Two things I’m thinking about today…

1) All year you and I have been on a mission.

It’s to discover if now is the time to be upping your exposure to risk assets, or dialling it down.

I put my stake in the ground ages ago: get bullish!

It’s working. For example, the current average gain for my Small Cap Systems service is over 40%.

There’s been a few big winners lately.

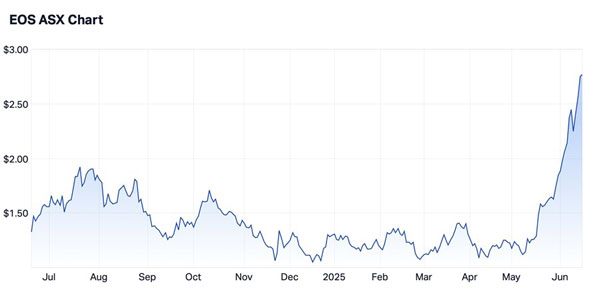

One of those is a stock called Electric Optic Systems ($EOS). We got the first trigger for this back in December. It didn’t quite fire. The second trigger came in May.

Look at her go lately…

| |

| Source: Market Index |

Now, that’s fun.

Could there be more action like this? I don’t see why not.

Of course, they don’t all go gangbusters like this, and I got whacked the other week on a different idea.

Them’s the breaks, sometimes. Overall, 2025 has been a ripper so far.

And the markets are rumbling in more ways than one.

The Australian reports this morning that non bank firm Pepper Money ($PPM) is up for sale.

This is not the first rodeo on this idea. The same thing went around last year.

Apparently, the sticking point is the price that Pepper’s majority owner – a private equity group – wants.

They can (arguably) afford to be patient. Pepper is a profitable business. That said, private equity generally liked to close out a deal sooner rather than later.

You and I care because its just another example of how much corporate activity is going on right now. Last year three of my recommendations were taken over.

The trend continues.

There are buyouts and deals going on all over the place. Another example is the bidding feud over gambling small cap Pointsbet ($PBH).

Then there’s the transactions happening in the gold space.

This is what you want as an investor. A potential bid on your stock from a suitor adds another compelling element to any investment case.

Of course, you can never guarantee something like this will happen.

In the case of Pepper, you could have waited for years for something to happen. It’s been ‘cheap’ and unloved for a long time.

Bids, mergers, takeovers…you name it…it all adds up to improving liquidity and confidence. Now we have a few more IPOs coming to market.

You do have to be in it to win it. Don’t wait around. One idea comes via my colleagues over at Strategic Intelligence.

They too see untapped opportunity…in America’s heartland no less, so tariffs and trade are no issue. Check it out here.

2) If you need a bit more evidence that companies are becoming more aggressive, look no further than Cedar Woods Properties ($CWP).

I flagged this as a good buy back on May 1. It’s up about 10% since.

What news this merry morning?

CWP announce they’re going to buy land in Melbourne, with a price tag of $50 million. They’re buying off a private vendor. Ka-ching!

CWP will eventually put 300 apartments there. I see this as a shrewd move.

I’ve followed CWP for a long time. They were buying land in Perth when it was down in the dumps before 2020.

Now Perth is booming. Melbourne’s real estate market has slumped recently.

Property mavens call this type of move “countercyclical”. In the share market we’d call it contrarian.

A developer like CWP operates on long lead times. These apartments won’t show up as earnings for years. That’s a bit too far away to juice the stock now.

But again, it shows the economic and market wheels are turning faster and faster.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

S&P 500

| |

| Source: Tradingview |

We all know that feeling right at the highest point of the roller coaster.

You aren’t moving, but your heart is in your mouth and the feeling of expectation has your heart racing.

That’s pretty much how I feel looking at the S&P 500.

But the funny thing is the daily, weekly, and monthly trends are all still pointing up!

A technical analyst relies on the chart because they have experienced enough times where their gut feeling just turned out to be indigestion.

Gut feeling isn’t a trading strategy, but many years watching markets has me wary of what comes next.

The only clear sign I have is the fact the price of the S&P 500 remains close to the sell zone of the recent correction.

But we need to see follow through selling before I can become more confident in my view and start taking evasive action.

With Trump leaving the G7 meeting early I can’t help feeling we are close to a bunker busting bomb being dropped and perhaps the assassination of the Ayatollah.

What happens after that is anyone’s guess.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments