Diversified miner of nickel, copper, cobalt, lithium, and gold IGO [ASX:IGO] has a wide variety of operations. The company is ramping things up by announcing two new drilling projects for lithium, gold, and rare earth elements (REE) drilling at Burracoppin.

IGO and Moho Resources [ASX:MOH] have now commenced drilling for REE and gold at Burracoppin across 39 air core drill holes in Perth.

The announcement was shared by IGO but originated from Moho, IGO’s joint venture partner.

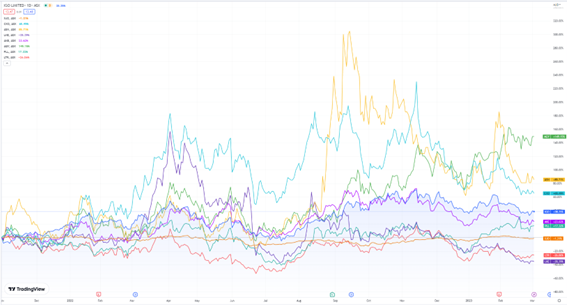

IGO shares were moving very slightly down today. The miner’s stock has gained 14% over the last year, though it has dipped 8.5% in the last month:

Source: tradingview.com

IGO and Moho begin drilling for gold and REE

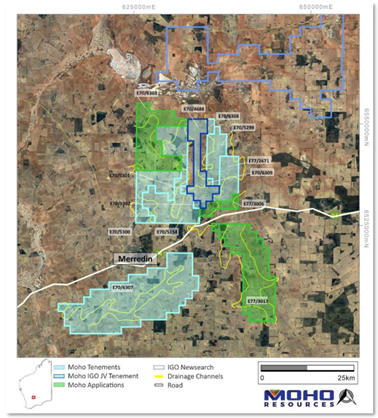

Joint venture partners Moho and IGO have shared the news that air core drilling at E70/4688, E70/5300 and E70/5154 at the Burracoppin REE and Gold Project has now officially kicked off.

The venture partners aim to achieve proof REE within drainage channels already scoped out by Moho.

Soil surveys have already provided results at Crossroads, identifying total REE in surfaces and downhole, with several areas showing elevated levels of Dysprosium and Neodymium.

The latest Burracoppin expedition focuses on an air core drilling program across 39 drill hole locations for around 2,000 meters to explore geological constraints of drainage channels, test for potential REE mineralisation, check Dysprosium and Neodymium values and test for gold.

Around 23 holes have been tested for identified soil gold anomalies for bedrock mineralisation across E70/5154 and E70/5300, and the miners have found elevated levels of arsenic, which Moho believes could be linked to gold-arsenic anomalies as sulphide.

Some limitations have surfaced for land access — like IGO having to provide some compensation for access to some areas.

Ralph Winter, Moho’s Managing Director, commented:

‘This exciting next phase of REE exploration should assist in proving the concept of ionic clay (REE) accumulations over 16km of channel through centre of the Burracoppin project.’

Source: MOH

Once the drilling is completed, the two companies will review and interpret the results and undertake further drilling at other prospective areas of tenements — if initial testing is successful.

MOH and IGO formed an unincorporated joint venture for the purpose of exploring, so this could soon be extended to developing and mining E70/4688.

IGO’s 30% interest will be free carried until a prefeasibility study is completed, which could then see IGO contribute pro-rata to ongoing work or convert its 30% interest to a 10% free carried interest.

Moho has undertaken substantial exploration around E70/4688 and expanded the tenure of the Burracoppin Project.

Earlier in February, IGO also shared updates on its lithium ventures, co-owned with Venus Metals and Tianqi, with ground exploration activities at Greenbushes East sampling 1,350 soil extracts for lithium.

Meanwhile, expanded reverse circulation exploration drilling continues at Mt Alexander, and additional diamond drilling is scheduled for the rest of 2023, testing lithium pegmatites across 15km.

For the fiscal year that ended 30 June, IGO reported a 43% increase in revenue of $541.7 million, and profit is up 552% of $591 million.

Australia’s next commodity boom

Speaking of hydrology and the energy sector, our resources expert thinks the Australian resources sector is set to enter a new era based on the world’s transition to carbon-emission-free energy.

It could be an era that paves the way for commodity corporations to make big gains, just like Fortescue Metals when it struck gold — well, iron — the last time around.

James Cooper, trained geologist turned commodities expert, is convinced ‘the gears are in motion for another multi-year boom in commodities’ … and the best part is that Australia and its stocks are in prime position to reap great benefits.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’, right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning