Today I want to show you a little trick I use that can help to uncover hidden investment opportunities.

When I show you it, you’ll kick yourself for not thinking of it yourself!

Then, I’ll show you two unusual trends I found using this tool. They could spur some great investing ideas for you.

As I said yesterday, there’s opportunity in the flux of change.

And while I hope that we’re over the worst of the pandemic — and thank God Australia seems to have mostly dodged a bullet so far — there’s no question ordinary life will be different than it was before.

The flip side to the opportunities, is it also means there are investments I’m happy to steer clear of too.

For example, the ‘big banks’ are one area I’m starting to see people tout as ‘cheap’.

That’s a trap as far as I’m concerned. They fail to notice the immense change going on beneath the surface, led by a revolution in fintech. But that’s a topic for another day.

The point is, as I said yesterday, there will be both big winners and big losers that come out of this tumultuous time.

It’s one for the stock pickers, that’s for sure.

With all that in mind, let’s get stuck into how this free tool can help you pinpoint areas of great change…

The tool that shows you what the world is thinking

Today, you don’t ‘search’ for something on the internet, you ‘Google’ it.

It seems the internet giant always seems to know how to find exactly what you’re looking for.

But did you know they share some of this information for free with everyone?

The site is called Google Trends and by using it you can see what the world is searching for. Try it out for yourself.

Type in ‘bitcoin’ for example 😉

You can type in any phrase you like in an area you’re researching and see what the trend in search interest has been in that phrase over a selected amount of time.

You can also sort your results by geography too, which can be handy if you’re looking for something country specific.

Here’s an interesting example that could potentially have snagged you a 33% gain if you’d been awake to it.

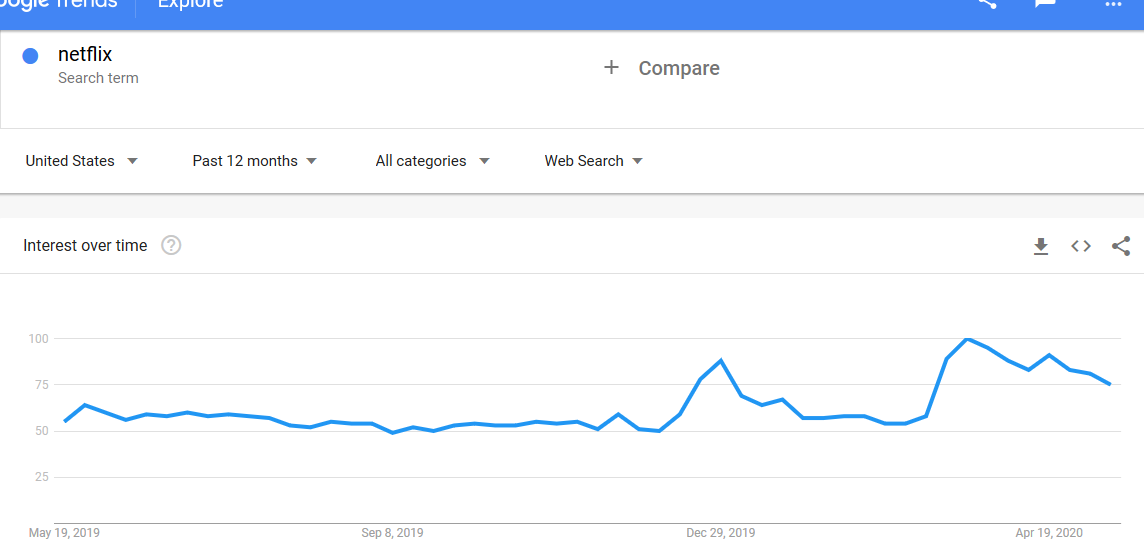

This is the search interest for the word ‘Netflix’ in the US over the past 12 months:

|

|

| Source: Google Trends |

As you can see there was a little spike near Christmas. Perhaps that’s a seasonal trend?

But what’s more interesting is the surge in interest in late February as the COVID-19 crisis developed.

As we now know, as the world went into lockdown, the idea of a TV streaming service became attractive to more and more people looking for stuff to do! And Netflix stock has clearly benefitted.

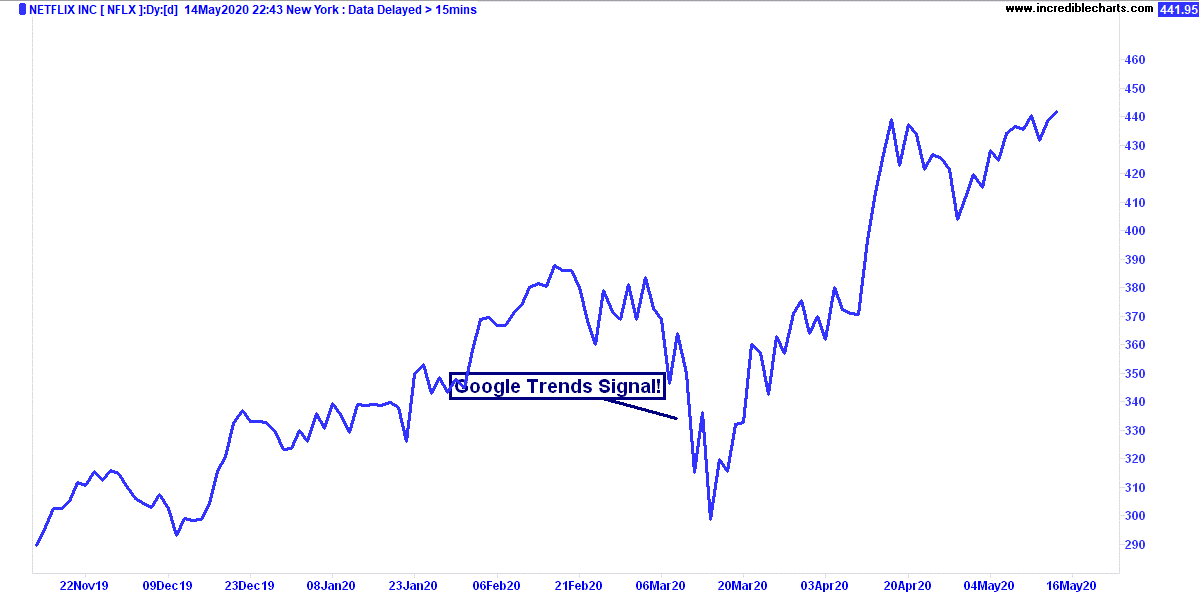

Check out the share price chart of Netflix:

|

|

| Source: Incredible Charts |

As you can see, if you’d been monitoring the ‘Netflix’ searches on Google Trends, you may have been able to assume what was happening and bought in at around US$330 per share two months ago.

Today, Netflix trades at around US$440 per share.

That’s a decent 33% return in just a couple of months.

Anyway, that’s just one example, and the data on Google Trends is certainly not always as clear cut as that.

However, looking for emerging trends here can be a great way to generate new investing ideas to look into.

Here’s two ideas I was looking into recently…

Two recent ‘Google Trends’ signals to get your investing juices flowing

As everyone knows, grandparents love to spoil their grandchildren.

No visit to my mum and dad’s place is complete without a new toy or a lollipop being produced on the way out as a treat for the little ones.

So, it was no surprise to me when I came across the fact that grandparents’ spending on toys has grown particularly fast.

In fact, grandparents account for roughly $2 billion of the $7 billion per annum toy market in the US.

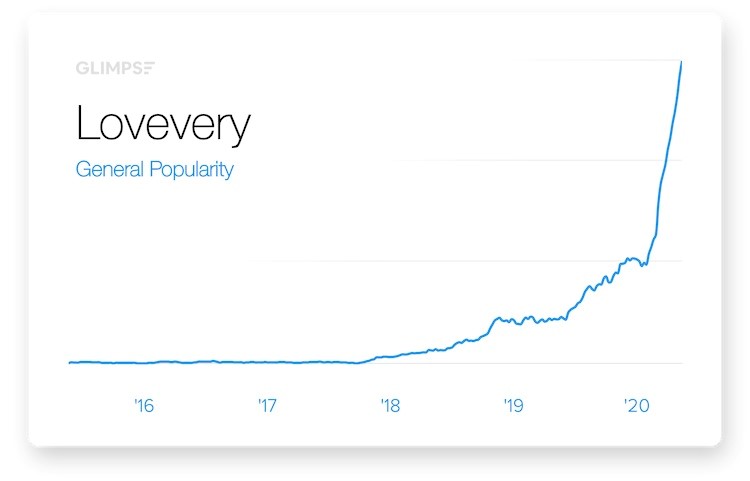

With that in mind, check out the graph for Google Trends searches of a company called ‘Lovevery’.

|

|

| Source: Google Trends |

Lovevery creates educational toys for kids using a unique subscription model.

The toys are targeted by age and the toys ‘transition’ as the child grows older. So, a playmat for an 18-month-old becomes a set of building blocks for a two-year-old.

Anyway, the interesting information from this was the rise in interest in educational toys, the growth of subscription models of business, and the idea of grandparents changing consumer habits…even in areas you might not think of, like toys!

I realise there’s no clear-cut opportunity in that, but that’s the point. Google Trends can help you see major trends, but it’s up to you to put the investing jigsaw together.

Here’s a very topical search term I noticed trending on Google recently.

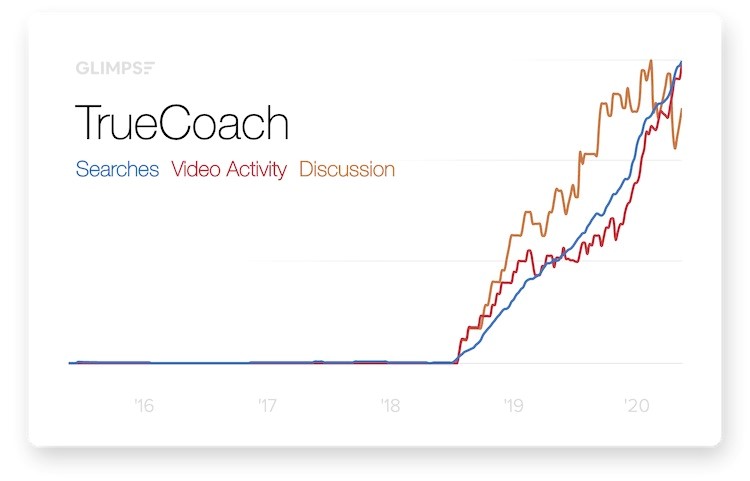

It’s for a product called ‘True Coach’:

|

|

| Source: Google Trends |

You can see three lines here in red, yellow, and blue. That’s because you can also divide the search data by general searches, video searches, and discussion mentions.

As you probably know, gyms and gym equipment were one of the biggest causalities of the pandemic. One of my mates in Melbourne has even decided this week to pack in his gym business and move to warmer climes!

But as I’ve been saying recently, in a state of flux, opportunities emerge. And True Coach is one company that is benefitting from this change.

True Coach provides video software to help personal trainers and gyms run online sessions. An idea tailor-made for the times we live in.

And the stats bear it out.

The site saw 1.7 million visits last month, double the traffic it saw earlier in the year, which is a clear signal there’s opportunity here for investors.

Are there any other ideas out there like that you can invest in?

Then, at a deeper level, what does such a boon in online communication mean for 5G and telecom infrastructure stocks?

Expanding your toolbox

Today, I just wanted to give you a flavour for how you can use this information.

It’s actually a really great way to find new investing ideas. Sometimes these ideas are direct, sometimes they’re more nuanced.

But whatever you use it for, Google Trends can be a great addition to your investing toolbox.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: In this free report, Money Morning analyst Lachlann Tierney reveals two assets set to benefit as the ‘corona crisis’ worsens. Click here to claim your copy today.

Comments