A few weeks ago, I interviewed Global Forecaster’s David Murrin to discuss his analysis of the Kondratieff long wave and the prospect of war at the peak of this current cycle.

If you didn’t catch it, you can watch it here.

David Murrin is one of the smartest men I’ve had the pleasure of meeting.

He’s a renowned global forecaster, author, and entrepreneur, known for his groundbreaking work in predicting and analysing major world events. With a career spanning over three decades, Murrin has earned a reputation as one of the most astute and accurate forecasters of our time.

Murrin’s best-known work is his seminal book Breaking the Code of History, which was published in 2011 and became an instant classic.

He’s also author of Red Lightening — How the West lost World War III to China in 2025.

It’s an insightful title considering 2025 will be signalling the forthcoming peak of both the real estate cycle and the Kondratieff wave, which is exactly when we would expect conflicts to escalate.

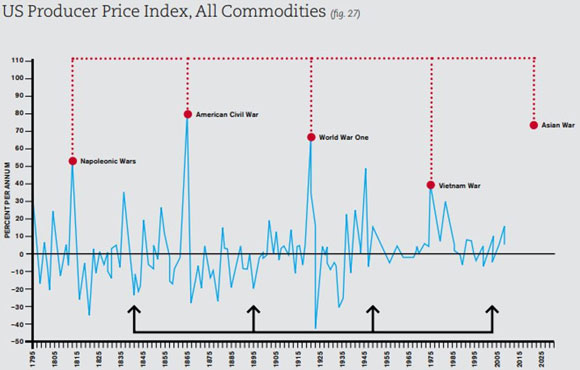

Kondratieff long waves (K-waves) are long economic cycles related to the demand for commodities and the technology they fuel.

Steam and railways, steel and heavy engineering, oil, electricity, the automobile, information and telecommunications, robotics, and so forth.

They can be traced back to the 16th/17th century.

They last, on average, around 50–60 years.

Roughly 25 years of rising commodity prices, followed by 25 years down.

But the peak of the K-wave is also strongly correlated with war.

Great powers fighting to gain access to land and its raw materials…just as we’re seeing now with the global trade wars.

Kondratieff himself noted:

‘[I]t is during the period of the rise of the long waves, i.e., during the period of high tension in the expansion of economic forces, that, as a rule the most disastrous and extensive wars and resolutions occur.’

Major struggles happen on the upswing and peak of each Kondratieff wave.

- 1803–15: The Napoleonic Wars — featuring trade embargoes, blockades, and formation of international alliances.

- 1858: The Battle of Plassey to establish British control over India — its commodities and control of its trading routes.

- 1861–65: The American Civil War — slavery being driven by demand for cotton and other agricultural commodities.

- 1914–18: First World War — territorial claims over territories in Africa and parts of Asia, for raw materials.

- 1961–75: Vietnam War — a power struggle between the US, the Soviet Union, and China.

The peak of the current K-waveis in around 5–6 years’ time.

The graph from below put together by David Murrin charts it nicely, with an apt addition forecasting an Asian war:

|

|

| Source: Global Forecaster — David Murrin |

The lead up promises to be both bullish and volatile.

Following on from our first interview, I reached out to subscribers of Cycles, Trends & Forecasts and invited them to submit questions for an exclusive Q&A session with David.

The response was huge, and I think you’ll find the content extremely interesting.

We discussed in brief some events that have taken place in recent weeks, including the discovery of Chinese spy balloons over the US.

Also included is:

- More analysis on the Kondratieff wave and timing of the peak.

- We uncover some of the tools David uses to conduct his analysis.

- I glean further details on David’s opinions on where investors should be putting their money whilst facing the prospect of war at the end of this cycle.

- We also dig into David’s views on the real estate market — to answer the question of what would happen to prices if war were to occur.

- And we take a deep dive into the role Australia would take in any forthcoming conflict.

All this and much more!

It’s a pleasure to also bring this content to subscribers of Land Cycle Investor. I hope you enjoy the chat as much as I did.

Click on the video below to watch the second interview with David Murrin now.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments