Faith in the competency of central banks should have ended when this statement was proven to be completely and utterly wrong:

‘We do not expect significant spillovers from the subprime market to the rest of the economy.’

Chairman Ben Bernanke,

US Federal Reserve, May 2007

Those who trusted Bernanke (the most powerful banker in the world) to know what he was talking about paid a hefty price…some lost their life savings.

In recent times, a trusting public has once more been subjected to central bank pretentiousness and ignorance:

‘We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates.’

Chairman Jerome Powell, US

Federal Reserve Bank, June 2020

‘There will be no interest rate rises until at least 2024.’

RBA Governor Dr Philip Lowe, March 2021

‘Our message to Canadians is that interest rates are very low and they’re going to be there for a long time. If you’ve got a mortgage or if you’re considering making a major purchase, or you’re a business […] you can be confident rates will be low for a long time.’

Governor Tiff Macklem,

Bank of Canada, July 2020

My long-held and publicly expressed view is when the current investment cycle fully rotates from UP to DOWN, trust in central bankers will be completely destroyed.

They have all slavishly followed the same lazy economic growth model — suppressed interest rates, higher levels of debt, and an increased immigration intake.

It’s been nothing more than a massive Ponzi scheme.

The days of suppressed interest rates are over…for now.

Higher levels of debt? Unlikely with rising rates and a more cautious consumer.

Increased immigration? Maybe. But if the economy tanks and unemployment rises, then I’m not so sure.

We are on the cusp of the everything bubble (the greatest and most encompassing asset bubble in history) collapsing.

What comes next is going to make the GFC look like a walk in the park.

Central bankers aren’t going to save you. How can they? They’re the ones who created this mess. They’ve proven beyond a shadow of a doubt that they are absolutely and certifiably clueless.

The only person who can protect your hard-earned capital from what’s coming is…YOU!

The decisions you make BEFORE it all goes pear-shaped will determine your financial destiny.

That might sound a touch dramatic, but I can assure you, it’s not.

Having been through the pre- and post-periods of the US housing bubble, I’ve seen firsthand how lives can be turned upside down in a matter of weeks and months.

Such is my concern over what I believe is coming; I’ve decided to break protocol and share an edited extract from a recent issue of the members-only Gowdie Advisory.

Knowing the secret to long-term wealth creation AND retention has, in my opinion, never been more crucial:

‘The secret to long-term wealth creation

‘The secret to long-term wealth creation is a lifelong commitment to the dull and dreary.

‘Studying market history. Understanding mathematics. And a deep well of patience to draw on.

‘History and maths are the beacons we look to for direction…and patience provides the persistence to stay the course.

‘Our success or failure is determined by how we manage our allocations and emotions around [the] markets [we invest in]. That’s it. Full stop.

‘The golden rule with investment markets is…what the boom giveth, the bust taketh.

‘And, for the average investor, the bust takes far more than what the boom ever gave. Why? Because most come to the party just as last drinks are being served. They get intoxicated on the prospect of the good times that are going to be had. The operative word being…going. Past performance gets extrapolated into the future…what went up 20% last year will go up 20% or more next year and the year after that…ad infinitum.

‘Warning people a trend is about to break (or has broken) is a thankless task. No one wants to be told their paper gains are temporary…not permanent.

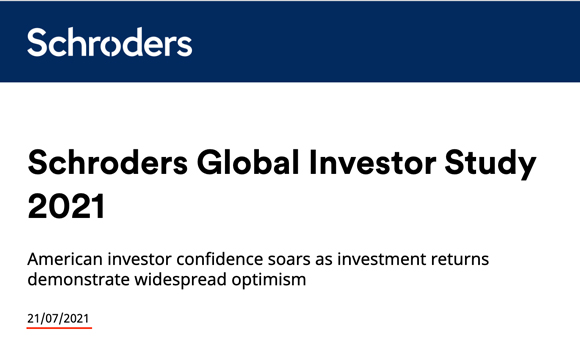

‘Schroders publishes an annual “Global Investor Study”…a comprehensive survey of 23,000 people from 32 different global locations.

‘Mid-way through the 2021 speculative boom in cryptos, meme stocks, IPOs, and loss-making tech stocks…confidence and optimism were riding high…

|

|

|

Source: Schroders |

‘The findings of the survey were consistent with what happens in every boom (emphasis added):

“Investors predict even higher returns from their investments than previous years.

“On average, people expect the annual return from investment over the next five years to be 11.3%.”

‘With each passing year — and the bubble still increasing in size — investor expectations of future returns rise in tandem.

|

|

|

Source: Schroders |

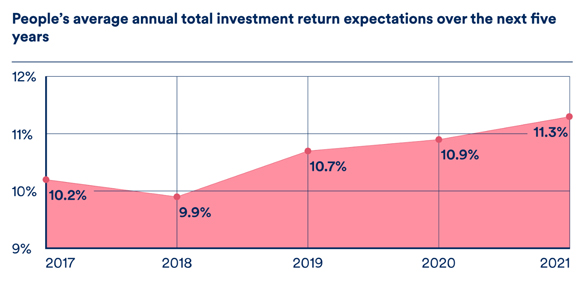

‘The expected return of 11.3% per annum for the next five years is the survey average.

‘When divided into age groups, it’s no surprise younger investors have higher expectations than the cohort of “vintage” investors.

‘Those in the 71-plus age group are a tad more conservative in their outlooks…but, even those who’ve been through a cycle or two and should know better, are still expecting to get 9% per annum on their money over the next five years.

|

|

|

Source: Schroders |

‘Imagine this…all 23,000 survey participants are gathered into one stadium.

‘A hush tone comes over the crowd as a lone voice comes on stage.

‘The crazy/brave soul has one simple message…“You lot are dreaming. If you get zero on your money in the next five years, count yourselves lucky.”

‘The smugness and surety that comes from the embrace of groupthink, would bring forth howls of derision…the sole voice of mathematical reason and historical context would exit stage left to the guffaws of the 23,000 strong crowd.

‘Some simple maths

‘In the cold light of day, away from the glare and emotion of our imagined stadium, we have to ask, just how valid is the average expectation of an 11.3% per annum return over the next five years?

‘Is it based on maths, history, or simply an extrapolation of what has been, will continue to be so…but only better?

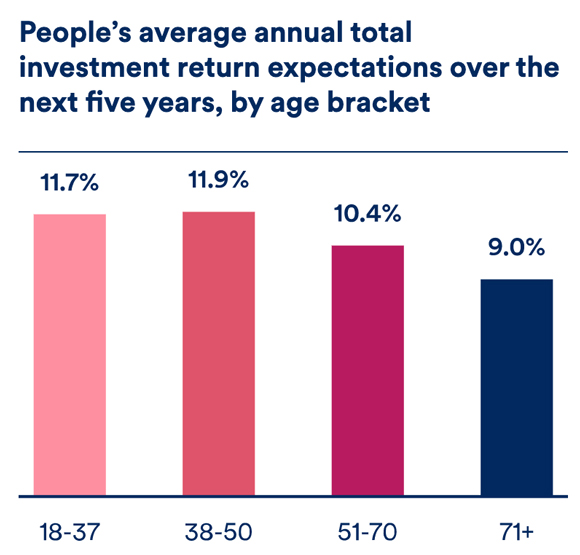

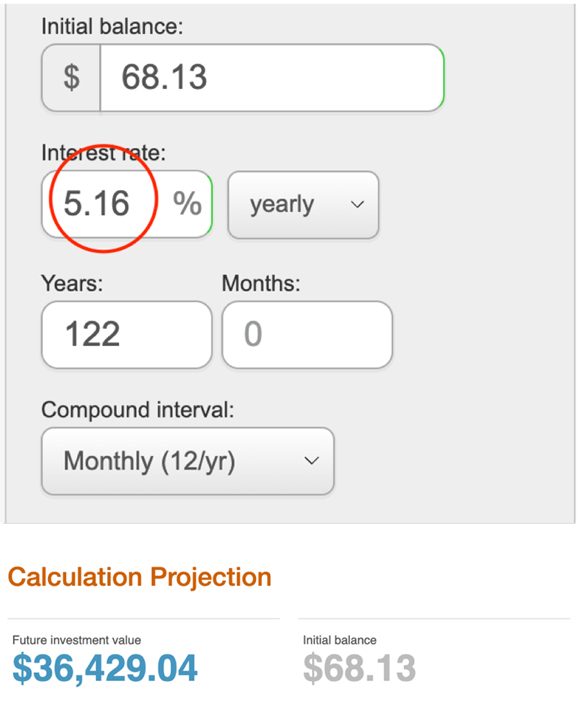

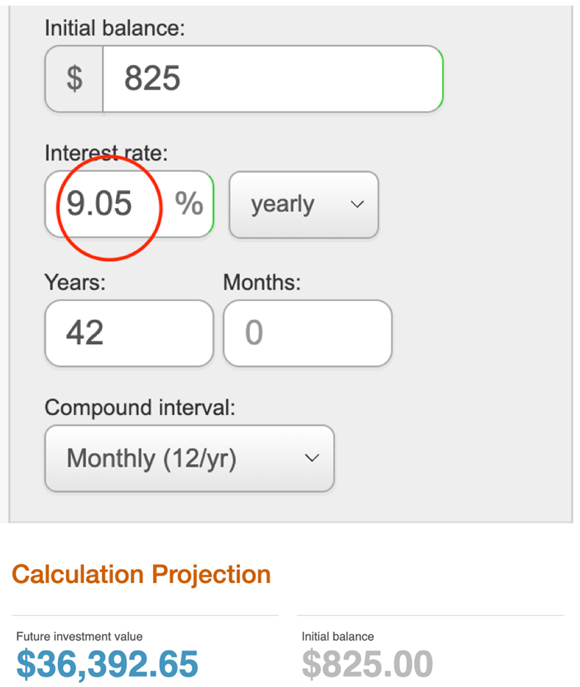

‘Over the very long term — from January 1900 to December 2021 — the Dow Jones has validated the industry mantra of “in the long term, share markets always go up”.

|

|

|

Source: Fed Prime Rate |

‘The 122-year annual compound growth rate of the Dow has been…5.16% per annum.

|

|

|

Source: The Calculator Site |

‘Add in an average dividend payout (which over the decades has ranged from 6%-plus to as low as 1%) of say 3%-plus, total annual return (before any product fees are deducted) over this 122-year period is in the ballpark of 8.5% to 9% per annum.

‘Using the very long-term annual return as our starting point, we can conclude the expected 11.3% per annum is (well) above the average.

‘If we slice the 122-year period into different segments, a clearer picture emerges to explain why today’s investing cohort is so positively positive.

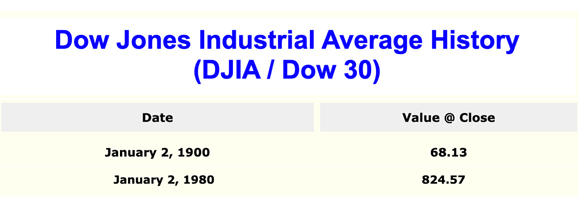

‘The 80-year period from Jan 1900 to Jan 1980 provides a totally different picture of compound returns:

|

|

|

Source: Fed Prime Rate |

‘The annual compound return over this period was…a mere 3.17%.

‘Add in an annual dividend of 3%-plus and total return was around 6.5%-plus per annum…a little over half the rate today’s investors are expecting:

|

|

|

Source: The Calculator Site |

‘Why did I choose 1980?

‘From the very early 1980s onwards, interest rates started to fall; debt levels began to rise, and the Fed commenced its forays into market price intervention.

‘With hindsight, these three factors turbo-charged returns…well beyond anything investors had experienced in previous decades.

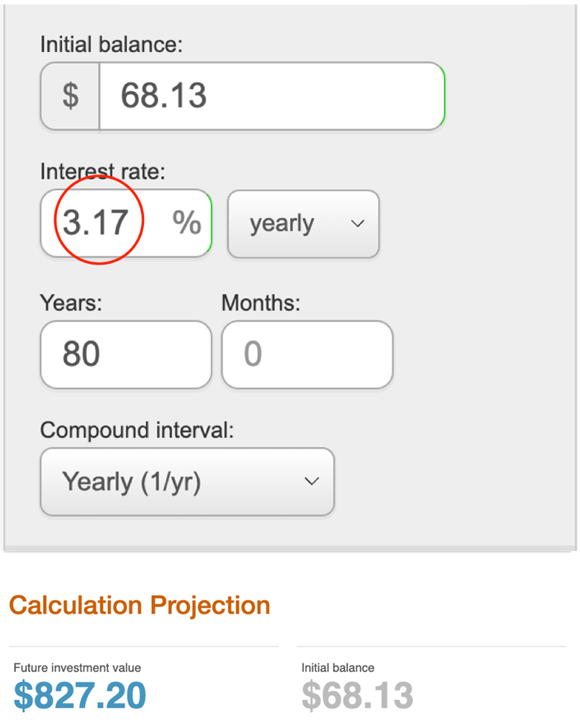

‘During this 42-year period, the Dow compounded at an impressive annual rate of 9.05% per annum PLUS dividends (which over this period have been less than 2% per annum)…total annual return of 11%-plus per annum (before product and adviser fees):

|

|

|

Source: The Calculator Site |

‘This four-decade period of exceptional growth (compared to the very long-term average) is the one ALL of us have grown up with…this has conditioned us to believe this level of performance is normal.

‘But, when put into historical context, it is far from normal.

‘This performance abnormality has been a product of actions that are without historical peer:

- ‘Suppression of interest rates to the lowest level ever recorded in history

- ‘The accumulation of the greatest debt load in history

- ‘A level of sustained intervention in the price discovery process without historical precedent.

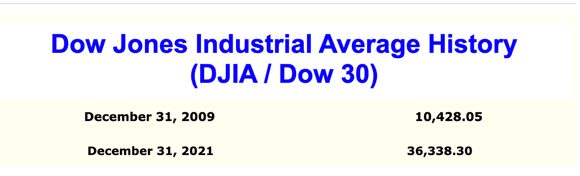

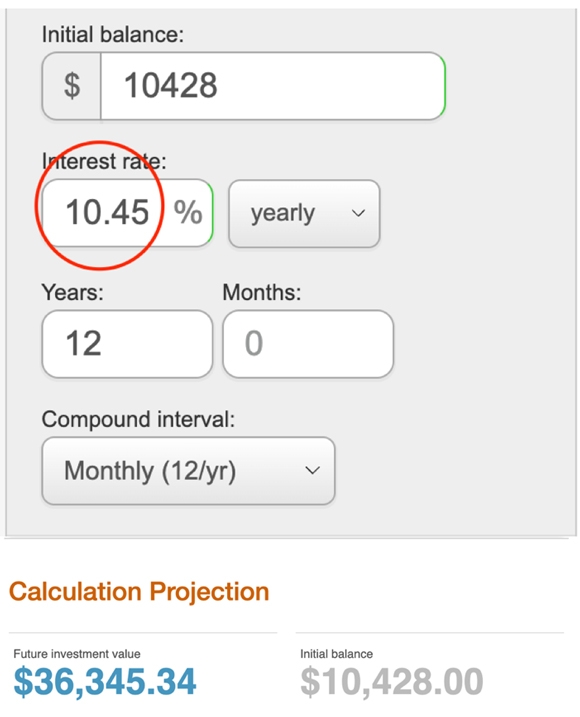

‘The effect of these history-making (for all the wrong reasons) factors is evident in the post-GFC performance of the Dow Jones Index:

|

|

|

Source: Fed Prime Rate |

|

|

|

Source: The Calculator Site |

‘The annual compound return of 10.45% per annum is more than three times the 1900 to 1980 level of return.

‘Add in dividends, it rounds out the post-GFC total annual return to 12%-plus per annum.

‘Which just so happens to coincide with investor expectations…funny that!

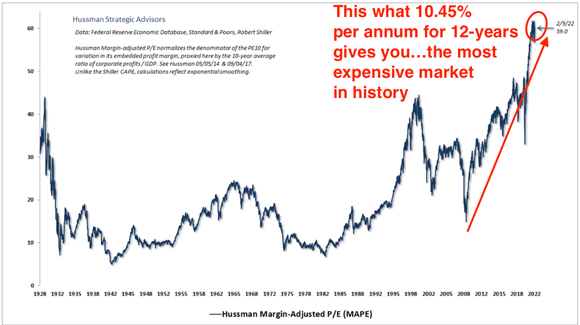

‘If we use John Hussman’s Margin-Adjusted PE model as an historical guide on value, this is what 10.45% per annum growth over a 12-year period buys you…THE MOST EXPENSIVE MARKET IN HISTORY:

|

|

|

Source: Hussman Strategic Advisors |

‘In mid-2021, investor expectations were clearly not grounded in historical context or maths.

‘They expect “THE MOST EXPENSIVE (AND MOST MANIPULATED) MARKET IN HISTORY” to continue rising at this rate for another five years? I find that extraordinary.

‘The Schroders survey was a reflection of prevailing social mood.

‘Which, in itself, is an excellent predictor of what the future is likely to hold…what tends to happen is the complete opposite of what the group thinks.

‘What’s past is prologue

‘To quote from William Shakespeare’s play The Tempest:

“What’s past is prologue”

‘Wikipedia cites the modern interpretation of Shakespeare’s quote as…history sets the context for the present.

‘Knowing the long and storied history of financial markets gives you context.

‘While the actors and sets may change, the storyline follows a pattern as predictable as a romantic comedy.

‘Every boom has a beginning, middle, and end.

‘From 17th century Tulip Mania to the present-day everything bubble, investor behavioural patterns have never varied…not once.

‘Even the old “it’s different this time” storyline gets an airing with each and every boom.

‘It…is…just…so…predictable.

‘The mapping of hardwired emotional responses is an invaluable resource for any student of long-term wealth creation.

‘Having an appreciation of where we might be in the cycle and knowing what is actually going to happen next (on the upside and downside) is invaluable.

‘And as stated earlier…what comes next is rarely what the majority expect.

‘Mathematics — as shown above — is “dull and dreary”. Eyes can glaze over. But it is oh-so crucial to long term wealth creation. Some people get maths. And others…well, they’d rather have their glazed over eyes taken out with a spoon than do an equation. I get it. But underneath all the emotions driving markets on a minute by minute, day by day basis, it comes down to numbers, percentages, ratios, multiples, and knowing how averages have been calculated.

‘In 2007, I was the lone voice…but to a much smaller audience.

‘I’ve witnessed firsthand how an ignorance of basic maths cost people their life savings.

‘In 2007, I used this very example to explain to a prospective client the perils of gearing (margin lending) in a booming market.

‘Starting position:

‘Investor equity — $100k

‘Margin loan — $100k

‘Total Initial Investment — $200k

‘Here’s the very simple maths if the market falls 50%…reducing the total initial investment from $200k to $100k.

‘Finishing position:

‘Margin loan — $100k

‘Total Investment — $100k

‘End result…investor equity gets wiped out.

‘If the investor equity was made up of their lifesavings (money in the bank and superannuation) AND the equity in the home they spent their entire working life paying off, then, you have lost everything you’ve spent your life accumulating!

‘That’s exactly what happened to clients of Storm Financial.

‘Do you think people could be told this before it happened? No way. Why did the mental shutters go up? Because the All Ords had been pumping out 20%-plus per annum returns for three years. What had been, would continue to be so. No amount of reason (and, in one particular case, pleading) could change people’s minds.

‘The failure to understand basic maths and appreciate market history (that 50% falls are not without precedent) cost people dearly…not just financially, but emotionally…can you imagine losing everything you owned?

‘Experience tells me we’re in for a repeat of this in the coming months/years.

‘History, maths, and investor sentiment provide valuable reference sources to assist us in making reasoned assessments on where we might be at in the cycle.

‘Long-term wealth creation AND retention is the product of many factors…and getting caught up with the mob is not one of them.’

There has never been a more important time to question the assumptions you have about future market performance…will a Roaring Twenties-type market continue, or are we headed into a 1930s-style economic situation?

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia