Things just got trickier for Philip Lowe and the RBA…

Earlier last week, we saw data suggesting inflation was cooling, but yesterday’s retail data is running hot! A 0.7% jump in monthly retail spending was well above the 0.1% expectation.

Year-on-year sales are up 4.2% too, showcasing just how much more money is flowing. Granted, these stats are still well below the pandemic splurging we saw from households.

The question on everyone’s mind now, though, will be whether this will force the RBA’s hand.

Our chances of seeing another rate rise next week appear to be growing…

However, I believe investors shouldn’t get caught up in this game.

You can understand and work around a high-interest market environment.

For example, I’m sure many advisors would probably tell clients to give up on stocks entirely.

With rates this high, it isn’t hard to secure low-risk yields from other investment instruments. Even a simple term deposit is a pretty secure worry-free investment right now.

But as any seasoned investor will tell you, that’s not really growing your wealth.

You’re just keeping up to speed with inflation at best with this strategy.

Of course, that’s better than potentially going backwards with bad stocks. And considering how volatile the market is right now, that’s not hard to do.

It is possible to prosper in tougher conditions though.

You just need to know where to look…

Be a picky investor

Like I’ve said before, I’m a believer in going long right now.

We’re seeing a lot of exciting and promising stocks being hit hard by macro uncertainty. If you’re able to stomach that risk, buying and holding for a couple of years could be a big money-making move.

But obviously, that’s not going to be the ideal strategy for everyone.

It is a risky approach.

Not to mention the fact that you still need to be picking the right long-term plays.

We’re in the midst of some pretty big shifts, both societally and economically. That is going to result in a lot of winners and losers in terms of stock returns.

But I digress…

Instead, what I suspect is the ideal strategy for most retail investors right now is a bit of a balanced approach. Obviously, everyone’s situation is different, but by being somewhat defensive you can stay ahead of inflation without going all-in in terms of risk.

How do you do that, you may ask?

Well, rather than limit yourself to income from fixed interest solutions, you should take it one step further…

Dividends are where you can potentially make some serious coin right now.

Because while they are certainly riskier than a term deposit, they also have far better yields.

That’s why our own investment director, Greg Canavan, is going all-in on dividends.

Double-digit payouts are up for grabs

See, while many people are familiar with dividends, few truly appreciate how lucrative they can be.

Most people usually associate dividends with large-cap household name companies. The big four banks, for instance, are often covered by the mainstream for their dividend potential.

They get excited about yields in the 3%, 4%, and 5% range.

And if it were 2019, that might be worth getting excited about.

But it’s 2023 and inflation is idling above that range already.

These small yields aren’t worth the risk of owning the stock.

Fortunately, despite what many may think, there are dividend stocks beyond the banks and big miners. A lot more actually…

You just won’t find as much coverage on them, or their potential yields.

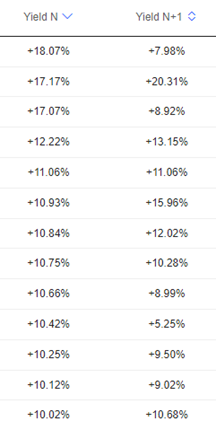

If you go looking though, you can find yields even in the double digits:

|

|

| Source: Market Screener |

These yields, where N represents FY23 and N+1 represents FY24, showcase what’s out there on the ASX. Income that will net you a far bigger return than you’ll ever see from a bank dividend.

But I’ve kept the names of these stocks hidden for two reasons.

First and foremost, we’re not in the business of charity. I can’t, in good conscience, reveal these stocks for free, although I’m sure you could find them if you tried.

More importantly, these aren’t necessarily the best dividend stocks to buy now. You’d want to have secured your investment in these particular stocks months ago.

Which is precisely why, the best dividend stocks in 6, 12, or 24 months’ time will probably be completely different. You must look forward as best you can, and not just at the present.

Of course, that is easier said than done.

But that is what people like Greg do…

He has been digging through dividend stock after dividend stock to find the best of the best.

A task that has led him to five ‘royal’ picks, as he puts it.

Five stocks that just might be the best investment you could make right now.

And if you want those five names, then you need to check out Greg’s full research right here. Because as I hope I’ve made clear, his dividend strategy may be the best game in town right now.

Regards,

|

Ryan Clarkson-Ledward,

For Fat Tail Commodities