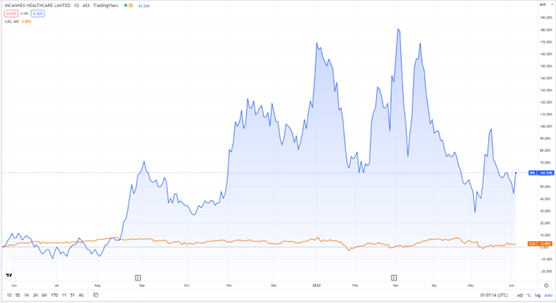

Incannex Healthcare [ASX:IHL] climbed as high as 13% on Friday after releasing a clinical trials update.

Despite today’s spike, the IHL stock is down 35% year to date.

Source: TradingView

Incannex’s Winning AHI Results

Incannex Healthcare has revealed clinical trial results for phase two of its IHL-42X investigation into sleep apnoea.

Upon Novotech’s analysis, Incannex was able to announce that IHL-42X ‘exceeded our expectations’.

Incannex is a clinical-stage pharma stock aiming to commercialise ‘unique medicinal cannabinoid’ products and psychedelic medicine therapies.

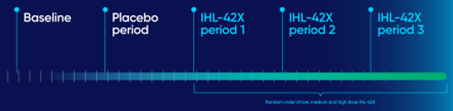

Incannex described the IHL-42X trial in the following way:

‘The clinical trial assessed three doses of IHL-42X at reducing the AHI in patients who suffered from OSA.

‘Data was also collected for other aspects of sleep quality, THC clearance and safety.

‘Trial participants received each of the three doses of IHL-42X and placebo across four seven-day treatment periods, separated by one week washout periods.

‘At the end of each treatment period, they attended the clinic for an overnight sleep study where AHI was determined, along with other measures of sleep quality, quality of life and drug safety.z’

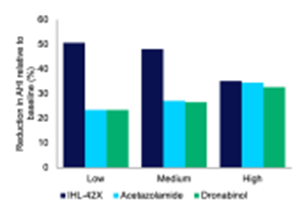

Conducted on 10 participants, IHL said the results displayed reduction in sleep hypopnea symptoms, improving sleep quality across a three-dose cycle.

IHL found that a lower dosage of IHL-42X proved more effective than mid to high doses.

Lower doses reduced the Apnoea Hypopnea Index (AHI) by 50.7% versus the baseline.

Incannex reported that 25% of participants experienced a greater than 80% reduction in AHI.

Overall sleep quality of participants was also greatly improved, alongside a reduction in cardiovascular stress and improvement to oxygen desaturation (ODI) by 59.7% — all on low dosages:

Source: Incannex

IHL-42X tolerance was favourable, while the product also proved more effective than sole applications of either dronabinol or acetazolamide.

Source: Incannex

IHL share price outlook

Incannex commented on the results:

‘[IHL-42X] has shown substantial clinical benefit to people with obstructive sleep apnoea at the lowest dose given.

‘This not only means people can get the full benefit with a reduced risk of side effects, but also, during the low dose treatment period every subject was substantially below the legal driving limits for THC in their blood the morning after dosing, thus removing a significant hurdle for IHL-42X’s widespread use.’

Incannex also mentioned that the US FDA provided constructive comments to assist in Incannex developing a treatment for OSA and sleep apnoea.

Dr Mark Bleackley, Incannex’s Chief Scientific Officer, said:

‘The feedback (the FDA) provided on the overall proposed development program was positive.

‘The agency’s responses to the specific questions we posed allow us to revise our clinical trial protocols, to ensure that we are running highly efficient studies that generate the type and amount of data the FDA will require in a future marketing application.

‘The results from the pre-IND meeting will shape the IHL-42X development program over the coming months.’

Incannex said obstructive sleep apnoea affects 900 million people worldwide, with no current available pharmacotherapies.

Incannex thinks the addressable market to help sleep apnoea sufferers totals US$10 billion.

Clearly, if IHL-42X proves materially beneficial for people with obstructive sleep apnoea, Incannex can stand to gain a large revenue stream.

But a lot has to happen between now and then…further research, more regulatory approvals, and more R&D spending.

As a pre-revenue company, today’s jittery climate isn’t exactly favourable, with IHL down 35% year to date.

But this bearish mood isn’t necessarily bad. Volatile times like these provide savvy investors with buying opportunities.

But how do you recognise a buying opportunity from a trap?

Our small-cap expert Callum Newman has come up with a strategy for picking ‘left-for-dead’ stocks that could bounce back strong.

You can find out how he does it, ‘grave-dancer’ style, here.

Regards,

Kiryll Prakapenka,

For Money Morning