The Incitec Pivot Ltd [ASX:IPL] ended FY21 with a net profit after tax of $359 million, up 91% on FY20.

IPL share price is currently trading at $3.28, up 5%.

Over the course of 12 months, IPL shares have gained 55%.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

IPL’s FY21 performance highlights

Incitec’s principal activities involve the manufacture and distribution of industrial explosives, chemicals, and fertilisers.

Here are Incitec’s highlights from its latest financial results:

- ‘NPAT: A$359m, ex IMIs of A$209m, up 91% from A$188m on pcp

- ‘Earnings Before Interest and Tax (EBIT) ex IMIs: A$566m, up 51% from A$374m on pcp

- ‘Earnings Per Share ex IMIs: 18.5 cents per share, up 70% from 10.9 cents per share on pcp

- ‘Strengthened balance sheet with net debt of $1bn and Net Debt/ EBITDA ratio of 1.1x at 30 September 2021, down from 1.4x at 30 September 2020

- ‘Return on invested capital (ROIC) improved during the year to 5.8%

- ‘Final dividend of 8.3 cents per share declared, 14% franked; total dividends of 9.3 cents per share for FY21.’

Now, when IPL refers to IMIs, it is referencing individually material items.

Incitec’s NPAT including IMIs was $149 million in FY21. IPL reported this was an increase of 21% on the previous corresponding (IMI-inclusive) period.

IPL reported $209m (FY20 $65m) of after-tax IMIs relating to the closure of manufacturing facilities at Gibson Island, Queensland, and the impairment of manufacturing assets at IPL’s plant in Cheyenne, Wyoming.

IPL share price outlook

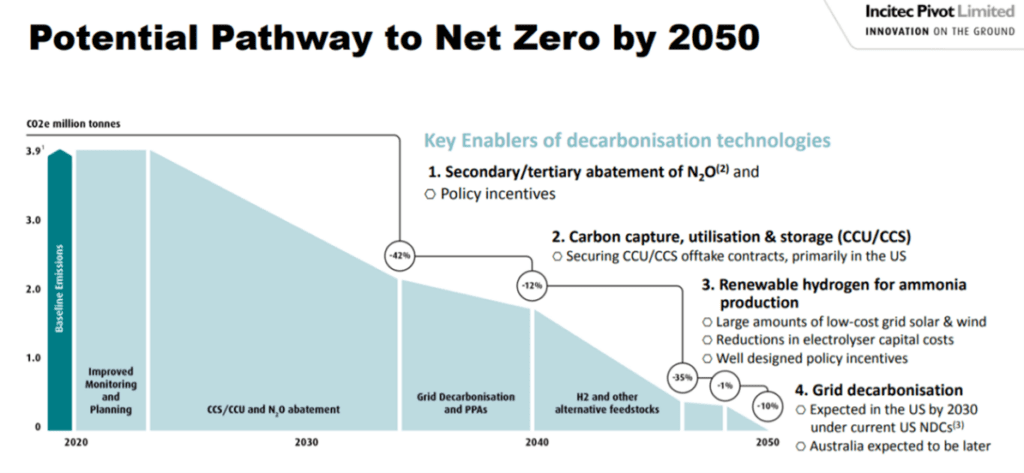

Sensing the changing winds, IPL today updated investors on its plan towards ‘net zero’ decarbonisation ambitions.

Incitec Pivot Limited Managing Director and CEO Jeanne Johns commented:

‘In addition to our longstanding commitment to sustainability, there was a step change in our work on climate change during the year. We increased our commitment to decarbonization including setting out a potential Net Zero pathway by 2050 or earlier if practicable.

‘We are embedding climate change into our strategy to make sure we leverage commercial opportunities as well as manage risks effectively. Our pathway to Net Zero requires investigation of new and emerging technologies and key to this is leveraging our world leading ammonia manufacturing expertise.

‘We have recently formed two significant partnerships – with Fortescue Future Industries at Gibson Island, and two of Singapore’s leading companies Keppel Infrastructure and Temasek at Newcastle and Gladstone.

‘Both partnerships are investigating the commercial feasibility of manufacturing green ammonia from renewable hydrogen.’

Many industries are now pivoting to carbon neutrality or green energy tech.

But one of the hottest industries catering to the green investing theme is the ASX lithium sector.

If you want to learn more about the lithium industry, I suggest checking out this report.

And if you want an in-depth tour of investing in lithium, I suggest going over this guide we published last month.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here