Many Aussie investors are familiar with ASX-listed lithium stocks, so here we will cover the essentials you need to know before investing. Turns out, knowing how to invest in lithium stocks is closely tied up with a basic understanding of how mining stocks work, combined with factors specific to the company.

Not all ASX-lithium stocks are the same so here’s how we’ll go about this guide:

- What is lithium?

- Australian lithium industry: an overview

- History of ASX lithium stocks

- Electric vehicles: a very short introduction

- EV market and its role in the lithium price

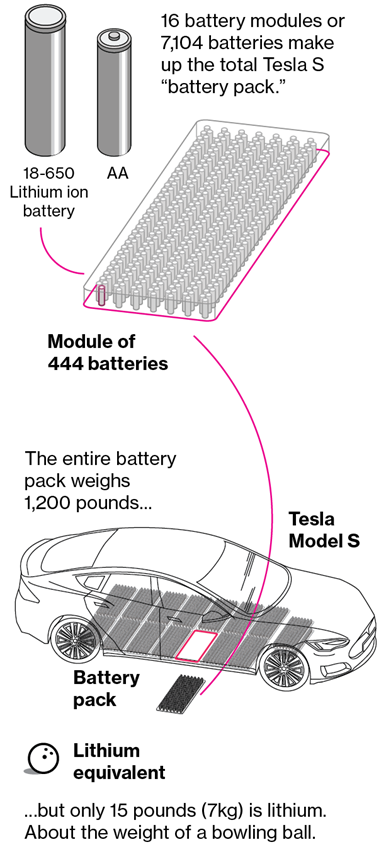

- One of the most crucial components of EVs is the lithium-ion battery

- But what makes the lithium-ion battery so special?

- The three main types of lithium stocks

- The different stages of a mining company

- How to compare lithium stocks

- The future of lithium and battery tech

- Substitutes and alternatives

- Concluding thoughts: lithium and the future

Why invest in lithium?

The COVID-19 pandemic rightfully consumed much of the world’s attention in 2021.

But so, too, did unprecedented weather events.

2021 was a year of unprecedented heat, unprecedented drought, unprecedented fires, storms, and floods.

These unprecedented events are no flukes.

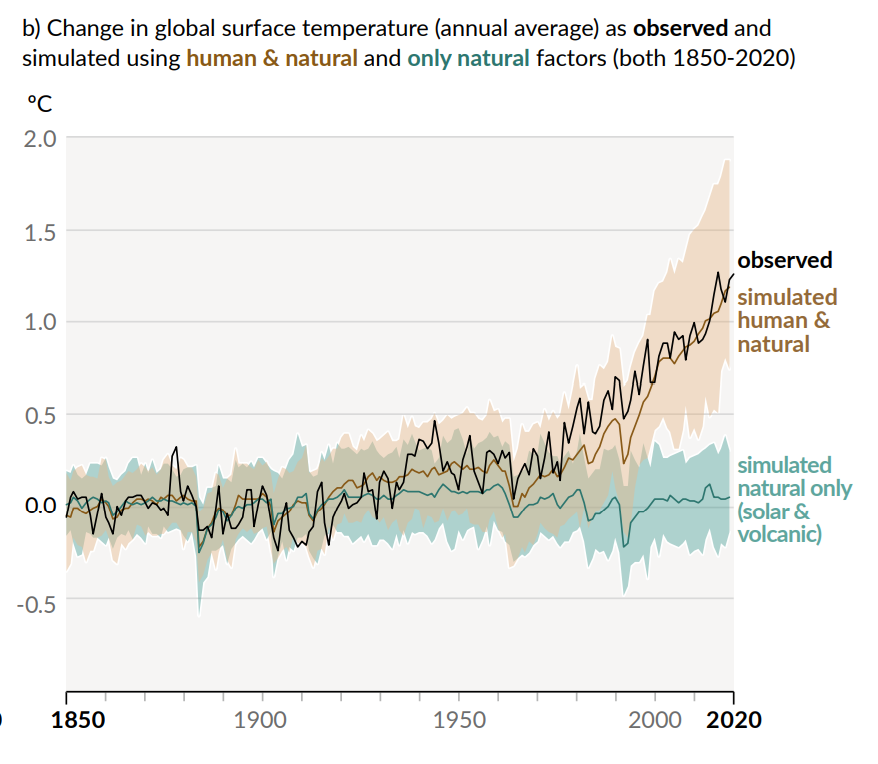

Scientists the world over attribute the turbulent weather events to the carbon we release into the air

According to the latest report from the Intergovernmental Panel on Climate Change, worldwide greenhouse gas emissions since 1850 are now at 2,400 billion tonnes of carbon dioxide.

Every subsequent 1,000 billion tonnes is likely to cause between 0.27°C and 0.63°C more warming.

But as Bloomberg reported, the grim news should not overshadow the dramatic technological progress made to replace fossil fuels.

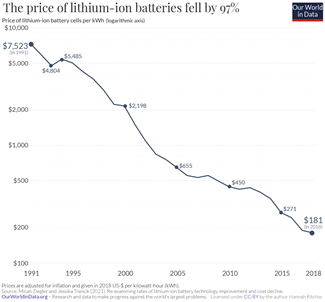

And some of the greatest advances have come in batteries.

Since 2000, improvements in energy density and reductions in manufacturing costs have brought the price of electric vehicle (EV) batteries down almost 10-fold.

Analysts at Bloomberg New Energy Finance (BloombergNEF) predict that 2023 could be the year EVs reach price parity with internal combustion vehicles. This would make the clean energy transition that much speedier.

And that’s where lithium comes in. For lithium is a vital component of the electric batteries set to power our energy revolution.

But first…

What is lithium?

Lithium is the third element in the periodic table and the lightest classified as a metal, discovered in 1817 by Swedish scientist Johan August Arfwedson.

Lithium is soft and silver. It is lighter than water, about half of its density, so it can even float.

What makes lithium attractive for industrial application is the fact it has the highest electrochemical potential among all the metals.

It is ideal for use in rechargeable batteries, providing efficient energy storage.

Lithium is therefore an element of rising importance.

This is highlighted by the British Geological Survey (2015) in their metal risk list. This list evaluates the supply risk index of metals according to several factors such as production, concentration, distribution, and substitutability.

Lithium has been ranked with an index of 7.6 (out of 10), the same as the platinum group elements, increasing its index from a 5.5 in 2011, and a 6.7 in 2012.

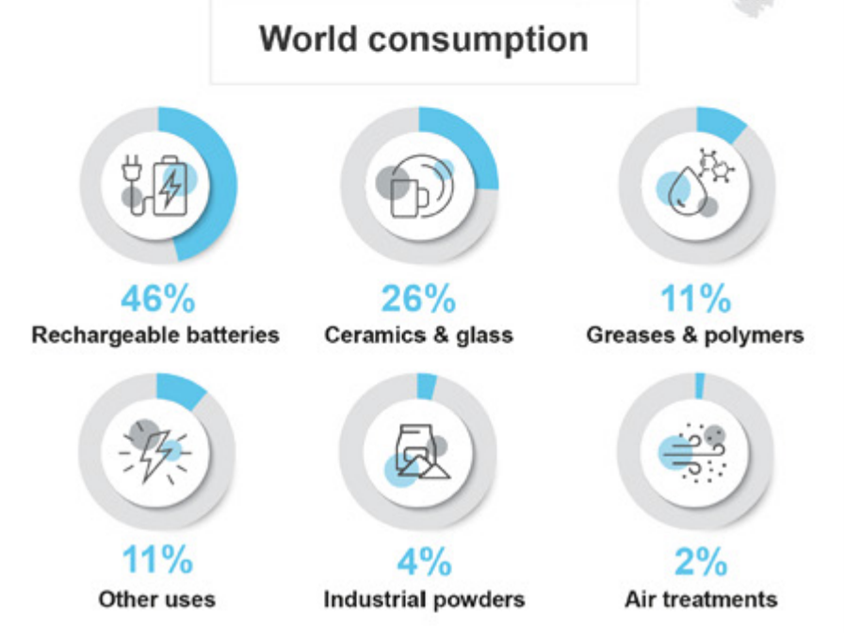

Lithium in various forms, such as lithium carbonate, lithium hydroxide, and lithium chloride, is also used in lubricant greases, pharmaceuticals, catalysts, and air treatment.

Below is a breakdown of lithium world consumption as of 2021:

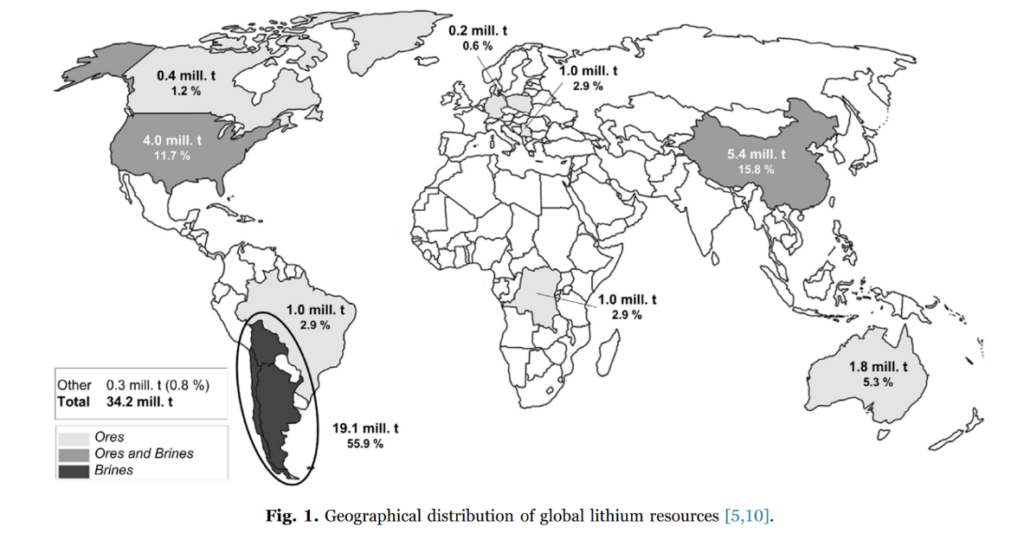

It’s also useful here to talk about the types of lithium resource, as lithium miners differ on means of extraction.

Lithium on Earth only occurs as a mineral compound in igneous rocks, subsurface lithium brines, lithium clays, or as a dissolved solid substance in seawater.

Although there are more than 100 minerals containing lithium, only three are commercially mined today. Found in pegmatites, these rock/minerals are lepidolite, spodumene, and petalite.

Spodumene is the most common.

Lithium from hard rocks and clays is extracted via conventional mining methods.

However, lithium is also found in continental brine deposits, saline groundwater pools and is enriched in dissolved lithium.

Brine deposits represent about 65% of the world’s lithium resources.

Canada, China, and Australia have significant resources of lithium minerals, while lithium brine is produced mainly in Chile, Argentina, China, and the US.

Unlike hard rock lithium extraction, extraction of lithium from brine deposits involves evaporation processes in man-made ponds.

Lithium brines are the dominant feedstock for lithium carbonate production

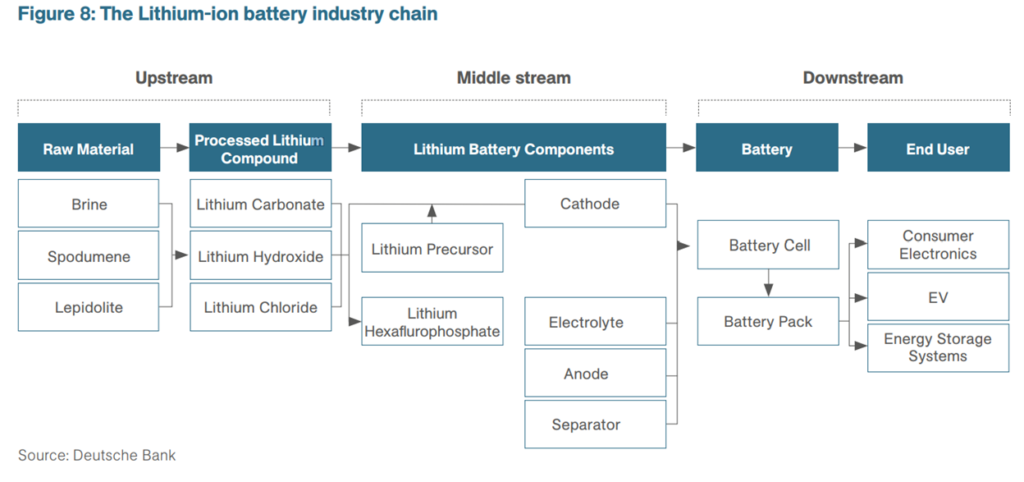

Basically, the most common lithium-bearing raw materials are brine and spodumene, with lepidolite being the third, less common, source.

This raw material can then be processed into three lithium compounds: lithium carbonate, lithium hydroxide, and lithium chloride.

However, only lithium carbonate and lithium hydroxide can be used in electric vehicles and li-on batteries.

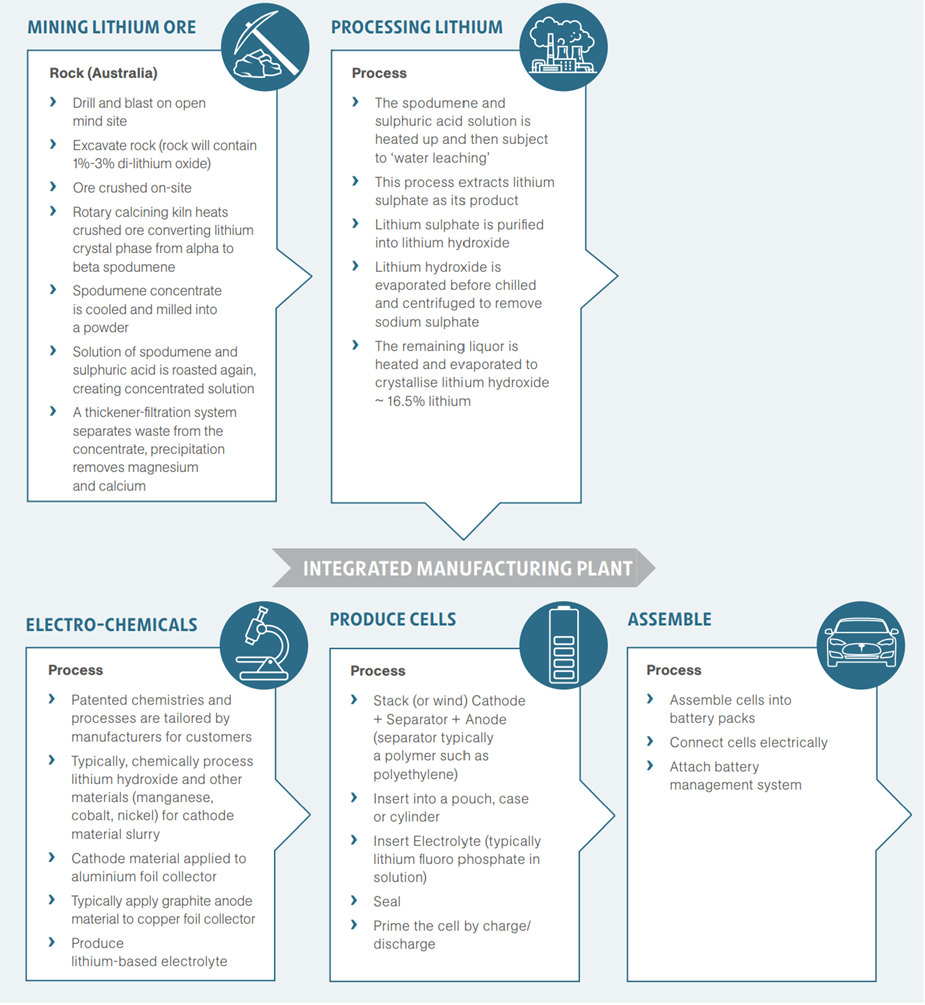

For more detail on how hard rock mining of spodumene ore leads to the assembly of a lithium-ion battery, see the diagram below:

Australian lithium industry: an overview

Australia was bestowed the bounty of natural resources.

But while iron ore and coking coal often get the bulk of our attention as Australia’s predominant export goods, we shouldn’t forget lithium.

According to the federal government’s Department of Industry, Science, Energy and Resources, Australia is the biggest lithium exporter globally.

Australia produced 49% of the world’s lithium in 2020.

A 2021 United States Geological Survey found that ‘five mineral operations in Australia, two brine operations each in Argentina and Chile, and two brine and one mineral operation in China accounted for the majority of world lithium production.’

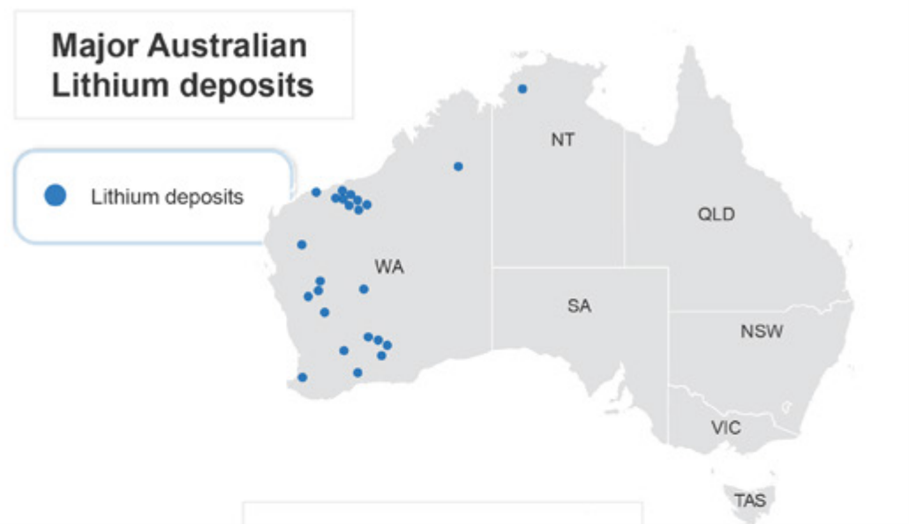

As the chart below shows, most of our lithium comes from Western Australia.

The state is home to lithium mines from ASX lithium stocks Pilbara Minerals Ltd [ASX:PLS], Galaxy Resources Ltd [ASX:GXY], and Mineral Resources Ltd [ASX:MIN].

Impressively, Australia had no resources of lithium considered subeconomic, according to the most recent data from Geoscience Australia.

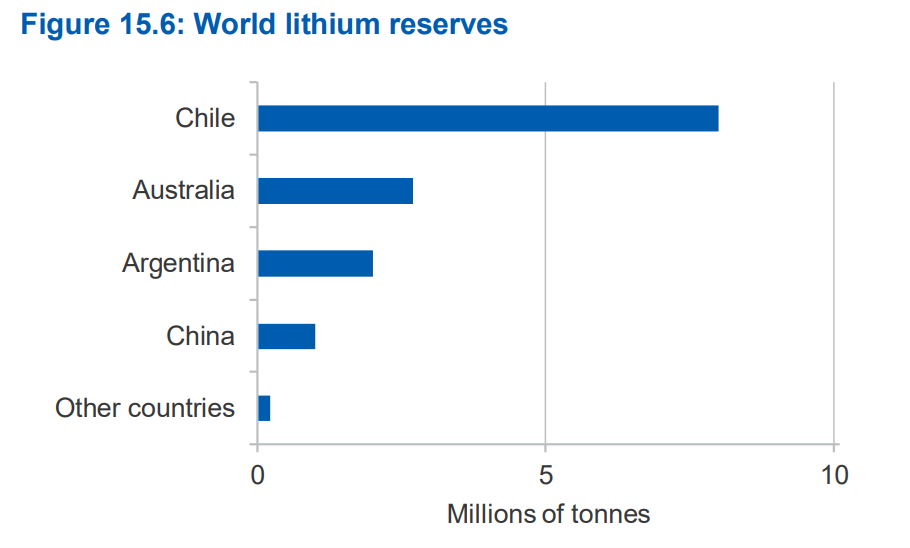

Zooming out, and Australia also lays claim to the world’s second-largest lithium reserves, behind only Chile.

History of ASX lithium stocks

Despite Australia possessing large natural deposits of lithium minerals, the history of the local lithium industry is not as storied as, say, Australia’s gold or iron ore sector.

For instance, the federal government’s ‘Resources and Energy Quarterly’, which provides data on the performance of Australia’s resources and energy sectors, didn’t start covering the lithium industry until 2017.

And even then, reference to lithium related to a broader discussion of market conditions for nickel.

Partly, that’s because the largest lithium producing companies are overseas firms.

As Mining Technology reported in August 2021, the top three largest lithium producers (by market cap) were China-based Jiangxi Ganfeng Lithium (US$38.5 billion), US-based Albermarle Corp (US$26.8 billion), and China-based Tianqi Lithium (US$24.4 billion).

But the resurgence of the lithium price in late 2020 gained the lithium industry close attention.

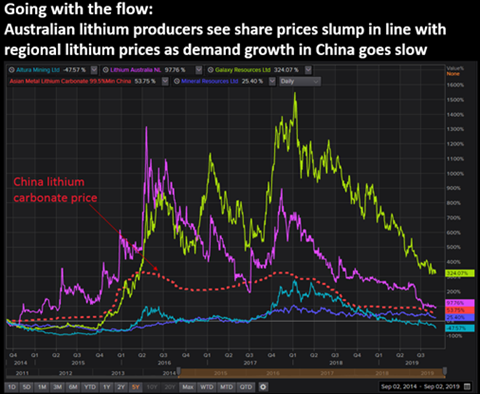

Now, any history tour of the lithium sector must mention the boom of 2016–17 — and subsequent bust in 2018.

Lithium stocks are commodity stocks. And for them, the supply and demand equation are vital.

Commodities — like iron ore, coal, lithium — rise when demand outpaces supply.

That could also happen when supply is constant, but demand rises. Or when demand is constant, but the industry suffers a supply shock.

Well, in 2016–17, the price of lithium boomed but was followed by a price bust as too much new production came onstream too soon.

Australia’s lithium industry — as well as the globe’s — was still digesting the oversupply when the pandemic caused a demand shock, compounding the glut.

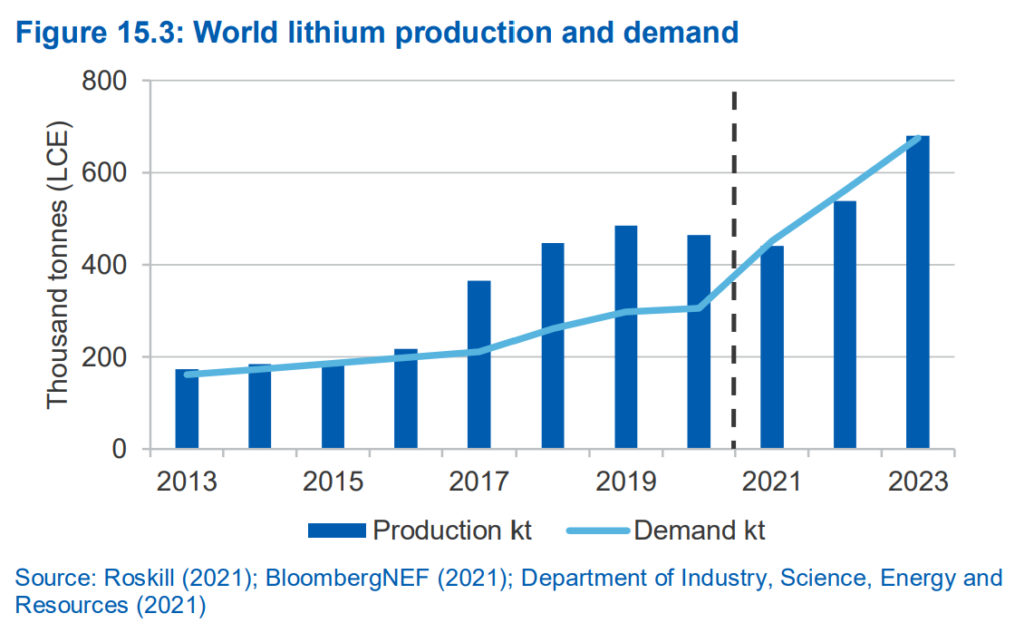

As you can see from the chart below, the world’s lithium production was running way ahead of demand in 2017–20 — an unfavourable scenario for a commodity.

The spot lithium hydroxide price eased from US$16,139 a tonne in 2018 to about US$11,000 a tonne in late 2019.

Lithium hydroxide prices (delivered to China) continued falling, dropping 41% year-on-year to the June 2020 quarter.

Lithium carbonate prices (delivered to China) declined by 46% in the same period.

Unsurprisingly, this impacted the stock prices of lithium firms in Australia.

Lithium is a relatively abundant metal. It’s a commodity. And commodity stocks are usually price takers.

Take, for instance, iron ore — the pride of Australia’s resource sector.

Iron ore, like lithium, is a commodity.

So consider how sensitive iron ore stocks are to iron ore price moves.

Both Rio and BHP can act as examples.

In Rio’s case, a 10% change in the iron ore price was forecast to impact calendar 2021 earnings before interest tax and depreciation (EBITDA) by US$4.18 billion.

It’s a similar situation with BHP. A US$1 per tonne move in the iron ore price was expected to impact EBITDA by $234 million in FY21.

The takeaway here is lithium stocks ride the demand cycle and inexorably rising lithium prices are not guaranteed.

That said, they were rising again in 2021.

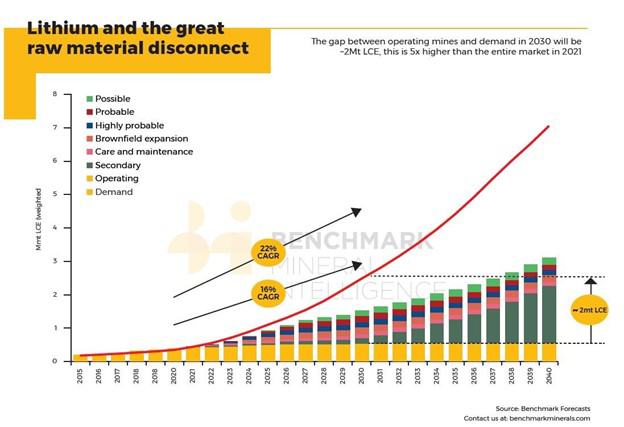

As Benchmark Mineral Intelligence Managing Director Simon Moores said in September 2021, the lithium deficit in 2025 is slated to be bigger than the entire lithium industry was in 2016.

And a big reason is the huge anticipated growth in electric vehicle production.

Electric vehicles: a very short introduction

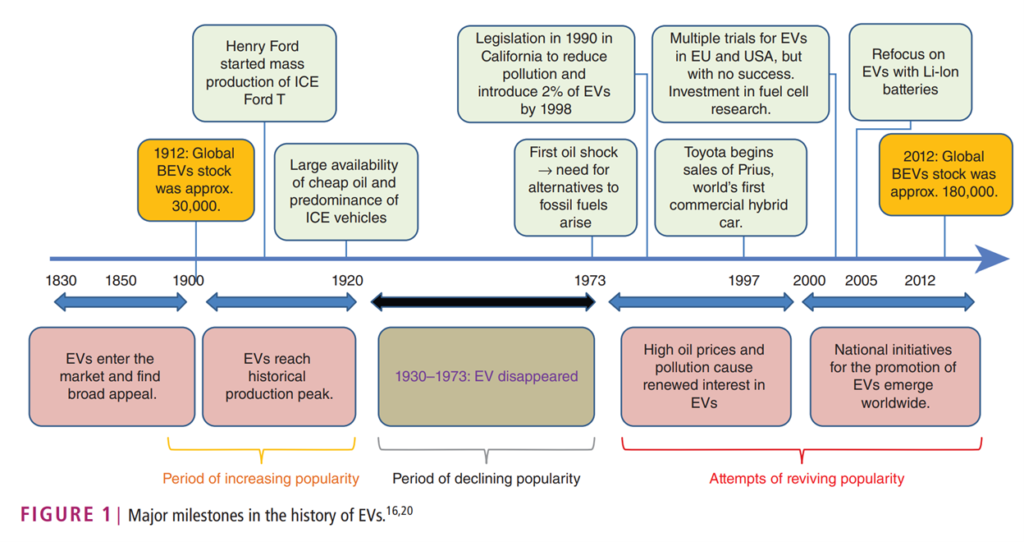

Many think electric vehicles started with Elon Musk unveiling the Tesla Roadster in 2008.

But electric cars were first demonstrated back in 1828. And the first EV produced came in 1884.

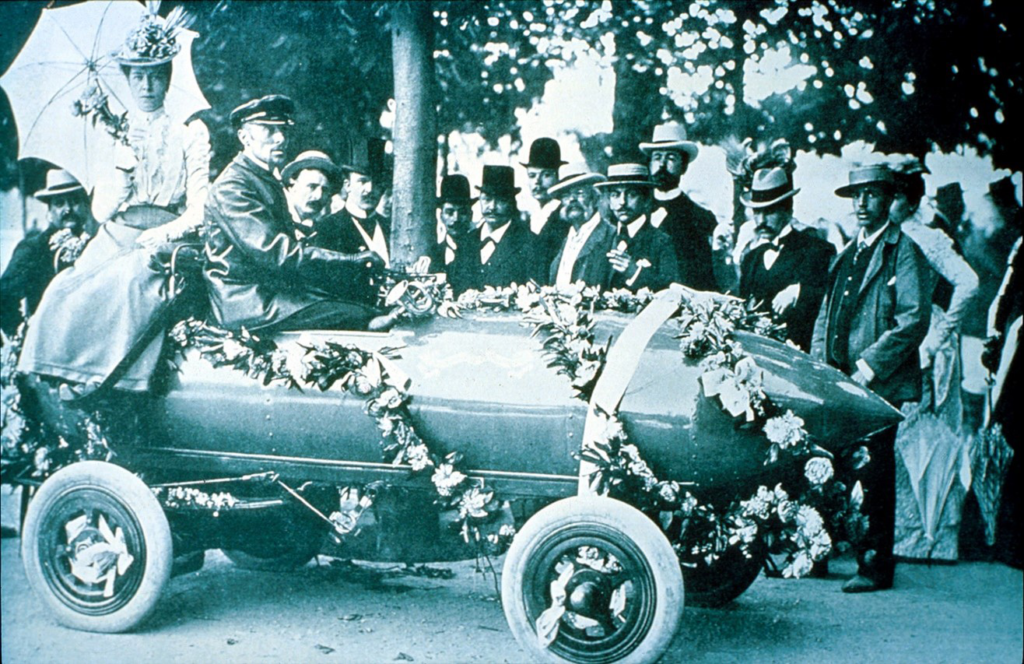

In 1899, Camille Jenatzy’s La Jamais Contente EV was the first automobile to exceed 100km per hour.

The history of EVs is long enough to be split into three major phases: their increasing popularity (about 1890–1920); their declining popularity (after 1920); and attempts at reviving popularity (after 1970).

As researcher Amela Ajanovic wrote in 2015:

‘The “golden age” of EVs was reached in the period 1880–1920 in the USA where the electric passenger car was far more successful than in Europe. At this time, three types of cars were available: steam-powered vehicles, gasoline ICE vehicles, and EVs. In 1900 EVs became the top-selling road vehicles in the USA, capturing 28% of the market. By 1900, 936 gasoline-, 1575 electric-, and 1681 steam vehicles have been registered nationwide. In the major urban areas (New York, Boston, and Chicago), EVs were dominant, about two EVs to one gasoline.

‘The market was divided with no clear indication of which type would dominate. Each technology had its advantage and disadvantages, fighting to be competitive in the open market in performance and price. Steam-powered vehicles were faster and less expensive but required a long time to fire up and frequent stops for water. The ICEs were dirtier, more difficult to start and moderately more expensive but could travel longer distances at a reasonable speed without stopping. EVs were clean and quiet but slow and expensive.’

Incredibly, while ICE vehicles vastly outnumber EVs today, this was not always the case. EVs enjoyed top status in the early 1900s.

What changed?

The 1920s saw better road networks — favouring the longer range of ICE vehicles — and the introduction of the revolutionary mass-produced Ford Model T.

Henry Ford’s Model T was the first mass-produced vehicle with 15 million cars. The scale of its production allowed Henry Ford to cut Model T’s price from US$850 in 1909 to US$260 in 1920.

The prices of the less efficiently produced EVs did not decrease in tandem, however.

The 1920s saw better road networks — favouring the longer range of ICE vehicles — and the introduction of the revolutionary mass-produced Ford Model T.

Henry Ford’s Model T was the first mass-produced vehicle with 15 million cars. The scale of its production allowed Henry Ford to cut Model T’s price from US$850 in 1909 to US$260 in 1920.

The prices of the less efficiently produced EVs did not decrease in tandem, however.

EV market and its role in the lithium price

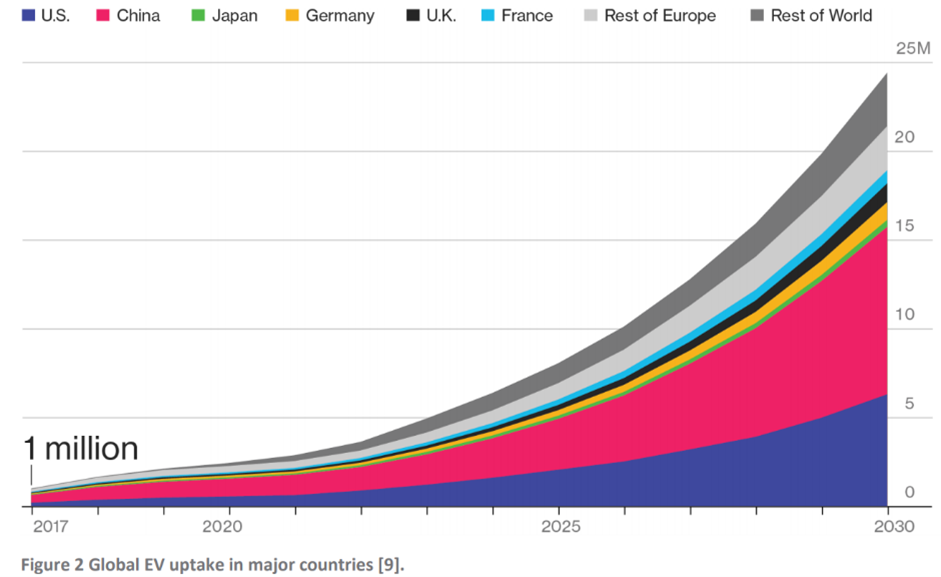

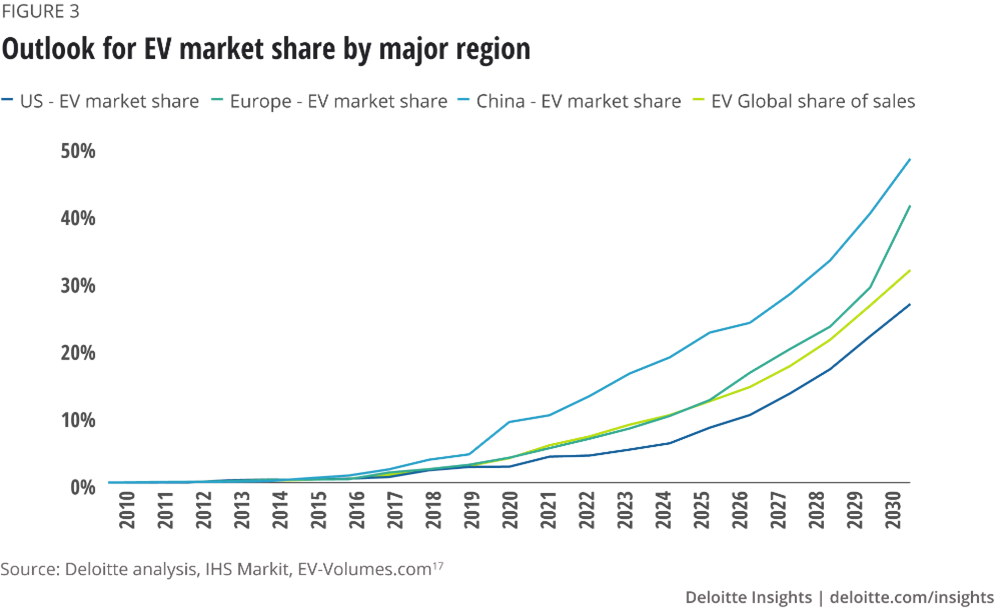

The lithium investment thesis is best explained by considering a few charts below.

But before we get to the charts, we need to note the context.

In August 2021, the UN’s Intergovernmental Panel on Climate Change released a report signed off by 234 scientists from more than 60 countries.

The report found the world is likely to temporarily reach 1.5C of warming within 20 years even in a best-case scenario of deep cuts in our greenhouse gas emissions.

But what’s the best way to cut greenhouse gas emissions?

According to the World Resource Institute, the energy sector contributed to 72% of the global human-made greenhouse gas emissions.

Clearly, if the world is to act, the energy sector will be a big focus.

And at the forefront of this focus is the electric vehicle and its energy source: the lithium-ion battery.

Consider these figures.

In 2020, a record three million new electric cars were registered, up 41% from 2019. This is despite the broader global car market shrinking 16% in 2020.

But three million cars aren’t much in the scheme of things.

That’s where the rising demand comes in.

According to the International Energy Agency, the worldwide number of electric cars, vans, heavy trucks, and buses will rise to 145 million by 2030.

And BloombergNEF estimates that at least two-thirds of global car sales will be electric by 2040.

Internal combustion engine vehicles — the ones most of us are currently driving — have already peaked.

And EVs are only set to get cheaper and more powerful.

So here’s the first chart, then:

As you can see, the demand for EVs is set to accelerate after 2021, with the major consumer regions — the US, China, and Europe — dominating the market share.

In 2021, the Department of Industry, Science, Energy and Resources reported that the planned capacity increases of automotive manufacturers to 2025 already exceeds the requirements of government policies.

Auto manufacturers are clearly investing heavily in the transition from internal combustion engines (ICE), but they are not primarily in the charity business.

Automakers expect these investments to pay off.

As the Department concluded, higher EV production ‘may place pressure on the supply of materials such as spodumene and lithium hydroxide.’

‘At this stage, supply may fall short of demand unless mine and brine operations are expanded beyond initial projections.’

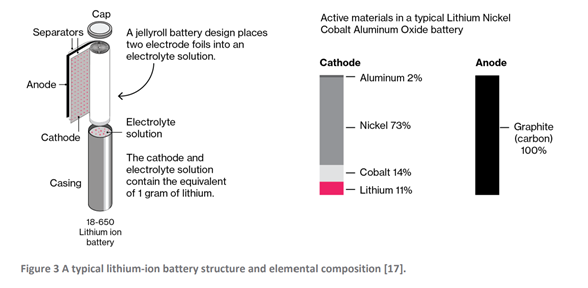

One of the most crucial components of EVs is the lithium-ion battery.

And here is another wrinkle to the demand story.

To drive greenhouse gas emissions down, we need a low-carbon energy system and low-cost energy storage.

Well, lithium-ion battery cells have been getting cheaper, making electric vehicles more affordable and driving up sales as a consequence.

For instance, the World Electric Vehicle Journal ran a survey in Australia in 2019 that found affordable price was the biggest factor in encouraging EV uptake.

This attitude hasn’t changed in decades.

For instance, in 2000 The Economist cited research that found that while Americans favour cleaner, more fuel-efficient vehicles in principle, ‘they are unwilling to pay much more for them than they would for a traditional gas-guzzler.’

With EV sales on the up, what changed wasn’t the parsimonious attitude of consumers but the price of EV batteries.

Specifically, the price of lithium-ion batteries fell by 97% since 1991.

To put this in perspective, the Nissan Leaf electric car currently has a 40kWh battery. At 2018 prices, the battery costs about $7,300.

But in 1991 the Leaf’s battery alone would cost you $300,000!

A steep price that would hamper demand even for the most environmentally conscientious.

As The Economist wrote in 2021, the average cost of a lithium-ion battery pack is roughly $140 per kilowatt hour.

The ‘holy grail’ is $100 per kilowatt hour.

This is when EVs reach parity with ICE vehicles and become cost-competitive with combustion ones.

BloombergNEF estimates this can happen by 2023.

But what makes the lithium-ion battery so special?

Lithium-ion batteries have significant advantages over other battery sources.

For one, they have higher energy density and a longer cycle life. They can charge and discharge faster than other storage alternatives.

They can supply applications needing high currents. And they require less maintenance.

It’s time for another chart.

Here’s a breakdown of the key components in a typical lithium-ion battery:

So…

The world’s greenhouse emissions are rising. The IPCC released a dire warning report in 2021 urging more action.

EVs are set to overtake internal combustion engines by 2040. And EVs rely on lithium-ion batteries to run.

What does this all mean?

Let’s consider another chart:

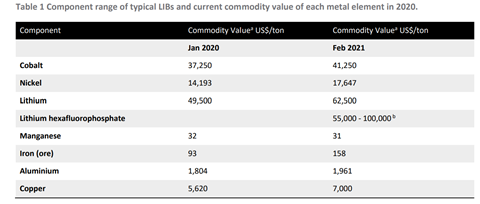

The chart above shows the prices of the key components of a lithium-ion battery in 2020 versus 2021.

As you can see, the prices for most of the key components are rising.

Lithium, of course, registered one of the bigger price jumps.

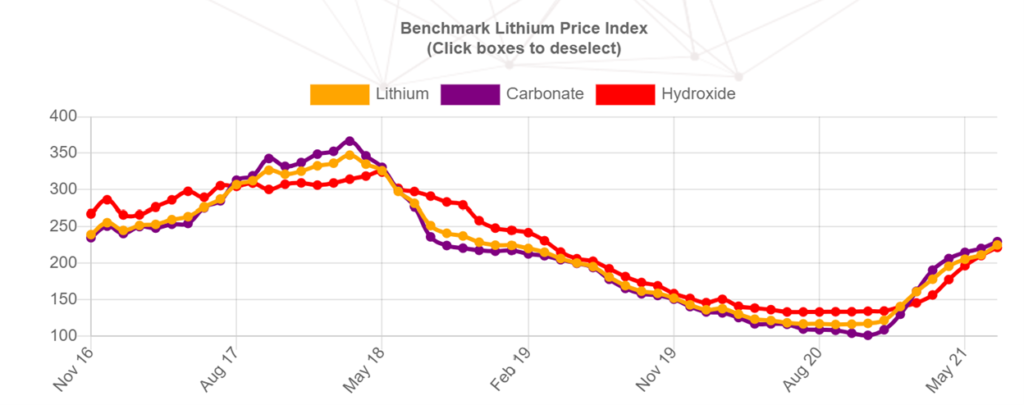

That’s corroborated by this chart below, from the oft-cited Benchmark Minerals.

Again, the chart is showing that after the oversupply of lithium in 2018 led to a price crash, lithium is rising again.

Rapidly.

The three main types of lithium stocks

When it comes to analysing a lithium stock, it pays to consider what type of lithium stock it is.

There are three main types:

- Explorers

- Developers

- Producers

Of course, there will be gradients within these categories, but that’s the main distinction.

Lithium explorers’ prospect for viable ores.

Explorers are yet to operationalise any mine and are a long way from producing any lithium.

Instead, lithium explorers seek out patches of land they can economically mine.

At this stage, of course, lithium explorers are money pits. Not only are revenue years away, but revenue also isn’t even guaranteed.

An explorer may find that a prospective tenement, after much surveying and assaying, will yield uneconomical results if mined commercially.

In those unfortunate cases, the money spent on land claims, tenements, drilling, and surveying goes to waste.

That’s why junior explorers are often described as speculative punts.

Despite the risks and upfront costs, according to a Victorian state government parliamentary inquiry, in recent decades, the smaller companies with a market capitalisation of less than $50 million have shouldered a larger share of exploration in recent decades in Australia.

The inquiry found that, in many respects, ‘big mining companies have effectively outsourced mineral exploration to the juniors.’

The Australian Institute of Mining and Metallurgy found in 2011 that junior explorers possess one key advantage over large-scale mining companies.

Explorers have greater efficiency in conducting their exploration activities.

Explorers, by nature of their status, must find a way to do more with less. Dearth incentivises efficiency and thrift.

Managing director of MinEx Consulting Richard Schodde summarised this point well:

‘At any one time a junior company, on average, has got two years with cash in the bank, so they have got to deliver results in the next two years otherwise they will not get funding for the future.

‘They are always on a very short fuse.’

Here are three ASX lithium explorers:

Argosy Minerals Ltd [ASX:AGY]

Argosy is a junior Australian explorer with a current 77.5% interest in the Rincon Lithium Project in Argentina’s Salta Province.

AGY also holds a 100% interest in the Tonopah Lithium Project in Nevada, US.

Argosy’s jewel is the Rincon Project. AGY thinks Rincon is a potential game-changer given its prime location in the famed Lithium Triangle.

Global Lithium Resources Ltd [ASX:GL1]

Global Lithium is currently exploring the Marble Bar Lithium Project in Western Australia’s Pilbara region.

The region is home to much of the country’s operations.

GL1’s assaying suggests the Marble Bar Project exhibits spodumene-bearing pegmatite. To date, GL1 has focused on exploring the Archer deposit, comprising spodumene-bearing pegmatites over a 3km by 1km zone.

In 2020, Global Lithium reported a JORC inferred mineral resource of 10.5 million tonnes at 1.0% Li20.

GL1 thinks opportunities exist for further discoveries across the broader Marble Bar area.

Anson Resources Ltd [ASX:ASN]

Anson Resources is a lithium exploration company currently focused on the discovery, acquisition, and development of natural resources serving the new energy markets.

Its key exploration target is the Paradox Basin Brine Project in southern Utah, US.

In 2021, Anson identified a large brine aquifer in the Mississippian Leadville Formation, with the exploration target comprising 1.3–1.8Bt grading 80–140ppm Li.

ASN also has a portfolio of base metals assets in Western Australia, covering 458 square kilometres.

Developers

If a company discovers land possessing sufficient ores with further exploration showing the ores are of high enough grade, the company will then seek to develop the area for commercial cultivation.

At this stage, the company believes it has found land of prospective quality it wishes to develop into a commercial mine with the intention to start producing lithium at scale.

The development stage involves planning and construction of a lithium mine but also any associated infrastructure.

That’s why many lithium mine developers emphasise if their mine site is close to any established ports, roads, or transportation lines. This proximity reduces capital expenditure on associated infrastructure.

Companies at the development stage must also obtain permits and licenses before they can begin construction.

This can take several years and can depend on the bureaucracies of local governments.

This also incurs regulatory risks as permits are not guaranteed.

For instance, Piedmont Lithium Inc [ASX:PLL] faced some permit issues in 2021 when Gaston County board commissioners in the US state of North Carolina said they might block or delay PLL’s project due to environmental concerns.

Here are three current ASX lithium project developers:

Core Lithium Ltd [ASX:CXO]

Core Lithium seeks to become Australia’s next lithium producer by developing the spodumene Finniss Lithium Project near Darwin Port in the Northern Territory.

In 2021, CXO released a Definitive Feasibility Study and a Scoping Study on Finniss. Both suggested Core could produce an average of 173,000tpa of lithium concentrate at a C1 Opex of US$364/t and AU$89 million Capex through DMS (gravity) processing.

The initial Finniss mine life is set at 10 years.

As an advanced developer, Core expects to commence construction at Finniss before the curtain closes on 2021, with first production slated before the end of 2022.

Vulcan Energy Resources Ltd [ASX:VUL]

Vulcan Energy was one of the pin-up stories for the resurging ASX lithium sector in 2021.

Over 12 months to September 2021, the VUL share price gained 900%.

In large part this was due to Vulcan aiming to develop the world-first zero carbon lithium project in the Upper Rhine Valley in Germany.

Vulcan is aiming to develop the project that will produce premium, battery-quality lithium chemicals with a zero-carbon footprint.

The company seeks to achieve this by harnessing renewable geothermal energy to drive production, avoiding evaporation ponds, mining, or fossil fuels.

Lake Resources NL [ASX:LKE]

Like Vulcan, Lake Resources is pioneering cleaner lithium extraction and processing as it seeks to develop its flagship Kachi Project as well as three other lithium brine projects in Argentina.

Lake’s projects cover 200 square kilometres in a prime location well-known as the Lithium Triangle. 40% of the world’s lithium is produced at the lowest cost there.

LKE seeks to leverage direct extraction technology it has developed with tech partner Lilac Solutions.

Lilac’s technology has been backed by the Bill Gates-led Breakthrough Energy Fund and MIT’s The Engine Fund.

LKE plans to produce high-purity lithium carbonate and has returned samples with 99.9% purity.

In November 2018, Lake announced a maiden JORC resource at Kachi of 4.4 million tonnes (Mt) of contained lithium carbonate equivalent (LCE).

In April 2020, Lake announced pre-feasibility study (PFS) results for Kachi, revealing an annual production target of 25,500 tonnes of battery-grade lithium carbonate using direct extraction technology.

Producers

Lithium producers have overcome all the hurdles entailed in discovering and exploring prospective ore, securing funds to develop an economical mine, bringing the construction of that mine to completion, and finally beginning to extract, produce, and ship its lithium product.

Here are three current ASX lithium producers.

Mineral Resources Ltd [ASX:MIN]

Mineral Resources is a diversified producer across multiple commodities, including iron ore and lithium.

MIN emerged after the amalgamation of three firms — Crushing Services International, PIHA, and Process Minerals International.

Combining as one, the three companies became Mineral Resources, listing on the ASX in 2006.

MIN operates mine sites in the Pilbara, Goldfield, and Yilgarn regions.

Mineral Resources mines and produces both direct shipping ore lithium and spodumene concentrate.

MIN’s Mt Marion lithium mine was slated to produce 206,000 tonnes of spodumene concentrate per annum, but a recent upgrade project is underway to increase production to 450,000 tonnes.

Orocobre Ltd [ASX:ORE]

I would have mentioned Orocobre and Galaxy Resources Ltd [ASX:GXY] separately…were it not for their giant $4 billion merger in April 2021.

The merger was finalised in August 2021, with the two companies currently trading under ORE’s ticker.

The merged entity — suddenly the world’s fifth-largest lithium producer — said it wishes to rebrand as Allkem.

ORE and GXY — now Allkem — have combined their large assets in Argentina, part of the famous ‘lithium triangle’.

In Argentina, Orocobre completed around 60% of the Olaroz lithium carbonate plant expansion from 25,000mt/year to 42,500mt/year, while Galaxy has been developing the first stage of the Sal de Vida lithium brine project to produce about 32,000mt/year of lithium carbonate.

Prior to the merger, Orocobre was well on its way to completing a 10,000mt/year Naraha battery-grade lithium hydroxide plant in Japan.

This plant will help what is now Allkem to enhance its vertical integration by allowing it to convert Olaroz lithium carbonate into battery-grade hydroxide.

Allkem will also operate what was once GXY’s Mt Cattlin operation in Western Australia, which produces around 200,000 mt/year of spodumene concentrate.

Pilbara Minerals Ltd [ASX:PLS]

Unlike Mineral Resources, Pilbara Minerals is a pure-play lithium business, owing 100% of the world’s largest, independent hard-rock lithium operation.

Pilbara’s Pilgangoora Operation in Western Australia produces a spodumene concentrate.

The Pilgangoora Operation has attracted big global partners like Ganfeng Lithium, General Lithium, Great Wall Motor Company, CATL, and Yibin Tianyi.

In FY21, PLS shipped 281,440 metric tonnes of spodumene concentrate.

The different stages of a mining company

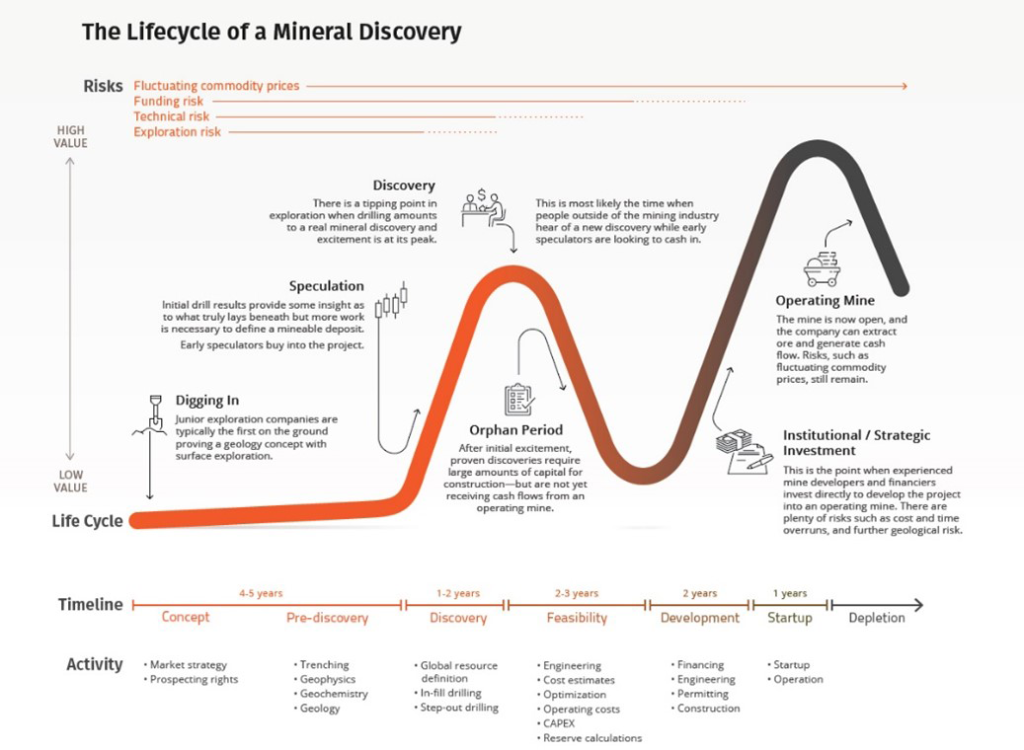

These three broad-stroke distinctions — explorers, developers, and producers — can be neatly transmuted to stock market prices by what’s called a Lassonde Curve.

The Lassonde Curve’s namesake is Pierre Lassonde, one of the founders of Franco-Nevada, the first gold royalty company.

You can check out a handy diagram breaking down the Lassonde Curve below:

How to compare lithium stocks

When it comes to evaluating and comparing lithium stocks, you must consider multiple factors.

You have to consider the lithium stock’s resource: does it possess spodumene, brine, clay, or a mixture?

For context, approximately 59% of the world’s lithium resources are found in brines and 25% in minerals.

The remainder is found in clays, geothermal waters, and oil field brines.

The type of resource also relates to where the lithium project is located.

Source: Martin, Rentschb, Höckb, Bertau

Source: Martin, Rentschb, Höckb, Bertau

For instance, Europe overtook China as the world’s largest electric vehicle (EV) market for the first time in 2021.

This development plays into assessing which lithium stocks have the most growth potential.

With Europe overcoming China as the largest EV market, lithium stocks with projects in Europe could stand to benefit greatly.

That could partly explain the run-up in the Vulcan Energy Resources Ltd [ASX:VUL] share price.

Why?

Because VUL’s key lithium project resides in the Upper Rhine Valley…in Germany.

Lithium is now centre stage of the clean energy revolution, being a key feedstock for the EV battery.

But lithium assuming this mantle means focus is also shifting to cleaner extraction and processing of the white metal, too.

And that’s another way to compare lithium stocks — their extraction methods and ESG credentials.

Lithium stocks like Lake Resources and Vulcan Energy consciously advertise themselves as clean lithium companies by accentuating the environmentally friendly nature of their mining and extraction.

Cleaner mining practices will grow more important as the ESG trend strengthens across the world.

While lithium is a vital material for a sustainable future, extracting lithium is often not environmentally friendly.

BloombergNEF estimates, for example, that ‘each ton of lithium extracted from brine requires 70,000 liters of fresh water. Making matters worse, much of lithium mining happens in regions that are already water-stressed.’

These concerns prompted German automaker giants Daimler AG and Volkswagen AG to launch a study into the environmental impact of lithium mining in Chile — the second-largest supplier of the white metal.

Peer comparison approach

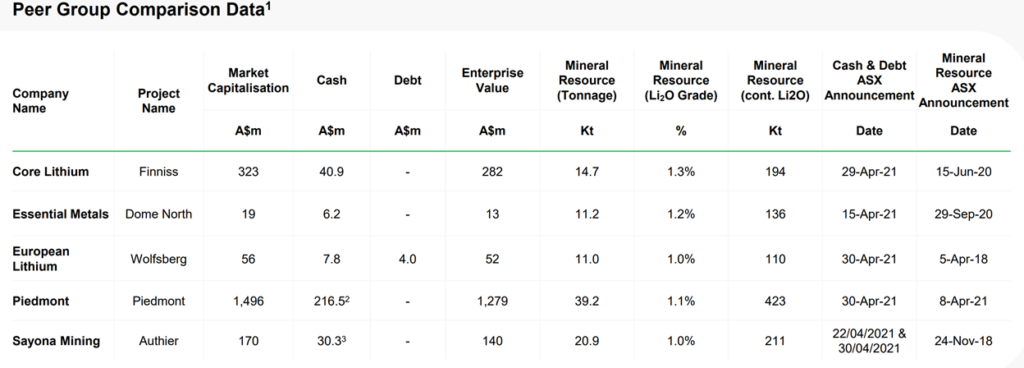

A detailed way to evaluate lithium stocks is by pitting them against each other on essential criteria like the stocks’ mineral resources, lithium grades, efficiency of extraction, mine life, and estimated project valuation.

A lot of this information can be found in feasibility studies released by the lithium firms.

Emerging lithium stocks also occasionally release peer comparison data themselves in a pitch to investors.

The comparison tables below were provided by Global Lithium Resources Ltd [ASX:GL1] in a May 2021 investor presentation:

![For instance, Europe overtook China as the world’s largest electric vehicle (EV) market for the first time in 2021. This development plays into assessing which lithium stocks have the most growth potential. With Europe overcoming China as the largest EV market, lithium stocks with projects in Europe could stand to benefit greatly. That could partly explain the run-up in the Vulcan Energy Resources Ltd [ASX:VUL] share price. Why? Because VUL’s key lithium project resides in the Upper Rhine Valley…in Germany. Lithium is now centre stage of the clean energy revolution, being a key feedstock for the EV battery. But lithium assuming this mantle means focus is also shifting to cleaner extraction and processing of the white metal, too. And that’s another way to compare lithium stocks — their extraction methods and ESG credentials. Lithium stocks like Lake Resources and Vulcan Energy consciously advertise themselves as clean lithium companies by accentuating the environmentally friendly nature of their mining and extraction. Cleaner mining practices will grow more important as the ESG trend strengthens across the world. While lithium is a vital material for a sustainable future, extracting lithium is often not environmentally friendly. BloombergNEF estimates, for example, that ‘each ton of lithium extracted from brine requires 70,000 liters of fresh water. Making matters worse, much of lithium mining happens in regions that are already water-stressed.’ These concerns prompted German automaker giants Daimler AG and Volkswagen AG to launch a study into the environmental impact of lithium mining in Chile — the second-largest supplier of the white metal. Peer comparison approach A detailed way to evaluate lithium stocks is by pitting them against each other on essential criteria like the stocks’ mineral resources, lithium grades, efficiency of extraction, mine life, and estimated project valuation. A lot of this information can be found in feasibility studies released by the lithium firms. Emerging lithium stocks also occasionally release peer comparison data themselves in a pitch to investors. The comparison tables below were provided by Global Lithium Resources Ltd [ASX:GL1] in a May 2021 investor presentation:](https://daily.fattail.com.au/wp-content/uploads/2021/10/ASX-Lithium-company-deposit-comparison-1024x565.webp) Source: Global Lithium Resources

Source: Global Lithium Resources

But analysing lithium stocks is by no means easy.

Just because the price of lithium is going up doesn’t mean that every single lithium stock will also fare well.

To invest wisely, you shouldn’t indiscriminately throw cash at any stock with lithium in the title.

You must delve deeper into the economics, costs, and business model of each individual company.

This can be a hassle.

So if you’re interested in lithium stocks and the wider clean energy theme but not keen on sifting through feasibility studies and ore readings, we have a dedicated publication here at Fat Tail Investment Research that may be of service.

New Energy Investor shows you how to grab your stake in the great energy switchover as the world transitions out of fossil fuels and into cleaner, greener, renewable energy.

Helmed by James Allen in London and Selva Freigedo here in Melbourne, New Energy Investor hunts the best and brightest clean energy prospects on the market — long before many Australian investors get to hear about them.

If you want to invest in the wider lithium demand theme, you can also gain exposure to the wider industry via an ETF.

For instance, the ASX-listed lithium battery and energy-storage themed ETFS Battery Tech & Lithium ETF [ASX:ACDC] offers investors exposure to the energy storage and production megatrend, including companies involved in the supply chain and production for battery technology and lithium mining.

The future of lithium and battery tech

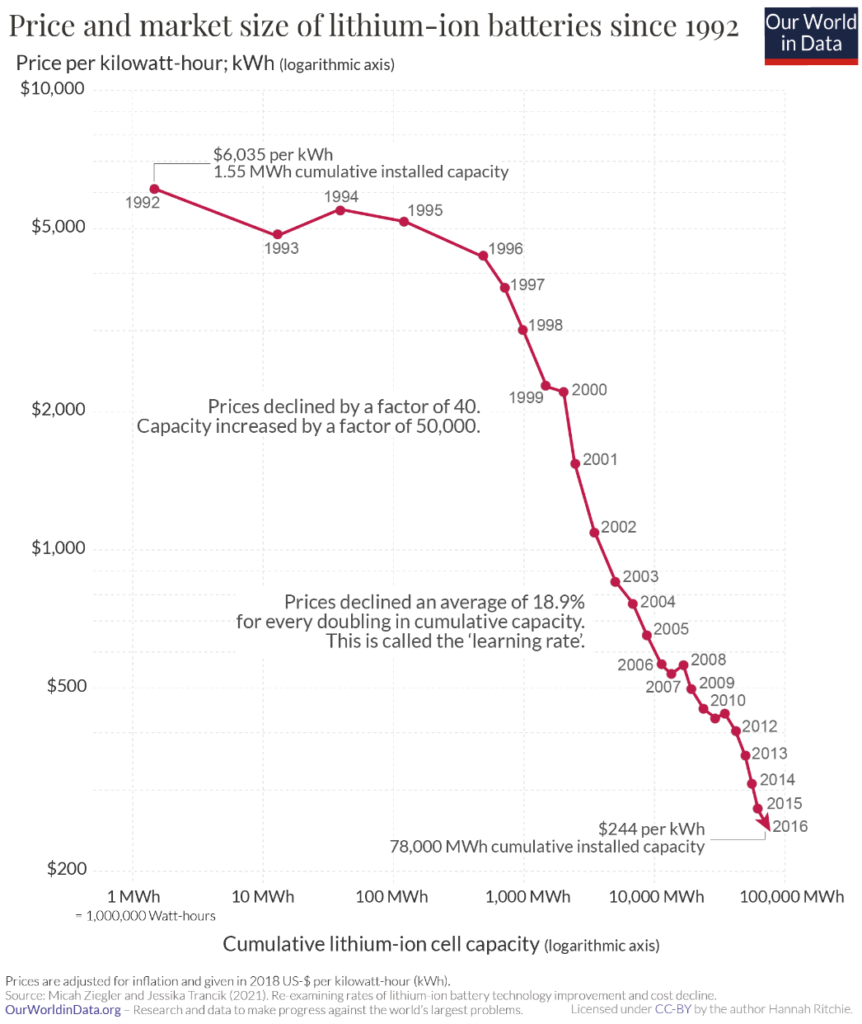

A way to analyse the future of battery tech is by contemplating what’s called a learning curve.

A learning curve is the relationship between price and cumulative installed capacity.

It is a concept often used to understand cost improvements in technologies of scale.

A technology’s learning curve can tell us how much the price of something falls for every doubling of the tech’s cumulative capacity.

Research suggests the learning curve for lithium-ion cells is 20.1%. Meaning prices fall an average of 18.9% every time the installed capacity doubles.

The lithium-ion cell learning curve tells us batteries are getting cheaper but hold more capacity.

The continuation of this trend also holds clues for the future.

While technological improvements have made EVs more affordable and democratic, the learning curve suggests there’s still a lot more the technology can achieve.

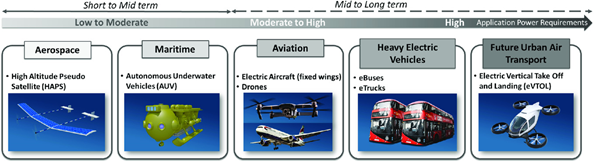

Can capacity reach a threshold for us to have electric airliners? Or electric cargo ships?

Electric vehicles are front and centre right now when it comes to discussing lithium and lithium-ion cells.

But if the global shift to green energy is permanent, applications of lithium-ion batteries will not be reserved exclusively for electric vehicles.

Substitutes and alternatives

Economists love to talk about substitutes and alternatives.

For instance, in 1980, Paul Ehrlich and Julian Simon made a famous bet on whether the prices of a bundle of natural resources would rise or fall over the ensuing decade.

Simon — who was an economist — won the bet as the real price of the bundle fell significantly.

Simon took on the bet because he thought any potential shortages of natural resources will be offset by countries and businesses developing substitutes, promoting efficient usage, discovering new supplies, or developing methods to extract greater proportions of existing sources.

A key takeaway here is that few goods are essential; much can be replaced.

Why should this concern our discussion of lithium and lithium-ion batteries?

The world’s rising battery demand can spur innovation and alternative technologies.

‘Lithium-ion is not a one-size-fits-all-solution’, as senior energy storage analyst Mitalee Gupta told Bloomberg in 2020.

Alternatives to lithium-ion using materials such as zinc, vanadium, or sodium are finding uses for many tasks, especially stationary storage used by utilities to capture renewable energy and deliver electricity to consumers hours later.

Another factor to consider for the future of battery tech is this:

According to BloombergNEF, in lithium-ion products, raw materials account for about 60% of the entire cost of the battery cell.

So when the lithium price is elevated or rising, substitute goods become more appealing to battery makers.

This can spur innovation and, like Julian Simon argued, lead to finding lithium alternatives to power battery cells.

Or to innovations that reduce a battery’s reliance on lithium, cutting the manufacturer’s costs.

The latter is already happening.

ASX-listed Lithium Australia NL [ASX:LIT] is working to establish a strategic market position for cobalt-and-nickel free lithium-ion batteries.

According to LIT, these batteries are longer-lasting and require less raw materials — including lithium.

These battery types are growing, especially after the release by BYD and Tesla of all-electric EVs powered by lithium iron phosphate batteries in 2020.

Electric vehicles and affordability: A China case study

In 2020, China — one of the largest EV markets — cut electric vehicle subsidies.

These cuts had the unintended task of incentivising local producers to shave production costs to be more competitive with ICE vehicles.

This has led to a larger than expected increase in the number of models using low-cost LFP (Lithium–iron–phosphate) batteries.

LFP battery share in China rose from 5% in calendar 2019 to 15% in calendar 2020, with even higher rates in 2021.

According to mining giant BHP Group Ltd [ASX:BHP], LFP chemistries offer ‘pedestrian performance characteristics (at best), but they have advantages in terms of lower cost, decent cycle life and thermal stability.’

However, BHP’s customer intelligence from the battery ecosystem implied that the rising LFP mix is a ‘China–specific matter in a specific customer segment: not a “back to the future” moment for the EV revolution globally.’

Time will tell.

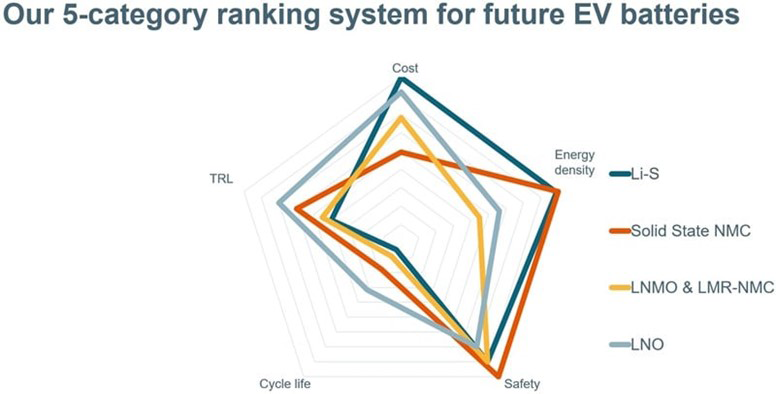

Going back to BHP, the company released some research on the EV industry in 2019. Here is an interesting excerpt:

‘In the long run, well beyond the cost competitive tipping point versus internal combustion engines, as EV penetration gains pace across all light vehicle segments, we expect that a multiplicity of chemistries will emerge. This is a logical outcome of both a concerted research effort as well as the varied demands of customers in each of these segments.’

Later in its research brief, BHP mentioned something that could come straight from Julian Simon himself. BHP argued the high demand for EVs will lead to high innovation as firms are incentivised by high profit and cash flow possibilities.

‘Outlays on R&D respond to the profit motive and available cash flow, which are both elevated in high case worlds. In low case worlds, cash flow is constrained and firms tend to “settle” for incremental innovation in existing processes and technologies, with little financing available for “moon shots”. In such a world, there is a large degree of technological lock-in, with R&D aiming predominantly at thrift.

‘In the high case, nothing is fixed, everything is up for grabs and a major disruption is entirely possible.

‘Our views on some of the early stage technologies that might break through in time are summarised visually below. Note that Li-S stands for Lithium-Sulphur; LMR-NMC stands for Lithium-Manganese Rich; LNO stands for Lithium-Nickel Oxide.’

As if on cue, Li-S Energy [ASX:LIS] listed on the ASX in September 2021, specialising in a battery chemistry BHP mentioned.

LIS raised $34 million via its IPO; money it will allocate to render possible the commercial viability of lithium-sulfur batteries.

Citing much of what we’ve discussed earlier, LIS mentioned that the current battery cost (at up to 30% of total EV cost) calls for new capacities’ commercial lithium-ion chemistries are yet to deliver.

Accelerating demand will spur a need for a broader range of battery types, using a whole range of raw materials.

Speaking with Bloomberg, Venkat Viswanathan, associate professor of mechanical engineering at Carnegie Mellon University, said that ‘eventually, basically every device you interact with will probably have a battery inside it. And once you get to that scale, you’ll need a vast variety of cells.’

The point here is that other battery chemistries will likely come into the mix.

So it would be remiss not to mention hydrogen.

Hydrogen versus lithium-ion battery EVs

Hydrogen is seen by some as the future for passenger cars.

The hydrogen fuel cell electric vehicle (FCEV), for example, runs on pressurised hydrogen from a fuelling station and emits zero carbon emissions from its exhaust.

It can be filled as quickly as a fossil fuel equivalent and offers a similar driving distance to petrol.

In 2021, Toyota introduced the second generation of Mirai — one of the world’s first HFEVs.

In May 2021, the second-generation Mirai broke the world record for distance driven with one fill of hydrogen. The journey lasted 1,003 kilometres.

There are detractors, though.

Powerhouse automaker Volkswagen released a statement deriding hydrogen’s EV future.

‘The conclusion is clear. In the case of the passenger car, everything speaks in favour of the battery and practically nothing speaks in favour of hydrogen.’

The present issue with hydrogen FCEVs for many is efficiency.

As Senior Lecturer in Chemical Engineering at Aberdeen, Tom Baxter, noted:

‘The hydrogen produced has to be compressed, chilled and transported to the hydrogen station, a process that is around 90% efficient. Once inside the vehicle, the hydrogen needs converted into electricity, which is 60% efficient. Finally the electricity used in the motor to move the vehicle is around 95% efficient. Put together, only 38% of the original electricity — 38 watts out of 100 — are used.’

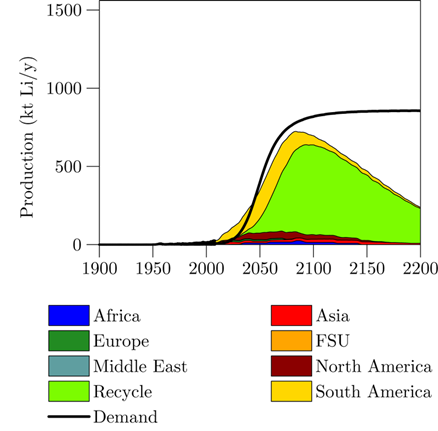

Battery recycling

A cleaner, greener world ushered by electric vehicles cannot forget recycling.

After all, recycling is at the core of environmental best practices.

‘Reduce, reuse, recycle’, as the slogan goes.

And reusing and recycling lithium will be a major part of the industry’s future.

What happens to all the EV batteries when they wear out and what happens to all the scrap material generated in their manufacturing?

Electric vehicles aren’t a simple ticket to a cleaner world. Sustainable extraction and recycling will play a large role, too.

There’s also a more pragmatic reason for battery recycling.

As the world’s locomotive fleet switches from internal combustion engines to lithium-ion batteries, battery recycling will grow in importance to assuage fears high EV adoption will cause a shortage of lithium carbonate.

As a 2014 paper found:

‘If usable materials can be recovered from used batteries, less raw material needs to be extracted from the limited supplies in the ground. If the raw materials come from abroad, recycling domestically reduces the quantities that need to be imported, improving the balance of payments. In addition, significant negative environmental impacts can occur from mining and processing ores (eg, SOx emissions from smelting of sulfide ores, such as those that yield copper, nickel, and cobalt), and these are avoided if the materials can be recycle.’

Recycling in the resource sector isn’t a new development.

For instance, the US makes most of its steel and aluminium by recycling scrap metal from manufacturers and from discarded products such as demolished buildings, old cars and thrown away cans.

But recycling lithium-ion batteries currently poses challenges.

Because Li-on batteries are expected to last the life of the electric vehicle they support, they will not be ending their useful lives in large numbers for about 10 years.

Why is this important?

As researcher Linda Gaines noted in a paper on the future of EV lithium-ion battery recycling, automotive Li-ion batteries have only been in commercial use for a short while.

Large volume EV use is still ahead of us, all the while the batteries’ long shelf life ensures there’s not nearly enough batteries reaching the end of their lives to support large-scale recycling plants.

Due to the huge lithium resources and reserves, lithium from secondary sources (recycling) currently has no significant impact on global supply.

For now, of course.

Some scenarios predict a 25% supply substitution by 2050, with the biggest potential focused on the recycling of lithium batteries.

And the above graph shows recycling will play a huge role in lithium production — not only in the coming years but in the coming decades.

ASX lithium-ion battery recycling stocks

Here are three ASX stocks involved in battery recycling at some capacity. They are EcoGraf Ltd [ASX:EGR], Lithium Australia NL [ASX:LIT], and Neometals Ltd [ASX:NMT].

Ecograf Ltd [ASX:EGR]

Ecograf seeks to become an integrated battery anode materials company supplying the battery storage and EV manufacturing market.

Ecograf is also progressing with a proprietary graphite purification technology to recycle anode material and anode production scrap.

It has also developed a process to recycle high-purity graphite from spent LIBs.

Lithium Australia NL [ASX:LIT]

Lithium Australia is developing means to extract lithium from spodumene waste and produce LIB components.

LIT is also developing a hydrometallurgical technique that recovers lithium from spent LIBs.

Its R&D runs in conjunction with Murdoch University.

Neometals Ltd [ASX:NMT]

Neometals is also developing a proprietary process to recover valuable materials from spent LIBs as well as cell production scrap.

NMT says its processing flowsheet targets the recovery of >90% of all battery materials from LIBs that might otherwise be disposed of in landfill or processed in energy-intensive pyrometallurgical recovery circuits.

In a joint venture with German company SMS Group, NMT plans to offer recycling services, catering for the European market.

Risks

Financing risks

Lithium explorers and junior developers are often expected to secure additional capital to fund their exploration and development costs.

This is especially so if feasibility studies indicate a lithium company has a viable project on its hands.

Since junior lithium stocks are largely pre-cash flow companies, they will be reliant on a mixture of equity, debt, and external capital for funding.

But there’s no guarantee junior companies will secure the funds necessary to keep the company running.

Additionally, tapping the market for fresh funds may dilute the equity stakes of existing shareholders.

There are other financial risks to consider.

Since junior lithium stocks may not start producing product for years to come, they must rely on cost projections when deciding how much cash to keep on hand to fund the project before it can begin paying for itself.

But accurate estimates of project costs will depend on the completion of feasibility studies. These feasibility studies may end up throwing up capital costs exceeding prior assumptions.

And, of course, another big risk is the lack of guarantee junior lithium explorers will end up making a positive investment decision for their project.

Exploration risks

Exploration demands high upfront capital expenditure. This means exploration risks cross over with the financing risks we outlined earlier.

A junior explorer also incurs risk if it does not accurately interpret its geochemical, geophysical, and drilling data.

Of course, as price-takers, lithium companies are also exposed to commodity price fluctuations. If a company has higher costs than its peers, a drop in the price of lithium can strain its margins.

And given the global nature of the lithium-ion industry, lithium stocks also incur currency fluctuation risks.

A rising Australian dollar may make an Australian lithium stock less attractive to international importers.

Operational risks

Once in production, a developing lithium company may incur risks like plant and equipment breakdowns as well as metallurgical, materials handling, and other technical issues.

Additionally, an unexpected jump in operating costs could reduce the company’s profitability and free cash flow negatively impact its valuation.

Lithium brine projects also have operational risks relating to control the temperature, reagent dosage, solids loading, and gas pressures at altitude.

Finally, the actual characteristics of a lithium stock’s reserves may differ significantly from its initial ore estimates or interpretations.

This can materially impact a company’s production relative to original expectations, expectations that influenced a company’s current valuation. Note: Any stocks or ETFs mentioned in this report do not constitute formal recommendations but are mentioned merely as examples for your consideration.

Concluding thoughts: lithium and the future

In 2015, world leaders at the UN Climate Change Conference in Paris reached the historic Paris Agreement. It set long-term goals guiding all nations to substantially reduce global greenhouse gas emissions.

To mark its seriousness, the Agreement is a legally binding international treaty, with 190 countries plus the European Union joining.

As we’ve discussed earlier, the energy sector contributes to 72% of the global human made greenhouse gas emissions (where transportation contributes 15%).

If nations are to uphold the Paris Accords, the energy sector will be a big focus.

And that’s why electric vehicles — and lithium — are set to play a big role in the coming decades.

But investing in this green transition won’t be straightforward, especially with lithium as the focus.

The perennial influence of the supply and demand equation on a commodity like lithium, the emerging capacity to recycle lithium-ion batteries, innovations in extracting and processing the metal, and the unique nature of individual lithium stocks all play a role in any potential investment decision.

I hope this guide helped you tease out all these complexities. If you’re looking for a deeper dive in to specific lithium stocks, why not take a look at our 5 stocks to watch in 2021 and beyond?