Though pleasing to the eye and beautiful as jewellery, gold is often dismissed by critics as a bad investment or no investment at all.

After all, you can’t project gold’s earnings and it offers no yield. So why does gold still retain importance for many investors today?

Many people invest in gold to protect themselves against economic downturns.

Gold has been used for centuries as a safe haven asset and as a store of value due to its scarcity.

Investing in gold can be one way to prepare for future financial uncertainties, but it’s important to understand the risks involved.

This guide will answer some frequently asked questions about gold investment in Australia so you can make an informed decision about whether this type of investment is right for you.

Jump to Section:

- A Brief History of Gold

- Can gold beat inflation?

- Is investing in gold safe?

- How can I start investing in gold?

- Investing in gold mining stocks

- Is gold investment taxable?

- Can gold jewellery be an investment?

- Where can I buy gold for investment?

- What are the differences between a gold investment and a silver investment?

- Where does the demand for gold come from?

- What determines gold prices?

- Final thoughts

A Brief History of Gold

To understand the history of gold means understanding the history of money. And in understanding the history of money, it’s useful to contemplate barter.

Barter is cumbersome.

Imagine Australia descended into a money-less society, and you were a baker seeking meat.

How would you obtain it? You’d try visiting your local butcher.

But what if your local butcher already got his bread from someone else? As you can imagine, such a world presents difficulties and transactional frictions.

Under a bartering system, transactions are contingent on both parties possessing the desired goods in the desired quantities.

In more technical parlance, an economy that relies on barter is said to require the double coincidence of wants — the unlikely occurrence that two people each have a good or service that the other wants.

So, what happens when money replaces barter? I’ll let Adam Smith explain from his book The Wealth of Nations:

‘But when barter ceases, and money has become the common instrument of commerce, every particular commodity is more frequently exchanged for money than for any other commodity.

‘The butcher seldom carries his beef or his mutton to the baker, or the brewer, in order to exchange them for bread or for beer; but he carries them to the market, where he exchanges them for money, and afterwards exchanges that money for bread and for beer.

‘The quantity of money which he gets for them regulates, too, the quantity of bread and beer which he can afterwards purchase.’

But what did people use as money?

In some form or other, we’ve used money for thousands of years. For most of those years, we used commodity money.

Commodity money is intrinsically useful and would still be valued even if it did not serve as money, in contrast to fiat money.

And here we finally make our way to gold. Gold was the most common commodity money.

It has been mined for more than 6,000 years, and gold jewellery also adorned the necks and fingers of royalty for centuries.

But as Jim Rickards wrote in The New Case for Gold:

‘Our investors did not use gold just because it was shiny or beautiful as modern critics suggest.

‘Gold in the only element that has all the requisite physical characteristics — scarcity, malleability, inertness, durability, and uniformity — to serve as a reliable and practical physical store of value.

And unlike silver, gold doesn’t tarnish. That’s why so many societies placed value on gold.

Incidentally, Jim Rickards runs a financial newsletter available at Fat Tail Investment Research called Jim Rickards’ Strategic Intelligence.

The aim of Strategic Intelligence is for Jim — along with Editor Nick Hubble — to help investors connect the dots between geopolitical and financial events to pre-empt crises and position early for investment opportunities.

For centuries, gold acted as commodity money.

However, by the time Adam Smith published The Wealth of Nations in 1776, many countries, including his native Scotland, were using gold as part of a commodity-backed money system.

Commodity-backed money utilised paper notes rather than gold coins. But unlike the dollar bills we use today, commodity-backed notes were issued with a promise to exchange the notes for gold on demand.

Hence the name: your paper notes were backed by a guarantee the notes can be converted into a valuable good like gold.

Gold was such a popular form of money that during the late 19th and early 20th centuries, most of the world’s major economies operated under the gold standard.

Under the gold standard, each participating country maintained a reserve of gold, agreeing to exchange one unit of its currency for a specified amount of gold.

This meant that under a gold standard, the world’s economies were operating a fixed exchange rate system.

In 1816, Great Britain officially tied the pound to a specific quantity of gold.

In 1873, the US dropped the silver from its ‘bimetallic’ silver-gold standard and went on an unofficial gold standard.

In 1900, the Gold Standard Act placed the US officially on the gold standard, fixing its exchange rate to the value of gold.

Famously, of course, the gold standard lasted until US President Richard Nixon struck the US dollar from the gold standard in 1971.

In recent years, gold has seen a resurgence in popularity as an investment asset class due to financial uncertainty and inflationary pressures around the world.

When factoring in gold jewellery, the precious metal’s market worth is about US$8 trillion.

Can gold beat inflation?

Probably one of the most widely held beliefs about gold is that it is an inflation hedge. The other is that gold is a long-term hedge against a depreciating dollar and/or stock market risk.

Gold does have a history of being able to maintain its value in tough economic conditions.

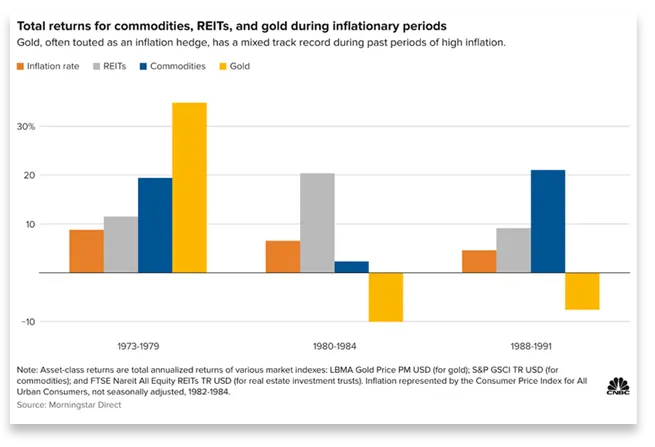

For instance, as the chart below shows, during the inflationary period of 1973–79, gold outperformed commodities, real estate investment trusts (REITs), and beat inflation.

But that’s not to say that gold always beats inflation.

If we refer to the chart again, we can see that gold underperformed other asset classes during the inflationary periods of 1980–84 and 1988–91.

As Bloomberg’s John Authers noted in April 2021:

‘Although the metal is regarded as an inflation hedge, it isn’t as simple as that.

‘It is more sensitive to interest rates. When rates rise, because of fears of long-term inflation, gold can be expected to fall.

‘Hence, the price has taken a horrible tumble even as markets brace for inflation.’

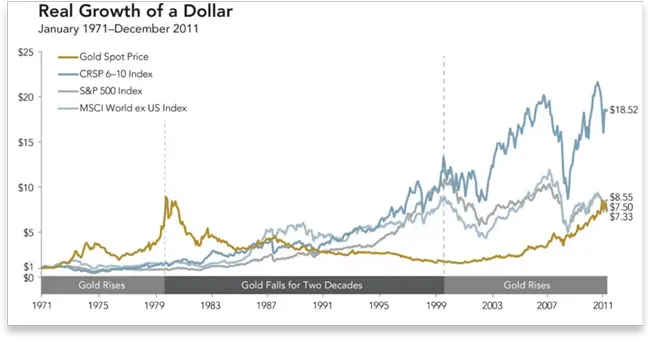

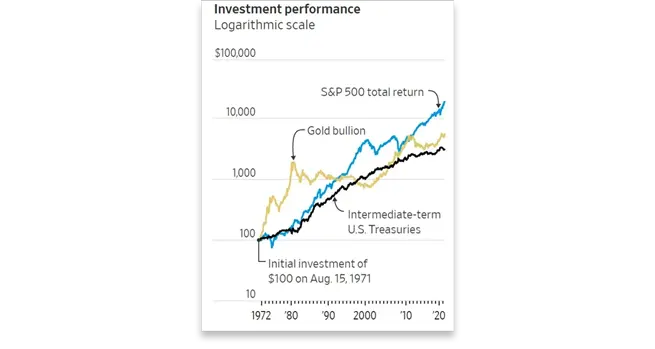

The chart below shows the real growth (inflation adjusted) of a dollar invested in gold and equities between 1971 and 2011.

In that period, gold provided lower inflation-adjusted growth than other assets.

Another — novel — way to contemplate the inflation-hedge capacity of gold was performed by Duke University Professor Campbell Harvey and research partner Claude Erb.

The pair aimed to measure gold’s return in the very long run by comparing what the Roman Emperor Augustus paid his soldiers, measured in units of gold, to what the US pays its military today.

What did they find?

‘In the era of Emperor Augustus (reigned from 27 B.C. to 14 A.D.), a Roman legionary was paid about 2.31 ounces of gold a year (225 denarii) and a centurion was paid about 38.58 ounces of gold a year (3,750 denarii).

‘Converted to U.S. dollars, the pay of a Roman legionary was about 20% that of a modern day private in the U.S. Army and the pay of a centurion was about 30% greater than the pay of a captain in the U.S. Army.’

Of course, military pay is a narrow measure.

But Harvey and Erb gleaned two insights.

One, there are some incomes denominated in gold that might be a very long-term hedge to preserve real purchasing power.

More broadly, the researchers concluded that while gold ‘may very well be a long-run inflation hedge’, this long run ‘may be longer than an investor’s investment time horizon or life span.’

However, gold can be a hedge against other risks like geopolitical events and global turmoil, not necessarily inflation.

It is also interesting to see the relationship between the gold price and perceived stock market risk.

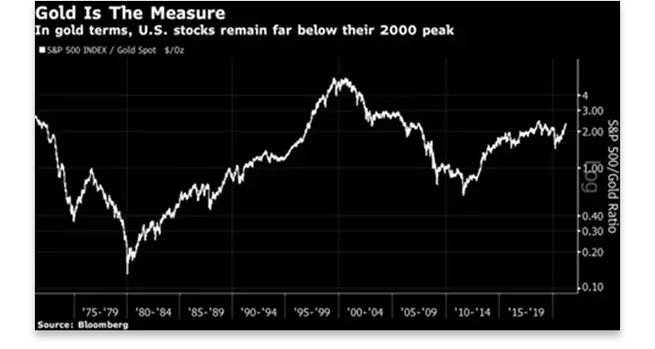

Consider this chart:

The chart represents the S&P 500 in gold terms (the ratio of the S&P 500 to the gold price) and its performance over 50 years.

As you can see, a bear market in the 1970s — amid oil shocks and stagflation — saw the S&P 500 fall relative to the price of gold only to be followed by a two-decade-long bull market that crashed again as investors ditched stocks amid the dotcom bubble fallout.

Is investing in gold safe?

As we’ve just seen, gold can protect against inflation and economic downturns — although we should note this is not guaranteed.

This raises the questions: Is investing in gold safe? Is gold a good investment?

As always, no investment asset is without risk. An investment can be safe in one context but fraught with danger in another.

So, we should always keep the risk of drawdowns in mind.

That said, let’s assess the safety of gold as an investment.

One thing to note is that gold may fluctuate more than what is expected of ‘safe’ investments.

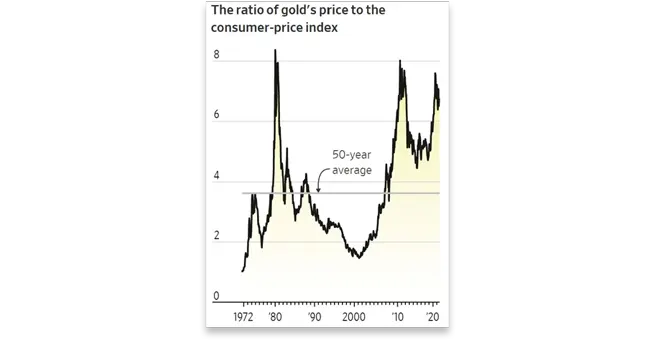

Since the early 1970s, the ratio of gold’s price to the consumer price index (CPI) ranged from as low as 1.47 to as high as 8.68, according to research by Duke University Professor Campbell Harvey, and Claude Erb — former commodities portfolio manager at TCW Group.

Harkening back to our inflation discussion, Harvey and Erb found that over very long time frames, gold does appear to have maintained its inflation-adjusted purchasing power.

However, this wasn’t the case over shorter time frames, even when these periods were a few decades in length.

Having briefly touched on gold’s volatility, can we say gold is a good investment?

Economists often talk about opportunity costs, referring to the principle that the true cost of something is the next best alternative we must give up to get it.

In other words, the opportunity cost of a purchase — or an investment — is the purchase or investment we did not make.

Much of investing is comparative. How does the rate of return compare to the risk-free rate? What is the stock’s discount rate relative to its peers? How does a company’s P/E ratio stack up against its industry, and its rivals?

So, when we assess asset classes, it can be useful to compare their performance against each other.

As the above chart shows, gold bullion’s performance over the past 50 years to 2020 was weaker than stocks (as measured by the returns of the S&P 500).

Research cited by the Wall Street Journal found that over 40 years to 2021, gold rose at a 3.6% annualised rate, compared with 12.2% for the S&P 500 and 8.2% for the Treasuries.

What can we make of this?

On the face of it, we may conclude the opportunity cost of gold is too high. But there’s more nuance to this.

The weaker return of gold does not rule out a role for the metal in a diversified portfolio.

Why?

Because gold’s correlation with other asset classes has often been low or even negative, meaning gold’s presence in a portfolio could smooth out returns and decrease volatility.

Back to the research from Wall Street Journal, it found that over the past 50 years to 2021, a stock-and-bond portfolio ‘could have improved its risk-adjusted performance by adding a small allocation to gold—around 5% or so.’

As a fun fact, some have taken the diversification capabilities of gold quite seriously.

In 2012, the US Federal Reserve reported that Richard Fisher, then president of the Federal Reserve Bank of Dallas, had more than US$1 million of gold in his portfolio.

So, allocating a percentage of your assets to gold can help you diversify your portfolio and prepare for various future financial uncertainties.

How can I start investing in gold?

Today, there are many ways you can invest in gold.

Generally, gold can be purchased as gold bullion, gold bars, gold coins, or gold ETFs.

Gold is also available in three different types of accounts: physical gold accounts, gold mutual funds, and gold stocks.

So before you start investing, you need to decide what type of gold you’re after — whether that be physical holdings of gold or paper gold.

One way to invest in gold is by buying physical gold. Physical gold can come in many different shapes and forms like coins, bars, or jewellery.

There are several advantages to owning physical gold.

The main one is that you are investing in something tangible. Also, physical gold is easy to buy, sell or transfer.

There are some disadvantages, though.

It doesn’t have a yield, and it costs money to store physical gold. And, of course, the dollar price of gold can fall.

Another way to make a gold investment is what is often referred to as ‘paper gold’.

This is an asset that derives value from the underlying physical gold. Paper gold investments can include gold exchange traded funds (ETFs) and gold mining stocks.

There are some advantages to paper gold.

For one, paper gold markets are very liquid. Two, you don’t need to transport and carry your paper gold to a gold dealer to sell it. And, of course, you’re not required to pay storage fees or insurance.

One disadvantage is that you don’t own tangible gold, which leaves you exposed to counterparty risk.

Another is higher volatility.

Gold mining stocks can move more than the prevailing market price for gold. This can amplify gains…and losses.

We can conceptualise gold mining stocks as leveraged plays on the gold price.

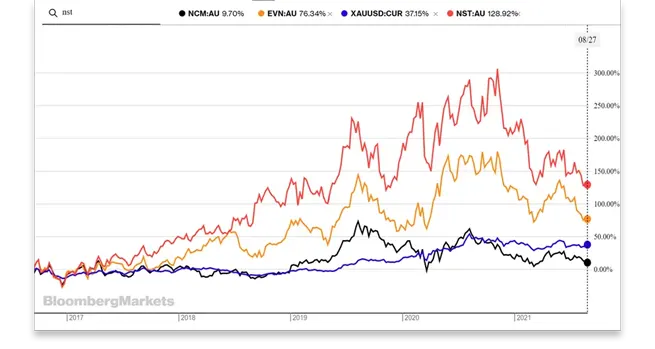

Consider the chart below.

It shows the gold spot price in US dollars (blue line), compared to the share prices of gold mining stocks Newcrest Mining Ltd [ASX:NCM] (black line), Evolution Mining Ltd [ASX:EVN] (orange line), and Northern Star Resources Ltd [ASX:NST].

As you can see, the three gold stocks experienced more volatility than the underlying price of gold:

Now, if you have a conservative approach to diversification, you could allocate a small portion of your net wealth to gold.

If you’re more aggressive in your diversification — believing in the long-term value of gold — you may want to consider a larger allocation to gold.

But that’s not to say paper gold doesn’t have a place in your portfolio.

As we’ve said, exchange traded funds (ETFs) with 100% exposure to gold price movements can be a useful tool to trade the gold price.

There are many ETFs listed in Australia now. The following is a list of ETFs backed by 100% physical gold holdings:

- ETFS Physical Gold [ASX:GOLD]

- BetaShares Gold Bullion ETF — Currency Hedge [ASX:QAU]

- ANZ GOLD ETF [ASX:ZGOL]

Note, however, that since gold can be freely traded on the market these days, its price can fluctuate…like any other asset.

There are occasions, for example, where the gold price moved US$100 per ounce in a day. An example of this was when Donald Trump was elected as US president on 8 November 2016.

As we covered earlier, this just highlights how the gold price can react to geopolitical events, creating price swings that can open up short-term investing opportunities.

Investing in gold mining stocks

While gold can be represented as physical bullion or its paper derivatives, the precious metal is also represented in the stock market in the form of gold mining stocks.

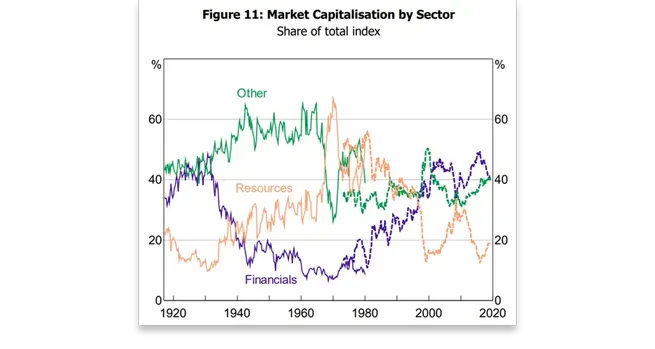

Gold mining stocks are part of Australia’s significant resources sector. A sector that was frequently the largest sector by market capitalisation on the ASX, as the below graph from the Reserve Bank of Australia shows.

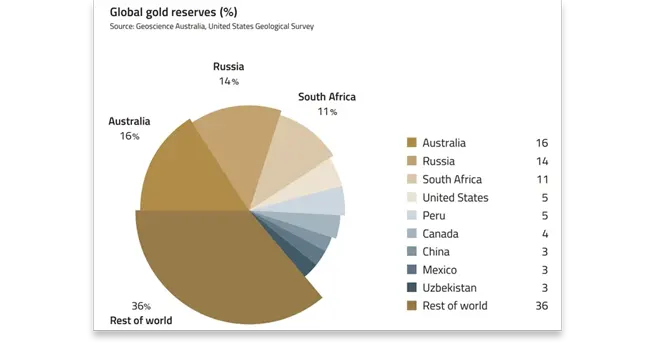

In fact, Australia has roughly 16% of globally known gold resources, the largest share in the world.

Australia is also the second largest gold producer in the world after China.

So, clearly, if you were thinking of investing in gold stocks, the Australian Stock Exchange would be a great place to start.

But, first, some caveats.

As mentioned earlier, gold mining stocks follow gold to a great extent — but they are also more volatile.

Traditionally, gold stocks are described as leveraged bets on the physical metal.

What does this mean?

Essentially, when gold rises, mining stocks can rise higher. But conversely, if gold drops, mining stocks can fall faster than the underlying metal.

What we should also consider is that gold mining stocks are idiosyncratic.

They are not uniform like futures or indices.

Instead, each gold stock is an individual business with unique characteristics like ore quality, management, financing, cost efficiencies, etc.

So, what you shouldn’t do is invest as if all gold stocks are alike. They are not.

Some are well-run and established. Others are shambolic and inexperienced.

As an investor, you’ll have to sort the credible gold miners from the duds. And that takes work.

For one, since any company goes through growth and expansion cycles when it takes on more debt and has a lower cash on hand balance, it’s imperative to analyse its long-term figures rather than a shorter financial picture time frame.

You might also spend time researching a stock’s board and management, and maybe even scout the stock’s mines.

This can quickly add up to a lot of work.

Here at Fat Tail Investment Research, we have a gold guru who spends his time diligently researching ASX gold stocks and the broader gold market.

His name is Brian Chu.

Brian started out teaching actuarial studies, statistics, finance, accounting, economics, and risk management.

Since early 2017, Brian has been steadily building his own database containing the operational, financial, and metallurgic information of various ASX-listed gold mining companies.

After that, Brian established his own fund, The Australian Gold Fund, possibly the only 100% gold equity fund in Australia today.

He now runs two advisories here at Fat Tail Investment Research — Gold Stock Pro and Strategic Intelligence Australia.

Is gold investment taxable?

Gold investing may have taxation implications and you should consult a taxation specialist for advice regarding your circumstances.

Can gold jewellery be an investment?

It may sound superficial mentioning gold jewellery but, in fact, gold jewellery is serious business.

If we are to talk about gold in detail, we would be remiss not to mention the role jewellery plays in the gold market and gold demand.

The Mineral Council of Australia (MCA) estimated that about half of all gold in above-ground reserves exists in the form of jewellery.

The modern aspiration to possess gold as jewellery transcends national boundaries.

As MCA notes, the rising economic power and emerging consumer class of East Asia is a long-term driving force for gold demand, with China and India the largest markets for gold jewellery.

For context, annual 2016 gold demand was 2,415 tonnes (57%) for jewellery, 1,467 tonnes (35%) for investment, and 331 tonnes (8%) for technology.

There are many gold jewellery pieces that can be considered an investment purchase, but it is not always wise to buy gold jewellery just because you think gold prices will rise.

As we’ve discussed, there’s always the risk prices won’t.

For instance, the World Gold Council reported that 2020 marked a record low for gold jewellery demand, unable to overcome the persistent challenges presented by the pandemic.

Another thing to consider with gold jewellery is purity.

One way the insiders measure gold purity is by referencing carats.

Carat is a measure of gold purity or fineness and is not to be confused with ‘carat’, the unit of weight applied to diamonds.

The word ‘carat’ derives its meaning from carob seeds, which gold merchants used to balance scales in ancient Asian bazaars.

As a reference, it was decided then that a pure gold coin should weigh the same as 24 carob seeds. And this is how ‘24 carat’ became the measure for gold purity today.

But since pure gold is very soft and ductile, societies have had to use metal alloys like copper or silver to make jewellery.

So, if you hear that a gold ring is 18 carats, it means it is 18 parts gold and six parts another metal. If a gold piece is 12 carat gold, then it is 12 parts gold and 12 parts another metal.

You get the idea.

So if you’re considering a gold jewellery item, endeavour to determine its purity.

Most homeowner insurance policies will cover jewellery, but it might be wise to supplement your coverage with another policy if need be.

Where can I buy gold for investment?

How would you go about acquiring physical gold for yourself?

Well, today gold investors have plenty of choice. There are many dealers spread across Australia.

I will list some here:

- ABC Bullion — Sydney

- KJC Bullion — Sydney

- Gold Stackers Australia — Melbourne

- Australian Bullion Company — Melbourne

- Gold de Royale — Brisbane

- Ainslie Bullion — Brisbane

- As Good As Gold — Adelaide

- Perth Mint — Perth

Of course, we are not affiliated with these dealers. I’ve just listed some of the largest bullion dealers in Australia to get your search started.

The best way to get started is to visit your local bullion dealer, either in person or through their website.

You don’t have to buy from a bullion dealer in your state. Most of them will ship to any address, as long as you can sign for the delivery in person.

What are the differences between a gold investment and a silver investment?

Silver is often dubbed gold’s poor cousin.

But just as gold’s dollar price can fluctuate, so, too, can silver’s. And that can lead to periods where silver outperforms gold or periods where gold outperforms silver.

Absolutes rarely exist in investing, and we should avoid blanket thinking and declare an investment class better than another no matter what and in all circumstances.

To illustrate my point, consider this.

The Wall Street Journal reported that from 2001–11, gold rose 636% while silver rallied 904% over the same period.

And in another bull market for gold from 1993–96, gold rose 28% while silver gained 63%.

So, silver shouldn’t be regarded as gold’s poor cousin, living in gold’s shadow. As we’ve seen, it can outperform gold.

Silver also has more industrial uses than gold.

Silver is an important component for batteries, electronics, solar panels, water filtration, aeronautics, X-ray film, dentistry, and other medical instruments.

Growth in demand for these things can boost demand for silver. However, this means silver is more linked to the business cycle than gold.

Where does the demand for gold come from?

Gold’s unique characteristics mean it is in demand for a variety of reasons.

For instance, chemically inert, gold’s non-reactivity makes it safe for use in the human body, especially in breakthroughs in nanotechnology in medicine.

Gold is also one of the most malleable metals. It can be beaten into thin sheets and used as a shield against heat and light.

For example, gold-coated visors help protect astronauts’ eyes from sun rays in space. Gold is also used on various spacecraft surfaces.

Gold is also a ductile and conductive metal, meaning it can transfer heat and electricity, making it the metal of choice for high-end electronics.

And, of course, gold is nice to look at.

Gold jewellery represents the largest source of annual demand for gold.

While the demand has declined over recent decades as more uses are found for gold, jewellery still accounts for about 50% of total demand.

Gold is also in demand from sophisticated and retail investors as well as central banks.

Especially since the 2008 financial crisis, emerging market central banks have increased their gold purchases and European banks stopped selling.

Other investors in gold include ETFs that purchase gold on behalf of others.

What determines gold prices?

Whether gold goes up or down depends on multiple factors.

Factors like the decisions of central banks on interest rates, inflation and the market’s expectations of future inflation, exchange rates, and the basic supply and demand of the metal itself.

For instance, gold mining is becoming more difficult with time, and that could play a role in rising long-term gold prices.

Of course, the gold price is also highly influenced by futures contracts for gold.

Market convention has it that the price of gold, like other commodities, is partly based on the prices of the futures contracts maturing the earliest.

This is an important point.

It’s handy to understand the distinction between the physical gold market and the paper gold market.

The latter consists of many contracts: COMEX futures, ETFs, gold swaps, gold leasing, forward contracts, and even unallocated gold issued by the likes of London Bullion Market Association banks.

Basically, all kinds of derivatives form the paper gold market.

So what?

Well, by the nature of a derivative, the paper gold market could easily be one hundred times the size of the physical gold market.

A handy way of thinking about this is — for every 100 people who think they own gold, 99 are mistaken. Only one of the 100 will end up getting delivery of the physical gold.

Another way to think of gold price is to realise that ‘gold is going up’ or ‘gold is going down’ is only one frame of reference.

As Jim Rickards pointed out in his book The New Case for Gold, we can instead think of gold as a constant unit of measurement.

Economists and mathematicians call this a Numeraire or counting device.

A Numeraire is a good that plays the role of money by expressing the prices of other goods in quantities of the good itself.

Gold has many attributes of a Numeraire.

And in fact, in times of the gold exchange standard, prices were expressed in quantities of gold.

On this understanding — of gold as Numeraire — it is the currencies that are fluctuating, not the gold.

What can this mean for gold prices? As Rickards explains:

‘If you think the dollar is going to get stronger, you might not want so much gold. If you think the dollar is going to get weaker, which I expect over time, then you certainly want gold in a portfolio.’

All up, the price of gold has several determinants.

Today, gold demand, the amount of gold held in central bank reserves, the value of and the expectations on the US dollar, and the desire to hold gold as a hedge against inflation and currency devaluation all contribute to pricing gold.

Final thoughts | The potential pros of investing in gold

- Disaster insurance —The idea behind investing in gold is that even during the worst of economic times, you will always have a valuable asset.

- Diversification — Rather than putting all your eggs in one investment, many put their investments into several products, such as stocks, bonds, and gold. If the markets plummet and your other investments suffer value loss, gold is expected to retain or increase its worth.

- Inflation and currency debasement insurance —One reason people buy gold is to protect themselves from inflation. They believe that if the Australian dollar gets significantly devalued, gold will retain and even increase its value.

- Tangibility —Some people have reservations about buying assets that they can’t touch, like cryptocurrency or shares. They prefer tangible investments like gold, which they feel will always retain its value, no matter what happens in the future.

The potential cons of investing in gold

- Volatility —Historically, gold prices have been volatile. As the Wall Street Journal noted, since gold began to trade freely in the early 1970s, gold’s yearly returns in inflation-adjusted terms have ‘fluctuated just as wildly as they have in nominal terms.’ Hence, if you’re taking a short-term investment view on gold, this may incur more risk as you’ll be dealing with more volatility.

- No yield —Investing in gold will not provide you with any income or yield, unlike a stock that may pay you dividends. If you bought 10 ounces of gold in 2010, 10 years later, you’ll still just have those 10 ounces of gold. For example, to profit, the dollar value of gold in 2020 must be higher than the dollar value of gold in 2010, when you first bought the ounces.

- Can be difficult to transact —Buying gold can be profitable, but you need to know what you’re doing. There are many legitimate sellers out there who will take advantage of unsuspecting buyers by charging high prices for low purity gold.

- Opportunity cost —While gold can effectively diversify your portfolio, the dollar appreciation of gold may not always outpace returns from other asset classes like stocks and property. Investors should be aware of the alternative destinations of their investment capital when considering purchasing gold.

So, what can we conclude?

Parking the academic debates on gold’s inflation hedging ability, we should first acknowledge that a crucial element of an investment portfolio is diversification.

And there’s little dispute that here is where gold really shines.

Why? Because the price of gold is largely uncorrelated with stocks and bonds.

As prominent economist Greg Mankiw noted, ‘despite gold’s volatility, adding a little to a standard portfolio can reduce its overall risk.’

And in today’s world, with multiple gold bullion exchange-traded funds now available, investing in gold is easy and low cost.

As always, though, remember the risks.

Gold is volatile, especially the paper market.

And, at the end of the day, investing in gold entails a bet as to the future real price of the yellow metal, whether or not we even think about the bet.

So, keep your head, conduct your due diligence, and happy investing!