Australian battery minerals producer IGO [ASX:IGO] has boldly appointed Ivan Vella as its CEO and managing director.

This decision comes after details of Vella’s unexpected departure from Rio Tinto [ASX:RIO], rattling investor confidence. Details were scant, but Rio Tinto said the dismissal was due to a breach of protocol in handling confidential information.

Shareholders have reacted poorly today, with the shares down by -2.92% to $8.48 per share. IGO has been under pressure lately as low lithium prices and operational issues have weighed on sentiment.

Year-to-date, IGO’s stock has lost almost -44% of its value, bringing its market cap to just $6.43 billion. This highlights the financial hurdles IGO faces in the coming year.

Let’s explore if today’s move was brave or foolhardy for the company.

Source: TradingView

No mal-intent claims CEO

Despite the controversy around his departure from Rio Tinto, IGO stand firmly behind its decision to appoint Vella.

IGO has faced difficulties since the sudden passing of its previous CEO, Peter Bradford, in October last year.

The company selected Vella in June, expecting a smooth transition from his role at Rio Tinto. However, on 15 November, Reuters reporters got an internal Rio Tinto email stating that Vella had been dismissed early.

‘The first stage of our external investigation has concluded that Ivan failed to maintain the standards expected of him relating to this topic,’ explained the internal email.

While the details were light, Rio Tinto has confirmed that it has ‘not identified and information has been compromised.’

Despite this, IGO’s board were confident in Vella’s character and professionalism.

Vella, acknowledging his accountability for the policy breach, emphasised that no information leaked due to his actions. He went on to say:

‘l regret the events that led to my early departure from Rio Tinto but, having been passionately dedicated to Rio Tinto for over 20 years of my life, I can confirm that there was no mal-intent. I am now very excited to be joining the IGO team and working together to deliver the full potential of IGO’s purpose.’

IGO’s decision comes at a critical time. The company has been grappling with depressed lithium prices and operational challenges.

They faced a write-down of nearly $1 billion in FY23, due to escalating capital costs at its Cosmos nickel operations in WA.

Additionally, its Kwinana lithium hydroxide refinery joint venture with Tianqi Lithium faces technical issues, delaying production.

IGO also missed nickel production guidance in its last update. The company has struggled to recover from a fire at its Nova nickel-copper-cobalt mine’s power plant in December 2022.

So with all of these operational issues, what’s next for the company?

Outlook for IGO

Mr Vella’s role in the short term is critical for IGO, especially considering the challenges the company faces.

His experience at Rio Tinto, spanning over two decades, could bring valuable insights and strategies to navigate IGO.

His immediate tasks would involve addressing the technical issues at the Kwinana refinery, managing the costs at Cosmos nickel operations, and restoring investor confidence.

IGO’s board has kept its conviction in Vella, and have confidence in his ‘character, integrity and professionalism’.

However, the risk to IGO here is a distracted CEO and board at a time when the company desperately needs leadership.

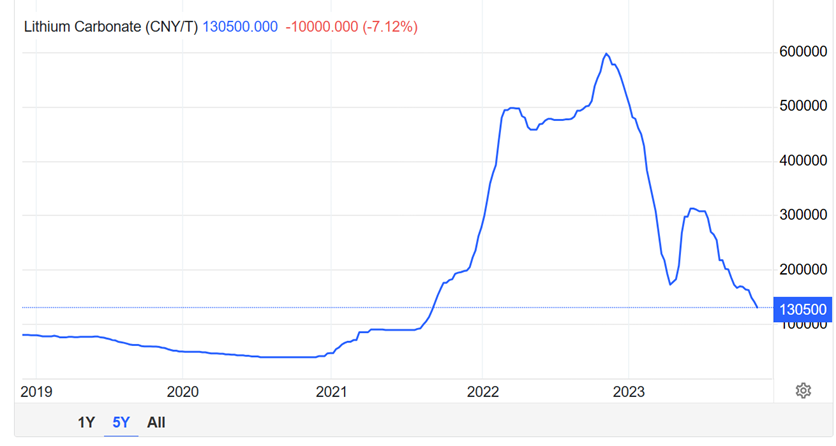

This year has faced falling lithium carbonate prices as China’s economic headwinds continue.

Source: Trading Economics

The EV market usually restocks lithium inventory in this quarter, but high inventories from old Chinese subsidies mean prices look to remain muted in the short term.

Vella will need to prove his value in the coming year for IGO to overcome these hurdles.

Lithium comeback-kids

Just because lithium prices are down doesn’t mean there isn’t a huge opportunity in the space.

The future will rely on battery metals and battery tech, and lithium is at the heart of it.

Are you ready to look into an investment strategy in the lithium market?

Editor Ryan Dinse has made a special report where he unveils a smarter, often overlooked approach that is essential for your portfolio.

The old tactics that brought gains in 2021 and 2022 are outdated. Discover the smart way to invest in lithium in 2023 and beyond.

In the free report, Ryan will outline three lithium companies he thinks could make a comeback with lithium.

Click here to learn how to access the free report and start your lithium accumulation phase.

Regards,

Charlie Ormond

For Fat Tail Daily