1) Looky here, iron ore is back to US$150 a tonne. Perhaps you’re thinking what I am? Something doesn’t square here.

On one hand, we’re told that the Chinese property market is teetering on a precipice. On the other, iron ore is up 75% since the low it hit late last year.

And it’s looked solid throughout the wild swings of 2022.

Chinese property makes up 42% of Chinese steel demand. If they’re not building houses, where is all this steel going?

Your guess is as good as mine. Perhaps all they need to do is ship it to Europe.

Look at the parabolic rise in EU steel prices below:

|

|

| Source: Bloomberg |

You can peg the recent lurch up on the EU decision to ban Russian steel and iron ore.

Hmm.

There is a kind of madness to this.

The EU is hurting its domestic market by pushing up steel costs. Think of its auto industry alone!

But the overall effect on Russia is unclear.

Why? Oil and gas are not included in the sanctions.

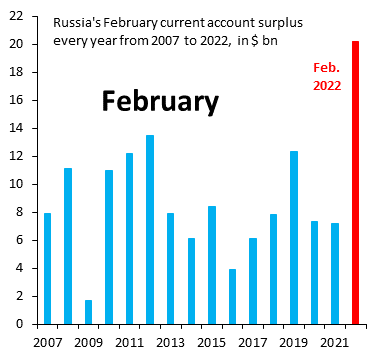

Therefore, Russian energy revenue is booming. You can see that here:

|

|

| Source: Twitter |

I’ll leave the policymaking to those more qualified than I.

As far as you and I are concerned, all we need to note is this commodity boom is driving huge revenue through firms like BHP, South32, and Rio Tinto.

This could drive the Aussie market into new highs the longer it continues.

The Australian delved into BHP specifically over the weekend.

What do we see?

They say if iron ore and coking coal stay at current spot prices, BHP could see its earnings rise 75% next financial year. That’s not all, either.

The recent lift in oil has taken the value of the petroleum demerger with Woodside up by $8 billion.

Altogether, the next BHP dividend due in September could be another doozy.

Don’t be blasé about this, though. I remember a similar scenario in 2021 before iron ore tanked last year. BHP shares got whacked 30%.

Like so much right now, it all depends on the war in Ukraine. A peace deal would likely see some slack come back into the system and, therefore, prices.

For now, Australian miners are minting a fortune. This gives a solid base to the market to build from if this rally can keep going.

2) The above is an example of how difficult it can be to predict the market.

After all, when iron ore tanked last year, who on Earth could predict that a war between Russia and Ukraine would knock two iron ore exporters out of the market?

Certainly not me. That’s why a good trader and investor will rely less on prediction and more on preparation.

In late 2021, it was enough to know which stocks might benefit if — in this case — iron ore rallied up again.

That allowed you to jump on to BHP and Rio at cheaper prices than they are today. I spilled a bit of ink in The Daily Reckoning Australia, trying to highlight that opportunity.

In October last year, I also recommended Rio Tinto for readers of Cycles, Trends and Forecasts. They’ve got a decent capital gain so far (17%) and a juicy dividend ($6 per share) coming in April.

But the sheer size of BHP and Rio means there is only so far they can run before they become fully priced.

The small-cap end of the market gives you a much longer runway. Of course, this longer runway adds a lot more risk because of the huge volatility swings.

It’s a tricky space to navigate, that’s for sure.

Gold expert Brian Chu does a pretty good job at navigating the smaller end of the gold market. If you’re interested in being a little more speculative in your commodity investing, check out his service Strategic Intelligence Australia.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Keen to invest or trade? You need money for that! It’s hard to bank lots of cash relying on wages alone.

History shows most self-made men and women got that way owning their own business.

In my podcast tomorrow, I reveal my favourite book on this topic. You then hear from Stewart Bracken.

He’s a buddy of mine who grew a business over 10 years before a multimillion-dollar exit. Now he advises and invests in start-ups. Tune in tomorrow to discover if a business is for you…