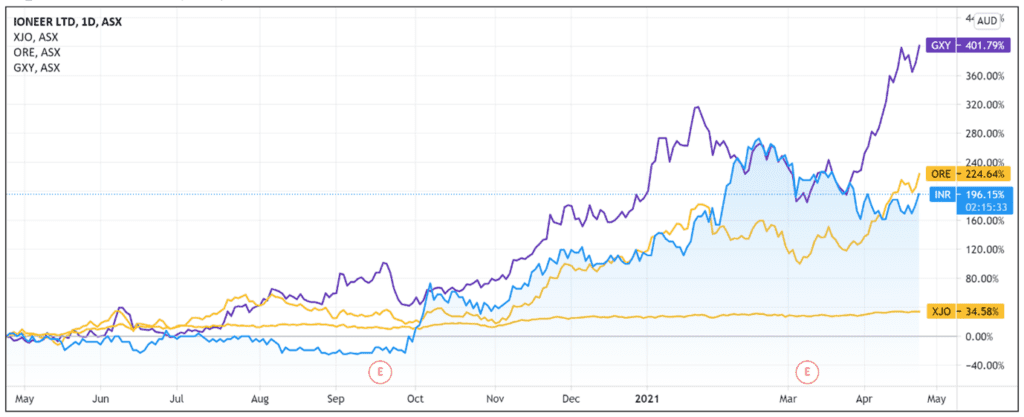

Ioneer’s announcement comes at a time when ASX lithium stocks are riding strong momentum.

Year-to-date, the INR share price is up 35% and up 190% over the last 12 months.

Who is Ioneer?

Ioneer is producer of lithium and boron hoping to become a leader in the production of materials necessary for a sustainable future.

Prior to 2018, Ioneer was known as Global Geoscience.

Global Geoscience listed on the ASX in 2007 to apply geological methods in pursuit of greenfield mineral discoveries.

In 2016, an unheralded lithium-boron project in Nevada was brought to the attention of Managing Director Bernard Rowe.

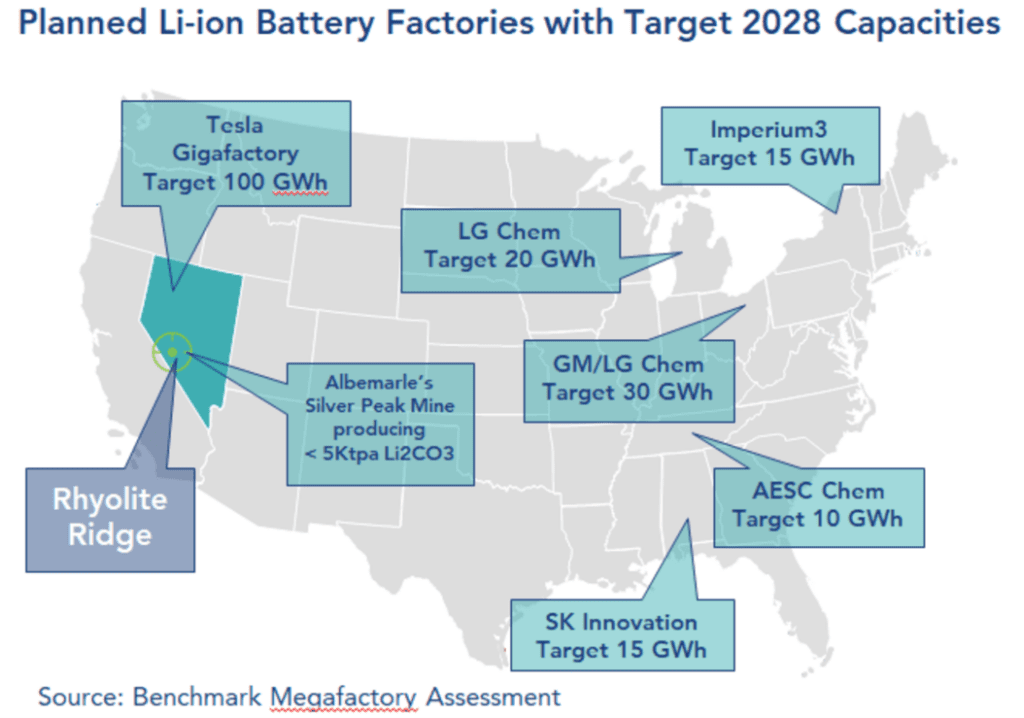

Rowe’s surveys suggested that the Rhyolite Ridge project in Nevada could become the ‘lowest cost source of lithium in the world.’

After securing ownership of the Rhyolite Ridge lithium-boron project in 2017, the company changed its name to Ioneer to reflect its pivot to supplying the green revolution.

Market expert reveals why every Aussie investor should pay attention to this trillion-dollar opportunity. Click here to discover more.

Ioneer’s Rhyolite Ridge lithium-boron project

INR’s lithium project in Nevada is a shallow lithium-boron deposit to existing infrastructure in Nevada.

Ioneer owns 100% of Rhyolite.

According to INR, the lithium and boron found at Rhyolite differs from other sediment-hosted lithium deposits due to the low-clay, low-carbonate and high boron content of Rhyolite rock.

In October 2018, a Pre-Feasibility Study indicated Rhyolite Ridge can be a sustainable, low-cost mine.

In April 2020, Ioneer announced that a Definitive Feasibility Study validated the project’s ‘robust economics and viability’.

The company estimates the lithium and boron mineral resource to be 146.5 million metric tonnes, with an ore reserve of 60 million metric tonnes.

Ioneer forecasts to process 63.8 million metric tonnes over 26 years, averaging 2.5 million metric tonnes per year.

Highlights from Ioneer’s March 2021 activities report

A standout item from the activities report ending 31 March 2021 was INR’s AU$80 million capital raising via a fully underwritten institutional placement.

210,526,316 ordinary shares were issued at a fixed price of 38 cents per share.

BNP Paribas Energy Transition Fund provided cornerstone investment.

The raised capital will fund:

- Acceleration of Rhyolite Ridge construction.

- Detailed engineering (to 60% completion) and vendor engineering to construction ready status.

- Environmental, research and consulting expenses.

- Discretionary substantive pre-construction activities.

- Working capital and general purposes.

Another highlight was Ioneer successfully producing lithium hydroxide during the quarter.

The firm’s metallurgy and engineering team was able to convert lithium carbonate into battery grade lithium hydroxide at its pilot plant.

INR touted this as a ‘key milestone’ as the conversion corroborated the company’s ambition to provide high purity technical grade lithium carbonate and battery grade lithium hydroxide.

Finally, the miner explained that work during the March quarter focused primarily on progressing engineering from the DFS phase to the start of the Full Notice to Proceed (FNTP) phase.

The FNTP phase is also known as the Engineering, Procurement, and Construction Management (EPCM) phase.

The quarter’s ongoing activities included:

- Cumulative completion of approximately 30% of execution deliverables.

- Receiving vendor engineering for the acid plant blower, steam system and air filter.

As of 31 March 2021, Ioneer had AU$89.5 million total cash on hand.

Expenditure during the quarter totalled AU$6.2 million worth of investing activities on top of AU$1.3 million worth of operation activities (net of interest received).

What next for the Ioneer share price?

Rowe commented today that:

‘Rhyolite Ridge remains the most advanced lithium project in North America and we are poised to take advantage of the ever-improving demand outlook for lithium and lithium products.’

Rowe also pointed out that INR’s successful conversion of lithium carbonate to battery grade lithium hydroxide points to further upside.

Battery grade lithium hydroxide is a higher premium product that will contribute an important chunk to Rhyolite production and sales.

According to Rowe, it is the second largest chemical produced by the lithium industry and has ‘the highest growth rate of all lithium products’.

There are plenty of positives for Ioneer.

A strategic location for its mine. A large mineral resource and ore reserve. Recent funding to accelerate construction. A lithium price rising in tandem with demand for electric vehicles.

But investors will likely home in on INR’s commercialisation execution.

For instance, Rhyolite Ridge is a highly strategic location so investors may expect the company to secure high-profile offtake agreements in the medium-term to shore up forward sales.

Addressing this point, Ioneer’s release today mentioned that ‘discussions remain at an advanced state, with offtake announcements expected in the June quarter.’

INR managing director further added that the company is ‘looking forward to finalising various offtake discussions and the completion of strategic funding discussions as we prepare to commence Project construction.’

And of course, the company must still successfully commence construction at Rhyolite Ridge and avoid associated obstacles.

The interest in lithium stocks is likely to intensify as governments and legacy automakers shift their focus to electric vehicles.

Therefore, if you want more information on a sector enjoying a resurgence, then I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning