In this guide to dividend investing, we are going to show you how to find some of the best dividend stocks on the ASX.

There are two ways to make money from investing in shares. The first is through capital gains. That’s when you get a return once the share price increases. The second is through dividends.

What are dividends?

Before we get into how to start investing in dividend stocks, it would be a good idea to start with a definition. Put simply, a dividend is when a company pays out a part of its profits to shareholders.

Dividends are usually paid on a per-share basis. For example, if the company decides to pay a $1 dividend and you own 10 shares, you will receive $10. Dividends are also usually paid periodically. That is, they can be paid quarterly, biannually, or annually.

While many investors will trade shares to get capital gains, the main idea of investing in dividend stocks is to provide a steady stream of income. That’s why dividend investing is more of a long-term strategy.

Dividends can be a great source of passive income. Passive income is making your money work for you, not the other way around. In other words, making money without doing much. And that’s a great way to build wealth over time.

An example of passive income can be rental income from an investment property or sticking your money into a savings account.

The interest you receive from your savings will generate a reliable passive income stream while you sleep.

This can be difficult in times of low or negative interest rates, particularly when interest rates are lower than inflation rates. That is, inflation will eat away the interest you receive on your savings accounts, which will diminish your wealth.

When savings as an income stream feel pretty much dead, investors looking for alternatives to get extra income can still look into investing in dividend stocks.

What are some of the advantages of investing in high dividend stocks?

Some investors may find dividend stocks in Australia boring, but there are plenty of perks when investing in dividend stocks.

More than 2,000 companies currently trade on the Australian Securities Exchange (ASX), but not all pay dividends.

Companies that offer dividends are usually larger and more stable, which decreases the volatility of your portfolio. They are usually more driven to distribute their earnings to shareholders than by growth.

The other side of the coin, though, is that this means you may not see their share price appreciate much over time. But, as mentioned, successful dividend investing is to get a reliable income stream.

Another good thing about investing in dividend stocks is that it allows you to get a return from a company without selling your shares.

And, if the company has a dividend reinvestment plan (DRIP), you can also choose to reinvest your dividends to buy more shares in the company instead of receiving the cash as a dividend.

Just as the interest you receive and leave in a savings account will make you more interest, you can do something similar with your dividends. Reinvesting your dividends can also compound your gains, creating an even more successful investment experience.

But before we carry on…

Here are some things to consider before investing in stocks that pay dividends

So far, dividend investment may sound somewhat similar to having a savings account in the way that it provides a regular and steady income. But dividend investing is very different…and a lot riskier.

While a savings or interest-bearing account will guarantee a certain percentage of return, there are no guarantees when investing in dividends.

Companies that pay dividends may slash or cancel them at any time, even if they have a long history of paying dividends.

The company will periodically decide if it pays out a dividend and how much it will be. It’ll make that decision based on the company’s earnings, the overall economic situation, and the future outlook.

If there’s a lot of uncertainty around, companies may decide to keep their cash instead of paying it out to investors. Or they may decide to pay a smaller dividend than in the past.

In fact, many companies either decreased dividends or cut them altogether during the pandemic.

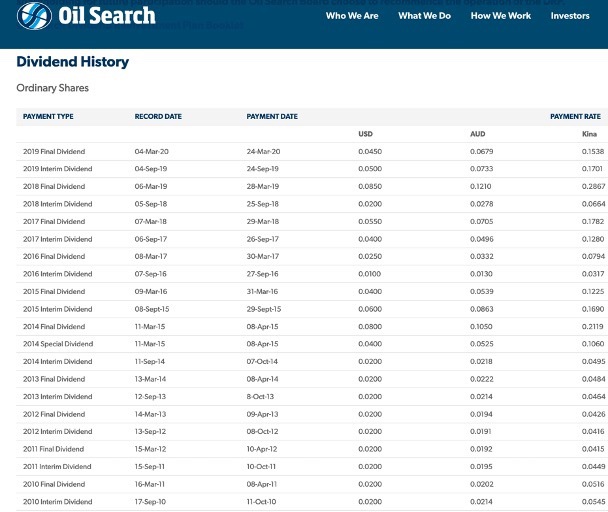

That was the case, for example, for former energy company Oil Search [ASX:OSH], before it merged with Santos [ASX:STO] in December 2021 and was removed from the ASX.

When oil prices collapsed in April 2021, during the height of the pandemic, Oil Search registered a drop of 19% in its revenue. So, with such an uncertain outlook for oil prices, the company decided to keep the cash and scrap its dividend, even though it had a long history of paying dividends, as you can see in the chart below.

Source: Oil Search

So, when you start your research to find the best ASX dividend stocks, keep this in mind: The previous dividend payouts you will see are in the past. Future payments aren’t guaranteed to be the same.

It’s difficult for companies to pay dividends when faced with a difficult situation.

But in saying that, plenty of companies thrived through the pandemic and shared their good fortune with shareholders.

One of those companies, for example, is Australian iron ore miner Fortescue Metals Group [ASX:FMG], which has announced a dividend record for the financial year 2020 of $1.76 per share, even with a killer virus gripping the world. By November 2021, it was trading at around $17 per share, which was a yield of about 10%.

Another important factor to keep in mind is a company’s share price. Even if a company pays regular dividends, if its share price falls in the meantime, your overall returns could be diminished.

In summary, there’s a lot more risk in investing in dividends when compared to a savings account, but the payout can potentially be much, particularly in periods of low interest rates.

So, without further delay, let’s dive into what successful dividend investing involves.

How to buy dividend stocks on the ASX

First and foremost, not all companies on the ASX will pay dividends. However, ASX has numerous dividend-paying companies. So, how do you find the best ones?

Look for stable companies

When investing in dividends, look for well-established companies.

You are not looking for the next miracle growth company. Instead, you are looking for companies that have been around for a long time, have a good reputation, and have predictable cash flow. In other words, companies that are stable, reliable, and aren’t focused so much on growth.

Look for companies that offer value, have great products or services that their customers need or love, are good at what they do, and have some sort of competitive advantage over their rivals.

JB Hi-Fi [ASX:JBH] is historically a good illustration of this. Customers keep coming back to this business because of its great prices and customer service. Another example is Telstra Group [ASX:TLS], which, for a while, owned much of Australia’s communications infrastructure.

Competitive advantage may include having infrastructure, assets, better prices, or any other factor that makes the best dividend investment companies more resilient.

History isn’t the whole story

One way to look for the best dividend companies on the ASX is to look at their track records.

Look at their past dividend history. Have they consistently been paying out? And, if so, is their dividend growing each year?

But that’s not the whole story.

Another thing to look at is the payout ratio. Investors will use this tool to see if the dividend a company is paying out is sustainable.

Remember, a dividend is the company paying out part of its profits. In other words, cash the company could use is instead given to shareholders.

The payout ratio calculates the dividend amount in relation to the profits. It’s calculated by dividing the company’s dividends per share by earnings per share and multiplying it by 100. This will give you the payout ratio.

If the company is paying out everything it earns or a good chunk of it on dividends, it won’t have much money left to reinvest. As a result, it may not see much growth in the future.

A company with a high payout ratio will also not be able to sustain the same dividend rate if profits fall in the next year.

On the other hand, a company with a low payout ratio will be conserving cash, which means that if it has a good year, it will have some room to increase dividends in the future.

As mentioned before, the other thing to remember is that when looking at a company’s dividend history, remember that it’s just that — history. It’s dividends that the company has paid in the past. There’s no guarantee that just because it has paid a certain dividend, it will continue to do so, especially if there’s not much chance of future growth, which makes it less likely that the share price will appreciate in the future.

It’s something to remember that just because a company is paying dividends doesn’t mean that the company and its finances are solid or safe.

How to be a successful dividend investor

If you’re determined to become a successful dividend investor, there are three simple yet crucial points always to remember to increase your chances of success.

Be wary of companies with high dividends

Plenty of sources list the best dividend companies on the ASX based on their yield. Many investors do just that. That is, choose some of the companies with the highest dividend yields and then just go for it.

Yet the fact that a company offers high dividend payouts doesn’t always make it the best one. You need to be wary of falling into a dividend trap here. That is when the dividend is actually too high and therefore not sustainable.

How do you know if you are looking at a dividend trap?

One way is through the share price movement. Dividends are a percentage of the share price. If the company’s stock price has dipped, the dividend percentage yield will increase.

Dividend yields tell the company’s past story. On the other hand, the share price is usually focused on the future.

If a company sees its share price fall substantially, it could be because investors don’t believe the company can maintain its current dividend payment.

Also, it could be that the company is taking on debt to afford to keep the high dividend payouts. Check out the company’s debt ratio. You want to look for companies that are not only paying dividends, but that can also cover their debt.

Another way to check for a dividend trap is to look at the company’s free cash flow over the previous years. If the dividend payout is higher than the amount of free cash flow, it could mean that the company is using debt to fund dividend payouts for shareholders.

And at some point, this will become unsustainable.

Get to know the company

Before investing, always do your research. This is critical.

Look at the history. Look at the company’s financial statements and compare its performance to other companies in the same industry.

And, of course, this includes researching the management team. Where have they been? Do they have any skin in the game?

At the end of the day, they are the ones who will decide whether to pay out a dividend and for how much.

Boards are usually keen on paying out dividends for a few reasons.

It really doesn’t reflect very well on the company when it cuts or reduces dividends. Investors may not only lose confidence, but it will also affect the share price.

Companies that pay out dividends consistently, on the other hand, attract investors. And the more dividends the company pays out, the better the company and its performance look.

Think long term

As we said, investing in dividends is a long-term investment strategy.

When looking at companies to invest in for their dividends, remember that you are investing in them for the long haul. You are not only investing in them for their dividend payout but also for their sustainability and resilience. You want the company to provide you with a good stream of income over time, but also you are looking for the share price to appreciate at the same time.

How to make the most of dividend investing

In summary, to be a successful dividend investor, look for stable, reliable, and resilient companies. Companies with a solid history of paying dividends offer good value and solid products or services.

Don’t just look at the dividend history, but also look at the company and its finances. Be suspicious of companies with high dividend yields, think long-term, and, most importantly, always do your research.

Hopefully, this guide serves as an introduction to dividend investing and help you find some of the best dividend stocks in Australia.