My dad, who was an economist for the Argentinean government, loved what’s sometimes referred to as the ‘real economy’. It’s something he’s passed onto me, along with his passion for economics.

Almost every night after dinner, he would spend hours poring over reports on wheat, mining, manufacturing…

He would look at what the country was producing, the projections, and how innovation helped improve competition in the global market.

According to Jim Rickards, the recent market crash we’ve witnessed is just the beginning. A total financial collapse might be next. Learn how to protect your savings and investments before it’s too late. Download your free report now.

The real economy is taking a beating from COVID-19

While until now we have had to rely on things like queues at Centrelink to assess the impact, some of the economic data is starting to come in.

Last Friday the US Federal Reserve published their monthly Industrial Production and Capacity Utilization index.

Total industrial production for April fell by 11.2%, the most in the report’s 101-year history. Manufacturing dropped by 13.7% in April. Mining also decreased by a record 6.1%.

Capacity utilisation for the industrial sector, which measures the difference between actual output produced of goods and services and potential output that could be produced at full capacity, dropped to 64.9%.

Unemployment figures were also dire. US unemployment increased to 14.7% from 4.4% in April, with the US losing 20.5 million jobs as factories and businesses shut during the pandemic.

For Australia, unemployment figures aren’t looking great either.

In one month, from March to April this year, close to 600,000 people lost their jobs.

According to official figures, close to one in five people are either unemployed or want to work more hours but can’t.

Figures would be a lot worse if it wasn’t for JobKeeper. The $6.3 million people enrolled in JobKeeper are considered employed, no matter if they are working or not.

The real economy isn’t producing

Figures from Roy Morgan though, are much higher, with close to one in four people either unemployed or underemployed.

As they noted recently:

‘Australians will be asking, how can the ABS say 594,000 Australians have lost their jobs in April but only 104,000 become unemployed? This is because the ABS claim 490,000 people left the workforce in April. i.e. the ABS claims these people lost their jobs and were not then looking for work and available to start work during the reference week. These workers are unemployed — NOT out of the workforce.

‘So the workforce size in April should match the March estimate of 66%. The real ABS unemployment estimate for April is closer to 1.35 million (9.8%) — an increase of 4.6% points on March.

‘Combined with the estimated ABS under-employment of 1.82 million (13.7%) this leads to a combined unemployment and under-employment of 3.16 million (23.5%).’

All this data is coming in, yet there doesn’t seem to be any grasp out there of the impact this is having…and what is to come. Instead, there’s the notion that things will spring back to normal in a couple of months, like nothing has happened.

But things have changed.

So far, the only solution we are coming up with is flooding the system with money…lots of it. All to avoid a recession and a collapse of the markets.

We aren’t producing. The whole economy is sustained by the actions of governments and central banks.

I’ve written here before that the coronavirus has expedited a lot of trends, and this includes the trend of money printing and flooding the system with liquidity. It’s something we’ve been doing for years, even when things were ‘good’. All this has increased debt.

And is increasing risk.

Bloomberg reports US zombie companies — companies that don’t earn enough to cover interest payments — are multiplying:

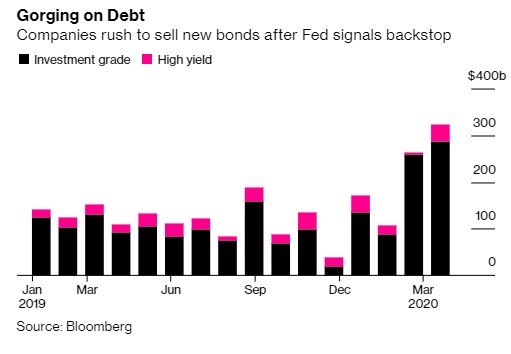

‘As the Federal Reserve pulls out all the stops to bolster credit markets, corporate America is gorging on debt.

‘From Carnival Corp., Marriott International Inc. and Delta Air Lines Inc. to Gap Inc. and Avis Budget Group Inc., many of the companies hardest hit by the coronavirus outbreak have priced billions of dollars of bonds and loans in recent weeks.

‘Never mind that profits have been wiped out, and that their business operations aren’t viable right now or likely anytime soon. As long as they’re propped up by the Fed, investors are willing to lend. […]

‘[I]t’s precisely this dramatic [US Fed] intervention that’s emboldening money managers to take greater chances and seek fatter returns.’

|

|

| Source: Bloomberg |

The real economy isn’t producing. Debt is increasing, we are killing growth in the long run, and stifling innovation.

Meanwhile, gold is rising and silver is waking up.

The question is, how far will all this stretch until it breaks?

For now, just hold on. Keep your cash and focus on real things.

| Best, |

|

| Selva Freigedo, |

PS: Jim Rickards warns that a total financial collapse is imminent. Learn how to protect your savings and investments…before it’s too late. Click here now.

Comments