No, today’s headline isn’t a typo.

And I didn’t forget to put one in.

It’s come on the back of me being frustrated with the sort of headlines I’m seeing day in and day out — attention-grabbing headlines about the Aussie house price bounce.

A couple of months of good data and suddenly everything is OK.

However, there’s a problem with thinking that.

Those headlines you see splashed across mortgage websites or your local paper rag aren’t really telling you the full story.

Sure, we are seeing the resurrection of property prices…

…but it’s not built on fundamentals…

…rather it’s too many people fighting over the scraps.

Never let the facts ruin a good story

There was a collective ‘ooooohhhhh’ from the editors at the Fat Tail Media office yesterday.

The latest data from the Australian Bureau of Statistics was out. We must have all seen the same thing in our viewing pane at the same time…

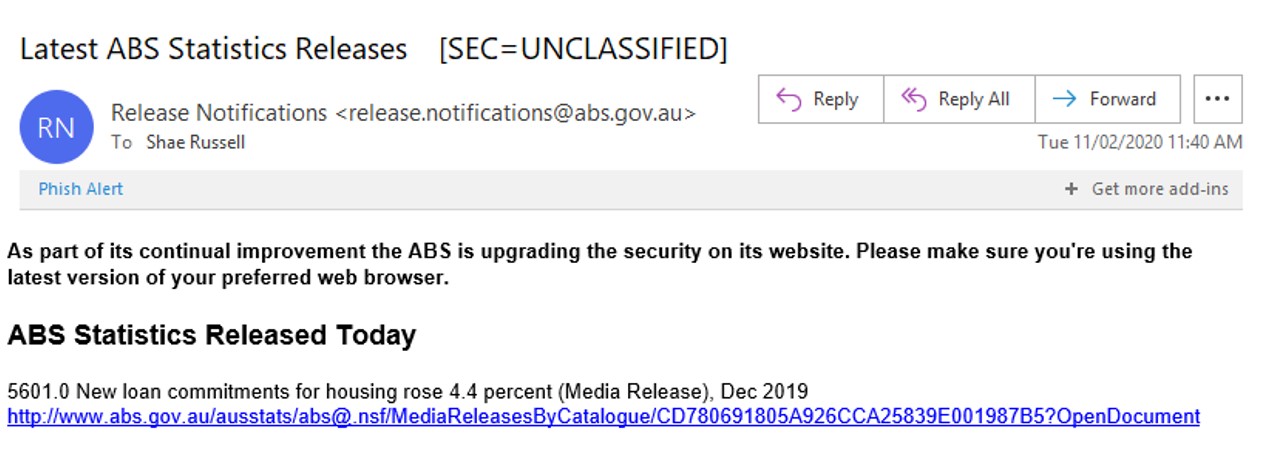

ABS data dump direct to my inbox

|

|

| Source: Shae’s overworked inbox |

There it was in black and white with a dash of blue. New loan commitments had risen by 4.4%.

Meaning that the amount of new mortgages agreed on between people and the bank — signed and settled — jumped by 4.4%.

‘Huh. I must be part of that data,’ said one voice, ‘I bought in December.’

Then my desk buddy Callum Newman, and chief editor of Profit Watch, announced under his breath that ‘The cycle goes on’, as he looked for a way to tweet the news to his followers.

Now December’s new loan commitments increase is a large amount.

And I knew it wouldn’t be long before the mainstream started chewing on it to prove Australia’s great pyramid scheme was back.

Lo and behold, this was the first headline I saw from The Australian this morning:

‘Housing price boom fuels broader economic recovery’

Oh. Really. It’s that simple is it?

House prices are up…Aussie economy will surely be firing on all cylinders shortly.

Yet any statistician will tell you that one month of data does not make a trend…

As my poppa told me growing up, never let the facts get in the way of a good story.

So The Australian, taking a page from our grandpa’s books everywhere, wrote:

‘Australians are taking up new mortgages at the fastest pace in more than three years, encouraged by a sharp recovery in property prices and stoking hopes for a recovery in spending and housing construction in 2020.’1

And the tall tales don’t end there. They added:

‘Approvals have climbed for seven straight months to be 21 per cent higher than May, with CBA economist Kristina Clifton saying the lift in housing lending was “a sign that the latest cash rate cuts are working”.

‘“Stronger borrowing is lifting dwelling prices and means positive wealth effects may come back into play and support consumer spending,” Ms Clifton said.’

I’m not surprised to see the wealth effect argument being trotted out.

Experts love to bring up the idea of the ‘wealth effect’ to tell a positive story.

The wealth effect is simple.

That is if the value of your assets are rising (like your house), you feel good about money, so you don’t mind spending your money on discretionary items.

Heck if you’re feeling a bit rich, you may even feel like you can take on a bit more debt to spend even more…

This sort of economic buffoonery is pretty much why some hate people like me pointing out the cold hard facts of an economy in decline. But an economic decline feels very much like a Friday subject…

Especially because The Australian brought out all the big guns for their property-positive piece.

All the way down at the bottom of the article, we find this gem from ANZ:

‘“It’s not just about pent-up demand by owner-occupiers,” ANZ economist Adelaide Timbrell said. “It’s a sign the property market is seen as a safer, stronger place to put your money.”’

But here’s the thing.

This article from the Australian — and I’m sure the rest I read today — happen to omit one important detail: Aussies are fighting over the scraps of the property market…

[conversion type=”in_post”]

Greater fool theory playing out?

Before we go forward, let’s go back to last week.

Recent house price data from places like CoreLogic show that prices did indeed rise in December.2

As they did for another property research firm, SQM Research.

But both companies were at pains to point out that the ‘strong’ property price ‘surge’ is largely concentrated to Melbourne and Sydney.

More to the point, they’ve both highlighted the lack of properties available for sale at the moment.

Data from CoreLogic shows the housing stock for sale is down 10% overall for 2019. That is, there’s 10% less properties for sale over 2019 compared to the year before.

SQM Research on the other hand noted big falls from November to December. Pointing out that there’s 30% less houses for sale in Sydney, and 16% less in Melbourne.3

The Australian Financial Review broke ranks and went out of their way to highlight this oddity for Aussies last week. Pointing out that perhaps the lack of stock is fuelling buyer hysteria, writing:

‘Sydney-based first-home buyer Luisa Low has been searching for more than eight months after getting her mortgage pre-approval to buy a home worth up to $1.5 million, but her attempts were foiled by the scant offering.

‘“We started looking before the federal election, when prices were lower and we found it impossible to actually buy anything,” she said.

‘“It has gotten harder in the last three months because there hasn’t been anything on the market at all.”

‘“I know a lot of people haven’t been able to buy because we kept seeing the same buyers at open houses for the past six months. Everyone’s in the same boat.”

‘Ms Low said some buyers even started turning up at the first open house with the contract already signed.

‘“People are getting desperate. It’s crazy,” she said.

‘“We’re ready to buy and have our finances sorted, but there’s hardly any listings. If something comes up, it gets sold at a ridiculous price.”’4

A mortgage broker interviewed for the article added that he hadn’t seen anything like it before.

Mentioning that he writes $200 million worth of mortgages each month, and says more than half are ‘failing to convert due to low stock’.

Aussies buying property scraps

To round out all the facts for the rising property price story, we turn to a concerned Martin North, from Digital Finance Analytics.

In a recent blog post he noted that people are taking out bigger and ever-increasing mortgages, but that volumes aren’t rising.

Or as he put it:

‘The key is understand that average loan sizes are growing much faster than loan volumes – thanks to weaker lending standards.’5

It appears dear reader, that once again the headlines are out to trick us into thinking everything is OK.

And that the Australian economy will right itself if only house prices start to rise once again.

However, when you look past the attention-grabbing headlines, we see that rising house prices are less about genuine value…and more about just a bunch of Aussies desperate to pay anything for the first bunch of bricks they don’t get out bid on.

| Until next time, |

| Shae Russell, PS: Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. Download your FREE report by clicking here. |