Miner and developer of metal assets spanning nickel, copper, cobalt, and, of course, lithium, IGO [ASX:IGO] was full of positivity on Tuesday morning, announcing higher dividends, earnings, and profit propelled by strengthening lithium prices.

And yet the miner’s shareholders were less enthusiastic, taking the IGO share price down around 7% in the early afternoon.

Over the past 52 weeks, IGO’s share price rose 27%, and despite the decline today, it’s gained 10% over the past month.

By comaprison, sector favourites Anson Resources [ASX:ASN] has gained 96% in the past full-year, and Argosy Minerals [ASX:AGY] climbed 92.5% in the year.

Source: TradingView

IGO logs high earnings and profit

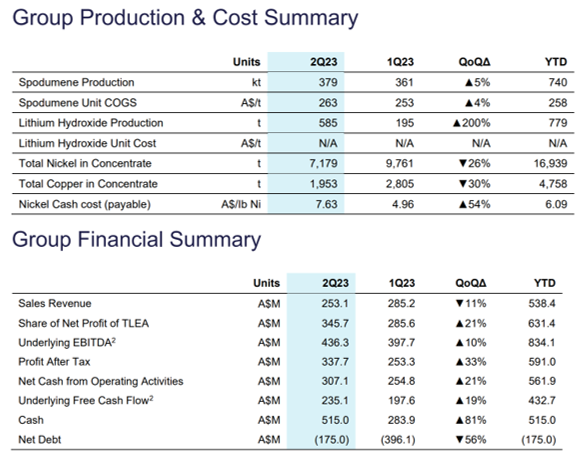

The minerals miner demonstrated a cheerful business performance report for Q2 FY23, brandishing record financial results that boosted shareholder returns.

These were the highlights:

- Underlying EBITDA went up 10% quarter-on-quarter (QoQ) with a total of $436 million

- Net profit after tax (NPAT) also climbed 33% QoQ, totalling $338 million

- Underlying FCF rose 19% QoQ, at the total of $235 million

- Net debt went down 56% QoQ, down to $175 million

- IGO produced 7,179 tonnes nickel in the quarter, a QoQ increase of 25%

- Lithium spodumene production reached 379 thousand tonnes, an increase of 5% QoQ

- A record interim 14 cents fully franked dividend have been declared

IGO stated record production combined with steady costs at Greenbushes were driven by the continued production ramp-up, as well as improved recoveries achieved in the quarter.

IGO has agreed to expand its TLEA lithium business by acquiring Essential Metals for $136 million. TLEA delivered a quarterly dividend of $334 million.

Acting Chief Executive Officer Matt Dusci commented:

‘We have safely delivered another record financial result for the Quarter, with the quality of our business underpinning record earnings and net profit after tax, despite the disruption we experienced at our Nova nickel operation. This has culminated in a record half-year result for IGO, demonstrating the transformational change to the Company. As a result, we are also pleased to announce a record interim fully franked dividend of 14 cents per share, reflecting the strength of the business.

‘Greenbushes recorded another strong quarter of spodumene production, whilst also continuing to deliver on the many growth and optimisation projects which are underway.’

Source: IGO

IGO tips lithium amid nickel’s misfortunes

Mr Dusci said that although the company’s nickel business came into some trouble in the second quarter, when a fire at Nova Power Station impacted production and costs — not helped by weak performance at Forrestania — continued efforts to optimise the segment should mean it can deliver, with tweaked guidance, for the rest of FY23.

Nevertheless, Mr Dusci left shareholders with a promise of continuing strong margins, thanks to improved lithium pricing:

‘A new chemical grade spodumene pricing formula was approved which will be effective from 1 January 2023. Strong lithium prices delivered outstanding margins and enabled the payment of a record $334M dividend to IGO via the TLEA JV.’

The company believes revised lithium spodumene pricing formulas around Greenbushes mean March 2023’s quarterly price will be significantly higher on the previous quarter.

IGO finished the quarter with $515 million cash on hand.

Australia’s boom in commodities, and how to capitalise

Our in-house resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

The next big mining boom is predicted to happen in the next few years, question is, are you ready for it?

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia