Let’s take our minds off all the US debt ceiling drama for a moment and focus on a promising area in the market: lithium.

Looks like the lithium recovery is well underway, with lithium prices up close to 40% in the last month.

Furthermore, high lithium prices have brought plenty of cash to lithium producers. In a presentation last week, Pilbara Minerals [ASX:PLS] showed just how much.

Just over a year ago, Pilbara had around $200 million in cash balance. That’s grown to $2.7 billion, and that’s after paying a $330 million dividend…

What’s more, Pilbara expects the good times to keep on rolling.

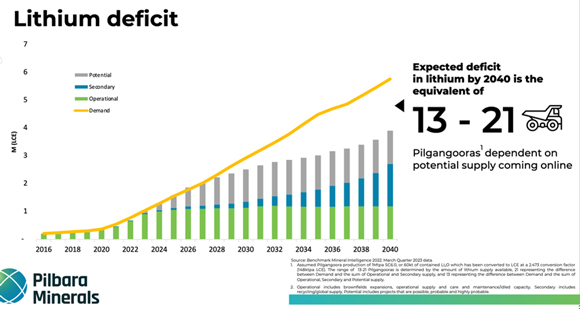

As they mentioned, they see a ‘really significant lithium deficit appearing’ in the long run, one that would need the size of between 13 and 21 Pilgangoora projects to fill it:

|

|

| Source: Pilbara Minerals |

By now, it’s no secret that to reach net zero targets, we are going to need a staggering amount of critical minerals.

To explain, the International Energy Agency (IEA) estimates that mineral demand from electric vehicles (EV) and battery storage will grow 10 times in a more conservative scenario. Furthermore, it would grow over 30 times in a scenario where the world keeps global warming well below two degrees.

It’s a daunting job ahead for miners….and a great opportunity for investors.

How geopolitics are playing into the critical minerals space

One other thing Pilbara Minerals mentioned in their presentation is they are very focused on adding value along the battery minerals supply chain.

The way they are planning to do this is through their joint venture with the South Korean company, POSCO. The POSCO Pilbara Lithium Solution is expected to produce 43,000 tonnes per year of lithium hydroxide and generate the company some downstream revenue.

In fact, there’s been a lot of talk from miners about moving down the supply chains and into value-added processes.

|

|

| Source: RMI |

Not only is there usually more money in it, but there are also geopolitical incentives to do so.

You see, China dominates when it comes to the EV battery supply chain.

China is the largest EV market in the world. It’s also the largest global battery manufacturer with a whopping 77% market share in battery manufacturing. What’s more, it controls many of the raw materials needed for the clean-tech supply chains.

It’s why much money has been flowing from the likes of Europe and the US. The Inflation Reduction Act (IRA) aims to develop more battery manufacturing capabilities — bringing those supply chains closer to home to challenge China’s dominance in this area.

And over the weekend, during the G7 summit at Hiroshima, we saw more steps in this direction.

Australia and the US announced they would be increasing their cooperation in the clean energy transition and critical minerals through the ‘Climate, Critical Minerals and Clean Energy Transformation Compact (The Compact).’

But what’s interesting is that US President Joe Biden promised to ask for congressional approval to add Australia as a ‘domestic source’ under the Defence Production Act (DPA).

We take this with a grain of salt, after all…it’s politicians’ promises we are talking about.

But with an end-of-year balance cap of US$750 million (around AU$1.13 million), the focus of the DPA is to speed up the manufacturing of clean technologies and boost domestic sources. This includes not only securing mineral supply but ‘value adding’.

Right now, the only country outside the US to be considered a ‘domestic source’ is Canada.

But IF it happens, this could open some interesting opportunities for Australian miners.

There’s a big push towards value adding

There’s a lot of focus to move down the supply chain…and there’s been money flowing too.

For example, last year the Morrison Government approved a $1.25 billion loan for Iluka Resources to develop an integrated rare earth refinery in WA to produce separated rare earth oxide products.

More recently, the government has given $50 million in grants under the Critical Minerals Development program.

Some of the winners included IGO, who received $4.6 million for their integrated battery material facility at Kwinana in WA. Queensland Pacific Metals got $5 million to engineer and design the first phase of a refinery at the Townsville Energy Chemicals Hub (TECH Project). International Graphite received $4.7 million for its mine-to-market battery materials project.

In short, there’s a big opportunity for investing in miners that are not just digging the stuff, but also moving down the mining supply chain.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments