You may have heard about hydrogen stocks and wondered what they are and what all the buzz is about.

There are a few reasons why hydrogen is making waves, but a lot of it has to do with its promising use as a clean energy source and potential replacement of fossil fuels.

Let’s walk through what this has to do with hydrogen being a viable stock option on the ASX.

As more and more research surfaces, it’s becoming increasingly apparent that hydrogen technology is already a promising alternative fuel source. Many investors are aware of the companies looking into cashing in on this venture.

Just think about it, a single hydrogen fuel cell coupled with an electric motor is already 2–3 times more efficient than an internal combustion engine running on petrol.

And it’s not like we don’t have enough of it going around. Hydrogen atoms are estimated to make up approximately 73% of the universe’s mass. Taking first placement on the periodic table, it’s not only the most common chemical element, but also the lightest.

So if you’re thinking of investing in hydrogen stocks on the ASX, this is the guide you’ll need to assist you in your journey of discovering all there is to know about the world’s no.1 chemical.

We’ll dive deeper into the role of hydrogen in our future and look into what this might mean for some of the most promising hydrogen companies on the ASX.

It’ll then be up to you to decide if hydrogen stocks could be an investment option that you’d like to see in your own portfolio.

Navigate to a section quickly:

- So, what exactly IS Hydrogen?

- How is hydrogen used?

- Increasing global demand for hydrogen

- What is green hydrogen?

- Hydrogen projects in Australia

- ASX companies exploring green hydrogen

- ASX companies exploring blue hydrogen

What exactly IS Hydrogen?

Hydrogen is the simplest element in the universe. It consists of a single proton and a single electron.

It’s colourless, odourless, and tasteless. Yet, this simple chemical element generates immense amounts of energy every single day.

Hydrogen atoms fuse to create helium atoms within the stars of our universe, including our favourite star — the Sun. Hello, most abundant chemical element number two!

A little closer to home, Earth’s own hydrogen is most commonly found as a compound in the form of water (H2O). However, in its simplest form, hydrogen comprises of two hydrogen atoms, the humble (H2).

Other common hydrogen-containing compounds include ammonia (NH3), methane (CH4), hydrogen peroxide (H2O2), and hydrochloric acid (HCl).

Science lesson aside, hydrogen’s growing importance is its value as a carbon-neutral energy source. Read on to find out how hydrogen technology is currently being advanced by industries.

How is hydrogen used?

Hydrogen production has been a staple of many industries for years. Since its humble beginnings, wherein English scientist Henry Cavendish first discovered our distinct little element in 1766; it’s continued being produced for multiple purposes.

One such purpose is that it’s being explored for use with renewable energy sources, much like solar power or wind turbines, which store intermittent energy that would otherwise go unused; here are just some of the many other uses of hydrogen:

- Refining petroleum

- Treating metals

- Producing fertilisers

- Processing foods

- Creating fuel

Increasing global demand for hydrogen

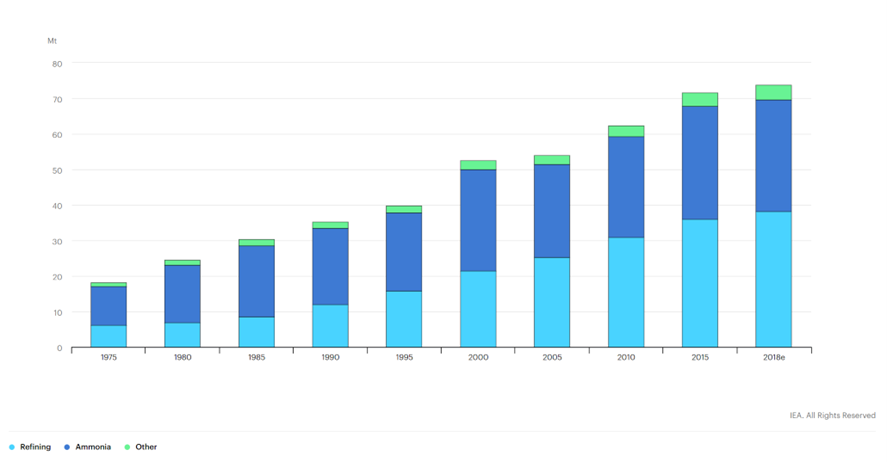

Global demand for hydrogen has been growing at a steady rate. Since 1975, hydrogen demand has increased threefold. And it doesn’t look like this trend is changing any time soon:

Global demand for pure hydrogen, 1975–2018

Source: iea.org

In a recent report by the International Energy Agency (IEA), clean hydrogen (blue and green) saw ‘unprecedented political and business momentum’.

What is green hydrogen?

Following the recent climate change summit (COP26), nations have entered an ongoing race to decrease their carbon emissions.

The end goal? To hit the glorified target of net-zero carbon emissions by 2050.

Hydrogen fuel will likely play a vital role in helping achieve this goal. As a fuel, hydrogen only emits water vapour upon combustion — thereby producing no carbon emissions.

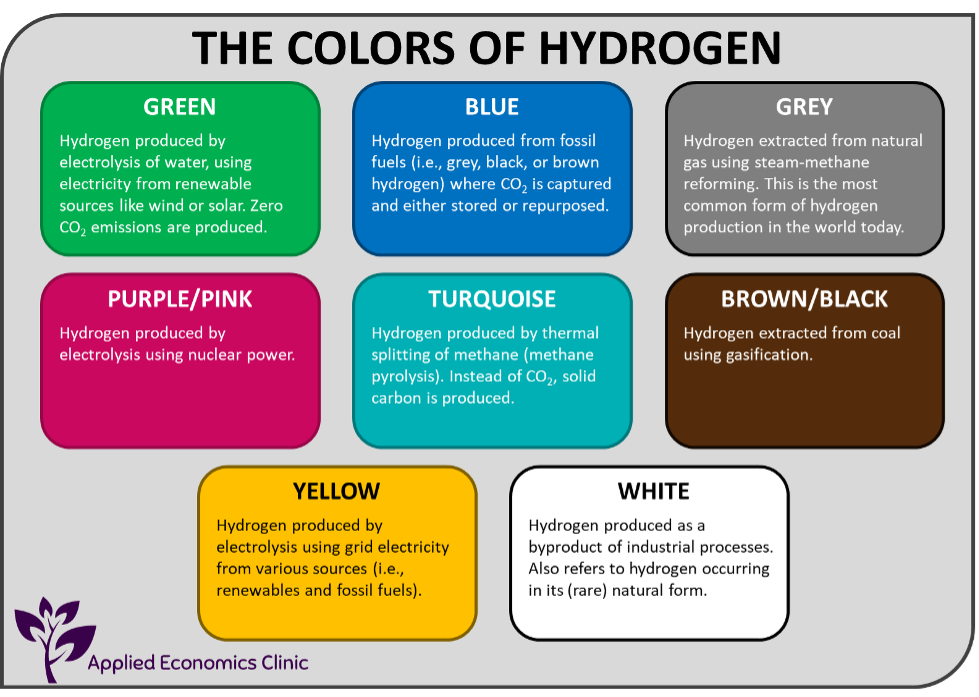

Unfortunately, however, not all hydrogen is classed the same, as the process of creating it varies.

Even as a potential ‘wonder fuel’ of the future, there’s the good, the bad, and the ugly when it comes to hydrogen. So it’s worth weighing up which type of hydrogen fuel will play the most significant role in our carbon-neutral future.

Labelled by colour, the hydrogen production process is classified as follows:

- Grey hydrogen — created using natural gas or methane.

- Blue hydrogen — created using natural gas and carbon capture storage.

- Green hydrogen — created from water electrolysis using renewable energy.

- Black or brown hydrogen — created using black or brown coal (gasification); this is the arch-nemesis of green hydrogen and causes the most harm to our environment.

- Yellow hydrogen — created from solar power and electrolysis.

- Turquoise hydrogen — created via methane pyrolysis, which can create hydrogen and carbon simultaneously.

- White hydrogen — the Earth’s naturally made hydrogen. A geological phenomenon that occurs through fracking and which we currently don’t take advantage of producing.

Source: aeclinic.org

Hydrogen projects in Australia

Recognising the world’s shifting energy needs, Australia has several projects exploring these hydrogen technologies.

With a recent investment of $1.2 billion from the Australian government into their National Hydrogen Strategy, Australia aims to lead the sector by 2030. Emission reduction plans include achieving clean hydrogen production at only $2 per kg.

The move to large scale, affordable, and clean hydrogen production will also position Australia as a critical partner for international hydrogen supply.

Other than government investments, there has been $55 million invested by the Australian Renewable Energy Agency (ARENA) for hydrogen projects, along with a recent deal between the government and Fortescue Metals Group [ASX:FMG]. This deal sets out to develop the largest green hydrogen equipment manufacturing hub the world has seen so far, right here in Gladstone, Queensland.

ASX companies exploring green hydrogen

The ASX is home to several companies investing in the potential of hydrogen. These companies range from research and development focused strategies to distributorships for various products.

If you’re interested in investing in Australian-based hydrogen stocks, it might be worth looking at the companies we have compiled for you below. While some of them are ore, gas, oil, and other mineral exploration companies, each have an interest in branching out into the hydrogen prospect.

However, please be aware that these are not formal stock recommendations. This is simply a list of companies that we encourage you to conduct your own research on to begin your journey in the hydrogen investment space.

ADX Energy [ASX:ADX]

Initially an oil and gas producer, ADX Energy plans to transform many of its old oilfield sites for green hydrogen production. A project has been announced between ADX Energy and Austrian wind farm Windkraft Simonsfeld AG to develop wind parks in Austria to produce and store green hydrogen in the Vienna Basin.

The project will allow excess energy produced from the wind farm to be converted to hydrogen using electrolysers.

Fortescue Metals Group [ASX:FMG]

Iron ore mining giant Fortescue Metals is developing large scale green hydrogen projects within Australia. These plans include the development of the largest electrolyser and hydrogen production equipment plant. Set to be built in Gladstone, Queensland, the plant should be capable of producing 2GW per annum.

The site will be a world first, doubling what has already been the annual output. Production at the site won’t just be for electrolysers, but for wind turbines, solar photovoltaic cells, and renewable energy infrastructure.

Global Energy Ventures [ASX:GEV]

This Perth-based company has announced new plans for a 2.8GW green hydrogen project. The new plant should supply green hydrogen for the Asia Pacific region, located in the Northern Territory’s Tiwi Islands. Approval of the plans, including a hydrogen ship, is expected to be announced this year.

Funding has already been provided for a feasibility study into the shipment of hydrogen. This was completed with an MoU with the HyEnergy Project, Province Resources, and Total Eren.

Incitec Pivot [ASX:IPL]

A feasibility study has been granted for chemical manufacturer Incitec Pivot to produce and export green hydrogen and ammonia from Gibson Island. The proposal is to develop a brownfield site into a new electrolysis facility capable of producing 50,000 tonnes of green hydrogen each year.

In 2020, Incitec Pivot invested in a feasibility study for a solar hydrogen and renewable ammonia production project in Queensland. This was part of their ongoing plans to achieve a zero-emissions future.

Lion Energy [ASX:LIO]

Oil and gas shareholders Lion Energy are moving forwards with its own green hydrogen strategy. With the intent to move into the green hydrogen sector, the company has begun feasibility studies that will look into solar and wind farms, as well as energy storage.

Lion Energy intends to produce affordable green hydrogen for domestic and export markets as part of its hydrogen strategy. As with other oil and gas giants, their plan to develop green hydrogen is to move faster toward zero carbon emission targets.

Province Resources [ASX:PRL]

Operators of the HyEnergy Project, Province Resources, are busy developing a facility capable of 8GW renewable power in the Gascoyne region of Western Australia. Development partners include Total Eren, an Independent Power Producer (IPP) and, more recently, Global Energy Ventures, with plans to make a deal on exporting green hydrogen.

A study is already underway into the shipment of compressed hydrogen using state of the art technology from Global Energy Ventures. This is due to be completed midway through 2022, validating the hydrogen supply chain plans. Province Resources have already got the first license underway for the new site in a bid to move forward.

Sparc Technologies [ASX:SPN]

Graphene-based product developer Sparc Technologies is endeavouring to create ultra-green hydrogen. In a new partnership with the University of Adelaide, the company intend to develop industry-leading hydrogen technology. The joint venture company ‘Sparc Hydrogen’ will be split between Sparc, holding 72% equity, and the University of Adelaide, holding 28%.

Not only is the project aiming to deliver a new, ‘ultra-green hydrogen’, but it intends to do so at a low cost. If successful, the project undertaken will create hydrogen without an electrolyser, wind, or solar farms, but with the use of sunlight. If achieved, this will lead to great strides for the global zero carbon emission targets.

ASX companies exploring blue hydrogen

Hexagon Energy Materials [ASX:HXG]

Hexagon Energy Materials have proposed a new project to produce and export blue hydrogen to domestic markets. Located in Alice Springs, Northern Territory, the ‘Pedirka Blue Hydrogen Project’ proposes using a surface gasification plant to produce low-emission hydrogen.

The blue hydrogen project enables Hexagon Energy Minerals to move into cleaner energy at an affordable cost. However, the company has stated that green hydrogen could also be a goal over the coming decades.

Pilot Energy [ASX:PGY]

Gas and oil explorer Pilot Energy is pursuing a new Carbon Capture Storage (CCS) and blue hydrogen production project in Western Australia’s Mid West region. Feasibility studies have already commenced for the project, at the cost of $8 million and with the help of Technip subsidiary Genesis, RISC Advisory, and 8 Rivers Capital.

If plans go ahead, the project will utilise CCS for the Cliff Head oil project and blue hydrogen production and sale. Further studies will investigate clean hydrogen production and clean power generation potential. Pilot Energy has stated the move as a ‘key step’ toward carbon management and blue hydrogen production.

Pure Hydrogen [ASX:PH2]

Planning to lead the way when it comes to fuel cell and hydrogen technology, Pure Hydrogen was created in early 2021. Following its merger between Real Energy and Strata-X Energy, the company has since gone on to acquire a 24% stake in H2X Global — a hydrogen fuel cell vehicle company.

Pure Hydrogen has already secured a deal to supply hydrogen to Singapore’s renewable fuel technology company CAC-H2, enabling three waste-to-hydrogen plants to be built in Australia.

It also established Pure X Mobility in order to provide a wide variety of hydrogen fuel cell vehicles across Australia. Further advances include a 60% stake in Liberty Hydrogen, where they plan to develop four new hydrogen manufacturing sites.

Summary

In a nutshell, hydrogen could be a massive game-changer for Australia.

The country has invested heavily in this technology and is poised to reap the rewards of developing it on its own terms. With the escalating global fuel crisis and climate change impacts, this demand is only likely to increase in the future with targets of net-zero carbon emissions by 2050.

So if Australia is looking to capitalise on a hydrogen-centred future, it’s certainly worth looking further into deciding if buying hydrogen stocks is right for you.