Is now the best time buy gold and silver?

Precious metals have been a store of value dating back to the Mayan civilisation.

Owning gold is also an emotional symbol of traditional value in Asian societies. Indians place an enormous value on gold. They consider no possession more valuable, and enjoy flaunting their collections — especially at weddings.

The bride’s family makes sure she is adorned in thousands of dollars’ worth of gold jewels, which serves as her financial security once she marries her husband. Indian brides start receiving gold as presents when they are young girls in preparation for their wedding day.

But it’s not just Indian brides that need to be thinking about precious metals. It should be at the top of your list too. Buying precious metals at some stage in 2019 or 2020 could prove to be an excellent move.

That said, you may wish to know how you can profit from buying gold and silver in the future. There are a range of options you can take.

Owning the paper version…

Some investors shy away from owning paper gold. True gold bugs will say that paper gold holds no comparison to owning the physical metal.

Both have their pros and cons.

The world is now well on its way to becoming cashless — everyone pays with their debit cards or phones. They don’t see the need to hold cash anymore. They prefer to shop online.

Governments even want to move to an all-digital system so that they can avoid bank runs. In this case, if the banking system seems likely to crash, how will you get your money out in a cashless society?

There are other perks for governments as well. In a cashless society, there will be no underground world. This means your average tradie will no longer be able to do a ‘cash job’. And the governments will be able to claim more tax. This new world will be here within the next decade.

In my view, just like owning physical gold in the 19th and 20th centuries, owning paper gold will be sufficient to protect your wealth in the 21st century. How will governments be able to steal your shares? (See below for more information).

The pros of owning paper gold — Exchange Traded Funds (ETFs) and shares — is that they are easier to liquidate and cheaper to own. This means that if you don’t want to own it anymore, you can sell it straight onto the market. The cons are that you won’t get to look at, feel, smell, or touch it.

If you want pure exposure to the gold price, precious metal ETFs are the cheapest and most convenient way to buy and sell gold and silver. With ETFs, you aren’t exposed to company specific risks such as capital raisings or institutional investors dumping stock.

[openx slug=postx]

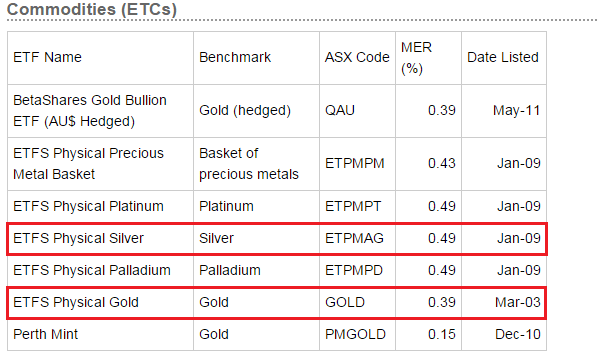

In the following table, I’ll show you a range of precious metal ETFs that are available on the ASX. The ETFs in the red box are the most popular, and are denominated in Australian dollars. This means that the US price is adjusted for the AUD/USD exchange rate.

Source: mymoneycalculator.com.au

Buying precious metal shares is another option. However, the ultimate way to own gold and silver is by buying the shiny physical stuff in the form of gold and silver bullion, or gold and silver coins.

Owning physical precious metals — what to buy…

The argument is that if there’s a collapse in the financial system in the future, owning physical gold and silver is the only option to protect your wealth. This isn’t necessarily true. Gold stocks outperformed in the market during the Great Depression.

However, a collapse in the financial system will still see you owning physical gold and silver. And owning the physical stuff means that you aren’t exposed to stock market panics or companies going bankrupt. This is a real avenue to protect and store your wealth outside of the electronic world.

Buying and selling gold bullion is more expensive than investing in an ETF or shares. Dealers charge a premium. You’ve then got the cost of delivery, storage and insurance. And when you sell, your dealer will take a cut.

On top of that, buying bullion isn’t ‘risk free’. The risk is that government will confiscate your gold and silver.

Franklin D Roosevelt (FDR) said on the radio that he wouldn’t confiscate gold before being elected. He said this the night before being elected President of the United Stated of America in 1932. On 5 April 1933, FDR confiscated every gold coin, bar and certificate, and people had to turn in their gold to the federal government.

It’s a risk that governments could do the same thing again in the future. History always has a way of repeating itself.

If history repeats, if you were to buy physical gold, I recommend that you buy fractional gold coins rather than gold bullion. This is because, if governments do confiscate physical gold, you can say that you own a coin collection.

As Peter Schiff notes:

‘Gold American Eagle and Canadian Maple Leaf coins are also produced in sizes less than one full ounce. These are called “fractionals.” They come in sizes of 1/2-ounce, 1/4-ounce, and 1/10th of an ounce. Their appearance is exactly the same as the full 1-ounce size.

‘Many people like fractionals since their value is significantly less than the 1-ounce coin and could be useful in barter transactions. Fractional gold coins also allow for greater flexibility in managing your portfolio, because you do not have to sell full ounces at a time.’

You may also choose to buy rare gold coins. Some rare collectables may have ‘added value’ in the eye of the beholder. The same can be said of antique gold and silver coins. This is a specialised market, and is best to avoid unless you really know your stuff.

Owning silver bullion, on the other hand, is safer than gold. This is because silver has been used for industrial purposes for years. Gold is far too expensive to use in the industrial process.

For this reason, whether you own silver bars or coins is irrelevant. I see little risk of confiscation by government in the future. You didn’t see government confiscating silver in the early 1930s.

Owning the shiny physical stuff — how and where to buy gold and silver…

Just remember that with precious metals, the ounces are ‘troy ounces’, which are equal to 31.1 grams. Australia has quite a few bullion dealers, and I’ve listed the main ones in this table below. Click on the name to visit the website.

Australian bullion dealers

| Bullion dealer | City | |

| Perth Mint | Perth | |

| Ainslie Bullion | Brisbane | |

| Guardian Gold | Melbourne | |

| Australian Bullion Company | Melbourne | |

| Gold Bullion Australia | Melbourne, Sydney, Brisbane Gold Coast |

Take the time to shop around for the lowest premiums and commissions. It’s quite surprising what differences there can be between the respective dealers. And make sure you’re comparing prices to the Australian gold or silver price.

You can head to the bullion office directly to buy gold and silver. But if you don’t have one located near you, you can place an order over the phone or even online. Delivery is easy to arrange, but ask questions about the method used and whether it is insured.

And then you’ve got eBay.

Bizarrely, eBay has quite an active silver market. I’ve bought and sold successfully this way quite a few times before. Selling is particularly good, as you’re the one charging the commission for once!

Using eBay to buy gold and silver is riskier than going through a registered dealer.

So it’s essential to get the metal tested. This is as easy as going to a business that buys scrap gold and silver, and asking them nicely to scan it for you. When you find a good seller, stick with them. It’s also a smart move to get the seller to insure it and send it recorded delivery. Make sure you’re familiar with eBay if you want to go down this route.

The other interesting way to cut out the cost of the middlemen is through SilverStackers, a precious metals forum. This puts you directly in touch with other buyers and sellers, as well as providing plenty of market commentary.

Where do you keep your precious metals?

Now you’re faced with the problem of storing it. A shoebox under the bed? Your home safe? A bank deposit box? Store it with the dealer you bought it from?

I personally avoid holding it at a bank. That means if a bank collapses in the future, you’ll still own your precious metals. But if you do want to store your gold and silver, I’d buy a vault and lock it somewhere safe at home — albeit, the risk here is being robbed.

A home safe can be installed for about $500 from a local security company. But you should only store small amounts this way. If you do keep it at home, you’ll need to avoid telling everyone down at the pub about your stash…

Most bullion dealers have storage facilities. When you buy bullion from a dealer, you can ask about the storage options available.

Depending on how much gold and silver you buy, it quickly becomes cheaper to store it at the dealer, or rent a safety deposit box for a few hundred bucks each year…

Safety deposit boxes are a great option. They provide security and easy access.

Banks offer safety deposit boxes, but then we are back to square one with the risk of having a bank as the counterparty.

If you want to remove counterparty risk, you can store it with a company that has nothing to do with the banking system. These are in short supply. One company called Guardian Vaults does this. They’re only in Melbourne for now, but they have clients nationwide.

I hope this all helps to put some new options forward in helping you buy and sell gold and silver — and that it helps you profit from it too.

Enjoy that bullion!