Editor’s note: In this weekend’s video I discuss the cobalt story — past, present, and future. I also look at the chart for three ASX-listed cobalt companies. Click the thumbnail below to view.

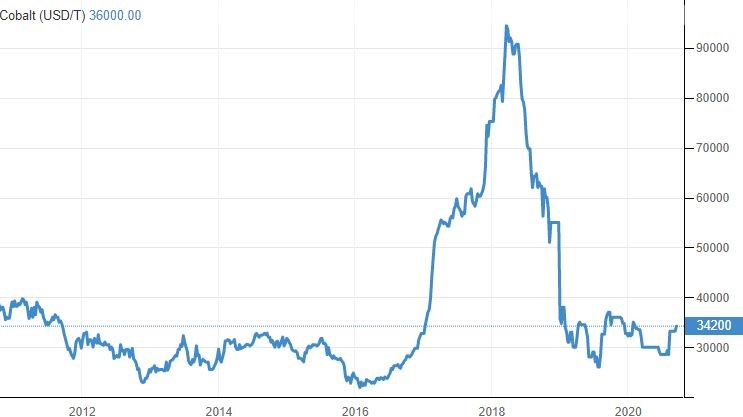

Cobalt prices went berserk in late 2017 and early 2018.

But is it poised for a comeback?

Depends on your timeframe.

Here’s the historical cobalt price:

|

|

| Source: tradingeconomics.com |

Back in 2017/18 the hype around cobalt was immense, and people piled into otherwise unknown explorers and developers on the ASX.

As you may know the Democratic Republic of the Congo (DRC) is where the majority of cobalt comes from — some 60–70% of it, in fact.

The problem is that there is significant wrangling over how it is mined.

[conversion type=”in_post”]

Cobalt’s troubled past and recent developments

This includes royalties to the government and various ethical considerations.

In fact, Apple, Alphabet, Dell, Microsoft, and Tesla were sued along with suppliers like Zhejiang Huayou Cobalt, Glencore, and Umicore for the way they went about securing the metal crucial for lithium-ion batteries.

As a result, the metal was dubbed by some as the ‘blood diamond of batteries’.

So, the huge spike for a number of ASX-listed cobalt companies around 2017/18 is understandable.

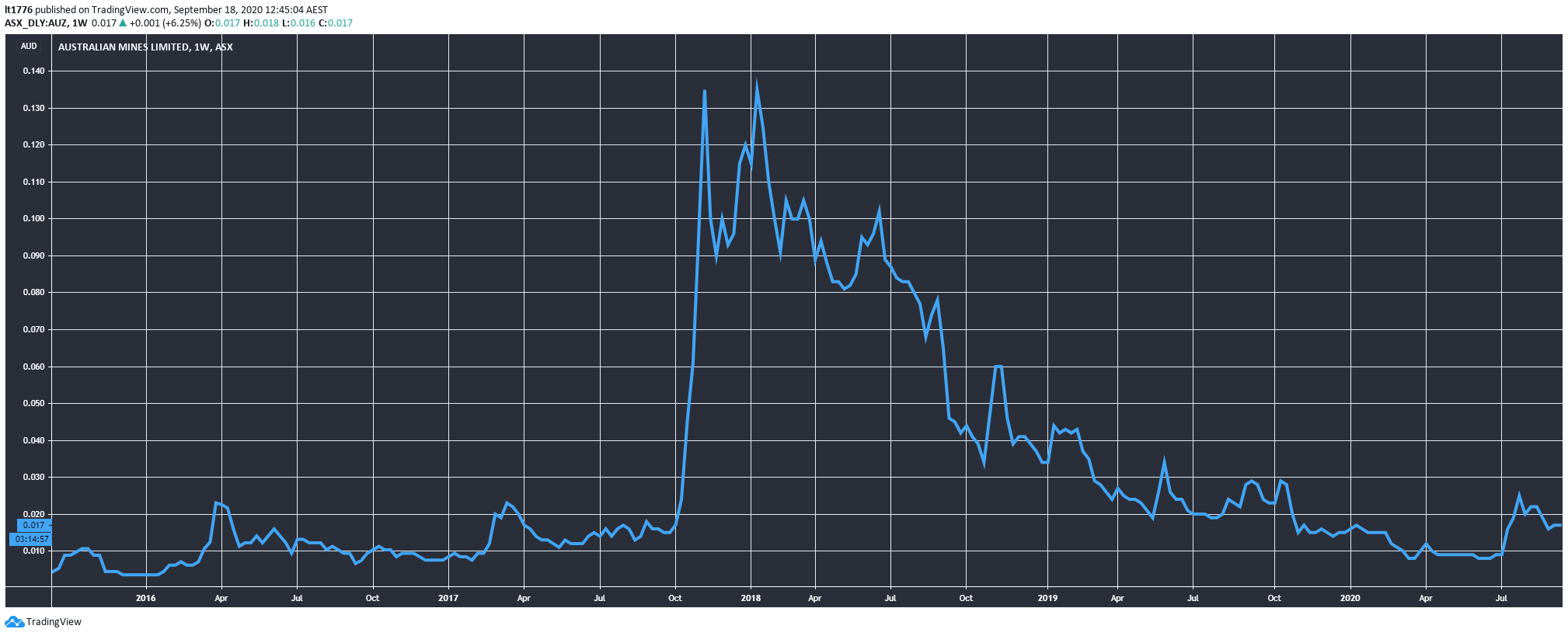

Just check out the chart for Australian Mines Ltd [ASX:AUZ] during that period to get a sense of how big the hype was:

|

|

| Source: tradingview.com |

Australia is a relatively low-risk mining environment compared to the DRC.

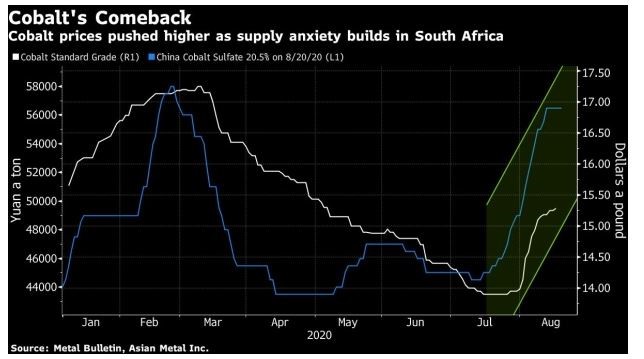

And here’s what is happening right now:

|

|

| Source: https://www.bnnbloomberg.ca/ |

For a bit of context, here’s a snippet of the Bloomberg article:

‘Cobalt’s steady bounce back over the past month faces headwinds even as the market is poised to tighten from state stockpiling in China.

‘While a bout of government-backed buying should be supportive for prices, there’s still little certainty around the timing and the impact of those purchases. This move had been basically priced into the market, said Serafina Huo, analyst at Shanghai Metals Market.

‘“There’s limited room for the cobalt price to surge further this year,” she said by phone. “Downstream companies have recently completed their seasonal stockpiling and end demand is generally weak this year.”

‘Authorities in the battery material’s top global market will buy 2,000 tons to place in the nation’s strategic commodity reserves, according to people familiar with the matter earlier this week. Prices had already surged 10% in a month amid pandemic-related supply disruptions from Africa.

‘Prices had declined steadily this year as the coronavirus crisis hammered demand from crucial sectors for cobalt, from electric-vehicle batteries to aerospace alloys. But there’s been a pick-up since July, partly because Covid-19’s spread in Africa is hampering shipments to China from the Democratic Republic of Congo via South African ports.

‘“Even if China goes ahead with these purchases, it will do so slowly and in small steps,” Xu Aidong, analyst at Antaike said in a Wechat post. When state authorities ordered 5,000 tons of purchases in 2015–16, the boost to prices proved short-lived, she said.’

So, the cobalt price bounce may be short-lived according to the analyst quoted by Bloomberg.

Cobalt and the macro picture for commodities

It seems like everything in commodities comes back to China.

Just as there are two camps in our editorial views on bank stocks, there are also two camps on commodities and China.

One camp thinks the growing political tension between Australia and China could crush Australian mining.

I am a bit sceptical but agree to extent.

For example, I am bearish on the big banks and bearish on the major miners like BHP Group Ltd [ASX:BHP] and Rio Tinto Ltd [ASX:RIO].

I think the bigger you are, the greater the risk emanating from this stoush.

But that doesn’t mean smaller companies can’t win in what we think is the commodities ‘Super Cell’ that we think is on the horizon.

Inflationary pressures will drive investors towards commodities as a hedge, we think.

You can learn all about this edge of the bell curve idea that could be the investment story of the next decade, right here in our special report.

Here’s something that recently emerged from supporting our thesis from a geopolitical perspective on Bloomberg:

‘China’s next five-year plan beginning in 2021 will call for increases to its mammoth state reserves of crude, strategic metals and farm goods, said officials familiar with the discussions.

‘Beijing is keen to heed the lessons of the coronavirus crisis and deteriorating relations with the U.S. and its allies, according to the officials, who participated in the drafting of the plan. That means ensuring the nation’s secretive stockpiles, almost certainly among the world’s ‘Largest, are plentiful enough to withstand supply disruptions that could cripple its economy, the officials said, asking not to be identified because the matter is sensitive.

‘China’s top leadership will next month lay out its strategy for 2021-2025 that will include ramping up domestic consumption and making more critical technology at home, in a bid to insulate the world’s second-biggest economy from worsening geopolitical tensions and fraying supply chains. Securing food supplies, fuel and materials is a precondition of greater self-reliance for the world’s biggest importer of commodities.’

Cobalt just happened to be the beneficiary of this push by China.

There could be other commodities to come as well.

I think Australia will mine its way out of the crisis, and China will build its way out of the crisis.

A while back, I asked my contact at the top-end of the superannuation industry what he thought about the China–Australia beef.

They still don’t see it as a big risk.

It could be a big blind spot — but it’s now almost contrarian to suggest that the Australia/China manufacturing/mining nexus will stand up over the next few years.

New batteries could push cobalt out in the long term

The way I see it, cobalt’s troubled past could push things one of three ways.

Either there is a sustained push away from DRC production to the benefit of Australian miners.

Or there is a technological shift that kills it off its role in batteries altogether.

Alternatively, a mix of these two scenarios.

A push in the medium term towards Australian cobalt players, followed by a long-term shift away from the metal.

This is reflected in a recent Forbes article which notes the rise of a new type of battery on the horizon.

While speculating on what Elon Musk might announce at the Tesla Battery Day on 22 September, the author said:

‘Tesla battery supplier CATL has already announced that it can manufacture batteries with a 1.2-million-mile lifespan that can last 16 years. However, these involve a shift away from lithium ion towards lithium iron phosphate (LFP) battery technology. It’s not obvious from the name, but the key thing about LFP is that it doesn’t use cobalt, a rare earth mineral that is one of the major reasons why EV batteries are so expensive. LFP batteries have a reduced density compared to lithium ion, but are cheaper to produce and have greater durability, so an announcement of their usage would be another step towards mainstream affordability for EVs.’

So long-term the picture may not be as good as in the medium term — given DRC production is projected to fall by 25% this year according to Fitch Solutions.

The current cobalt outlook, therefore, may be best suited to a trade rather than a multiyear investment.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.