We are clearly on track to enter a global bear market, coupled with a potentially withering recession amidst high inflation.

In short, it looks like the financial system is quite screwed — as well as many businesses and households.

I could have sugar-coated it. But let’s call a spade a spade.

Why is that?

Because recognising that there’s a problem will allow you to get in the right mindset and come up with the right solutions.

Now, I’m not here to revel in doom and gloom. Rather, I want to help steer your mindset so you can increase your chances of winning and avoid making the wrong decisions that many certainly will because emotions get the better of them.

I’m pretty sure you’ve heard from family and friends about how they have lost a lot in their investment portfolio — stocks, derivatives, and cryptos. And some of them are probably lamenting that they didn’t sell when they were ahead.

Those who had made much larger gains on paper, especially with cryptos, are likely to be more inconsolable. My bet is that a good number of these people cut their teeth for the first time in 2018, after that massive crash in Bitcoin [BTC] that brought it down from US$20,000 to around US$3,500.

This is what I want to talk about today.

Market downturns make the best teachers and offer a suitable training ground for successful investors.

Big successes don’t come without setbacks. This is because asset prices can run wild and oftentimes the biggest returns don’t come without prices crashing down to ridiculous levels.

The exception is when you’re dealing with a start-up investment that blazes the trail in its field and hence becomes a unicorn. That is rare, like scoring a hole in one.

So how do you set yourself up to succeed as the markets come crashing down right now?

Understand the drivers of value

In the current markets, everyone is scared of being the last one out. Many sell down without considering the company’s value. In such cases, you could end up buying at a bargain price.

But how do you tell what’s a bargain? You need to know what the company’s value is.

Value comes from the company’s assets — cash, inventory, property/plant/equipment, land, and various projects that are expected to deliver future revenue.

Past profits may give you some indicators of how efficiently the business runs. Economic conditions could change and cause the future profits to vary. Therefore, you may need to look at what are the key economic drivers that affects the way they do business.

While market downturns invariably mean that companies see their business volume and profitability decrease, a well-run company may end up gaining market share as its competitors crumble under the pressure.

And it may be the usual suspects that manage to get ahead in their industry.

Exercising resilience by refusing to join the herd in a panic

The well-known saying that ‘a loss is only on paper until you actually sell’ has stood the test of time.

I know that there are many instances of people losing their shirt by wrongly applying this statement. And this goes back to what I said above. It only applies when you know the key drivers of value and stick with companies that pass the test.

Holding onto a company as its price plummets well below what you paid for is painful. It makes you second-guess yourself as to whether you have made a bad purchase.

In a market downturn when everything is falling, it may not mean you own a bad company. It’s just that people are dumping. You should only start worrying if the company announces some bad news that may affect the company’s longer-term prospects. Otherwise, it may be a great opportunity to accumulate a quality company at a discount to your initial purchases.

Some of your best buys are made when everyone is dumping because the recovery hands you even better returns.

Stacking the odds to your favour now!

It’s important in such markets to focus on what you’re good at and build up your holdings.

Many financial pundits will talk about diversification, but I think this is where you shouldn’t follow their advice.

Remember that in a market crash, everything comes down. This means there are lots of gems selling as if they’re lumps of coal. You should be able to focus your portfolio on these and accumulate.

For me, I prefer gold stocks. It’s done me well for the last decade. This would be the third gold stock bull market for me when it comes around.

And why gold stocks?

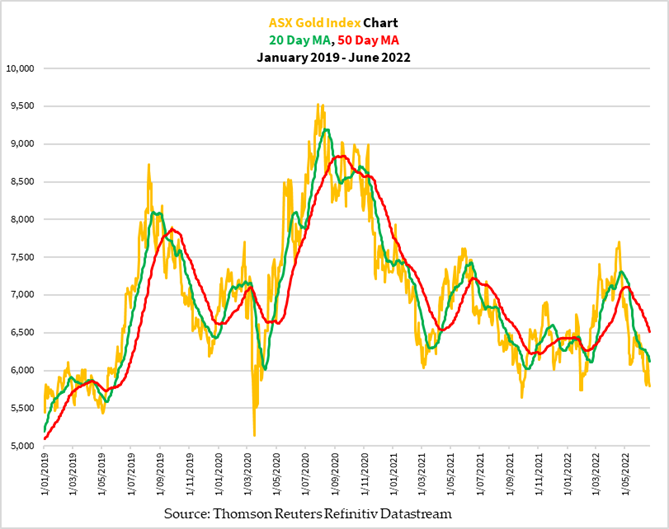

They’ve been falling longer than the rest of the market. You can have a look at the ASX Gold Index [ASX:XGD] since 2019 in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Australian gold stocks have experienced no less than four false rallies since 2021. It’s been disappointing, but I believe that those who held on are more emotionally resilient to handle the coming months than those who invest in other assets.

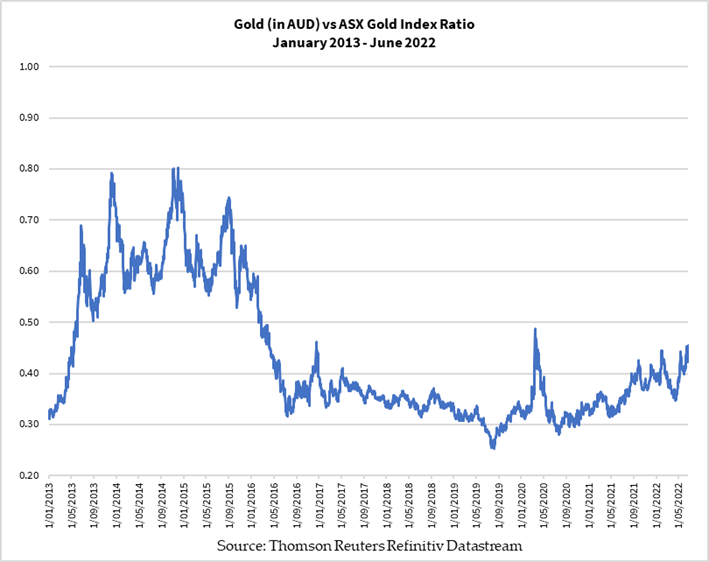

Unbeknownst to the market, gold stocks are setting up for seriously good returns in the future when the conditions are right. I’ve tracked the relative price of gold in Australian dollars against the ASX Gold Index. Here’s a figure showing the ratio between the two since January 2013, just before that withering gold bear market that led to a massive bull market in 2015–16:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

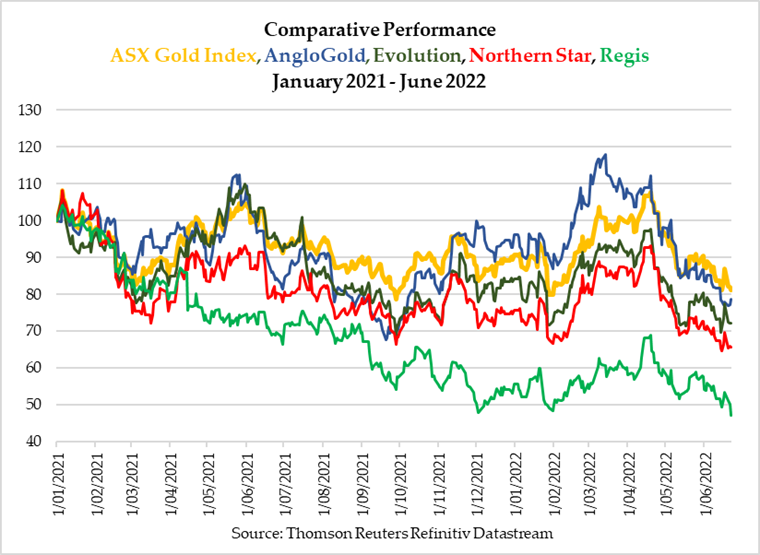

Since September 2020, you can see that gold has been retaining its value better than gold stocks, which is why the ratio is rising. Gold stocks did make a few recoveries but were beaten down and are now trading at increasingly depressed levels. Here’s the relative performance of the ASX Gold Index and four of the largest gold producers since the start of 2021:

|

|

| Source: Market Watch |

As you can see, even the biggest companies are trading 20–50% lower than 18 months ago.

Will gold stocks retreat even more relative to gold such that it is at levels we saw in 2013–14?

I hope not. But if so, that would be a wonderful setup for once-in-a-lifetime gains.

Seizing the golden opportunity

Right now, I see that the central banks are aggressively raising rates and trying to bring down inflation, and the entire financial system.

However, the world is now watching them. There’s no global pandemic nor a war to blame it on something else.

The wizards behind the curtain that is the World Economic Forum, and the central banks are now seen for what they are. It appears they’re behind the geopolitical tension, the push to shift the world to clean energy before the infrastructure is ready, and the corporate wokeism that is dividing the Western world.

They want you to ‘own nothing and be happy’.

They do that by buying low and selling high.

I plan to do the same. The difference is that they can pull the levers to move the markets.

Regardless, I am positioning myself to succeed. Join me on this journey here.

Those who like to trade frequently may also want to augment their successes with our latest offer here.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments