Dear Reader,

The last place you should turn when looking for accurate house price forecasts are the big banks.

Take Westpac, for example.

Back in 2020, they forecast a whopping 10% fall in national property prices between April 2020 and June 2021.

When it became clear how spectacularly wrong that forecast was, they backflipped.

The 10% fall was replaced with a 15% national price ‘surge’ forecast until mid-2023.

That was more in line with where values were heading at the time, of course.

But by mid-2021, the growth in national values had already exceeded their 15% forecast — increasing 22.1% through the 2021 calendar year alone.

Spin forward to 2022, and no surprise, their price projections have flipped again.

In the February 2022 edition of the ‘Westpac Housing Pulse’, the bank now forecasts a 14% fall in property prices through 2023 and 2024.

It reminds me of that old song…‘Up, down, flying around, looping the loop…’

Obviously, the requirement for accuracy isn’t high on the list of KPIs for Westpac’s chief economist.

When you consider that national median prices dropped some 10% in the early 1990s recession — a 14% fall would result in a significant property market crash.

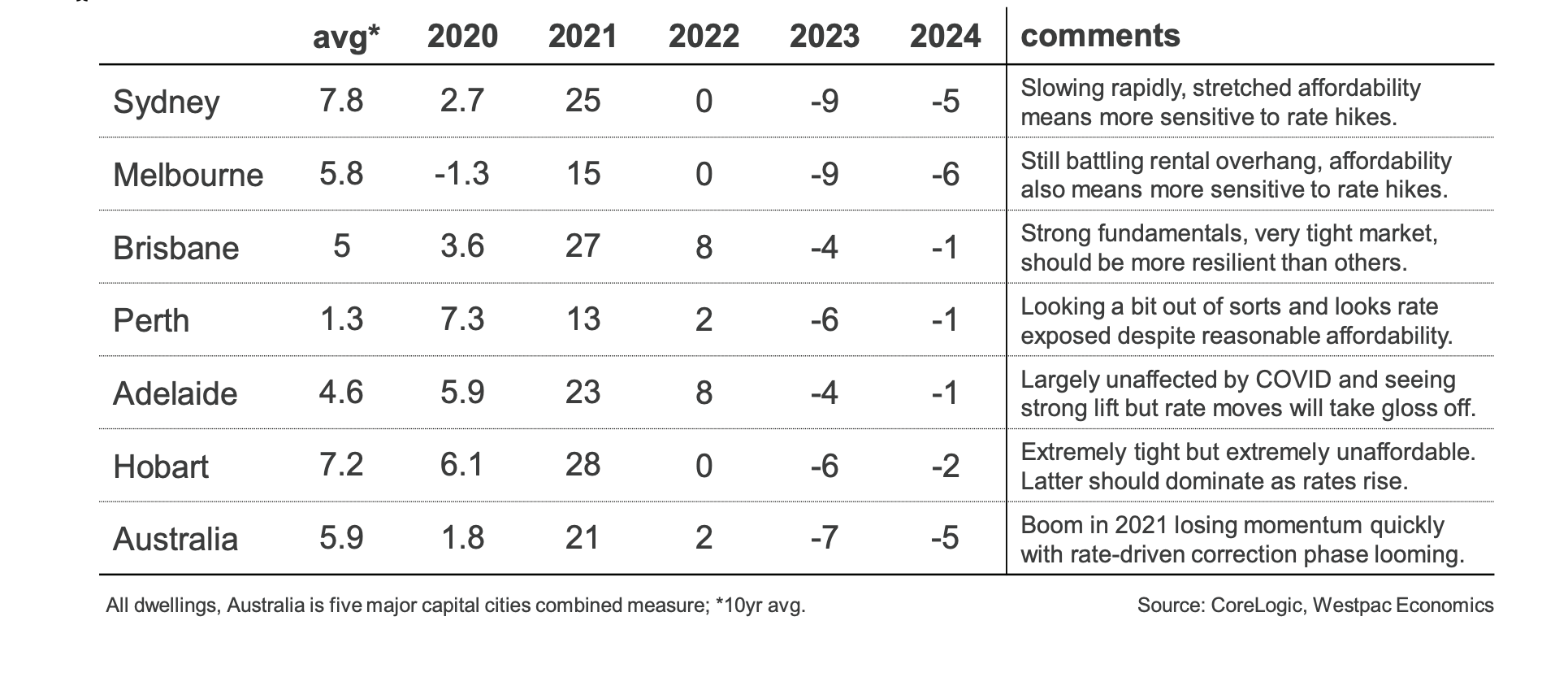

Here’s the breakdown of their current analysis:

|

|

| Source: Westpac Housing Pulse — February 2022 |

It’s hard to understand the reasoning behind some of the calls here.

Fo example, on the above table they say Perth is ‘Looking a bit out of sorts’.

I beg to differ.

In fact, all indicators show that Perth values will continue to increase and gain momentum through 2023–24.

Let’s take a look:

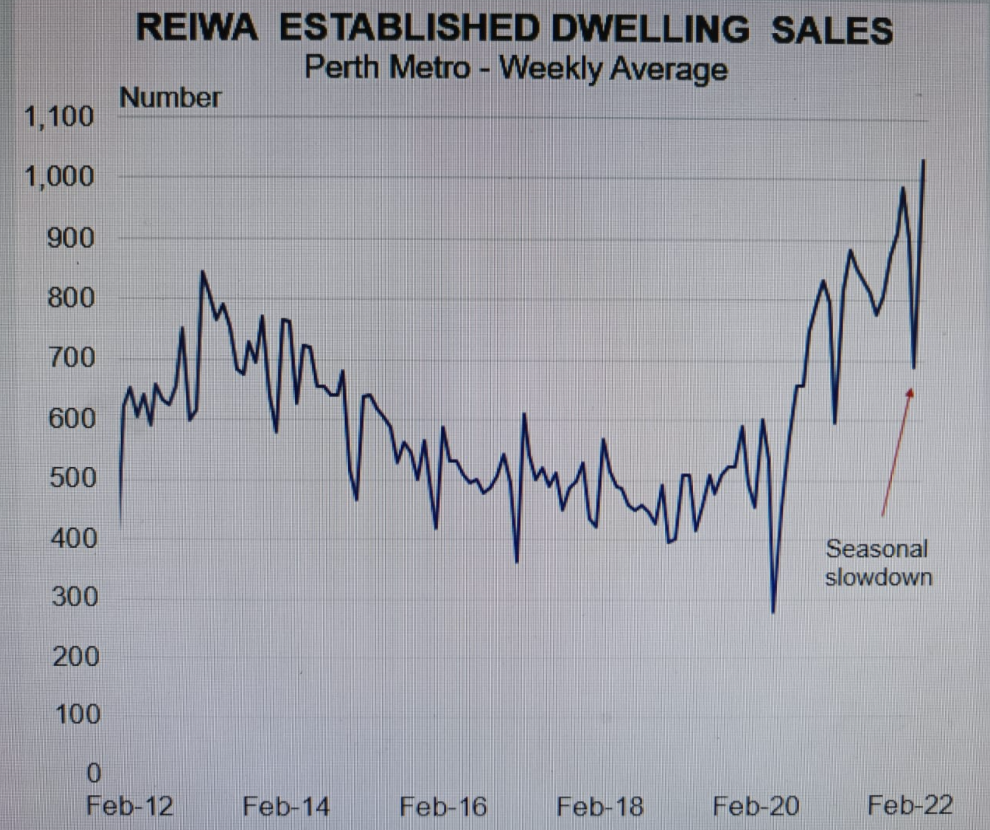

|

|

| Source: REIWA (Real Estate Institute of Western Australia) |

Analysis from the REIWA show sales in established properties in Perth are currently exceeding their last peak in 2013.

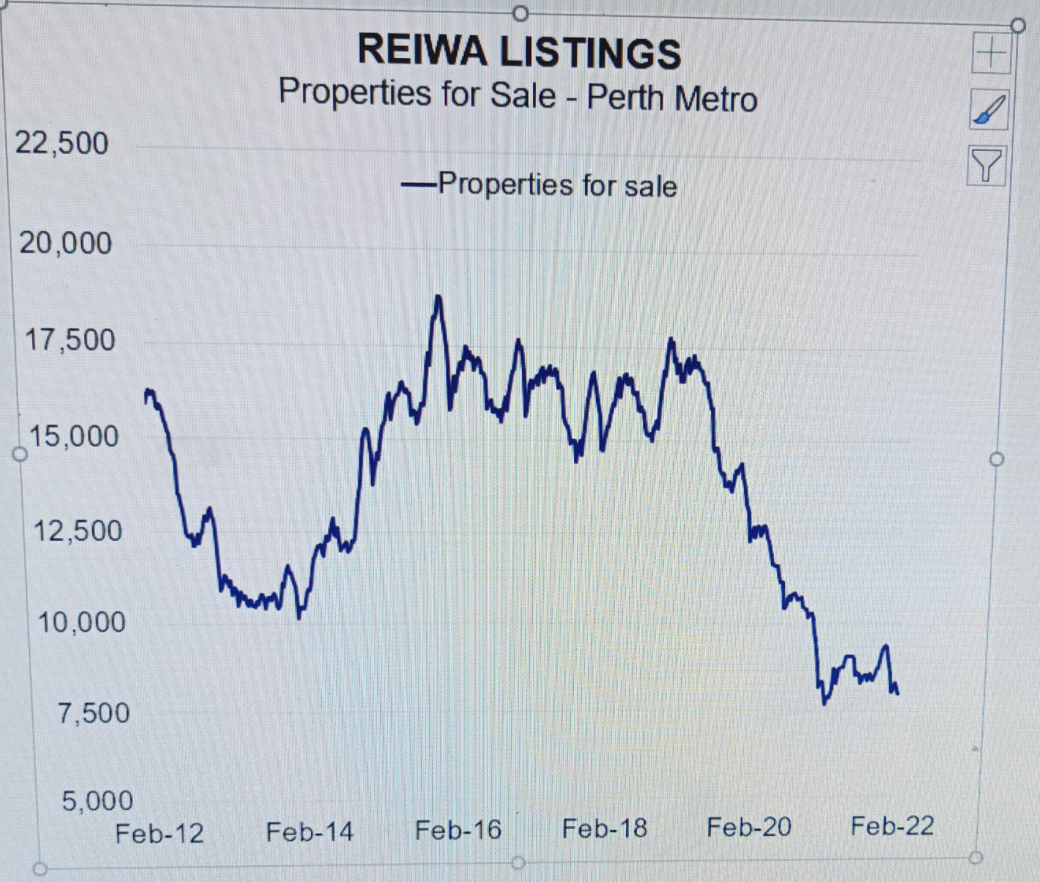

This sits against the number of listings on the market that have plummeted to all-time lows:

|

|

| Source: REIWA |

In other words, demand is well exceeding supply.

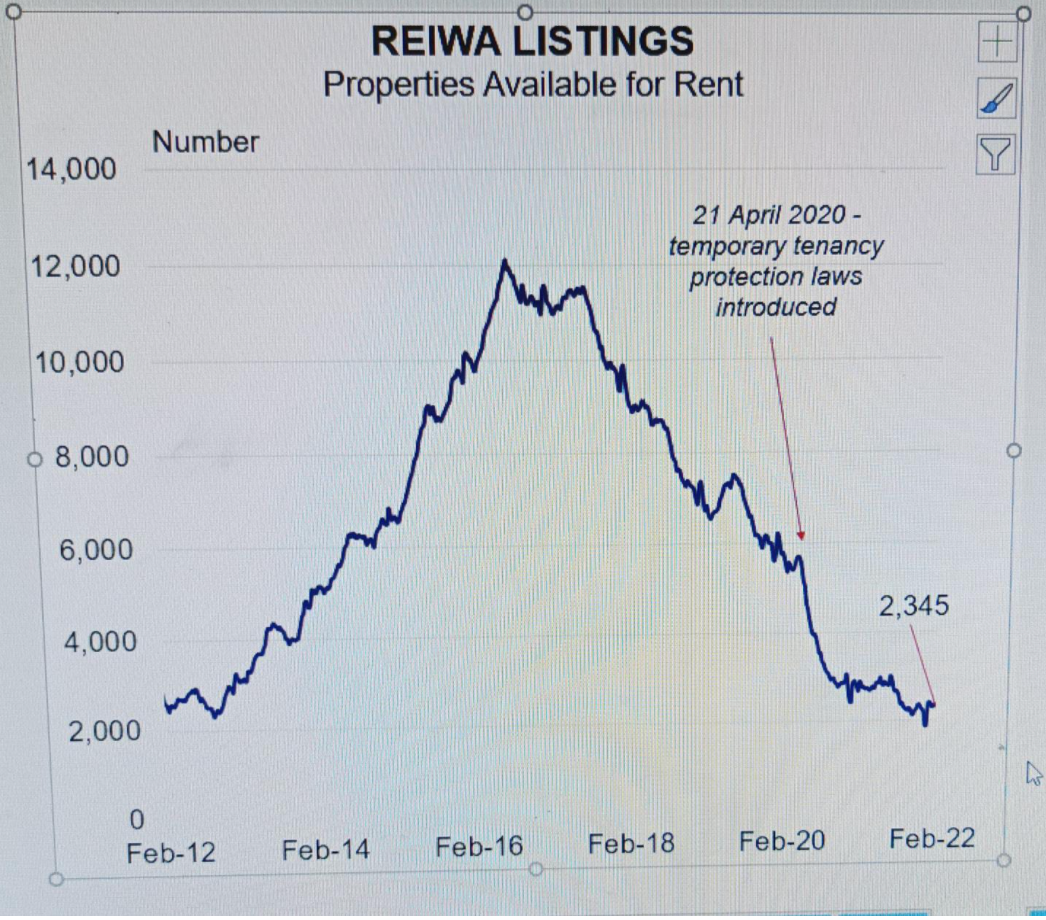

Add to the mix record-low vacancy rates that have produced a surge in rents not seen since the mining boom, and rental yields (the country’s highest) easily covering interest payments on a loan in many cases.

|

|

| Source: REIWA |

And you have the recipe for a boom, not a crash!

In the body of their report Westpac say the ‘WA market continues to look a little listless.’

Really?

It doesn’t look very listless to me.

Median property values in WA rose by 13.1% in 2021 to $520,000.

That looks very cheap to investors on the east coast.

The suburbs roaring ahead are on the beachside.

Through 2021, Cottesloe has grown by 33.2%, Dalkeith by 28%, and City Beach by 37.3%.

A few stories have hit the press recently to demonstrate the gains on an individual property level.

They come from Chris Hinchliffe, director of property valuers at Herron Todd White:

- A four-bedroom, two-bathroom home in City Beach. Purchased in March 2020 for $1.85 million. Resold for $2.45 million in August 2021.

A 32% increase in value.

- A renovated 1940s four-bedroom, two-bathroom home on a 759sqm block in Cottesloe. Purchased for $2.025 million in July 2019. Resold for $3.8 million in July 2021.

An 88% increase.

- A four-bedroom, two-bathroom, two-storey home in Nedlands, on a quarter-acre block. Purchased for $2.9 million in February 2020. Resold for $3.28 million in July 2021 after just 10 days on the market.

A 13% price increase in just 17 months.

How can Westpac’s economists be so consistently wrong?

The travesty here is their failure to study the land cycle.

The knowledge of this little-known secret informs everything we do over at Cycles, Trends & Forecasts.

It enabled me to forecast (during the depths of the 2020 COVID-related panic, no less) that property prices would not crash, but rather Australia would experience its greatest ever property boom from 2021–26. With the smaller states by population gaining the most.

So far, that forecast has played out as expected.

The boom through 2021 has been extraordinary — outside of all expectations.

And needless to say, I’m also very bullish on Perth’s real estate market. For good reason — as I explained above!

Believe me; I’m no soothsayer — with a little knowledge of cycles and the economics that underpin them, you too can make very profitable calls on the market.

What are you waiting for? Find out more here!

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia