First off, what is a REIT? (Said like ‘Reet’)

REITs can be best described as companies that hold property portfolios that are pooled with other shareholders looking to invest in real estate without the hassle of buying whole properties, sorting loans and managing mortgages.

It’s a system where you, as an investor, would get someone else to do all the managing for you, much like your regular managed funds used for everyday investments.

The R-E-I-T acronym stands for , which is basically a firm that invests in and manages real estate or other income-generating assets for its shareholders.

In Australia, these are known as A-REITs. These are functionally the same but need a different name to differentiate them from their US counterparts.

REITs allow people to invest in large-scale, income-generating real estate, which they may not otherwise be able to do on their own.

This is because some investments aren’t easily accessed by individuals, but rather through qualified corporations or groups.

We’ll get more into that later.

Key Points of a REIT

REITs are known to focus on a narrow property market niche or diversify their holdings. In fact, they can be divided into two broad categories:

- Those that invest primarily in commercial properties like offices, hospitals, retail centres, warehouses, and hotels or;

- Those that invest primarily in residential properties like retirement communities and apartment complexes.

You can invest in REITs in various ways, including buying publicly listed REIT equities, mutual funds, or exchange-traded funds.

Their flexibility and range are only growing — many real estate investment trusts are gaining prominence in defined benefit and contribution pension and retirement savings plans.

REITs can play a significant role when arranging a stock or bond portfolio. They can increase your portfolio’s diversity, boost your potential return, and/or reduce risk all at the same time.

In a nutshell, they are a great diversifier to have on hand because of their potential for both capital gain and their reputation for generous dividend payments.

REITs make an attractive option for investors because of their stable cash flow, regular dividend payouts, and potential for capital appreciation.

Don’t forget to consult an expert

But as great as all this sounds, at the end of the day, ASX-listed Australian REITs (A-REITs) are like any other type of investment. They’re not without their share of potential downsides.

There are risks to any investment, which includes REITs. They could stop paying a dividend at any moment, their capital growth may stop, so, before making any financial commitments, you should get the opinion of a qualified advisor you trust.

In this article, we will cover some of the potential risks you might face as a REIT investor, without going into too much detail or making personalised suggestions.

If you’re looking for some knowledge on a regular basis don’t forget to subscribe to where we cover the markets and events that affect housing and commercial property.

Main types of REITs

Now that you have some idea of what REITS are all about — let’s talk about some of the different types that are out there.

There are four main types of REITs, and we have listed them below:

Equity REITs

Equity REITs function something like landlords do, taking care of maintenance and other management duties on your behalf. They have complete control over the property and use the rent money to pay for maintenance and new improvements.

Mortgage REITs

In contrast to their equity counterparts, mortgage REITs do not have ownership of the underlying property. Often known as mREITs, these types of property funds have debt securities secured by the property instead. Mortgage REITs are much riskier than equity REITs but often have bigger dividend payouts.

Hybrid REITs

REITs that combine equity and mortgage are called hybrids. These companies have a portfolio including commercial property mortgages and real estate holdings. Reviewing the REIT’s prospectus can help you better grasp the company’s principal goals. Of course, this is the same principal used whichever company you decide to invest in, and in any industry.

Specialty REITs

These REITs focus on investing in niches property sectors such as data centres, healthcare facilities, or timberland. These portfolio’s give investors a very targeted exposure to one kind of real estate and a particular market segment. While these can offer attractive returns its important to research the specific sector’s prospects before investing.

Investing in REITs

There are a couple of options for you to consider. Investors can either invest in real estate by purchasing shares in a mutual fund or exchange-traded fund (ETF) that invests in REITs.

One option to start is by signing up for a brokerage account, where you can chat to a broker of financial planner to get more of an idea about what strategy would best suit your needs.

You may start looking into potential REIT investments as soon as your account is set up and you have online access to your account. Additionally, a screening tool that is available via your brokerage account may help you narrow your search and choices.

Publicly traded REITs are listed on a primary stock market, like the ASX, and you can buy shares for these via your broker. In fact, an investment broker who participates in offering a non-traded REIT is the only way to acquire REIT stocks.

Mutual funds and ETFs focused on real estate investment trusts (REITs) are another option if the above route doesn’t appeal.

Investing in a diversified ETF or mutual fund focusing on REITs might be an appealing alternative to trading individual REIT securities. With instant diversification, your risk is immediately reduced. These funds are available at many different brokerages, and investing in them is often viewed as a more convenient alternative to studying individual real estate investment trusts.

Be aware of fees when looking at ETFs or Mutual funds however as these can be a significant factor in their underlying performance.

Why invest in REITs?

From the perspective of the investor, REITs provide many advantages.

These property funds provide the ability to diversify portfolio holdings via exposure to several property types and markets, which have access to significant dividend distributions.

They also provide reasonable security as an investment option because, at the end of the day, both client advances and property titles belong in the Trust where they are maintained, supervised and protected.

Overall, REITs can be an excellent alternative to investing in equities or bonds because they hold that highly sought-after potential for great dividends and long-term capital gains, both of which they have been proven to provide.

Pros and Cons

Now, as with all things investing, there’s bound to be some strengths and weaknesses, and it’s always our job to educate ourselves on the risks and the rewards.

So, let’s explore what the balance looks like for this specific pocket of asset class. We’ll make it easier by breaking things down into pros and cons.

REIT Pros

- REITs over long periods have outperformed equities, making them a good diversifier in any investor’s portfolio. (Though keep in mind, this is historical data, and that doesn’t mean it’s assured for the future).

- REITs can have higher liquidity as public REITs are simpler to purchase and sell than properties.

- REITs typically have long-term contracts like leases that generate regular cash flow to support their debt unlike other companies.

- REITs are than equities due to their higher yields, their inflation-hedging capabilities and their diversified nature.

REIT Cons

- Non-traded and private REITs are harder to purchase and sell than publicly listed REITs. For long-term returns, it’s best to hold these REITs for years to potentially make gains.

- REITs are highly indebted due to the expensive nature of property. They are among the most indebted corporations as they distribute the majority of their income as dividends.

- Because REITs pay so much in distributions, they must issue new stock shares and bonds or take on debt in order to expand. In working this way, they need to pay back investors willing to buy into these offerings. If not, they’re not able to grow their real estate portfolio.

The Current Climate for ASX REIT Stocks

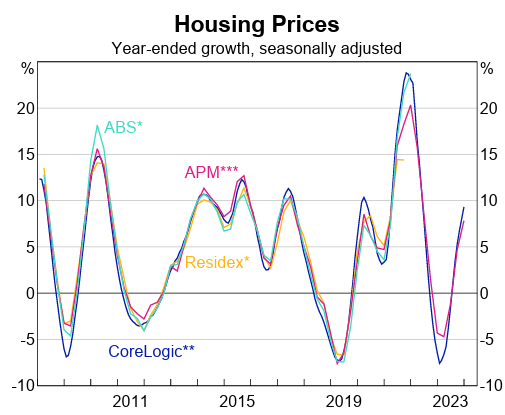

The dread of rate rises has infiltrated many industries even before the Reserve Bank of Australia raised the official cash rate 13 times this year to 4.35%. One industry that may be especially feeling the effects is the real estate market.

As you’re no doubt aware, when interest rates rise, mortgage payments increase, reducing demand and lowering home value.

Australia saw house prices bottom in early 2023 but since then has seen the price growth recover as higher immigration and fear of missing out (FOMO) have kept the market up.

Source: Australian Bureau of Statistics

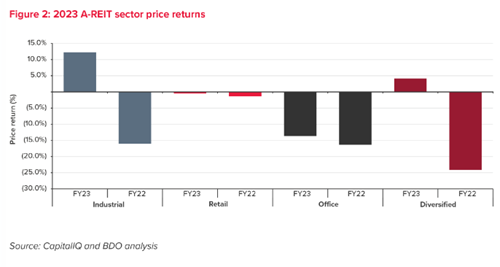

But other risks remain on the market beyond the potential economic headwinds. The shift in working habits during the pandemic have remained in many workforces.

People have become accustomed to the work-at-home lifestyle and technology has enabled them to effectively shop and work from home.

This has greatly impacted the commercial real estate market, as fewer people travel to central cities to shop and work, and the demand for office or retail space from businesses has decreased as a result.

What’s more, during the pandemic many homeowners decided to move out of the big cities and continue working from home from more rural locations instead, greatly impacting the central building districts and surrounding areas.

Because of this, REIT stocks on the Australian Securities Exchange (the ASX) fell sharply in 2022 and are only starting to see their prices recover.

Source: BDO Survey 2023

But even as things look tough in commercial real estate, REITs longer term horizons tend to ride through these bumps.

The ASX A-REIT market has been noted to be on the mend, with many REIT investors now beginning to feel that things are underpriced and ripe for opportunity.

The S&P/ASX A-REIT 200 Index gained of 15.5% in 2023, outperforming the ASX 200 by 9.5%. In the past 12 months the A-REIT Index is up 6.5%.

As things return to their norm post-pandemic more and more homebuyers are also looking to move back to the cities and business in the property market can return to normal.

Whether this is the early stages of a new property cycle driven by undersupply or the tail end of an old one remains up for debate, but for longer horizons REITs can look appealing at these prices.

But which ones should you consider?

Examples of A-REITs Worth Investigating

Below we have three ASX-listed REIT stocks that have been looking good on the charts. Peruse these examples to get an idea of what to look for if you decide to go the REIT route for your portfolio.

Remember that we are just showing ones with strong past performance and that is no guarantee of future performance. These also aren’t official stock recommendations, simply ideas to kickstart your research.

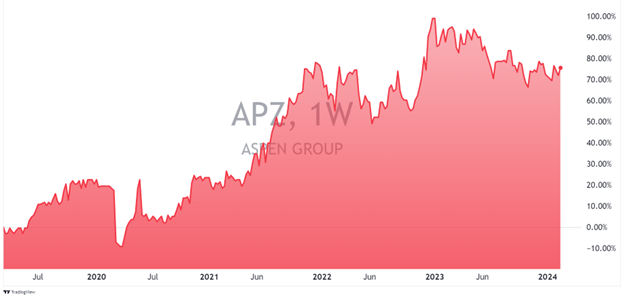

- Aspen Group [ASX:APZ]

Aspen Group is a smaller well-performing niche build-to-rent property developer. These niche developers tend to be less cyclical as they own specialised assets.

The group holds 18 properties and more than 5,000 sites and dwellings valued at $550 million. Compounding on a strong FY22, Aspen Group Limited grew their Net Tangible Assets (NTA) base while delivering shareholders significant returns.

Aspen managed strong returns earlier in the year but has fallen back to flat. Notably the group has a 97% trailing three-year return which is impressive considering the pandemic.

They have demonstrated that new development projects can be successful despite ongoing challenges in the construction industry, maintaining a healthy profit margin of 30%.

Earnings per share were 12 cents per unit, which is an increase of 39% on FY22.

Source: TradingView

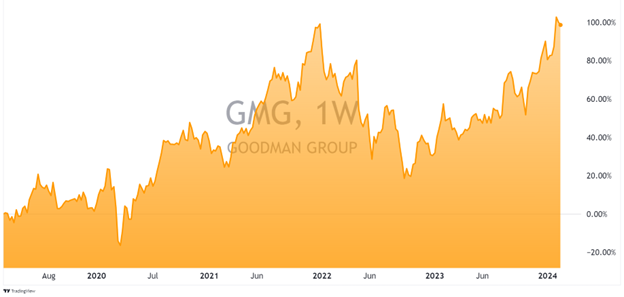

- Goodman Group [ASX:GMG]

Goodman Group is one of Australia’s most significant real estate investment trusts. It’s considered a safer bet that this stock has potential to outperform the market compared to other real estate investments.

With a market capitalisation of $44 billion, it is also among the most significant stocks on the ASX 200.

Goodman is a multinational, vertically integrated real estate company focused on the industrial sector. Its assets portfolio includes warehouses, factories, distribution centres, business parks, and office complexes.

Goodman Group pegs a large amount of their success to providing essential infrastructure for the digital economy. Their focus is on maintaining premium industrial assets in the face of exponential growth in e-commerce, supply chain optimisation, and data storage.

CEO and founder Greg Goodman claims the company is handling $83 billion in real estate assets under management and has $12.7 billion in initiatives planned.

There are a total of 418 properties under the company’s management. According to its annual report, the company made $1.56 billion in operating profit in FY23.

The company has forecasted an earnings per share (EPS) increase of 9% for FY24.

Source: TradingView

- Charter Hall Long WALE REIT [ASX:CLW]

Charter Hall Long WALE REIT [ASX:CLW] is another ASX-listed real estate option worth looking into.

This REIT works to invest in what it deems high quality real estate assets which are mostly leased to corporate and government tenants, and which feature heavily within the long-term lease category — making it a secure and protected candidate.

This REIT has expressed that its focus is on giving its investors a stability and security through a reliable income, with the added target of achieving capital growth through WALE properties (those that use weighted average lease expiry).

WALE is a way of measuring the average time period in which all leases in a property will expire, and it indicates when properties, parts of properties or groups of properties, are likely to fall vacant.

It currently has over $6 billion in this portfolio and owns 600 properties across the office, industrial & logistics and retail sectors.

The wider Chater Hall organisation holds approximately $88 billion in funds under management and manages 1,681 properties showing its strength in diversification for three decades.

As you can see it was badly affected by the pandemic, but has reversed trends recently.

Source: TradingView

Risks to consider when investing in A-REITs

Of course, A-REITs carry risks you should consider before jumping in.

As mentioned above, COVID changed the way people work, and with people working from home, many store fronts and offices have been left empty, which can impact a REIT’s holdings.

REITs are also impacted by property cycles, as well as macroeconomic factors and market cycles, which can affect an investor’s portfolio if market environments fall to the downside.

Volatility can also play a role in the outcome of REITs. They can be sensitive to wider market moves, which means its market value may not exhibit the underlying net asset value of the property portfolio.

And interest rate rises may impact the REIT performance negatively. This could decrease the overall demand, causing the price to fall.

A Concluding Word on ASX REIT Stocks

We hope you found this beginner’s guide to ASX REITs and their stocks useful. REITs can take the stress out of becoming a property investor by taking away much of the hard work owning multiple properties tends to involve.

If you are interested in looking into REITs and their stocks further, subscribe to for market updates on these stocks.

We recommend doing some more of your own research into ASX-listed REITs. You may want to consult a professional before to guide you through this process.

Regards,

Fat Tail Daily