You know the money is flowing thick and fast when the Initial Public Offerings (IPOs) are hitting the market in big numbers.

An IPO is when a new company ‘floats’ onto the ASX for the first time. We’re seeing a lot right now — with more to come!

That’s not all. Some of the recent ones are soaring in big numbers in their early days of trading. We already spoke about Douugh Ltd [ASX:DOU] last week.

It raised capital at $0.03 per share. It’s now trading around 29 cents.

Last week we saw Aussie Broadband Ltd [ASX:ABB] begin trading. It’s doubled since.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

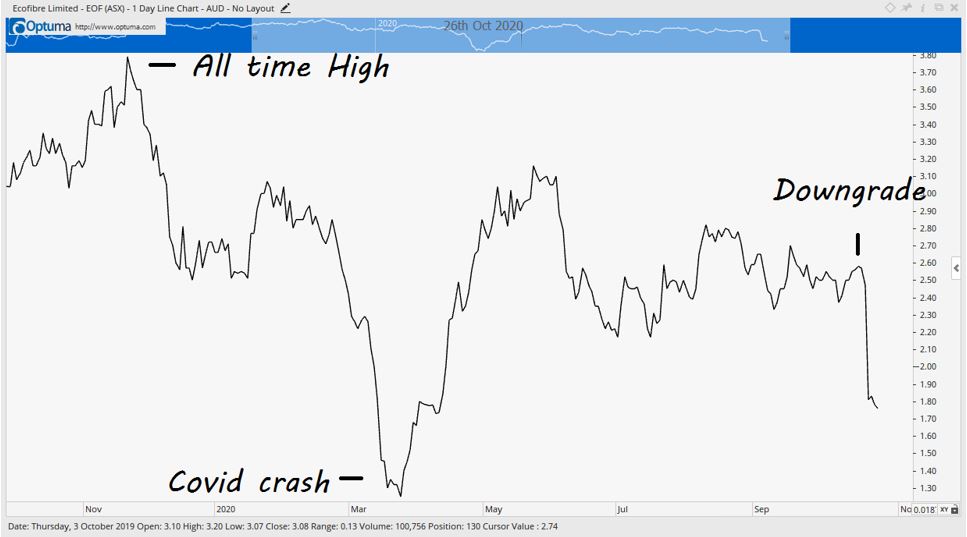

We’ll find out in the next six months and beyond how sustainable these gains are. The case of Ecofibre Ltd [ASX:EOF] might be instructive here.

Ecofibre is a cannabis company that is headquartered in Kentucky but founded and chaired by the seriously-rich Australian Barry Lambert.

The company listed on the market in 2019 after raising money at $1 per share. I thought about participating in the initial capital raise but got distracted.

Within a few months, it hit as high as $3.79.

I remember a young colleague thought about buying it at that extreme high for, in his words, a ‘break to the upside’. I told him ‘Yeah, nah’.

The reason was because, by then, Ecofibre was already carrying a near billion-dollar valuation. That was pretty rich for a loss-making company with modest revenues.

That wasn’t the whole story, either.

Ecofibre specialises in the hemp/CBD sector of the cannabis market. That went through a period of hype before intense competition hit the sector.

Let’s take a look at what’s happened since…

|

|

| Source: Optuma |

You can see that Ecofibre was already struggling before COVID came through the market like a freight train.

The interesting thing for me here is that I thought about buying Ecofibre after the crash, but the industry signals were weak regardless of the virus.

As you can see it went up anyway. I was kicking myself again for a while. However, turn your eyes all the way to the right-hand side of the chart.

Ecofibre recently came out and said its revenues were struggling due to the difficult trading conditions in the US. Reality has caught up with the stock — and the investors currently holding it.

We can see that anyone who bought over $3 and still holding is taking a pasting.

In the context of today’s market, you do have to make sure you do some homework on these new names hitting the market. Just because they’re surging now does not guarantee anything 12 or 24 months down the track.

Do keep an eye on Ecofibre though. It’s not a stock I’m going to buy anytime soon.

But who knows? Somewhere down the track the valuation and potential upside could swing back into our favour in a big way.

One of the great things about the stock market is that all of us are so damn impatient. Stocks often get dumped, forgotten, or unloved for an age in the stock market.

It’s not a situation you want to get caught up in. But it also hands great opportunities to anyone who happens to come across a stock at the right time.

Here’s one idea I’m watching now. Tabcorp Holdings Ltd [ASX:TAH] is the dominant company in the Australian lottery market, and also a big player in the wagering sector (sports betting, horse racing, etc).

The COVID disruption gave it a big kick between the legs because it closed down its retail network and sent sport and racing into a lot of uncertainty.

However, it’s reasonable to infer that this is in the price now. Tabcorp recently announced a big write down of its assets (non-cash) and gave an update on recent trading. The stock held steady both times.

That suggests the market is comfortable with where the business is at presently.

There’s not much doubt about the tasty earnings the company makes in the lottery arm of the business. It’s the wagering arm that’s lost market share in recent years.

The future outlook of the stock probably hinges on what happens here. Perhaps one sign on that could be how fast the company reinstates its dividend — which it deferred after COVID.

There are no guarantees in the market but TAH looks a reasonable risk versus reward right now, absent any wild card events.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.