In today’s Money Morning… income investing’s brief reality check… DividendKeeper on the way out… nothing is a ‘sure thing’ anymore… and more…

Dividends.

They’re probably one of the most divisive aspects of the ASX. At least they are in my opinion.

Personally, I’m not all that keen on dividends. Not because I think they’re unimportant or a poor use of company cash; but rather because I prefer seeing companies reinvest for growth.

That’s just what I look for in a stock a lot of the time. Which, truth be told, is probably because I’m not at an age where I’m worried about wiping out my retirement savings. Or looking for steady gains.

I’m more than willing to take on more risk because I have time on my side.

However, that doesn’t mean that everyone thinks like I do. Far from it.

In reality, I am the outlier. Because most Aussie investors can’t get enough of dividends. It’s what the ASX is renowned for. Carrying some of the best payout ratios you can find.

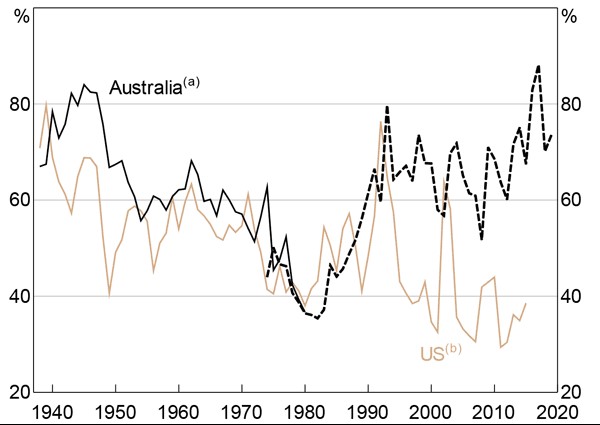

According to the RBA, from 1917 ‘til today, 65% of all earnings have been paid out in dividends on average. And from 1980s onwards, after the introduction of franking credits, these payouts have become even more turbocharged.

Take a look for yourself between this comparison of the Aussie and US markets for dividend payout ratios:

|

|

| Source: Reserve Bank of Australia |

You can clearly see how local investors have reaped the reward of more yield. With income investors enjoying close to a 90% payout rate just a few years back. The highest we’ve ever seen from the ASX.

But then, as we all know, the pandemic hit.

[conversion type=”in_post”]

Income investing’s brief reality check

I’m sure I don’t need to tell you, but last year was a tough year for income investors.

You may recall the uproar that we saw in response to the big banks’ decision to drastically cut their dividends. Or even, not pay one at all!

To many, it was an unthinkable outcome. With far too many investors treating these dividends as ‘guaranteed’ income. A fact that they have quickly come to learn is far from true.

But, income investors were lucky.

As we’re now seeing, this dividend dry-up didn’t last long.

According to the AFR we’re on track to reach $73 billion in dividends for the current financial year. With payouts on track to beat analyst expectations by 8.5%, apparently.

A sizeable improvement over last year’s $63.3 billion in dividends, but still short of the 2019’s all-time high of $88 billion.

The fact that we’ve seen such a swift turnaround is no doubt music to many investors’ ears. With bumper dividends set to line the pockets of those desperately seeking income once more.

Not to mention the fact that it underscores the rising levels of profitability. A sign that our economy is bouncing back nicely from last year’s economic squall. At least, that’s the takeaway at face value.

Here is how one JPMorgan ‘equity strategist’ worded it to the AFR:

‘Looking forward, particularly for banks, energy and financials, the trends look strong. So strong, in fact, that we believe an Australian dividend supercycle is in the offing.’

Yes, this man believes we could be on the cusp of a dividend supercycle. Which in my view is a bold claim to make, seeing as we’re not even close to reaching 2019’s highs.

More importantly, this view also fails to consider one of the more important tailwinds for dividends right now. A critical oversight that (seemingly) is propping up many income investors’ hopes and dreams…

DividendKeeper on the way out

See, whatever view you may have of dividends, you can’t afford to ignore the impact of JobKeeper.

Our government’s $56 billion stimulus program has been critical to keeping our economy afloat. Not only saving jobs, but also saving a lot of companies’ bottom lines.

However, as the program has continued, it has become increasingly clear that not every business needed this handout. With some graciously handing back the money out of goodwill.

Keep in mind though, legally any business which successfully claimed JobKeeper is entitled to that money. No matter how good or bad their final profits may be.

There is no legal requirement to pay back this money.

As such, we’re seeing some ASX-listed companies pocket this cash for good. Using it to paint a better-than-expected result on their balance sheet, and then pay out some fat dividends.

Again, whatever your ethical standpoint on this may be, they are well within their rights to do so.

From my perspective though, the key detail is the distortion this is creating. An inflated earnings season that has led to bigger dividend payouts. And while JobKeeper certainly isn’t the only factor at work here, it is still a big one.

Which begs the question, what happens when the program comes to an end one month from now?

28 March is the current date JobKeeper is set to finish. Putting a halt to these payouts.

What this could mean for future dividend payouts is unclear. But, if I had to bet money on it, I’d wager it won’t be good for many. Because unless they can bridge this stimulus gap with some serious growth, they won’t be making the same kind of profit this time next year.

Granted, I’m sure some companies will manage to seize the kind of growth I’m talking about. Just not all of them.

And for income investors, that should give them reason to pause.

I’m not suggesting dividends will dry up altogether, just that they may simmer down a little. But as we saw last year, that rarely goes over well with the market.

More importantly it is just another risk anomaly borne out of our modern monetary world. The kind of risk that Jim Rickards discusses in his latest book: The New Great Depression.

You can read all about Jim’s thoughts, and what it will mean for Aussie investors, right here.

Because if the past 12 months have taught us anything, it is that nothing is a ‘sure thing’ anymore. Even if dividends have long been a staple of our market.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.

Comments