There’s a longstanding belief that government agencies, news outlets, academic institutions, and major corporations act in good faith. These bodies often shape the official narrative of society and guide them in the way they behave.

However, with the internet becoming widespread, almost everyone can access global information. With it, we see competing sources, narratives and viewpoints.

This in turn adds another dimension to how to exert one’s power and influence on the people, being more effective than firing missiles or sending troops on the ground.

Many are starting to realise that their minds are being targeted as the agencies they’ve grown to trust no longer serve them as they used to.

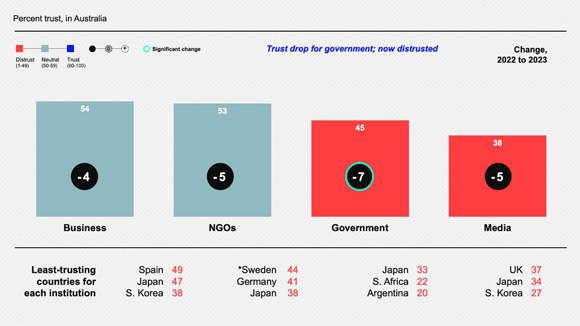

The Edelman Trust Institute published an annual trust barometer. The 2023 study found that the public’s trust in many major institutions continues to fall:

|

|

| Source: Edelman Australia Trust Barometer |

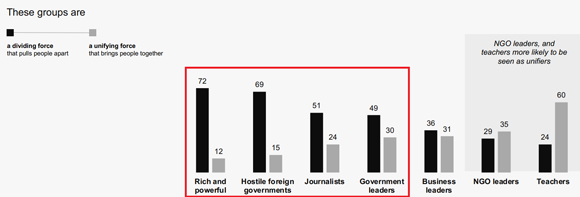

Not only that, but the majority also surveyed identified rich individuals, foreign governments, our own government, and the media as key causes for a divided society:

|

|

| Source: Edelman Australia Trust Barometer |

This finding is damning and is no longer mere fantasy.

Let’s look at some strategies these institutions adopt to transform society.

Institutions driving societal change through economic activism

In 2017, the CEO of the world’s largest fund manager, BlackRock’s Larry Fink, said that he believes in forcing companies to behave in accordance with the various globalist agendas including politics, climate change, social ideology, sexuality and consumer preferences.

You can check what he said in a DealBook forum here.

Six years later, you’re seeing exactly what he meant. Under the guise of Environmental, Social and Governance (ESG) and the Corporate Equality Index (CEI), companies feel compelled to toe the line to attract investments from managed funds that consider these matters in their asset allocation decisions.

In other words, they prioritise pushing an agenda over maximising profits.

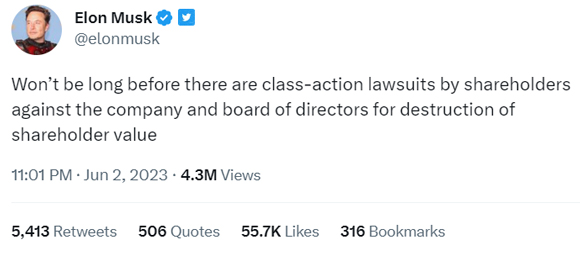

Companies like Anheuser-Busch, The Walt Disney Company, Target and many others have inexplicably embraced these agendas in their marketing and sales campaigns. Consumers responded by rejecting their products and messages, causing them to shed billions of dollars in market value.

Expect the public to turn up the heat if shareholders launch class action lawsuits against the board for breaching fiduciary duty:

|

|

| Source: Twitter (@elonmusk) |

Report the truth, the part truth and anything BUT the whole truth

You’ve seen an overt strategy on how they control the narrative.

Let me show you the subtler ways.

Many breaking stories have a limited life. Much of the public will only focus on them for as long as they’re given coverage.

You’ve seen it politically with the mainstream media’s coverage of the Hunter Biden laptop, the origin of the Wuhan virus outbreak, who was behind the Nord Stream pipeline bombing, and many more.

In the case of economic and financial news, some of the most important data points come from government agencies — such as the US Bureau of Labor Statistics, which releases the non-farm payrolls data, the unemployment rate and the Consumer Price Index (CPI) data on a monthly basis.

The data that are first released is only an estimate, and there’re revisions to these estimates in subsequent months.

You can see how the bureau could manipulate these estimates for political purposes.

Several sources (for example in February 2022) have highlighted that the BLS did this frequently under the Biden Administration.

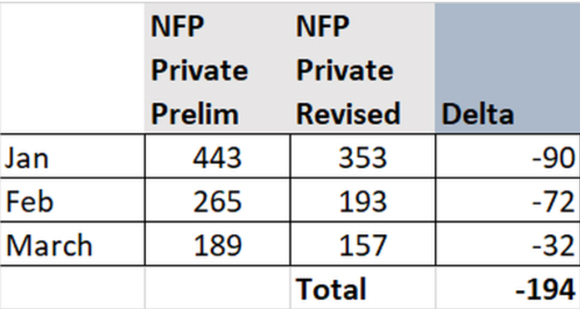

Looking at the April 2023 jobs data (released on 5 May), the BLS reported more job creation than consensus estimates. However, the BLS quietly adjusted the February and March figures downwards.

What happened to the May 2023 jobs data that the BLS released last week?

You guessed it, more downward revisions for previous months, see below:

|

|

| Source: Zerohedge |

Or leave no paper trail!

If you think that’s misleading, consider how some agencies may have taken it a step further and deleted the data afterwards!

Just ask my ex-student, Xin Yin Ooi, who recently took the NSW Department of Health to court where a representative testified that the department doesn’t store the data it used to compile the daily and weekly summary reports!

You can follow her Twitter thread here.

This pertains to cases, hospitalisations, deaths and vaccinations during what’s supposed to be the most severe pandemic in recent history.

The department representative told the NSW Civil and Administrative Tribunal that the data is for administrative purposes, and therefore wasn’t necessary to keep a record afterwards.

The problem is that this data is the basis for formulating health policies!

The fact that no one can access this later to verify it and use it to evaluate policymaking is alarming.

And that’s not the only thing.

The data itself shows a flawed methodology.

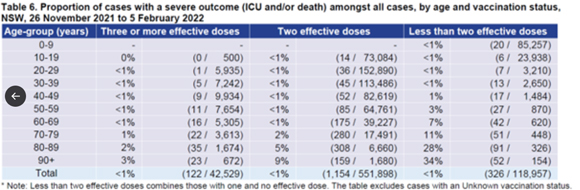

Refer to this table showing the cases of severe virus infection outcomes divided by age and the number of doses taken:

|

|

| Source: Twitter (@realXinOoi) |

Grouping individuals who didn’t take the vaccine with those who took one is quite illogical!

And yet, this isn’t the first time I’ve seen it happen.

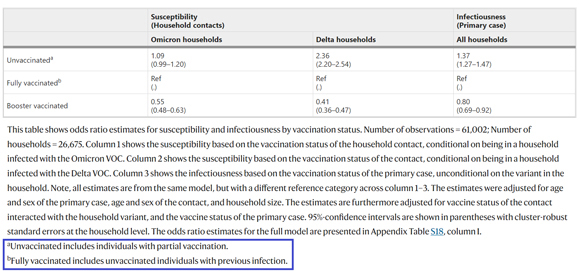

Recall last October I highlighted a table found in a paper published in Nature, one of the world’s top-ranking scientific journals:

|

|

| Source: Nature |

Why did they do this?

I’ll let you be the judge.

Take control of your wealth and well-being

If you’re wondering who you can run to, I’ve a suggestion for you.

Look out for those who matter to you most — family and friends.

First, protect your wealth against a rigged and increasingly corrupt system.

Second, start adopting a healthy scepticism with the information you receive.

Read the fine print and entertain a dissenting perspective from various sources. Then reconcile for yourself what makes sense.

Neither the mainstream nor alternative media hold the monopoly to the truth. They’ll have their inherent biases.

If you want to allocate some of your wealth in honest money — gold and precious metals investments — you can join me in The Australian Gold Report.

During these turbulent times, we’re anchored in the relative safety of the price of gold. Meanwhile, our core gold stock portfolio offers upside potential as the gold bull market gains traction.

To get news and political commentary that you won’t find anywhere else, check out Jim Rickards’ Strategic Intelligence Australia. Jim’s experience as an insider in various US Government agencies and top financial institutions will help you develop a discerning eye on what’s happening around you.

The world’s entering an unprecedented period of upheaval and change.

Your success through this depends on a sound mind and a solid portfolio.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia