February 2023

You’ve likely heard plenty about hydrogen lately.

Hydrogen produced from renewable energy — or green hydrogen — has been often dubbed as the ‘fuel of the future’, and could play a key role in the global energy transition…

…but it also has the potential to be a big investment opportunity for investors.

In this article, we explore the role of hydrogen in the energy transition and look at some of the pros and cons.

But first…

What is hydrogen?

Labelled with the symbol H and atomic number 1 in the periodic table, hydrogen is the universe’s most abundant element. It is a light, very flammable gas that has no colour or smell.

The name comes from the combination of two Greek words ‘hydro’ meaning water, and ‘gene’ meaning creator, based on the fact that when hydrogen burns, all it releases is water.

But while hydrogen is very common, it’s hard to find pure hydrogen on Earth. Instead, it’s usually found in combination with other elements, like water (H2O).

Today, hydrogen has plenty of industrial uses.

For example, it’s used in agriculture to make ammonia to be used as fertiliser, it’s used in the oil refining industry, and also in the production of plastics.

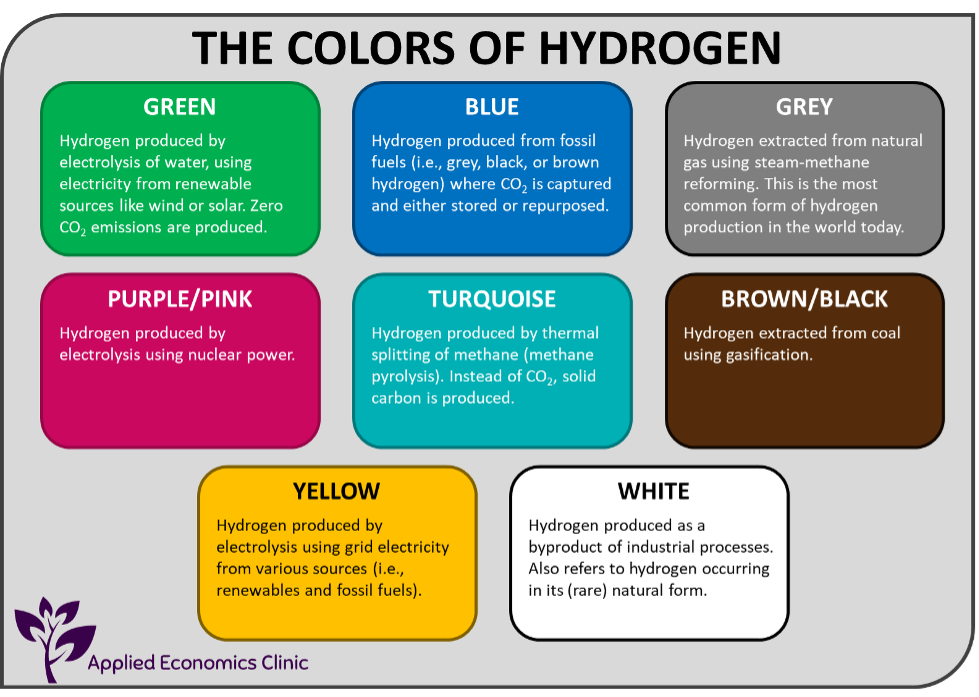

While hydrogen is an invisible gas, it’s usually classified by colours, depending on the technology that was used to make it.

As you can see below, there are many ways to make hydrogen:

Source: Applied Economics Clinic

Much of the hydrogen produced today is grey hydrogen, made through fossil fuels. It’s usually created from natural gas using a process called steam methane reforming. But the process produces emissions.

Another popular type is blue hydrogen. It’s also produced from natural gas, the difference being that the carbon dioxide that’s produced during the process is then captured and stored.

But you see, while hydrogen when burned produces only water, the way we produce hydrogen can be very carbon-intensive. That’s why ‘green’ hydrogen has been gaining ground.

Green hydrogen — produced by splitting water into hydrogen and oxygen using an electrolyser run with electricity powered from renewables — produces no emissions during its production.

Can hydrogen be used as renewable energy?

Hydrogen is not an energy source. Instead, hydrogen is an energy carrier that can store or transport large amounts of energy.

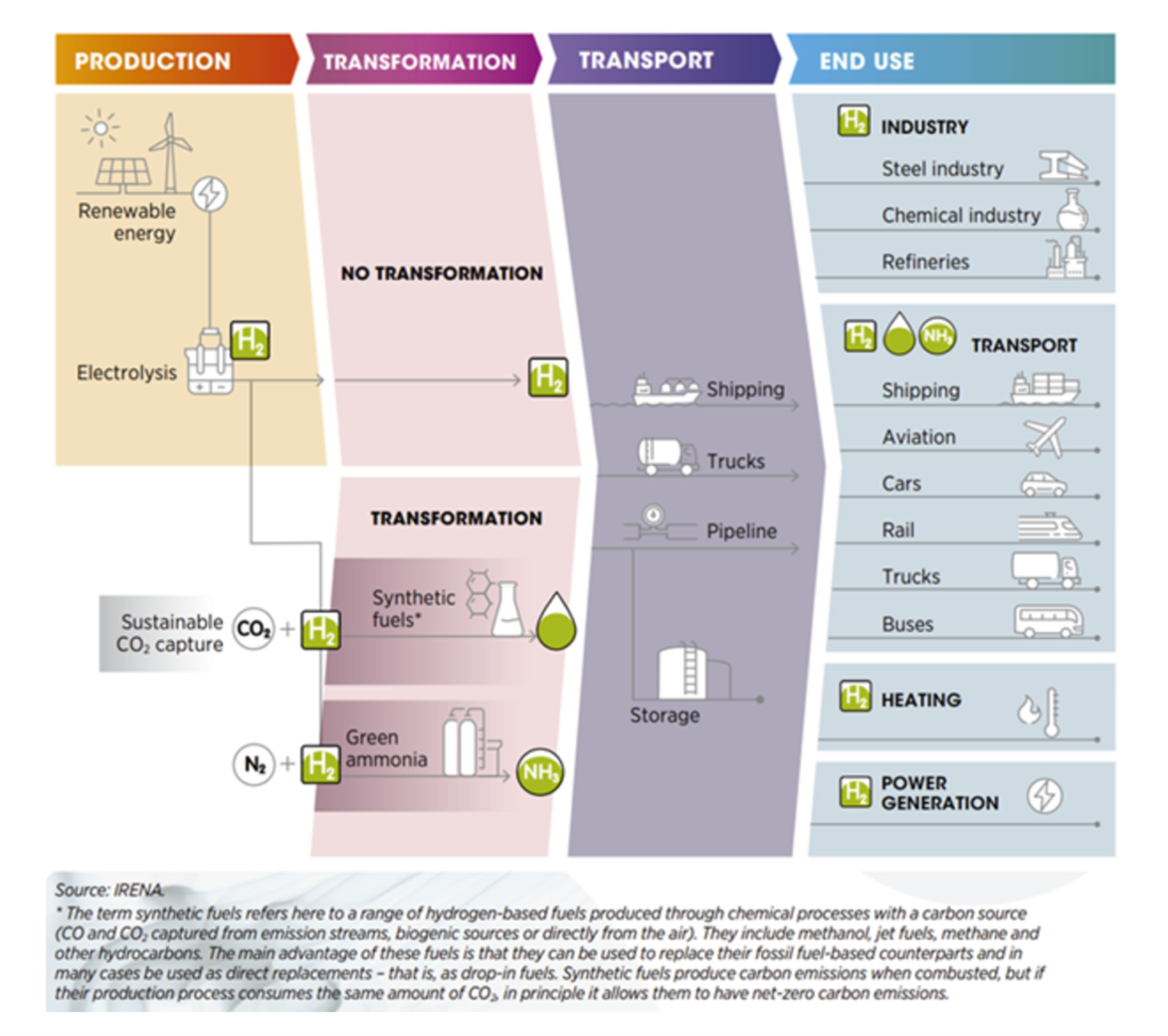

Hydrogen is an attractive storage option when solar and wind produce too much energy, for example. As you can see below, that hydrogen produced through renewables can then be stored to be used later on or transported for different uses. Although, hydrogen can be difficult to transport.

Source: IRENA

Green hydrogen has a huge potential to help reduce emissions in industries where electrification is difficult such as in steel, cement, and aviation.

Hydrogen can also be used to power things like cars, trucks, trains, or buses through fuel cells.

A fuel cell is a device that generates electricity through a chemical reaction. It works very similar to batteries, except that they don’t need to be recharged and don’t degrade — more on this later.

In short, green hydrogen can provide energy for a range of different applications while helping cut emissions.

So far, though, one of the major challenges for green hydrogen has been costs.

Green hydrogen has historically been more expensive to produce in comparison to hydrogen made from fossil fuels.

Recently though, green hydrogen has been capturing lots of attention. The war in Ukraine and higher fossil fuel prices have driven the cost of blue and grey higher, making them more expensive to produce. Something that has accelerated the investment into green hydrogen.

As Carbon Tracker has noted:

‘Rapid capital investment for non-fossil green hydrogen over the next few years could see its levelised costs fall under US$2 a kilo, making it one of the cheapest forms of energy.’

So, things for green hydrogen could very well change fast in the next decade.

Goldman Sachs forecasts that by 2050, green hydrogen could develop into a US$10 trillion market, supplying about a quarter of the world’s energy.

And while there’s lots of potential in green hydrogen, another ‘colour’ of hydrogen is also showing promise…

Nuclear energy can also produce hydrogen

As countries move forward with the energy transition and continue to struggle with high energy prices and shortages, we’ve seen a revival of a controversial sector in the energy market: nuclear.

You see, while in operation, nuclear power plants produce no greenhouse gas emissions, and over its life cycle, nuclear emits around the same amount of carbon dioxide emissions per unit of electricity as wind.

Europe, for example, has been looking at nuclear to help with the energy crisis.

In 2022, the European Parliament labelled some investments in nuclear energy as ‘green’, giving these projects access to ‘hundreds of billions of euros in cheap loans and subsidies’.

And, more than 10 years after the Fukushima disaster, the Japanese Government announced it’s ready to move back into nuclear.

Before the disaster, nuclear generated about 30% of Japan’s electricity. But that’s reduced drastically. In 2021, nuclear produced just 6% of Japan’s power.

Nuclear is starting to gain political and public support in Japan and the country is planning to ramp up its nuclear power generation in a bid to gain more energy security.

But what’s interesting is that nuclear can be also be used to produce hydrogen. And this combination is very appealing for a country like Japan, who is a leader in nuclear energy but also has big plans for hydrogen.

Why is Japan focused on hydrogen?

In 2017, Japan released its national hydrogen strategy which envisioned a ‘hydrogen society where hydrogen is used in every sector’.

By 2030, Japan wants to produce 3 million tonnes of hydrogen a year, increasing to 20 million tonnes a year by 2050.

In 2025, Japan is also planning to have 200,000 fuel cell vehicles on the road and 320 hydrogen fueling stations. But they want to up that to 800,000 and 900, respectively, by 2030.

And with Japan looking up to ramp up its nuclear production, some of that hydrogen could be produced by nuclear energy.

One way to do this is by using an electrolyser powered by nuclear energy instead of wind or solar power, what’s also known as purple/pink hydrogen.

But next generation nuclear could become a game changer.

One example is the high-temperature gas-cooled reactor (HTGR for short), which uses gas as a coolant instead of water. HTGR’s are usually smaller than conventional nuclear power stations, cheaper to build, and more flexible. They’re also supposed to be safer. HTGR’s can produce both unlimited amounts of hydrogen and electricity at the same time.

The High Temperature Engineering Test Reactor (HTTR), for example,

So nuclear could play an important role in the development of hydrogen and producing low-carbon hydrogen at a large scale.

Batteries versus hydrogen fuel cells, which one is better?

While green hydrogen has the potential to be a key player in hard-to-decarbonise industries such as iron, a big chunk of emissions come from the transport sector.

And here you may have noticed there’s a little rivalry going on.

It’s pitting batteries against hydrogen fuel cell technology in a competition to power the vehicles of the future.

All in all, each technology has its own fans, but also detractors.

No surprise here, but Elon Musk isn’t a big fan of hydrogen fuel cell technology. He’s even called them ‘fool cells’ and ‘mind-bogglingly stupid’.

Another big critic has been Herbert Diess, Volkswagen Group Chariman. As he tweeted recently:

‘It’s time for politicians to accept science. Green hydrogen is needed for steel, chemical, aero…and should not end up in cars. Far too expensive, inefficient, slow and difficult to rollout and transport. After all: no #hydrogen cars in sight.’

So, what’s the difference between battery electric vehicles (BEV) and fuel cell electric vehicles (FCEV)?

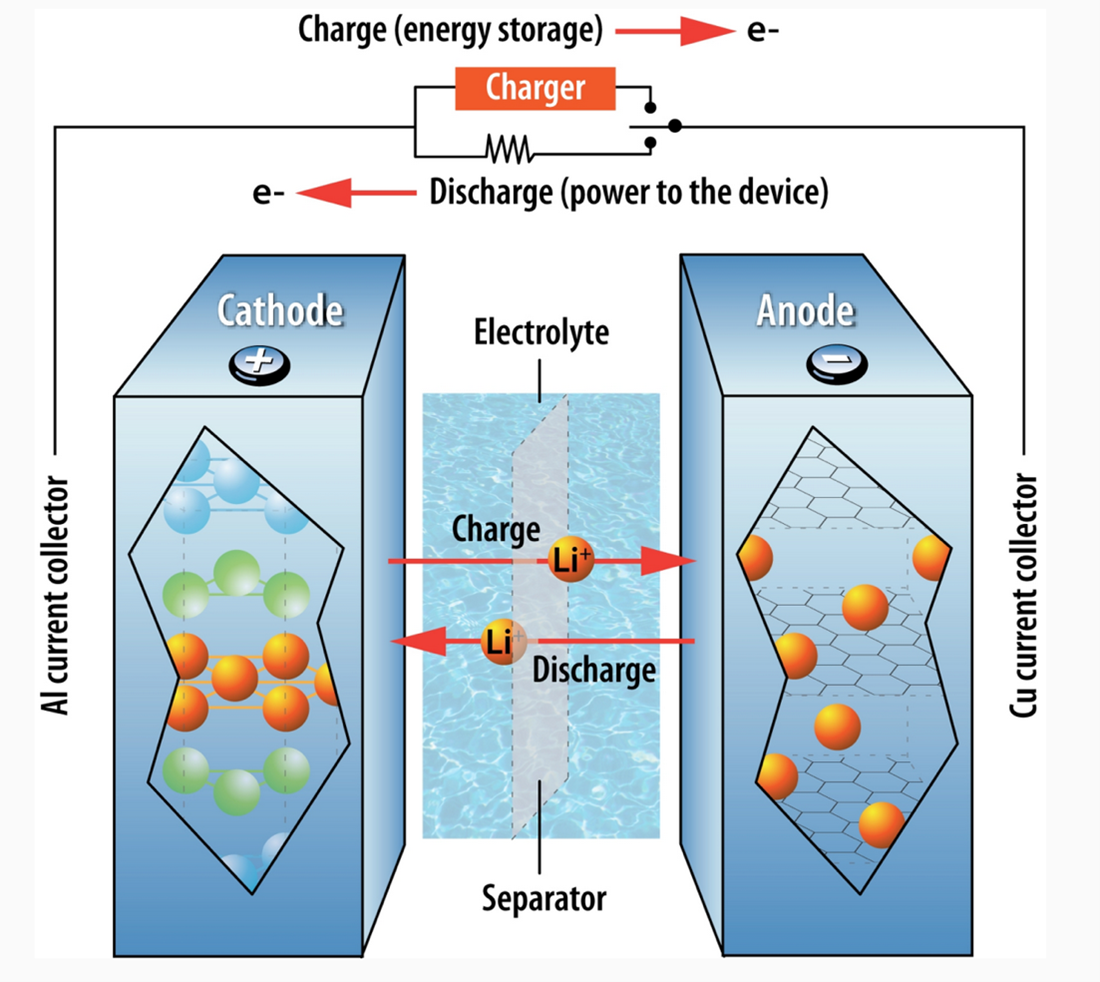

In a nutshell, BEVs get their power from a battery that stores electricity, while FCEVs produce their own energy from hydrogen.

BEVs store their power in a battery, usually a lithium-ion battery, and then draw it out as needed.

The battery in an EV, or the battery pack, is made of a collection of cells.

Each cell has three main parts: a positive side (the cathode), a negative side (the anode), a separator and the electrolyte which transports lithium-ions from the cathode to the anode and back again as the battery charges and discharges:

Source: Brookings

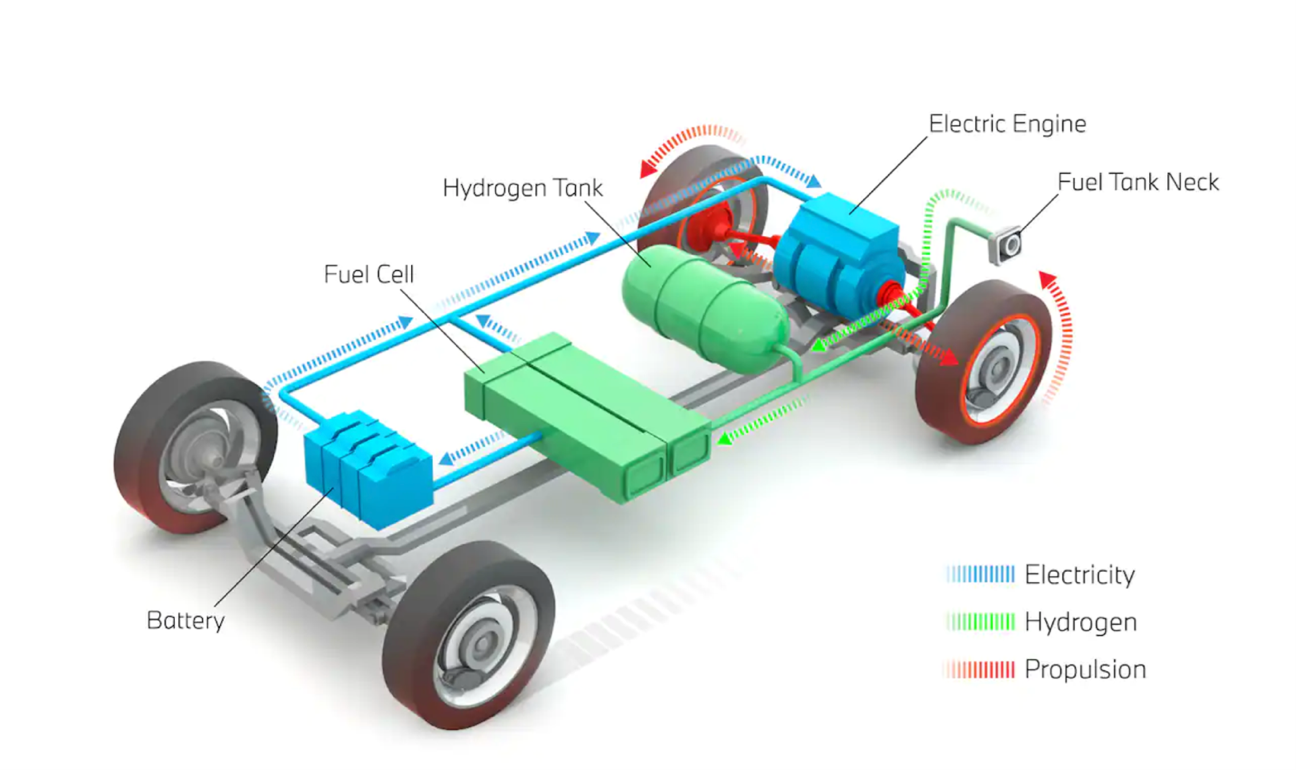

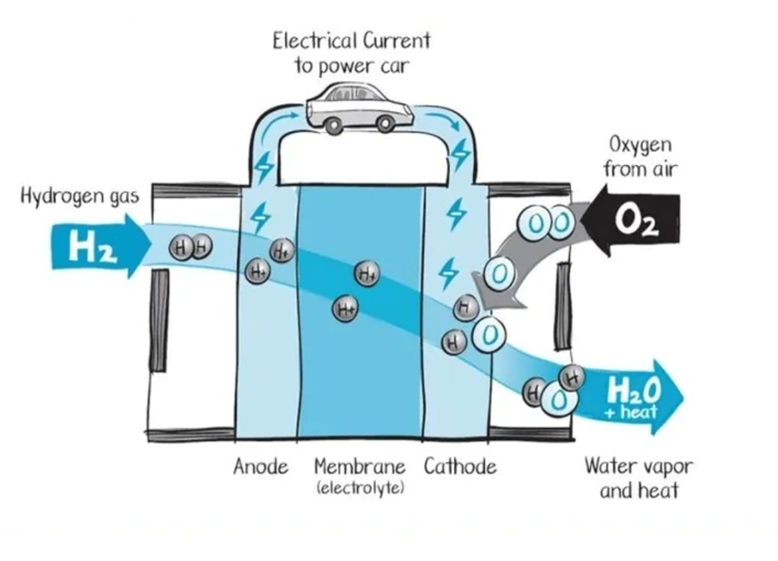

On the other hand, FCEVs store hydrogen in a tank and then use hydrogen fuel cells to power its electric motor.

Hydrogen moves from the tank to the fuel cells where it combines with oxygen inside the cell in a process called reverse electrolysis. This generates electricity that can then either go on to power the motor or go into a small battery inside the car to store and use later on.

The process ends up with the exhaust releasing water in the form of vapor:

Source: BMW

As you can see below, hydrogen fuel cells look a lot like a battery cell, they also have an anode, an electrolyte, and a cathode:

Source: Elexplorer.com

FCEVs have a key advantage over BEVs. Unlike BEVs, which can take a long time to charge, FCEVs can fill up their tanks in just minutes.

FCEV technology is also lighter than carrying heavy batteries, which allows for longer driving ranges, but could also make them a better option to power heavier forms of transport like trucks and buses.

There are some drawbacks to FCEVs, though.

Infrastructure, for one.

For all the advantages hydrogen has, it has one main disadvantage. Hydrogen needs to be compressed at very high pressures, which makes the storage and transportation of it very hard.

Most car manufacturers — companies like Tesla, VW, Volvo, Nissan, and Ford — have focused on manufacturing BEV vehicles.

In contrast, only a handful of car manufacturers (Honda, Hyundai, and Toyota) are making FCEVs. By the way, it’s no coincidence that two out of the three companies are Japanese. As we mentioned, Japan has big plans for hydrogen…

But the point is, there are way more BEVs on the roads than FCEVs, which means that there aren’t many FCEV fueling stations around.

And then there’s the issue of efficiency.

By the time hydrogen has been produced, compressed, transported to the fueling hydrogen station, and then turned to electricity inside the car and used to move the vehicle, its efficiency is only 38%. That’s pretty low.

In contrast, an EV converts electricity into movement, which makes it much more efficient. An EV can convert more than 77% of the electricity from the grid into power.

So which one will win the race?

It’s too early to tell, but hydrogen could give batteries a run for its money!

Could hydrogen replace fossil fuels?

In short, while hydrogen is not devoid of issues, it has one big advantage: versatility.

It has the potential to replace fossil fuels in many industrial processes and uses such as making steel, cement, and fertiliser, but also in transport.

And in our corner of the world, Australia is looking to become a leader in hydrogen production.

Hydrogen is one of the main technologies Australia is focusing on to reduce emissions, and with some of our trading partners — like South Korea, Japan, and Europe — investing in hydrogen technology to meet their net-zero commitments, it brings an export opportunity to Australia.

The estimate is that Australia’s hydrogen exports could be worth as much as $10 billion a year by 2040, according to the Australian Renewable Energy Agency.

This should make Australian investors ears perk up.

And while much of the push has come from the government, there are certainly many companies out there on the ASX involved in green hydrogen.

Just to name a few, Fortescue Metals Group [ASX:FMG] has been a big investor in renewable energy and green hydrogen around the world through its subsidiary Fortescue Future Industries.

Province Resources [ASX:PRL] is developing the HyEnergy green hydrogen project in Western Australia, which is expected to generate 550,000 tonnes per year of green hydrogen.

And Frontier Energy [ASX:FHE] is building the Bristol Springs Green Hydrogen Project in Western Australia.

Just note that the companies mentioned here are not recommendations, and by no means a comprehensive list. They’re just a place to get you started on your research.

All in all, hydrogen is a very exciting opportunity and something investors should be keeping an eye on.