Platinum is a precious metal well known for its scarce availability.

The element is listed as a critical metal in several countries, including Australia.

As a result, platinum has strategic importance in various sectors of the economy, ranging from high-end jewellery to the automobile industry.

In this report, we’ll take a close look at platinum’s applications in the latter — the automobile industry. We’ll also dive into why platinum is driving so much excitement recently, as well as ways to invest in this critical metal.

Let’s get stuck in…

Why platinum?

Platinum’s value stems not only from its scarcity but also from its appealing properties.

Platinum is one of six metals in the Platinum Group Metals (PGMs), which are essential precious metals that share similar physical and chemical properties and are usually found together in nature.

Platinum, like gold and silver, is also a noble metal. Noble metals have great resistance to chemical attacks and don’t corrode even at high temperatures. Noble metals are often used in jewellery because of their high durability.

What’s more, platinum is soft, ductile, and malleable. It also has high resistance to heat, with a melting point of 1,772 degrees Celsius.

These properties, primarily the heat resistance, make platinum ideal for automotive applications. It is a key part of catalytic converters for internal combustion engine vehicles. Almost every vehicle sold worldwide has these devices. They are placed in the exhaust system of cars, trucks, and buses to help reduce harmful emissions.

In the past, platinum was mostly used in vehicles with diesel engines, while palladium was used in gasoline vehicles for the same purpose. But more recently, automakers have been switching to platinum in gasoline vehicles to reduce costs. This, in turn, has been driving demand for platinum higher.

As such, platinum — and PGMs collectively — are currently listed as critical minerals in the US, EU, Japan, and Australia.

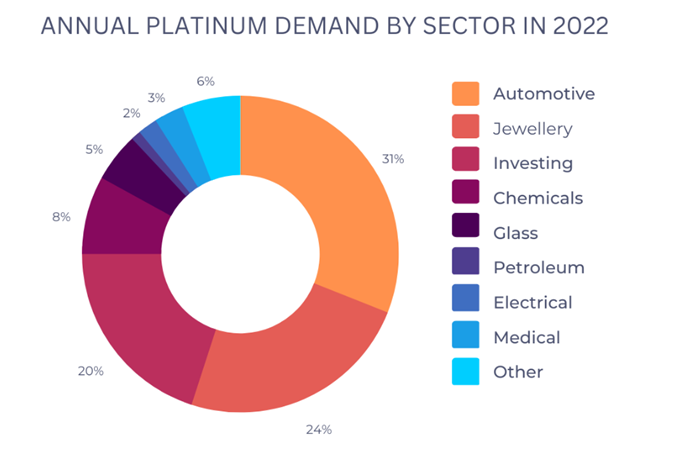

See below for a breakdown of platinum demand:

Source: Suisse Gold

As you can see, platinum is also used in the chemical industry to manufacture nitric oxide used to make fertilisers, explosives, and nitric acid. Platinum also has applications in the petrochemical industry (where platinum catalysts are used to refine crude oil) and in the medical sector as a key material in products like dental implants and pacemakers.

About a fifth of platinum’s demand comes from investing, with many investors buying things like platinum coins and bars.

However, more recently, platinum has been catching the eyes of investors due to its potential application within hydrogen energy alternatives.

A surge in demand to come…

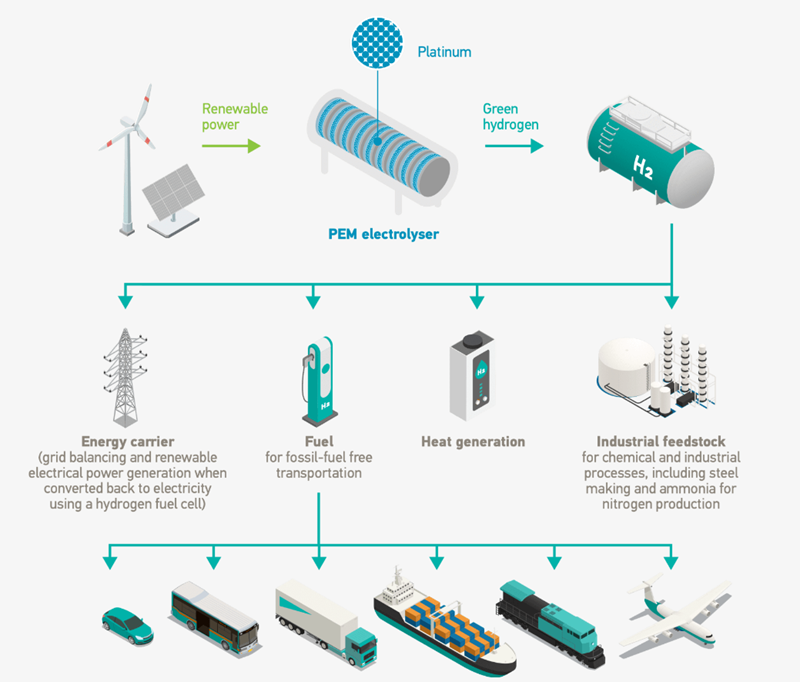

Platinum is a key ingredient in Proton Exchange Membrane (PEM) technology.

PEMs have two main applications. The first is in the transport industry, powering fuel cell electric vehicles (FCEV).

The second is in PEM electrolysers, which split water into both hydrogen and oxygen and can produce green hydrogen from renewable energy.

Source: World Platinum Investment Council

Platinum demand for these particular uses is quite small for the time being. However, this is expected to grow in coming decades, with the strong push towards renewable energy solutions.

As the World Platinum Investment Council (WPIC) research director Edward Sterck put it recently:

‘Hydrogen-related demand for platinum is expected to grow substantially…reaching as much as 35% of total yearly platinum demand by 2040.’

Can platinum supply meet demand?

Platinum production is quite concentrated.

The largest global producer by far is South Africa. In 2022 the country produced 140 metric tonnes out of the 190 metric tonnes produced worldwide.

South Africa also has the largest PGM reserves in the world, located in the Bushveld Complex. The second largest producer is Russia, which produced 20 metric tonnes in 2022. Other significant producers are Zimbabwe and Canada.

As mentioned, platinum is usually found together with other PGM metals (palladium, ruthenium, rhodium, iridium, and osmium), but PGMs can also be found close to nickel and copper deposits, where PGMs are mined as a byproduct.

While Australia has never been a significant global player when it comes to platinum production, it has some promising resources and could become a source of growth for platinum demand.

What influences platinum price?

The price is quite volatile, as you can see below:

Source: Macrorends

Multiple factors impact the price of platinum.

One main factor — as for any commodity — is supply versus demand. Since the platinum supply is mostly concentrated in one country, any instability, worker dispute, or conflict in South Africa can disrupt supply. When this coincides with a surge in demand, it can cause prices to spike.

Platinum prices went on a run in the mid-1970s when the automobile industry began using the metal to make catalytic converters.

Since the automotive industry is the biggest demand driver for platinum, another element that can influence prices is vehicle market trends.

For instance, platinum prices tend to fall during recessions as people usually stop buying cars. For example, just before the 2008 crisis, platinum prices hit an all-time high of US$2,270 per troy ounce and then went on to collapse spectacularly to around US$800. They also fell in 2020 during the pandemic.

Geopolitical conflicts can also have an impact as they can affect supply. In 2022, for example, the Russian invasion of Ukraine boosted platinum prices for fear supply disruptions would occur.

Granted, that was short-lived. Prices dropped at the beginning of 2023 as macroeconomic conditions worsened to hit US$900 an ounce.

Since March, however, prices have somewhat recovered on supply concerns, and, at the time of writing, it is trading at around US$1,000 an ounce.

Indeed, the platinum supply remains fragile.

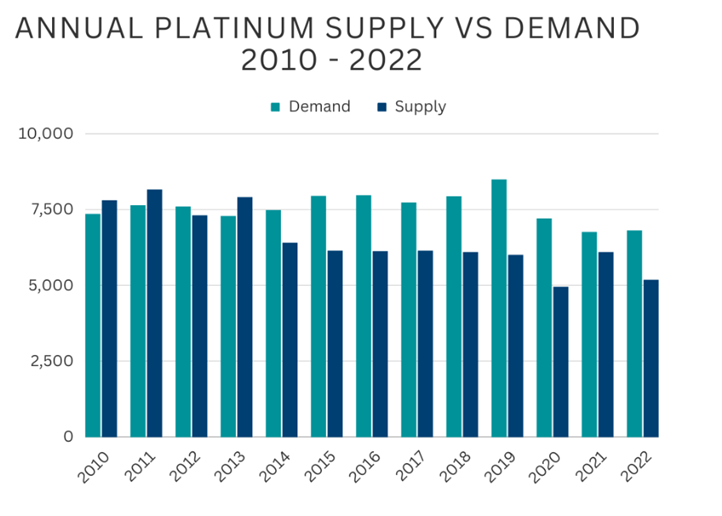

In fact, the platinum supply has been in a deficit to demand for the last few years. You can see this in the chart below:

Source: Suisse Gold

South African miners have recently been dealing with power cuts and operational challenges impacting production. This, coupled with the current geopolitical climate, has likely placed a strain on the platinum supply.

All this could mean higher platinum prices this year. As Suisse Gold recently put it:

‘The platinum market in 2023 is characterized by growing demand and a persistent supply deficit. The increasing demand for platinum in various industries, including green energy and healthcare, combined with supply constraints and underinvestment in new mining projects, has led to a tightening market. This makes platinum a potentially profitable investment over the next decade. Increasing demand coupled with current supply shortages are likely to cause a price increase, particularly as new sectors continue to develop. South Africa, as the world’s largest producer, holds significant growth potential in addressing these challenges and ensuring a stable future for the platinum industry. However, locating and putting new platinum mines into production takes a lot of time, and will not result in an immediate change in supply levels.’

So, how to back this growing trend?

How to invest in platinum

There are several ways to invest in platinum today.

Probably the easiest way to get exposure is to buy physical platinum directly.

Much like buying physical gold or silver, buying platinum bullion requires some research and consideration.

The first thing to consider is what type of platinum you want to buy. That is, either platinum coins or bars.

Then there’s the question of how much you want to invest. Platinum bars, for example, come in many different sizes: 50g, 100g, 500g, and 1kg, to name a few, although 1 ounce is the most popular size.

And then, you need to find a way to store it, which can be a disadvantage when buying platinum bullion since that usually comes at a cost.

An alternative way to invest in platinum that doesn’t require physical storage is through an exchange traded fund (ETF) such as Global X Physical Platinum [ASX:ETPMPT].

ETPMPT is backed by physical platinum, so it exposes investors to physical platinum prices without having to buy or store bullion.

There are some advantages to investing in ETFs. They are usually a lot cheaper than owning physical platinum, and it’s also easy to buy and sell as there’s no need to go to a dealer.

The big disadvantage, though, is that you don’t actually hold the bullion yourself.

Another way to jump on this platinum trend is to invest in ASX-listed miners involved in the exploration, development, and production of platinum.

One of those companies, for example, is Chalice Mining [ASX:CHN].

Chalice has 100% ownership of the Julimar Project in Western Australia.

In March 2020, the company discovered the Gonneville deposit as it drilled its first drill hole. The hole intersected shallow high-grade PGE-nickel-copper-cobalt-gold sulphide mineralisation.

The share price went on to spike 600% between discovery and May 2020.

As the company describes it, Gonneville is significant. It’s ‘one of the largest recent nickel sulphide discoveries worldwide, and the largest platinum group elements (PGE) discovery in Australian history.’

It’s estimated the Gonneville deposit holds 10 million ounces of palladium, platinum, and gold, along with 900,000 tonnes of base metals.

Another company with a platinum project in Australia is s Podium Minerals [ASX:POD], who is developing the Parks Reef PGM project west of Meekatharra in Western Australia.

The project has a mineral resource of 143 Mt at 1.30 g/t 5E, and Podium Minerals is looking to produce platinum, palladium, rhodium, iridium, and gold, along with base metals such as copper, nickel, and cobalt.

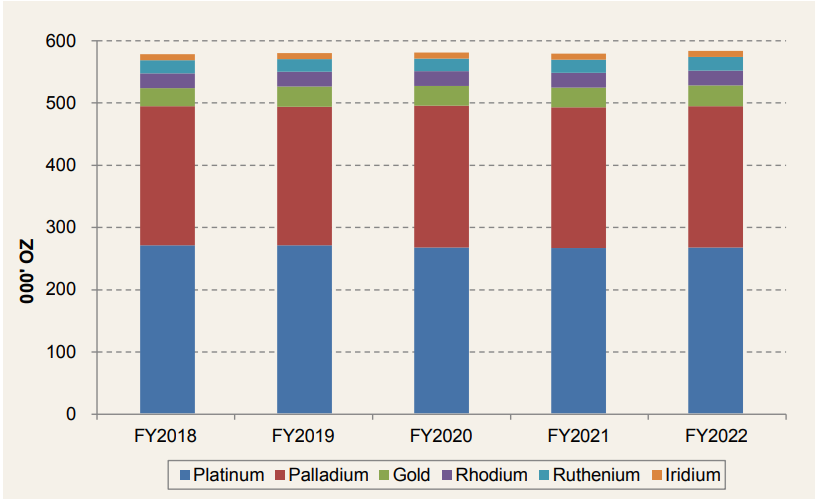

A platinum producer on the ASX with operations in Zimbabwe is Zimplats Holdings [ASX:ZIM].

Zimplats has five underground mines, three concentrator modules (two in Ngezi and one in Selous) and a smelter located in Selous.

In 2022 the company produced close to 300,000 ounces of platinum, along with other metals, including palladium, gold, rhodium, ruthenium, and iridium.

Zimplats has a $2.54 billion market cap. It also pays investors a dividend.

Please note that none of the companies mentioned in this report are official recommendations but are a place to start your research.

All share market investing carries risk. Do your research and never invest more than you are prepared to lose.

Opportunities and future outlook

In short, platinum supply could already be facing a big deficit this year as automakers continue to substitute palladium with platinum to save on costs. The World Platinum Investment Council expects the platinum deficit could hit 983,000 ounces this year.

And while it has never been a big player when it comes to platinum, we can see the makings of Australia playing an important role in future supply.