Perth-based mineral producer IGO [ASX:IGO] had a tough day on the ASX, with its share price opening -8.2% lower this morning.

The company has faced intense selling pressure in the past few months as commodity prices and lower sales have weighed on investor sentiment.

In a band-aid ripping move today, IGO released its quarterly performance and announced the closure of its Cosmos Project in WA.

Its shares are currently down -1.75%, trading at $7.56 per share after the market digested the full extent of the quarterly performance.

So, what were the notable updates that made the quarter so bad for IGO?

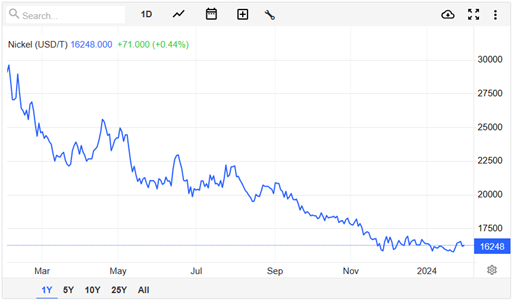

Source: TradingView

IGO quarterly report

IGO’s 2Q24 results were certainly a quarter the company would rather forget.

The company said it remained in a ‘strong financial position’ despite commodity price headwinds.

However, the shorter-term outlook is certainly one of a painful adjustment.

At the core of its challenges have been falling nickel and lithium prices.

Source: TradingEconomics

The price of these battery metals have plummeted in the past 12 months, with lithium prices down almost 90% and nickel around 40% lower.

For IGO, this meant revenues were down 28% QoQ to $179 million for the three months ending 31 December.

These poor revenues were reflected in the lower prices and weaker sales volumes at Nova and Forrestania Projects.

The softer prices also severely affected underlying EBITDA, which fell 58% to $152.8 million compared to the prior quarter.

As a result, the company saw a significant drop in its cash holdings.

IGO’s underlying free cash outflow for the quarter was $96.1 million. That’s compared to $529.7 million free cash inflow in the first quarter.

That is a 118% drop, leading the company to dip into its cash holdings, which fell 38% QoQ.

Thankfully, the company still holds $276 million in net cash and has $720 million in undrawn debt facilities.

Adding to its headaches, the company’s Kwinana Lithium Hydroxide Refinery saw lower-than-hoped output.

The refinery output was around 40% of nameplate output, resulting in 617 tonnes for the quarter.

Due to the poor lithium prices and demand, Kwinana recorded no sales for the quarter.

IGO also reduced its production at Greenbushes by around 20% because of the lower prices.

As a result, IGO revised its Greenbushes production guidance to 1,300–1,000 kt for FY24.

The final slice of bad news squeezed into today was the closure of its Cosmos Project.

IGO’s Cosmos project joins a growing list of WA nickel mines succumbing to high costs and low prices.

The company said that after reviewing its operations, they have decided to move the mine into care and maintenance.

The review found a lower life of mine, likely delays in getting to nameplate capacity and further increases in costs.

IGO’s Managing Director and CEO, Ivan Vella, was honest about the problems today, saying:

‘This is not the outcome anyone at IGO wanted, however we cannot ignore the operational and financial risks involved in continuing to develop Cosmos in the current environment. We still believe there is value in Cosmos, however in this nickel environment we need to be disciplined with our allocation of capital, while retaining our optionality to restart if market conditions improve.’

Nearly 400 jobs will be lost at the project and the company is writing off more than 90% of the $1.3 billion it paid for the mine almost 19 months ago.

So, can IGO turn this mess around?

Outlook for IGO

While painful, the decision to close Cosmos did not come as a surprise for WA miners.

As the prices of battery minerals have continued to fall, many of the bigger players have taken a capital-sensitive approach.

The first signs of this came back in July 2023 when IGO slashed the value of its new nickel mines by 75%.

More recently, Andrew Forrest’s Wyloo Metals shut down, after buying its WA mines just six months prior.

The domino effect from this closure saw BHP shut down its main processing plant.

The sector has seen over a thousand jobs lost in nickel mining as the falling prices weigh on producers.

For IGO, the move — however painful in the short term — could be a hopeful sign for the longer term.

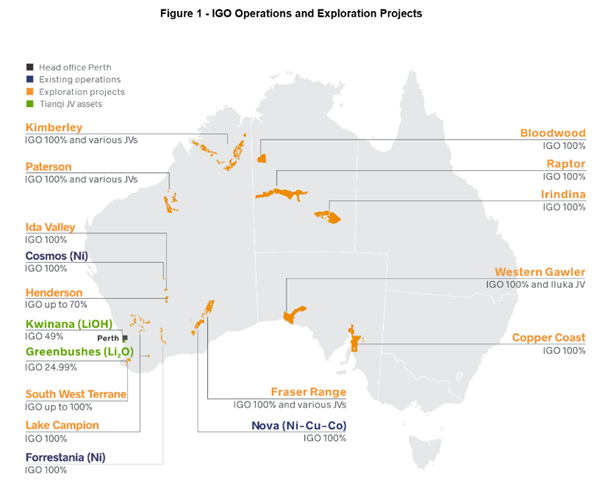

Firstly, the company has a number of hopeful exploration projects ongoing.

Source: IGO

Secondly, this story has been a similar one for many producers in recent years.

These initial moves will likely weigh on the stock in the shorter term, but ultimately, they will strengthen IGO’s position by eliminating drag on its profitability.

It’s still by no means a cherry outlook.

Nickel and Lithium prices will likely take time to recover from these lows.

But for now, IGO still holds other solid assets and has chosen a smart move in cutting a loss-making project.

For investors looking longer term at commodity prices, these troubles could be buying opportunities.

Where are commodity prices going?

The future demand for critical minerals like lithium is a hot topic for debate.

But demand for another critical resource has a much clearer long-term picture.

The movement of economies away from fossil fuels means skyrocketing demand for one metal in particular.

Goldman Sachs dubs it the ‘new oil‘, and it’s critical in our ability to build a new grid and power EVs.

Without it, our hopes of Net Zero and full electrification will fail.

But record demand has not been met with adequate supply.

Geologist James Cooper thinks the time is ripe for investors to consider jumping in.

What’s this critical metal, and what is the opportunity?

Click here to find out more about the electric age’s ‘new oil’.

Regards,

Charlie Ormond

For Fat Tail Daily